[ad_1]

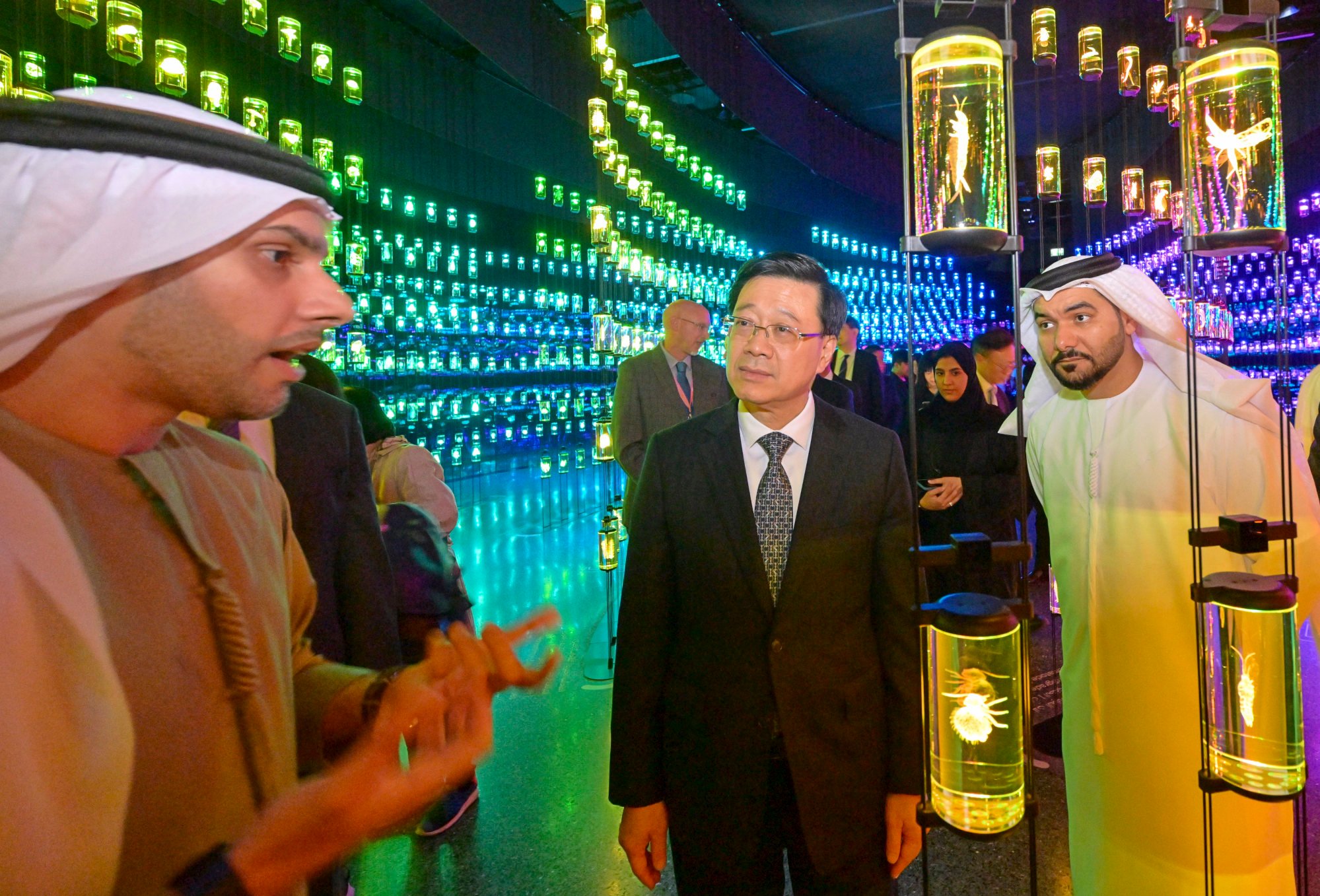

Hong Kong firms move to cut major deals in Middle East after John Lee’s visit

Hong Kong firms move to cut major deals in Middle East after John Lee’s visit

Analysts, businesses and professionals interviewed by the Post said despite their optimism, one of the biggest obstacles was the lack of strong cultural links with and knowledge of the Middle East. The see-sawing of Sino-US ties also makes forecasting of deepening ties more difficult.

Many also ask why the Hong Kong authorities cannot extend the same level of targeted and aggressive support that other companies are receiving from their own governments.

Much more than telling “good Hong Kong stories” would be needed if the city hoped to tap the Middle East market, they said.

Negawatt’s Lam learned how to bridge the cultural gap on the go. He changed his company’s pig character to a camel to be more sensitive to Muslims in the region.

The high-profile trip offered fame and sped up collaborations. In the past months, his company’s Emirati partners came to Hong Kong to assess how a similar project was being implemented in the more than 150 buildings managed by the Housing Society.

Not everyone though has seen such dividends.

Tapping the need for diversification

For now, all eyes are on the war and how long it will last. Israel is a partner Hong Kong was in the midst of building business ties with. Its high-technology sector, which took up 8.1 per cent of its gross domestic product last year, is a key focus and Hong Kong’s slice amounted to US$3.4 billion in 2022.

But trade and investment levels will depend on the war. About 15 per cent of the workforce of the Israeli tech sector could be called up for army service, according to Stephen Dover, head of the US-headquartered Franklin Templeton Institute.

For the Gulf region, Dover did not foresee a wider economic fallout if the conflict did not escalate. Currently, Saudi Arabia and the UAE have chosen a relatively muted response to the conflict, with their government spending and capital deployment continuing unabated as part of their diversification plans, he said.

Hong Kong architect makes his mark, turning desert dream into smart city

Hong Kong architect makes his mark, turning desert dream into smart city

“On a broader basis, business confidence in the Gulf region remains high while population and tourism support general consumption,” he said.

“There looks to be significant interest by the Gulf Cooperation Council in investing in both Hong Kong and China A-shares. Hong Kong should remain a key bridge for investors in the [council] to invest in China.”

The city’s largest trading partner in the Middle East last year was the United Arab Emirates, followed by Israel, Saudi Arabia and Qatar.

The UAE, which is trying to position itself as the most liberal country in the Gulf, has been building close economic ties with Hong Kong for decades. Last year, bilateral trade rose by 27.6 per cent year on year, driven by 35.3 per cent growth in exports from Hong Kong.

Major commodities exported to the UAE include telecoms equipment and parts, pearls and precious stones. But analysts have raised questions over whether Hong Kong can tap the Gulf nations’ diversification plans.

Commerce minister Algernon Yau Ying-wah has identified a few areas that Hong Kong can contribute to, such as finance, logistics, innovation and technology, as well as urban and infrastructure management.

John Lee jetting off to Middle East, Southeast Asia no fix for Hong Kong: experts

John Lee jetting off to Middle East, Southeast Asia no fix for Hong Kong: experts

Currently, the city’s home-grown technology companies appear to be benefiting, as evidenced by the numerous partnership agreements Hong Kong companies have signed with Middle Eastern ones in recent months.

They include aviation technology firm Aerosim (HK), blockchain builder D-Engraver and mobile advertising tech firm GoGoChart Technology. They were among the 11 companies sealing agreements with eWTPA Arabia Capital in July.

Hong Kong firms lack on-the-ground support

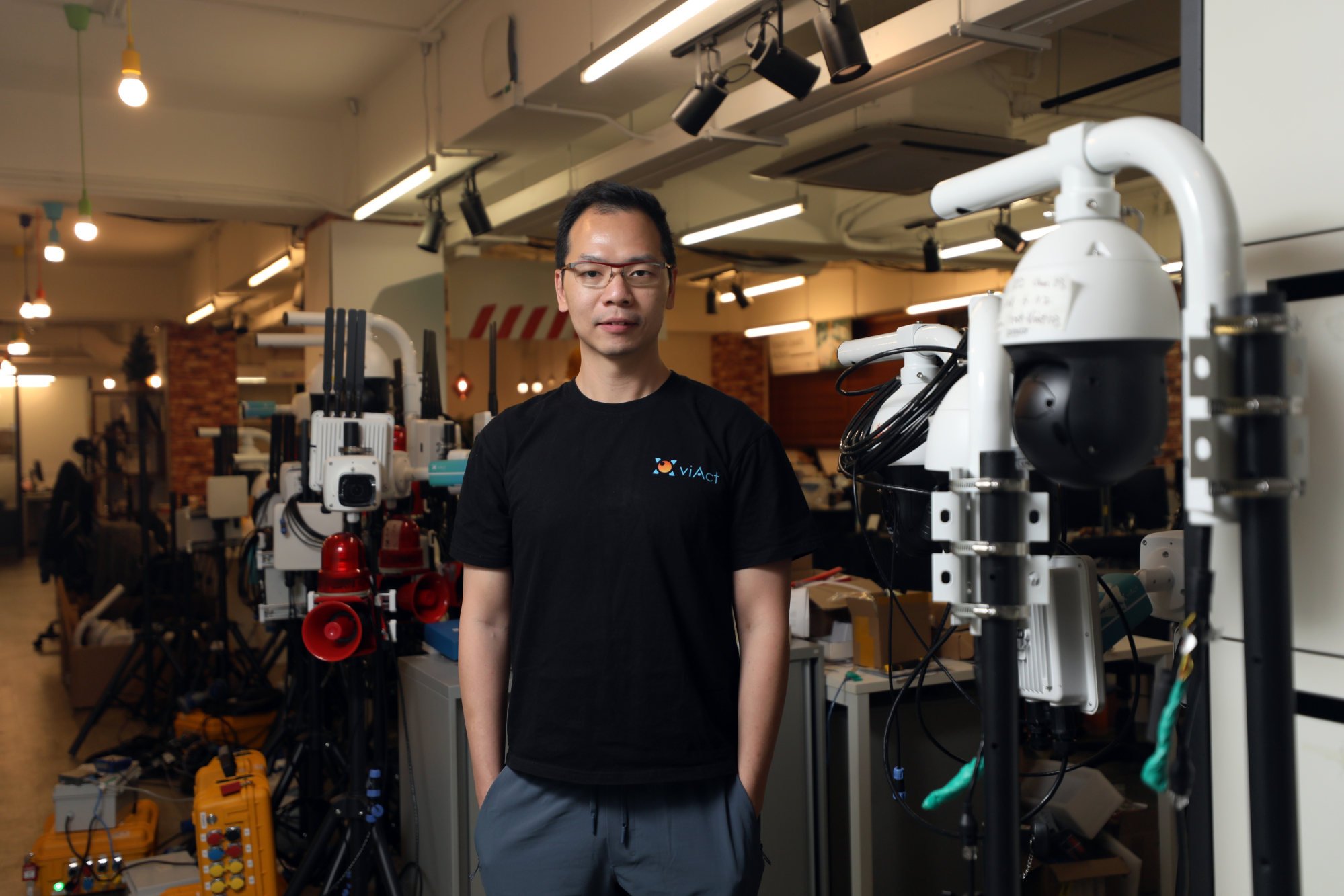

Last month, start-up viAct was the only Hong Kong firm invited by authorities to join the Dubai Centre for Artificial Intelligence Accelerator Programs to discuss the future of generative AI in government services.

ViAct uses scenario-based artificial intelligence and surveillance technologies to boost construction site safety. Recalling challenges in expanding the company’s footprint into other Gulf states, CEO and founder Gary Ng Chun-kui said Hong Kong firms often lacked embassy and consulate support.

“It’s always difficult for us to initiate meetings with potential partners and government officials on the ground,” he said.

“But through diplomats’ regular events which are often on a monthly basis, face-to-face networking can become natural and effective.”

“I sometimes feel like an orphan,” he said, adding he had to connect with others from different regions to dig for intelligence and initiate networking.

He said he hoped the Hong Kong government could be more strategic and aggressive, citing what the South Korean and Singaporean authorities had been doing.

As governments across the world race to get a slice of the pie as Gulf states plough billions of dollars of oil profits into economic reforms, the two countries have been helping their businesspeople on the ground.

The Singapore embassy in Abu Dhabi and consulate in Dubai, for example, have been busy organising networking events.

The South Korean government, after months of on-the-ground efforts, persuaded the UAE to send a large economic delegation comprising government entities and private sector representatives to the “COMEUP 2023” start-up festival in Seoul last month.

Cultural unfamiliarity as a weak link

For now, Dubai is the only place where Hong Kong authorities have a presence in the Middle East. The Economic and Trade Office opened in 2021, while InvestHK, the government’s investment promotion arm, and the Hong Kong Trade Development Council, have also set up offices there.

“All on-the-ground support is in one spot,” said Aaron Shum Wan-lung, one of Hong Kong’s trailblazers who first set foot in the Middle East 45 years ago.

“And they mainly rely on one-way delivery of information about events and happenings, often without follow-ups.”

Is John Lee’s investment push in Middle East too little, too late for Hong Kong?

Is John Lee’s investment push in Middle East too little, too late for Hong Kong?

Starting out as a sand factory accountant in Riyadh, Shum at one point owned more than 35 jewellery stores in the UAE. Following Lee’s February trip, he came up with the idea of forming a community to link Hong Kong businesses eager to explore business opportunities in the region.

Shum said he floated the idea in a WhatsApp group, and more than 100 people showed an interest in joining. The membership list soon grew to 250 and he decided to establish the Hong Kong-Middle East Business Chamber in July.

What Hong Kong needed was to quickly bolster people-to-people exchanges, he said. In the past year, he led three separate delegations to Gulf states to raise awareness of Arab culture.

He recalled how he nearly got into “serious trouble” in Saudi Arabia for selling kung fu shoes with prints, when worn out on their soles, could mean God in Arabic, an offensive way of using the script.

“People need to be there physically to learn the taboos,” Shum said.

Despite the challenges, business ties are growing at a steady clip. The Dubai Chambers and the Saudi Arabia-China Entrepreneurs Association have announced separately that they will set up offices in Hong Kong.

In September, the Belt and Road Summit featured a dedicated Middle East forum for the first time, while in December, the Future Investment Initiative Institute will hold a regional summit in Hong Kong to be attended by Saudi Arabia’s Ministry of Investment. The organisation plays a significant role in the kingdom’s reform initiatives.

The Post has also learned that Cathay Pacific Airways has decided to resume direct passenger flights between Hong Kong and Riyadh and it would just be “a matter of time” to iron out the schedule.

Just this past Monday, the pro-Beijing Hong Kong Coalition announced it had agreed with the Abu Dhabi Investment Office to co-host a joint investment forum every year starting in 2024.

Better script needed

According to a survey by the Private Wealth Management Association (PWMA) and KPMG, professionals in the sector believe that while interest in the Gulf states had increased, it “had not yet translated into a significant increase” in investments. Unlike mainland China, Hong Kong could not offer Middle Eastern clients the advantages of cultural similarity, it found.

“The private wealth management sector is very much a people’s business,” said Peter Stein, CEO and managing director of the PWMA.

“And it’s really important that the client advisers and relationship managers have a good understanding of the clients’ needs and their cultural background.”

Stein said that in recent months, industry players had been making trips to the Middle East to get family offices on board and secure new clients in a renewed push given that many firms already had a presence in the region. He said it would take time and skills to build up “the sense of trust and familiarity that the clients are looking for”.

But he is convinced of the unique advantages that Hong Kong offers to clients from the region who are interested in investing in the mainland, particularly in the Greater Bay Area, and to connect Chinese investors interested in diversifying their assets.

“That is something which other jurisdictions don’t have,” Stein said.

While Hong Kong scored high on the ease of doing business and investor protections in the same survey, it ranked third for “political stability”, after Singapore and Switzerland.

“It’s easy to make assumptions … I don’t think we can take it for granted that everybody understands the way things operate outside of this part of the world,” he said.

“Hong Kong, I think, can definitely do a better job in terms of marketing itself to the Middle East and the rest of the world.”

[ad_2]

Source link