[ad_1]

Data dependent

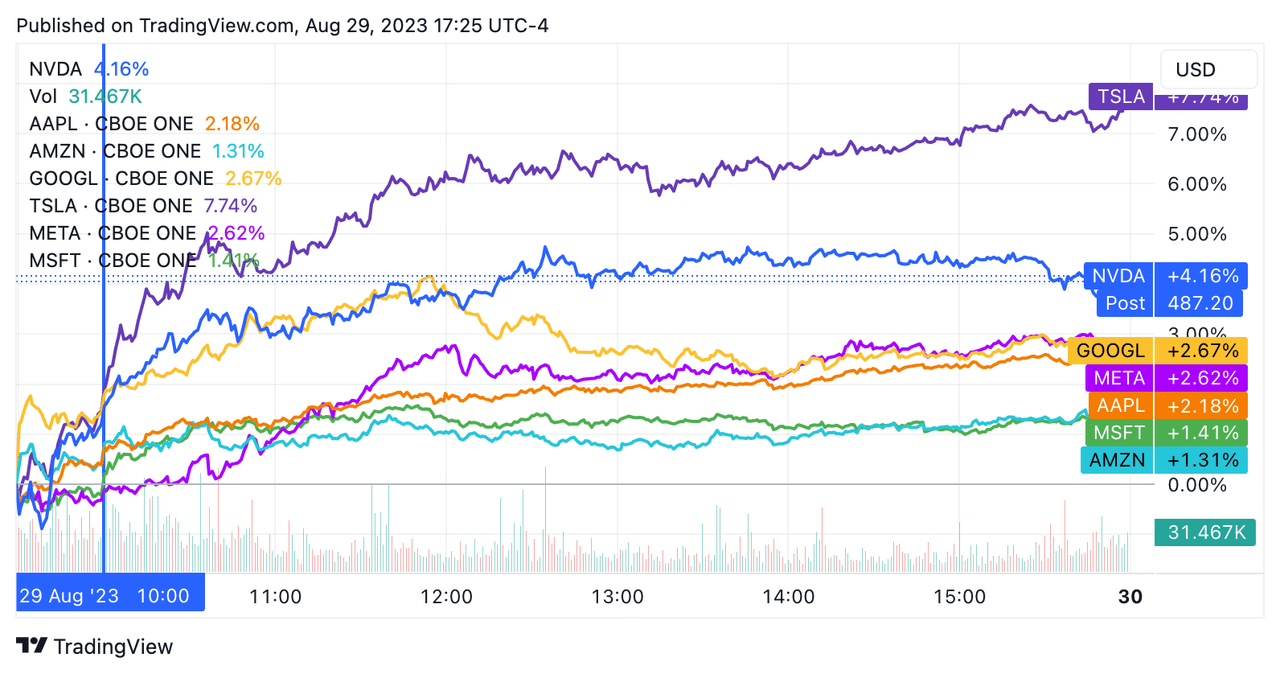

AI may be the future, but the day still belongs to the Federal Reserve when it comes to risk assets. The Magnificent 7 megacaps all rallied Tuesday, driving the broader market to its third straight session in the green and best one-day performance since June. The S&P 500 (SP500) (NYSEARCA:SPY) (IVV) (VOO) rose 1.5%, the Nasdaq (COMP.IND) popped 1.7%, while Info Tech (XLK) was up more than 2% on the day. The VIX (VIX) also dropped to its lowest level in a month.

Snapshot: XLK hasn’t seen a rise like that since June, when chips were still riding the AI wave of Nvidia’s (NASDAQ:NVDA) stunning guidance in late May. Nvidia exceeded lofty expectations with its latest results and guidance last week, but the sell-the-news reaction led to speculation the market was oversaturated on the AI front. On Tuesday, NVDA rose more than 4% to close at a fresh record high. Yes, there were headlines of a Google AI partnership, but the difference was the double dose of Fed-friendly weak data out at 10:00 a.m. ET (in the chart below, you can see the Magnificent 7 take off). Is a megacap breakout in the cards?

The first figures in a week full of key economic data began with JOLTS, which showed an unexpected drop in job openings to below 9M for the first time since March 2021. The “report bodes well for the Fed’s ‘soft landing’ dreams,” Wells Fargo economists wrote. “This indicator is clearly on a downward trajectory amid cooling labor demand growth and impressive labor supply growth… and today’s data are yet another sign that the inflation pressures of the past few years are slowly diminishing.”

On watch: Elsewhere on the economic front, the Conference Board’s latest measure of consumer confidence wiped out the gains of June and July. That helped trigger the bad-news-is-good-news trade – with equities rallying and Treasury yields retracing to prior levels – to reflect a slightly more dovish Fed path than the one plotted after Jay Powell’s Jackson Hole speech (see how rates are trading across the curve). Meanwhile, fed funds futures that had shifted to pricing one more quarter-point hike in November post-Powell moved back to a 52% chance of a pause, and expectations for a first rate cut were pulled forward to May from June. (6 comments)

Incoming!

Hurricane Idalia is bearing down on Florida’s Gulf Coast, where it is expected to make landfall today in the Big Bend area. “While we are not in the business of forecasting the weather as industrial analysts, should Idalia hit as the National Hurricane Center is projecting, there is historical precedence for certain E&C stocks to outperform in the short term,” said Citi analyst Andrew Kaplowitz. His list includes Quanta Services (PWR), Fluor (FLR) and several others. “We usually see more mixed performance for U.S. multis, where large hurricanes could cause factory shutdowns and temporary decreases in sales, but also opportunities in the form of energy/water infrastructure repair that could positively impact multis such as Emerson Electric (EMR) and Xylem (XYL).” (4 comments)

Crypto victory

Bitcoin (BTC-USD) is trading above $27,000 again after a federal court vacated an SEC ruling that had prohibited Grayscale from starting a Bitcoin exchange-traded fund in the U.S. Cryptocurrencies jumped on the news on Tuesday, as well as stocks exposed to the industry. “This is a monumental step forward for American investors, the Bitcoin ecosystem, and all those who have been advocating for Bitcoin exposure through the added protection for the ETF wrapper,” Grayscale CEO Michael Sonnenshein declared. While things could still get held up, the company plans on “next steps” to bring OTC:GBTC to NYSE Arca as a spot Bitcoin ETF, which could potentially pave the way for similar products. (72 comments)

Taking a hard line

Earlier this month, The Guardian reported that Amazon (AMZN) workers in the U.S. were being tracked and penalized for not spending sufficient time in company offices. Now, CEO Andy Jassy appears to be fed up. “It’s past the time to disagree and commit,” he said in a recording obtained by Insider. “And if you can’t disagree and commit, I also understand that, but it’s probably not going to work out for you at Amazon.” The e-commerce behemoth’s three-day-a-week policy went into effect in May, which prompted protests outside the firm’s Seattle headquarters. (213 comments)

[ad_2]

Source link