[ad_1]

Job cuts at the largest US banks this year are on course to surpass 11,000 as Wall Street contends with the worst recruitment market since the financial crisis following a pandemic-era hiring binge.

Citigroup this week became the latest big US bank to announce significant job cuts, telling investors that it planned to complete 5,000 redundancies by the end of the second quarter, mostly in investment banking and trading. That followed cuts affecting thousands of bankers at Goldman Sachs and Morgan Stanley.

The job cuts come as executives try to unwind a recruitment spree that started as the economy rebounded in the aftermath of Covid-19. Banks dramatically increased their headcounts to cope with a deals and trading boom at a time when working from home was scrambling traditional ways of doing business.

“This is probably one of the most challenging job markets we’ve seen since the 2008 financial crisis,” said Max Kemnitzer, managing director for banking and financial services at recruiter Michael Page in New York.

“When you look at metrics like the number of jobs coming up, conversion of résumés that turn into interviews and those interviews that turn into offers, those numbers are the most sluggish we’ve seen in a long time.”

A tight labour market during and after the pandemic had prompted companies to offer generous retention payments to existing staff while also recruiting aggressively amid fears that they would lose out in a war for talent.

At the end of the first quarter, the five large banks that dominate Wall Street — JPMorgan Chase, Bank of America, Morgan Stanley and Citi — collectively employed a record 882,000 globally, virtually unchanged compared with the end of 2022 and an increase of more than 100,000 versus the end of March 2020.

The only bank to report a significant staff reduction in the first three months of the year was Goldman, where headcount fell by 6.4 per cent to 45,400, the steepest drop in years. Morgan Stanley’s fell slightly to 82,266, while at Citi it was flat. JPMorgan has not announced large-scale reductions.

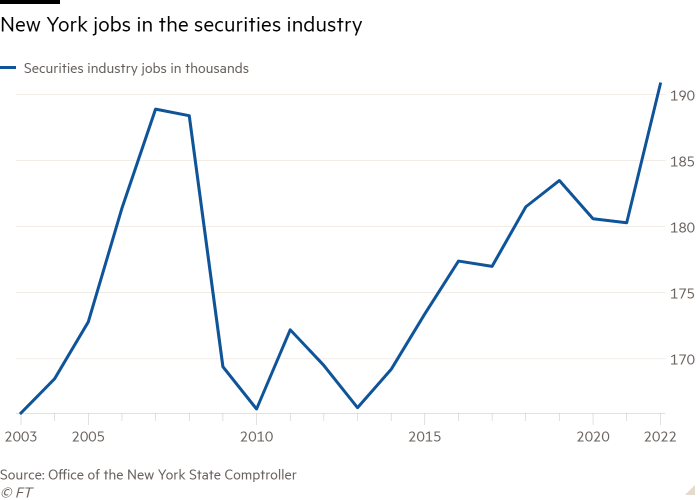

In 2022, employment in the securities industry in New York jumped almost 6 per cent, the biggest increase in at least 20 years, according to data from the state comptroller.

“Last year, hiring was crazy,” said Jeanne Branthover, head of financial services recruiting at search firm DHR Global. “I was told by many firms we are not just hiring because we are busy, we are hiring the best talent and retaining them to stay competitive.”

That trend has reversed this year, said Branthover. “It used to be one-out, one-in, but now managers are being told there has got to be a very specific reason to make a hire. Now even though one is out, it does not mean they are getting approval to hire a replacement.”

However, executives are struggling to move the needle on overall headcount in part because employees are leaving at a slower place amid waning demand for new appointments not just from banks but also asset managers and large technology groups, according to senior bankers.

That will test the plans of groups like BofA, which has tried to avoid redundancies but wants to eliminate 4,000 positions by not rehiring when employees leave. “We’re not making lay-offs,” BofA chief executive Brian Moynihan told CBS News this month. “We’re trying to do it by attrition, but even the attrition slowed to half what it was last year.”

Deal activity started to slow in 2022 as the Federal Reserve began lifting interest rates to tackle inflation, and a hoped-for rebound this year has failed to materialise. Global investment banking fees so far in 2023 are down around 16 per cent at $43.7bn, according to data from Refinitiv.

Goldman chief executive David Solomon said this week that “the opportunity set for our businesses has contracted and so we have to make appropriate adjustments”. Goldman cut around 6 per cent of its workforce in January and is now in the process of cutting roughly 250 managing directors.

The Financial Times last month reported that Goldman is also considering culling staff it deems to be underperforming in September, a process that resumed in 2022 after a pause during the pandemic.

However, Morgan Stanley chief executive James Gorman this week said that his bank was “unlikely” to pursue further large-scale job cuts in the near future.

Boutique investment banks are also trimming employees. Lazard told investors in April that it would cut 10 per cent of its staff over the course of 2023. “It’s clear that revenue will be down materially in M&A for the market this year,” incoming Lazard chief executive Peter Orszag said at an industry conference on Wednesday.

Perella Weinberg is cutting 7 per cent of its headcount to free up funds to appoint new talent, Bloomberg reported this week.

Spring is traditionally the recruitment season on Wall Street. Bankers receive their annual bonuses in February and start looking for new opportunities in March, with most moves wrapped up by the end of June.

But this year the normal pattern has been disrupted not just by lower demand but also the recent regional US banking crisis, which has raised the spectre of tougher regulation.

“Wall Street recruiting was already slow because of deal volumes,” said Mike Karp, a prominent recruiter who heads Wall Street search firm Options Group. “Besides the regional banking crisis and then the debt ceiling concerns, now you have the threat of higher capital requirements weighing on hiring plans as well.”

FT survey: Calling all consultants – what is working life like for you?

Have you lost your job recently or have you been working longer and harder than ever before? Or perhaps work has been slow and you’re wondering what is next for your career? We want to hear from you. Tell us via a short survey.

[ad_2]

Source link