[ad_1]

With a new year set to begin in a few days, here’s a look back at the 10 biggest business stories in Alberta in 2023, from blockbuster corporate deals and a surprising pause on the province approving new renewable projects, to the escalating energy confrontations between Alberta and Ottawa

Article content

Throughout 2023, Alberta became a magnet of sorts, attracting thousands of people from Ontario and British Columbia — and internationally — to the province.

It sparked a population boom and the biggest growth rate in Alberta since 1980, as a procession of moving vans headed to the province.

Article content

Alberta added 195,000 people during the 12 months ending in September. Its population now tops 4.7 million.

Advertisement 2

Article content

The trend has reverberated throughout the province.

More people arrived and filled labour openings during the year. Even with higher interest rates, the increasing population helped fuel rising housing prices and a spike in rents.

It powered an uptick in retail sales and propelled Alberta’s economy to lead the country in growth, even as other parts of Canada stalled.

“It clearly shows why Alberta is growing,” says Charles St-Arnaud, chief economist with Alberta Central.

“It has so many ramifications on different parts of the economy.”

These factors illustrate why the province’s population surge became the Calgary Herald’s top business story in Alberta in 2023.

With a new year set to begin in a few days, here’s a look back at the 10 biggest business stories in Alberta in 2023, from blockbuster corporate deals and a surprising pause on the province approving new renewable projects, to the escalating energy confrontations between Alberta and Ottawa.

A popular place

Alberta’s population growth usually mirrors the up-and-down fortunes of the province’s energy sector. Yet, even as oil and natural gas prices dipped slightly in 2023 from the previous year’s highs, people flocked to the province in large numbers.

Advertisement 3

Article content

While the population only rose by 1.8 per cent in 2021-22, the growth topped four per cent in the 2023 census year.

For the July-to-September period, Alberta’s population climbed by 61,000.

Much of the growth came from newcomers to Canada settling in the province — part of a national trend — while the volume of people relocating from other provinces was also extraordinary. Experts say it speaks to the job opportunities and relatively affordable housing available in Alberta, as Ontario and British Columbia residents decide to pack up and move to this province.

“A trend that we’ve seen over the last 12 months is massive migration, both internationally and domestically to Alberta,” said David J. Finch, a professor and senior fellow with the Institute for Community Prosperity at Mount Royal University.

“Alberta is a very appealing market and you see strong labour growth, a positive lifestyle and relatively affordable housing.”

Yet, the surge also highlighted some pressure points, particularly on housing.

The Calgary Real Estate Board reported the city’s benchmark housing price increased almost 11 per cent between November 2023 and the same period last year, averaging $572,000.

Article content

Advertisement 4

Article content

Rents in Alberta soared by 16 per cent in December from the same period in 2022, the highest increase in the country, according to Rentals.ca.

More people arriving also meant more economic activity. RBC says Alberta’s economy grew by 2.2 per cent this year, the highest rate in the country.

Even with a cavalcade of people relocating to the province, the unemployment rate barely budged, while nearly 100,000 jobs were created.

“Considering that we’ve increased our population by 4.1 per cent and yet our unemployment rate has barely increased — that’s quite fantastic,” St-Arnaud says.

“The concern is: Are the public services keeping up with increasing population?”

Energy flashpoints

Fights between Ottawa and Alberta over energy policy date back decades, but the Cold War turned into an active battle zone in 2023.

Early in the year, Premier Danielle Smith lashed Ottawa over its so-called “Just Transition” bill, which was renamed the Canadian Sustainable Jobs Act.

A bigger scrap ensued over the federal Clean Electricity Regulations, which aim to shift provincial power grids to net-zero emissions by 2035.

Advertisement 5

Article content

Smith warned the move would lead to blackouts and price spikes. Her government, which favours a 2050 target, ran a national advertising campaign attacking the federal initiative. It later tabled a motion under Alberta’s Sovereignty Act opposing the national electricity rules.

In October, a legal fight over the federal Impact Assessment Act went the province’s way. The Supreme Court of Canada found large parts of the legislation — previously known as Bill-69 — were unconstitutional.

In December, the clash escalated.

While at the COP28 climate conference, the premier blasted federal Environment Minister Steven Guilbeault for his new framework to cap emissions from Canada’s oil and gas sector.

Smith argued electricity and resource development fall under provincial jurisdiction. Guilbeault said the policies were necessary to address climate change.

These feuds were closely watched in business and political circles.

“It’s very aggressive environmental policy and it’s being aimed directly at Alberta,” says Martin Pelletier, senior portfolio manager at Wellington-Altus Private Counsel in Calgary.

Advertisement 6

Article content

“When you’ve got two outspoken individuals, it is going to get escalated, and we’ve seen that.”

An arena deal in Calgary

After the collapse of the previous Calgary arena deal in December 2021, it looked like it might take a very long time to hammer out an agreement for a new events centre.

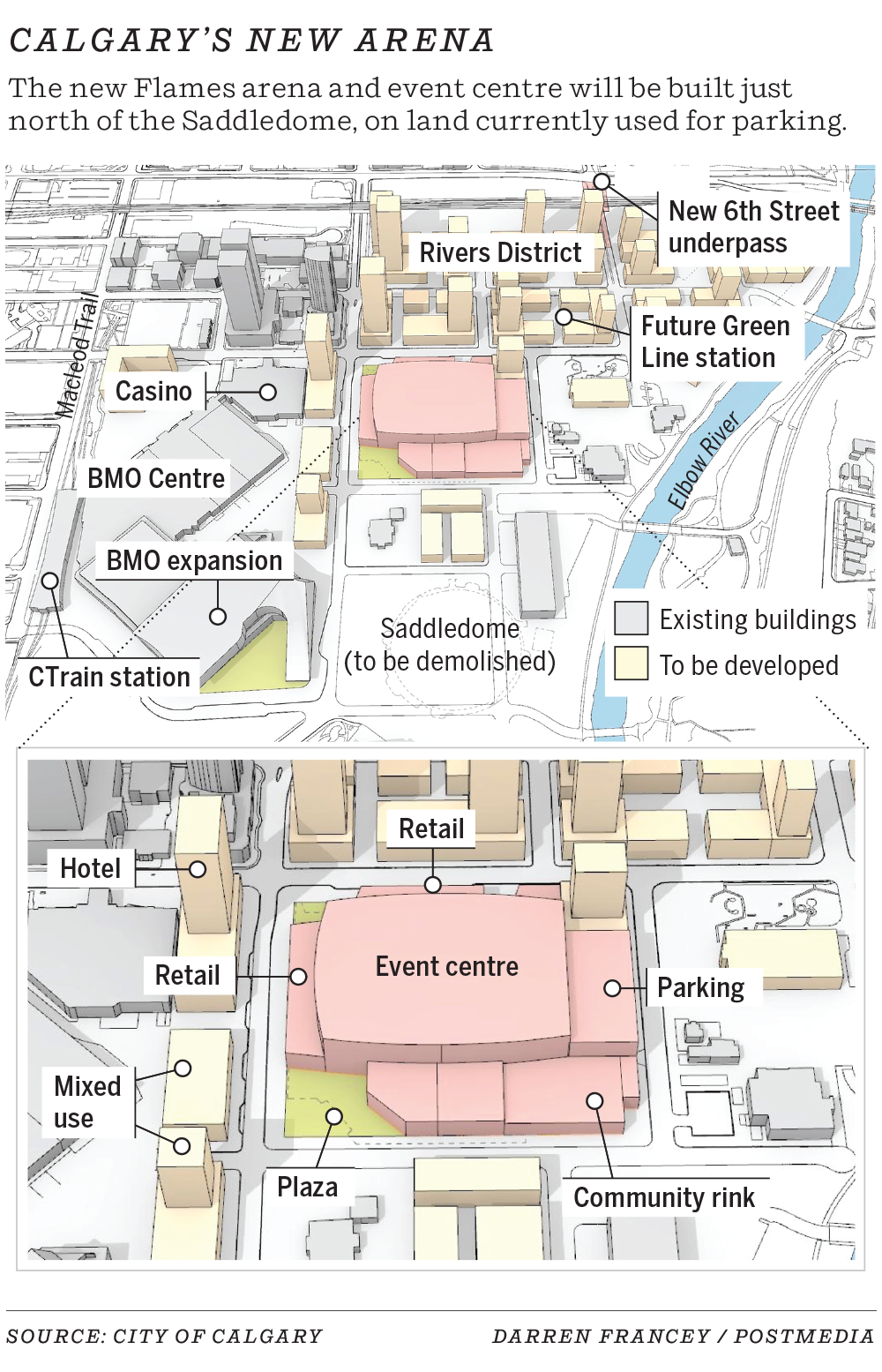

Yet, on the eve of a provincial election call in April, the UCP government joined the City of Calgary and Calgary Sports and Entertainment Corp. (CSEC), along with the Calgary Stampede, to announce an agreement in principle on a new $1.2-billion arena.

The price tag — and a large amount of public funding for the new facility, to be built just north of the aging Saddledome — rankled some in the city.

City hall will pay $537 million of the tab, with CSEC contributing $356 million. The province will put $330 million toward infrastructure and land costs.

The project is bigger than the previous $550-million arena plan reached in 2019. The new development has a larger footprint, and provides room for a community rink. There are plans for retail developments along Stampede Trail.

The facility is also seen as a key building block for the city’s emerging entertainment district.

Advertisement 7

Article content

“We are a city that’s ready to invest in ourselves,” says Calgary Chamber of Commerce CEO Deborah Yedlin. “If we work together, we can get stuff done.”

A divisive debate over CPP

After the re-election of the UCP government in May, Smith resurrected a contentious idea that has been bandied about for years: Alberta withdrawing from the Canada Pension Plan (CPP) and replacing it with a provincial fund.

In September, a long-awaited report for the government was released, asserting Alberta is entitled to 53 per cent of the base assets of the CPP, or $334 billion.

The report by consultancy LifeWorks said the figure was based on its “reasonable interpretation of the CPP Act,” but it was criticized by experts as unrealistic.

An ensuing campaign by the province over examining a potential pension pullout triggered an acrimonious debate that soon spread beyond Alberta.

The idea of Alberta leaving the CPP with more than half of its assets drew concern from other provinces, along with leaders of the Business Council of Canada and the Canadian Federation of Independent Business.

Advertisement 8

Article content

“You have to be careful what you wish for. It could unravel the whole thing,” Business Council of Canada CEO Goldy Hyder said in September.

Former provincial finance minister Jim Dinning was given the task of gathering public feedback from within Alberta, holding five telephone town halls.

The UCP government passed its Alberta Pension Protection Act in December, which would require a referendum on a provincial plan before the province could move to withdraw assets from the CPP.

As debate swirled, the federal finance minister told the Office of the Chief Actuary of Canada to give an estimate of the value of a potential asset transfer to Alberta.

The public engagement panel sessions were put on hold in early December, pending the arrival of the federal figure.

Pausing renewables

Alberta has become a renewable energy powerhouse within Canada, attracting more than $4 billion in investment since 2019.

But the UCP government surprised renewable proponents in August by announcing a six-month moratorium on approving new projects.

Critics saw it as an ideological move.

Advertisement 9

Article content

The Smith government said the province needed to review and establish policies to deal with the surge of proposed projects and to consider concerns from some landowners.

The freeze continues until the end of February.

“It’s like taking a jackhammer to deal with a nail,” Greengate Power CEO Dan Balaban said at the time.

M&A mania

Mergers and acquisitions took off in the Canadian energy sector in 2023, as companies armed with strong balance sheets went on a shopping spree.

In the largest deal of the year, energy infrastructure giant Enbridge bought three American natural gas utilities from Richmond-based Dominion Energy for $19 billion. Enbridge also unveiled a $4-billion bought deal equity offering to help pay for the acquisition.

In mid-December, Pembina Pipeline announced it would buy Enbridge’s interests in the Alliance gas pipeline and the Aux Sable joint ventures for $3.1 billion.

In the upstream sector, Canadian petroleum producer Crescent Point Energy acquired Hammerhead Energy in November for $2.6 billion, eight months after buying assets from Spartan Delta Corp. for $1.7 billion.

Advertisement 10

Article content

And ConocoPhillips spent $4.4 billion to acquire half of the Surmont oilsands assets from TotalEnergies.

Dow gives green light to mega-project

In December, U.S. petrochemical giant Dow Inc. announced an $8.9-billion investment in Alberta to build the world’s first net-zero integrated ethylene cracker and derivatives complex in Fort Saskatchewan.

It marks the biggest private-sector investment in Alberta in a decade.

The development will create up to 7,000 jobs during the peak of construction, and 400 to 500 full-time positions once it’s operating.

Imperial and AER in the spotlight

In March, Imperial Oil made headlines that put the company — and the Alberta Energy Regulator — under the public spotlight.

The integrated oil producer discovered industrial wastewater — containing arsenic, hydrocarbons and dissolved iron — had seeped from its external tailings area at the Kearl oilsands mining site in May 2022.

Nearby Indigenous communities weren’t properly informed about it until February 2023.

Separately, about 5.3 million litres of wastewater overflowed from a process water drainage pond at Kearl in late January, which led the AER to issue an environmental protection order and communities in the region to learn of the initial seepage. Imperial said its monitoring shows the seepage has not reached any waterways.

Advertisement 11

Article content

The incidents led to hearings before a parliamentary committee and pointed questions about the lack of communication by the AER and Imperial to Indigenous communities.

Pipeline progress

Pipeline progress is finally coming for western Canadian petroleum producers.

In March, the price tag for the Trans Mountain expansion surged to $30.9 billion — up 472 per cent from estimates made a decade earlier. Construction is nearing the finish line and the pipeline is expected to start up by the end of March.

Officials with the federally owned Trans Mountain Corp. applied for a pipeline variance with the national energy regulator in mid-December. They said potential risks, due to construction complications, could delay it being completed by about two years in a worst-case scenario if its request wasn’t approved.

Meanwhile, the $14.5-billion Coastal GasLink pipeline was mechanically completed by TC Energy in November.

New boss at Suncor

Suncor Energy appointed a new CEO — former Imperial Oil boss Rich Kruger — in February and he vowed to make the company more competitive.

In the summer, Suncor announced it would cut 1,500 positions. Kruger later found himself in the centre of a political debate in Ottawa over remarks made during a call with analysts in August. The CEO said Suncor had previously put “a bit of a disproportionate emphasis on the longer-term energy transition.”

After being called to a parliamentary committee in October, Kruger clarified his comments, saying Suncor’s commitment to decarbonization hadn’t changed.

Chris Varcoe is a Calgary Herald columnist.

Article content

[ad_2]

Source link