[ad_1]

A “beneficial owner” is:

- any individual who, directly or indirectly, has 25% or more ownership interest in a legal entity; up to 4 individuals per entity

and

- an individual with significant responsibility to control, manage or direct the legal entity (such as a CEO, Managing Direction or General Partner). This individual may also be referred to as a control person.

When opening an account on behalf of a business, you will be asked to complete a certification form providing ownership information and certifying that the information provided is correct to the best of your knowledge.

For each business, SVB Private is required to obtain the name, address, date of birth and SSN (or passport number for foreign persons) for each individual with 25% or more ownership interest and one control person.

SVB Private may also ask to see a copy of a driver’s license or other identifying document for each beneficial owner listed on this form.

For all foreign/non-US persons, SVB Private requires a scanned, color copy of the identification.

This new requirement generally applies to businesses such as corporations, limited liability companies, general partnerships and any other business or entity that files a public incorporation, registration, declaration, or similar document with a Secretary of State or similar office.

This new requirement generally does not apply to the businesses listed below. However, there may be circumstances where the certification form needs to be completed.

- sole proprietorships

- US or state governmental entities

- companies publicly traded on an US exchange

- registered public accounting firms

- state regulated insurance companies

- unincorporated associations

- personal trusts

This new requirement requires SVB Private to collect information on the ultimate beneficial owners of the business in order to open an account on behalf of the business. An ultimate beneficial owner is the natural person(s) who exercises ultimate ownership and control over the company structure. Hence, if your business is owned by another company, the ultimate beneficial owners are the natural person(s) with 25% or more ownership interest in the parent company as well as a natural person with the with significant responsibility to control, manage or direct the parent company.

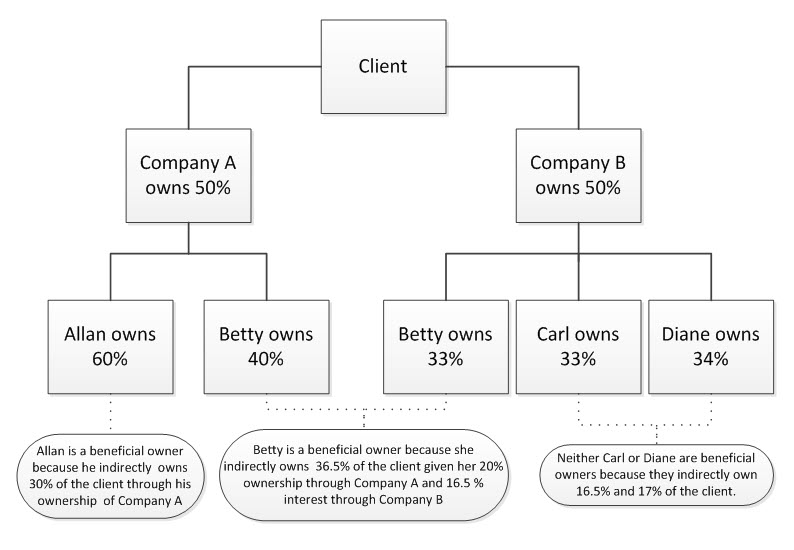

In the example below, both Allan and Betty are beneficial owners because they indirectly have 25% or more ownership interest in the client company and their information. Carl and Diane are not considered beneficial owners because they do not meet the 25% threshold. Additionally, a control person (such a CEO or General Manager) must be provided.

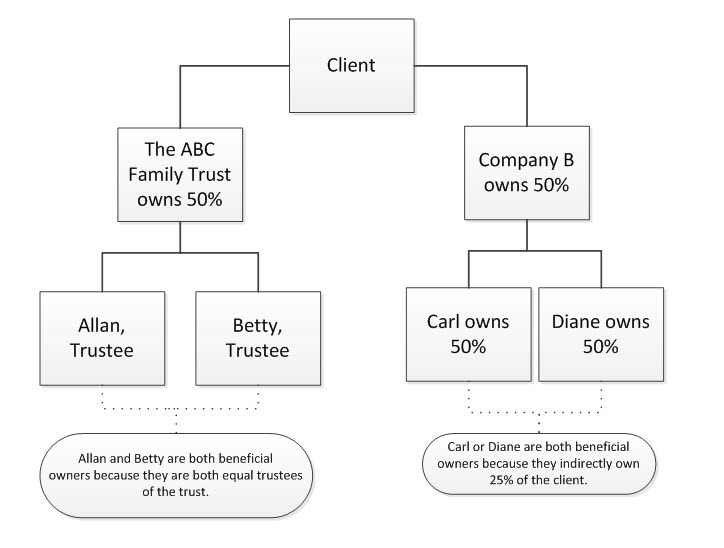

If a trust, directly or indirectly, has 25% or more ownership interest in your company, the trustee is the beneficial owner. Where there are multiple trustees or co-trustees, the name, address, date of birth and identification number of at least one trustee must be provided.

In the example below, both Allan and Betty are beneficial owners because they are both equal trustees of The ABC Family Trust, which has more than 25% ownership interest in the client company. Carl are Diane are also beneficial owners because they both have 25% indirect ownership of the client company through Company B. Remember, all individuals who, directly or indirectly, have 25% or more ownership interest in your company must be listed on the form and provide their information. Additionally, a control person (such a CEO or General Manager) must be provided.

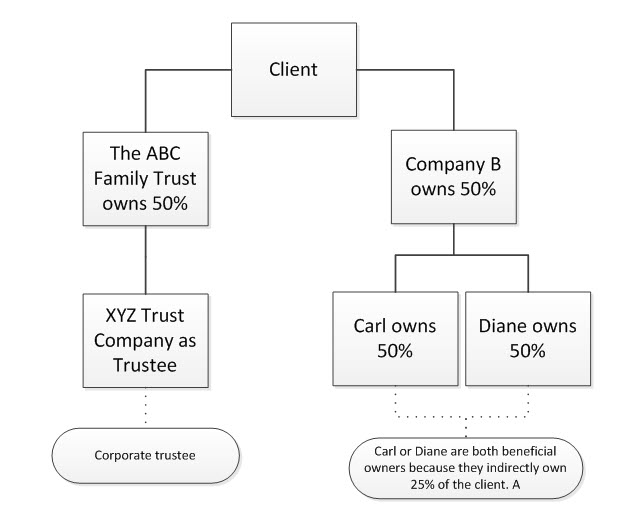

If a trust, directly or indirectly, has 25% or more ownership interest in your company and the trustee is another legal entity such as a law firm, bank or trust company, and there is no natural person as a co-trustee, then the legal entity may be listed as the beneficial owner. The name, address, and identification number of the legal entity of the trustee must be provided, and SVB Private may request additional documentation. If however there are multiple trustees or co-trustees, one of which is a natural person, then the information for that person as beneficial owner must be provided. A legal entity’s information as trustee may be provided only where a natural person does not exist for purposes of beneficial ownership.

In the example below, the information for the corporate trustee (XYZ Trust Company), Carl and Diane must be provided as beneficial owners. Additionally, a control person (such a CEO or General Manager) must be provided.

Yes, the information must be collected even in situations where owners and control persons have no relationship with SVB Private.

Of course. While we require the certification form to be completed, if you are more comfortable providing the information in person, please reach out to your Account Officer to arrange to complete the certification form in person.

This new regulation should not affect your existing accounts. However, there may be circumstances where the certification may need to be completed in order to update your records.

No. This requirement is only for business accounts.

Information provided on the certification form will be stored in SVB Private’s system of records and is subject to all privacy policies and procedures to ensure client confidentiality.

No, the information you provide will not be used for solicitation or prospecting.

[ad_2]

Source link