[ad_1]

Our latest disclosures

Our most recent disclosures can be found in our Annual Report 2023, Operating and Financial Review, 6.12 – Climate change and in the Sustainability links and downloads section at the bottom of this page.

Scenario analysis

In CY2020, BHP developed a 1.5°C scenario for the purpose of analysing the resilience of our portfolio to accelerated global action on climate change. This scenario requires steep global annual GHG emission reduction, sustained for decades, to stay within a 1.5°C carbon budget. 1.5°C is above pre-industrial levels. For more information about the assumptions, outputs, and limitations of our 1.5°C scenario, refer to the BHP Climate Change Report 2020 which can be found in the ‘sustainability links and downloads’ section at the bottom of this page. We consider a range of inputs, including our 1.5°C scenario, when testing the resilience of our portfolio, forming strategy and making investment decisions. The energy and resources modelling from BHP’s 1.5°C scenario conducted in 2020 remains consistent with the updated carbon budget released in the Working Group I report as the first part of the IPCC’s Sixth Assessment Report in 2021. In addition, we periodically benchmark our 1.5°C scenario against a number of published scenarios that align with a 1.5°C carbon budget, such as the IPCC and third-party energy and resource research organisations (including the International Energy Agency, IHS Markit, Wood Mackenzie, Bloomberg New Energy Finance and CRU).

As governments, institutions, companies and society increasingly focus on addressing climate change, the potential for a non-linear and/or more rapid transition and the subsequent impact on threats and opportunities increases.

Our operational planning, price outlooks and strategy formation are informed (together with other market sources of information) by our operational planning cases. As an input to our operational planning cases, we use our current estimates of the most likely high-, mid- and low-range of future states for the global economy and associated sub-systems; three pathways that we refer to collectively as our ‘One Energy View’. These are proprietary assessments of the likely future demand and supply of key commodities, rather than climate scenarios designed to test the resilience of our portfolio to different global climate action trajectories. However, our One Energy View pathways, implicitly present a global average temperature outcome given they cover the energy sector. In all the One Energy View pathways, most developed economies reach net zero around 2050, while other large economies reach net zero in 2060 and 2070, and they result in an implied global average temperature outcome of around 2°C by 2100.

We seek to maximise our exposure to products with significant opportunity under all pathways and scenarios and to minimise the risk that capital may be stranded in a rapidly decarbonising world. Our assessment in CY2020 indicated that the portfolio we then held would be resilient and have potentially higher financial value overall under our 1.5°C scenario when compared to our then current central planning cases that were associated with higher implied global average temperature outcomes. Since that assessment, we have continued to consider our 1.5°C scenario in our decision-making and strategy formation. We have made changes to our portfolio which would be expected to increase the resilience of our portfolio as a whole under our 1.5°C scenario.

Impact on our business, strategy, and capital alignment and allocation

The results of our climate-related risk (threats and opportunities) assessment across our short-, medium- and long-term time horizons, as well as our 1.5°C scenario, continued to be systematically integrated into our strategy and capital allocation process during FY2023, enabling us to test the extent to which our business, strategy and capital allocation is aligned with a rapidly decarbonising global economy.

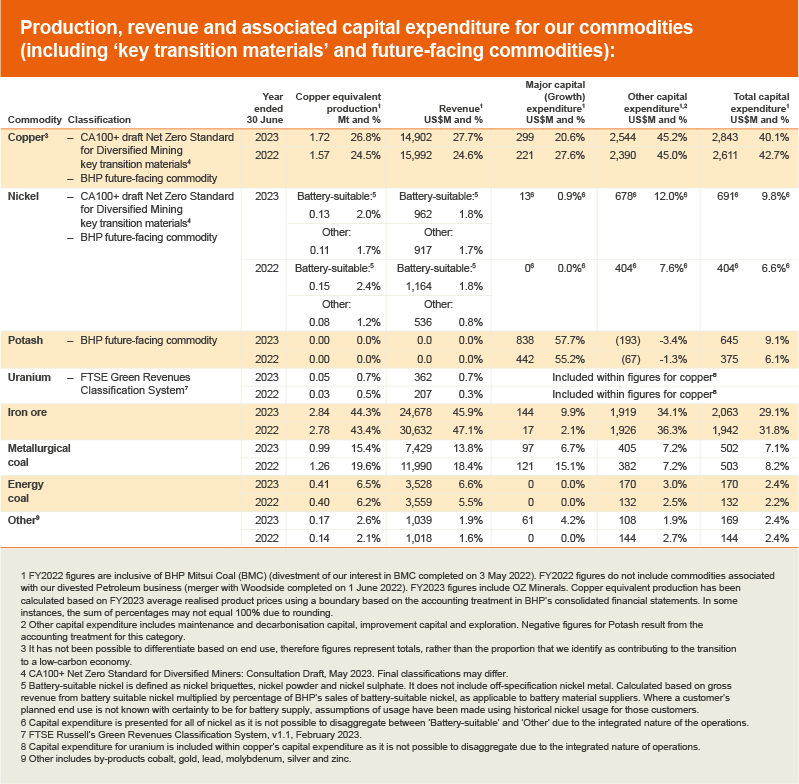

The table below outlines our FY2022 and FY2023 production, revenue and associated capital expenditure for our major commodities, including the identification of key transition materials as defined in the draft Net Zero Standard for Diversified Mining, as well as what we classify as our future-facing commodities (i.e. those that BHP determines to be positively leveraged in the energy transition and broader global response to climate change, with potential for decades-long demand growth to support emerging mega-trends like electrification and decarbonisation).

This table is intended only to present an indicative approach pending clear and resolved methodologies for the identification of the key transition minerals that contribute to the transition to a low-carbon economy and the calculation of the revenues they generate. We also acknowledge that the classifications in the table focus primarily on the theme of enabling the transition to a low-carbon economy to mitigate climate change and that broader sustainability indicators in relation to how these commodities are produced are also important to consider. Although steelmaking materials (iron ore and higher quality metallurgical coal) are not included in the classifications above, we have included them in the table for completeness and we believe they also play an important role in the transition.

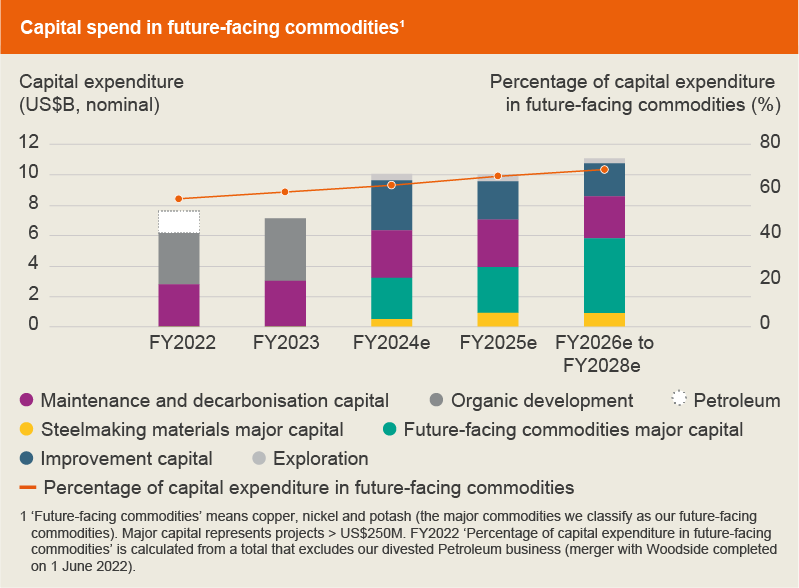

Our capital expenditure plans are increasingly focused on future-facing commodities between FY2024 and FY2028, as shown in the chart below.

Carbon pricing

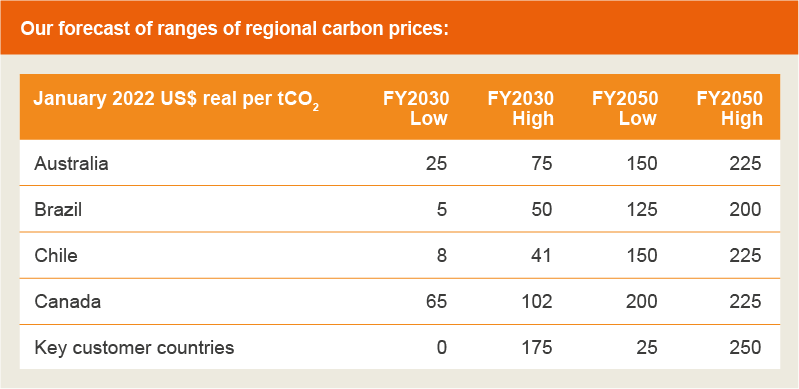

Our assets and markets will continue to be subject to evolving climate change regulations that may result in increasing levels of carbon prices by region and economic activity. Similarly, the competitiveness of our products and the downstream processes in which they are used are subject to carbon pricing legislation in customer countries. We use an explicit regulatory carbon price forecast for major BHP operational and customer countries that aligns with our One Energy View pathways framing and associated regional net zero ambitions.

In determining our outlook, we consider factors such as a country’s current and announced climate change policies, targets and goals (including net zero) and societal factors such as public acceptance and demographics.

Our forecast of ranges of regional carbon prices for major BHP operational countries and key customer countries is outlined below.

For more than a decade, we have incorporated regional carbon price assumptions in our planning, investment decisions and asset valuations. Carbon prices are used together with our operational planning cases based on the current economic outlook for asset planning, asset valuations and operational decision-making as well as when considering initiatives to meet our operational GHG emissions medium-term target and long-term goal.

Our carbon price forecasts are also used along with other qualitative and quantitative metrics, such as the outcomes of our 1.5°C scenario analysis, in assessing investments under the Capital Allocation Framework and to inform our portfolio strategy and investment decisions.

[ad_2]

Source link