[ad_1]

The latest business news as it happens

Article content

Top headlines

Article content

8:30 a.m.

Inflation cools to 3.1% in October as gas prices ease

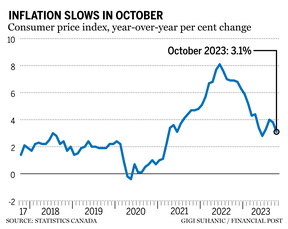

Inflation cooled in Canada in October, coming in at 3.1 per cent on a year-over-year basis, Statistics Canada said Tuesday.

Advertisement 2

Article content

Gas prices declined 7.8 per cent in October.

Prices for services rose by 4.6 per cent, driven by higher costs of travel, rent and property taxes.

Meanwhile, prices of food bought in stores continued to rise, though at a slower clip, rising 5.4 per cent in October compared to 5.8 per cent in September.

The annual inflation rate was 3.8 per cent in September.

The overall decline in inflation will be welcome news for the Bank of Canada as it looks for evidence of a sustained slowdown in consumer price growth.

The central bank opted to hold its key interest rate steady at five per cent at its last rate decision, but has said it is prepared to raise rates again if needed to bring inflation under control.

The Bank of Canada’s next interest rate decision is set for Dec. 6.

Financial Post, The Canadian Press

7:30 a.m.

OpenAI in ‘intense discussions’ after staff threaten mutiny over Sam Altman’s ouster

OpenAI said it’s in “intense discussions” to unify the company after another tumultuous day that saw most employees threaten to quit if Sam Altman doesn’t return as chief executive.

Vice president of Global Affairs Anna Makanju delivered the message in an internal memo reviewed by Bloomberg News, aiming to rally staff who’ve grown anxious after days of disarray following Altman’s ouster and the board’s surprise appointment of former Twitch chief Emmett Shear as his interim replacement.

Article content

Advertisement 3

Article content

OpenAI management is in touch with Altman, Shear and the board “but they are not prepared to give us a final response this evening,” Makanju wrote.

The memo from Makanju doesn’t elaborate on the extent of contact with Altman, and the former CEO didn’t respond to a request for comment outside regular business hours.

“We are continuing to go over mutually acceptable options and are scheduled to speak again tomorrow morning when everyone’s had a little more sleep,” Makanju wrote. “These intense discussions can drag out, and I know it can feel impossible to be patient.”

She added a word of reassurance for employees: “Know that we have a plan that we are working towards.”

Bloomberg

Read the full story here.

Before the opening bell: Stocks waver

United States equity futures wavered on Tuesday as some investors questioned the sustainability of a powerful rally fuelled by expectations of a U.S. Federal Reserve pivot to rate cuts.

Goldman Sachs Group Inc. strategists said there is a risk of “disappointment in the near term” amid lingering concerns about economic growth and inflation, after the S&P 500 surged to its strongest close since August and the Nasdaq 100 hit a 22-month high on Monday. Citigroup Inc. strategists warned of the possibility of a short squeeze that could derail the momentum.

Advertisement 4

Article content

“Despite a more certain outlook regarding peak rates and potential cuts in 2024, there are few upside catalysts,” said Liberum strategist Susana Cruz. “Corporate guidance was pretty soft during this earning season, forecasts for the fourth quarter have fallen and we will probably see more downgrades. That’s why we expect equities to experience a soft patch in the first half of 2024.”

Contracts on the S&P 500 and Nasdaq 100 were little changed.

In Canada, the S&P/TSX composite index closed up 70.70 points at 20,246.47.

Bloomberg

What to watch today

The inflation reading for October is out this morning. Economists expect the data to show inflation cooled on lower gas and food prices. Other data releases include the new housing price index for October, and in the United States, existing home sales.

Finance Minister Chrystia Freeland will table the Liberal government’s fall economic update this afternoon. Economists expect more spending on housing, but say Ottawa must find a delicate balance on spending as the economy slows.

The United States Federal Reserve Open Market Committee releases meeting minutes for its Nov. 1 interest rate decision at 2 p.m. ET.

Expect earnings reports from George Weston Ltd., Nvidia Corp. and Lowe’s Companies Inc.

Related Stories

-

None

-

What economists expect from today’s fiscal update

-

In Canada’s housing market, it matters who your parents are

Need a refresher on yesterday’s top headlines? Get caught up here.

Additional reporting by The Canadian Press, Associated Press and Bloomberg

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Article content

[ad_2]

Source link

Comments

Postmedia is committed to maintaining a lively but civil forum for discussion and encourage all readers to share their views on our articles. Comments may take up to an hour for moderation before appearing on the site. We ask you to keep your comments relevant and respectful. We have enabled email notifications—you will now receive an email if you receive a reply to your comment, there is an update to a comment thread you follow or if a user you follow comments. Visit our Community Guidelines for more information and details on how to adjust your email settings.