[ad_1]

The latest business news as it happens

Article content

Top headlines

Article content

2:41 p.m.

Warren Buffett keeps selling in 2023 exiting GM and Activision Blizzard

Warren Buffett’s Berkshire Hathaway Inc. reduced the number of stocks in its portfolio in the third quarter, exiting stakes in General Motors Co. and Activision Blizzard Inc. while trimming bets on companies including HP Inc.

Advertisement 2

Article content

The conglomerate’s retreat from Activision completes Buffett’s arbitrage play amid the video-game maker’s prolonged effort to merge with Microsoft Corp., which ran into antitrust scrutiny before the deal was completed in October.

All together, Berkshire exited stakes in seven companies, not including the restructuring of its investment in Liberty Media Corp. and related entities. The value of its disclosed investments decreased 10 per cent from the previous quarter to $312.8 billion.

The conglomerate said it had omitted some data from the filing that was reported confidentially to regulators, and it’s unclear whether the information withheld related to a new or existing position. The Securities and Exchange Commission sometimes allows companies to withhold information from the public to limit copycat investing while a firm is building or cutting a position.

Berkshire has been a net seller of equities throughout 2023, pocketing about US$23.6 billion from stock sales after purchases in the first nine months of this year. Those equity sales have contributed to a high-class problem for the conglomerate: more money than it can easily put to work. Much of the hoard has ended up in short-dated Treasuries, helping Berkshire rack up a record US$157 billion in cash.

Advertisement 3

Article content

Earlier this year, Buffett broke with his typical strategy of holding on for the long-term by revealing he had abruptly rotated out of a position in Taiwan Semiconductor Manufacturing Co. The billionaire chalked up the decision to concerns over political risk in Taiwan, even as he lauded the chipmaker as a “fabulous enterprise.”

There have been some other changes to Berkshire’s equities portfolio this year, with the conglomerate previously exiting U.S. Bancorp and Bank of New York Mellon Corp. even as it placed a wager on Capital One Financial Corp. amid a tumultuous period for the sector.

Bloomberg

12:39 p.m.

Slate Office REIT suspends distributions, plans asset sale; units plunge 20%

Units in Slate Office REIT sank 20 per cent after the trust suspended its monthly cash distributions and announced a plan to sell a large part of its portfolio of properties.

Slate units were down 21 cents at 81 cents in trading on the Toronto Stock Exchange.

The trust said late Tuesday that its management and board has identified non-core assets for sale comprising about 40 per cent of its total gross leasable area.

Article content

Advertisement 4

Article content

Slate also said the move to suspend its distribution is expected to provide it with an additional $10.2 million of cash annually that will be used to repay debt and fund its ongoing operations.

The changes came as Slate reported a net loss of $34.7 million in its quarter ended Sept. 30 compared with a profit of $18.4 million in the same quarter last year, while rental revenue held steady at $51 million.

The trust’s funds from operations amounted to $4.8 million or six cents per unit for the quarter, down from $10.3 million or 12 cents per unit a year earlier.

The Canadian Press

12:15 p.m.

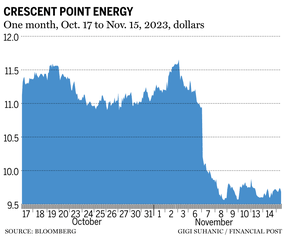

BMO, RBC lead Crescent Point clean-up trade following hung deal

A syndicate led by Bank of Montreal and Royal Bank of Canada is executing a clean-up trade on shares of Crescent Point Energy Corp., according to people familiar with the matter, after a hung deal last week left the lenders holding onto millions of shares.

Crescent Point shares were re-offered to clients at $9.70 each, according to terms of the deal seen by Bloomberg News. That’s 60 Canadian cents less than the price at which the BMO- and RBC-led syndicate underwrote the share sale last week.

Advertisement 5

Article content

The Calgary-based oil and gas producer closed a $500 million equity raise on Friday. The group failed to find enough buyers at $10.30 a share, leaving them with about 25 per cent of the 48.5 million shares issued, people familiar with the matter have said.

The difference between the original price and the re-offer implies the shares still held by the banking syndicate have declined $7.3 million in value, Bloomberg calculations show. Neither BMO nor RBC responded to a request for comment.

Crescent Point shares are down 13 per cent this month on a combination of a drop in oil prices and the announcement of its deal for Hammerhead Energy Inc. and the equity financing.

As of Wednesday morning, multiple analysts including at BMO were still restricted on the stock, according to data compiled by Bloomberg. Analysts are restricted on a stock when their firm is in the midst of trying to market shares of that company.

BMO and RBC are joint bookrunners on the share re-offer, the terms show. Settlement of the clean-up trade is expected on Nov. 16.

Bloomberg

Noon

Midday markets: ‘We got more Goldilocks today’

Advertisement 6

Article content

Stocks extended their November gains on speculation the Unites States Federal Reserve will be able to achieve a soft landing as the U.S. economy remains fairly resilient and inflation shows signs of cooling.

The S&P 500 topped 4,500 — though the advance was much smaller than Tuesday’s surge that was turbocharged by short covering and bets the Fed’s tightening cycle is over. Big-box retailer Target Corp. soared on solid earnings, while Nvidia Corp. dropped after a 10-day winning run. Treasuries halted an advance that put global bonds on the verge of erasing their 2023 losses.

Traders waded through a batch of economic data for clues on the outlook for the Fed’s next steps. U.S. retail sales slowed in October and prior months were revised higher — suggesting some resiliency going into the holiday season. Prices paid to U.S. producers unexpectedly declined by the most since April 2020.

“We got more Goldilocks today,” said David Russell, global head of market strategy at TradeStation. “Price growth is moderating, but with strong demand on the sidelines. The soft landing is taking shape.”

Advertisement 7

Article content

On Wall Street, the S&P 500 was up 0.20 per cent at 4,504.25. The Dow Jones Industrial Average rose 0.33 per cent at 34,942.45 while the Nasdaw composite was up 0.17 per cent at 14,118.68.

In Toronto, strength in the technology and base metal stocks helped Canada’s main stock index build on recent gains.

The S&P/TSX composite index was up 0.26 per cent at 20,076.15 after gaining more than 300 points on Tuesday.

The Canadian dollar traded for 73.17 cents U.S. compared with 72.86 cents U.S. on Tuesday.

The December crude oil contract was down 1.3 per cent at US$77.25 per barrel.

The December gold contract was down 0.03 per cent at US$1,965.90 an ounce.

Bloomberg, The Canadian Press

10:00 a.m.

Markets open: Stocks rise modestly as traders weigh more U.S. data

United States Treasuries fell after a surge that put global bonds on the verge of erasing their 2023 losses, with traders weighing mixed readings on U.S. retail sales and inflation for clues on the Federal Reserve’s next steps.

Two-year yields, which are more sensitive to imminent policy moves, climbed five basis points to about 4.9 per cent. Stocks edged higher, following a rally that was turbocharged by short covering and bets the Fed’s tightening cycle is over. Target Corp. soared on earnings that beat forecasts as the big-box retailer recovers from its recent profit-busting pileup of merchandise.

Advertisement 8

Article content

U.S. retail sales slowed in October and prior months were revised higher, suggesting some resiliency going into the holiday season. Prices paid to U.S. producers unexpectedly declined by the most since April 2020, adding to evidence that inflationary pressures are abating across the economy.

On Wall Street, the S&P 500 rose 0.25 per cent to 4,508.56. The Dow Jones Industrial Average was up 0.25 per cent to 34,914.60 while the Nasdaq Composite rose 0.31 per cent to 14,137.12.

In Toronto, The S&P/TSX composite index was up 0.28 per cent at 20,080.33.

Bloomberg, Financial Post

9:35 a.m.

Manufacturing sales up in value, down on volume

Statistics Canada reported manufacturing sales rose 0.4 per cent to $72.8 billion in September, as higher prices helped sales in the petroleum and coal product subsector move higher.

The agency says sales were up in 10 of 21 subsectors, as the petroleum and coal products group gained 6.3 per cent, the wood subsector rose 2.9 per cent and the machinery group added 1.3 per cent. The gains were partially offset by a 1.8 per cent drop in sales of chemicals and a 2.6 per cent decline in motor vehicle parts.

Advertisement 9

Article content

Total manufacturing sales in constant dollars fell 0.6 per cent in September, indicating a lower volume of goods sold.

In a separate report, Statistics Canada says wholesale sales, excluding petroleum, petroleum products, and other hydrocarbons and excluding oilseed and grain, rose 0.4 per cent to $83.1 billion in September.

The increase came as wholesale sales were higher in four of the seven subsectors, led by a 2.2 per cent increase in the motor vehicle and motor vehicle parts and accessories subsector and a 1.6 per cent gain for the food, beverage and tobacco subsector.

In volume terms, wholesale sales, excluding petroleum, petroleum products, and other hydrocarbons and excluding oilseed and grain, rose 0.5 per cent in September.

Statistics Canada began including the oilseed and grain industry group as well as the petroleum and petroleum products subsector as part of wholesale trade earlier this year, but is excluding the data from its monthly analysis until historical data are available for monthly and annual analysis.

The Canadian Press

7:49 a.m.

Advertisement 10

Article content

Canadian grocers’ profit and sales rise

Canadian grocers, Loblaw Cos. Ltd. and Metro Inc. reported higher sales and profits today.

Loblaw profit for its third quarter was $621 million or $1.95 per diluted share, up from $556 million or $1.69 per diluted share in the same quarter the year before. Revenue was $18.27 billion, up from $17.39 billion last year.

The parent company of Loblaws and Shoppers Drug Mart said food retail same-stores sales rose 4.5 per cent and drug retail same-store sales gained 4.6 per cent.

Metro said its fourth-quarter profit rose from $168.7 million last year to $222.2 million as sales rose 14 per cent.

A five-week strike at 27 stores in the Greater Toronto Area during the quarter cost Metro about $27 million after taxes or 12 cents per share, but it gained that same amount from the extra week in the quarter.

Metro sales totalled $5.07 billion, up from $4.43 billion a year earlier. The increase came as food same-store sales rose 6.8 per cent and pharmacy same-store sales gained 5.5 per cent.

The Canadian Press

7:30 a.m.

Elon Musk among CEOs hoping to woo China’s Xi

Advertisement 11

Article content

Executives from some of America’s biggest companies are converging on San Francisco this week for an audience with Chinese President Xi Jinping and other Asian leaders as long-frosty U.S.-China relations show only tentative signs of warming.

U.S. President Joe Biden and Xi meet today for a carefully choreographed, much-anticipated sitdown on the sidelines of the Asia-Pacific Economic Cooperation summit.

But some of the biggest names in American business are also scheduled to attend the summit, among them Citigroup’s Jane Fraser, Exxon’s Darren Woods, Microsoft’s Satya Nadella and Tesla Inc. and SpaceX’s Elon Musk.

The hottest ticket is the Xi dinner, and executives were scrambling for seats or to be put on a waiting list, according to people familiar with the situation. The Chinese president is under pressure to assure executives that his nation is very much open for business and making progress in its efforts to revive the economy. His guests will be keen to tell him that they still see China as a vitally important market despite Washington’s efforts to erect barriers around sensitive technologies.

Advertisement 12

Article content

Read more

Bloomberg

Before the opening bell

Stocks are continuing the rally sparked Tuesday by a cooler-than-expected inflation reading in the United States that raises the odds the Federal Reserve will end rate hikes.

Markets will be watching U.S. retail sales and producer prices out today for further confirmation that an economic slowdown will allow the Fed to stop tightening monetary policy.

Canada’s TSX gained 1.6 per cent Tuesday in a broad-based rally led by financials, base metals and utilities. See the top three performers here.

In New York, S&P 500 index closed up 1.9 per cent.

National Post wire services

What to watch today

All eyes are on the big grocers today as Loblaw Cos. Ltd. and Metro Inc. release earnings.

We’ll also get updated data on the health of the housing market this morning with existing home sales and the MLS home price index for October. Other data releases include Canadian manufacturing sales and orders, wholesale trade and new motor vehicle sales, along with U.S. retail sales and the U.S. producer price index for October.

Related Stories

-

None

-

Canada’s menacing mortgage math threatens crisis: Rosenberg

-

Teck is ready to sell its coal assets to Glencore

Need a refresher on yesterday’s top headlines? Get caught up here.

Additional reporting by The Canadian Press, Associated Press and Bloomberg

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Article content

[ad_2]

Source link

Comments

Postmedia is committed to maintaining a lively but civil forum for discussion and encourage all readers to share their views on our articles. Comments may take up to an hour for moderation before appearing on the site. We ask you to keep your comments relevant and respectful. We have enabled email notifications—you will now receive an email if you receive a reply to your comment, there is an update to a comment thread you follow or if a user you follow comments. Visit our Community Guidelines for more information and details on how to adjust your email settings.