[ad_1]

The latest business news as it happens

Article content

Today’s top headlines

Advertisement 2

Article content

Article content

10:44 a.m.

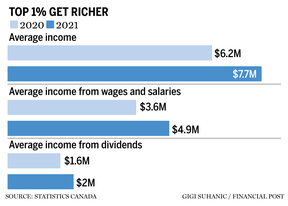

Top 1% of tax filers saw incomes rise by almost 10% in 2021: Statistics Canada

Statistics Canada says the country’s top one per cent of tax filers saw their incomes rise by almost 10 per cent in 2021, while those in the bottom half saw their average income decline.

The agency says the incomes of the top earnings group, excluding capital gains, jumped 9.4 per cent higher to $579,000.

Meanwhile, filers in the top 0.1 per cent saw their average income increase 17.4 per cent to almost $2.1 million and those in the top 0.01 per cent experienced an average income increase of 25.7 per cent, bringing their earnings to about $7.7 million.

At the same time, filers in the bottom half saw their average income fall by $1,400 to $21,100 in 2021 as the government ended many of its pandemic benefit programs.

Statistics Canada adds women made up roughly 26 per cent of the top one per cent of income tax filers, up from 25.4 per cent in 2020 and 11.4 per cent in 1982.

Its research also looked at money made from the sale of a home or other asset, finding 12.2 per cent of tax filers received capital gains, which had an average value of $37,600 in 2021. Average capital gains were $29,300 in 2020.

Article content

Advertisement 3

Article content

The Canadian Press

10:09 a.m.

Markets open: Caution switches to ‘year-end greed’

Stocks rose and bond yields fell, with Wall Street traders looking past the United States Federal Reserve’s efforts to downplay the market’s dovish bid ahead of a key reading on consumer sentiment.

The S&P 500 snapped back, following a slide triggered by a Treasury selloff and Jerome Powell’s remarks that officials won’t hesitate to tighten, if needed. While that’s roughly the message that several Fed speakers have been sending over the past few days, it served as a catalyst for a pullback in markets after a solid November rally. Two-year yields dropped below five per cent, while the dollar halted a four-day advance.

On Friday, the S&P 500 was up 0.34 per cent at 4,362.06, while the Dow Jones Industrial Average rose 0.13 per cent to 33,937.42. The Nasdaq composite was up 0.49 per cent at 13,587.35.

“For the market to sustainably rally from here it still needs what it hasn’t received: Calm in the Treasury market,” said Tom Essaye, a former Merrill Lynch trader who founded The Sevens Report newsletter. “Short, sharp declines are no more beneficial for stocks than short, sharp rises.”

Advertisement 4

Article content

Fed officials are trying to determine if they should keep raising rates after electing to leave the central bank’s benchmark unchanged at their last two policy meetings. It’s currently in a range of 5.25 per cent to 5.5 per cent, the highest level in 22 years. Fed Bank of Atlanta President Raphael Bostic said policymakers can return U.S. inflation to their goal without the need to hike further.

The caution that pervaded equity markets in the past three months has now switched to “year-end greed” on expectations of a decline in U.S. bond yields, according to Bank of America Corp.’s Michael Hartnett.

In Toronto, the S&P/TSX composite was down 0.20 per cent to 19,548.48.

Bloomberg, Financial Post

7:30 a.m.

Trudeau government outlines $500 million in spending cuts

Prime Minister Justin Trudeau’s government has unveiled the details of $500 million in spending cuts, aiming to assure Canadians that fiscal responsibility is a priority amid high interest rates and stubborn inflation.

Still, the cuts represents only about 0.1 per cent of the $490 billion in spending budgeted for the 2023-2024 fiscal year. Treasury Board President Anita Anand put forward the plan for the cuts — which take aim at consulting, professional services and travel across 68 departments and agencies — in the House of Commons on Nov. 9.

Advertisement 5

Article content

The reductions are an initial step in the government’s first spending review since taking power in 2015. In total, the government aims to chop $15.4 billion from spending over five years and $4.5 billion annually after that, and Anand promised to reveal more details in the months to come.

“Not only is this the first time our government’s undertaking a spending review, but we’re also in a time of high inflation and high interest rates,” Anand said. “What we need to do is to ensure that we are spending taxpayer dollars prudently.”

Bloomberg

Read the full story here.

Before the opening bell: Stock

Global equities retreated after United States Federal Reserve chair Jerome Powell’s warning that interest rates may have to climb further.

The Stoxx 600 shed 0.6 per cent, undermined also by a set of poor corporate announcements. Energy shares outperformed as the WTI crude oil benchmark rose for the second day in a row.

Nasdaq 100 index futures slipped 0.2 per cent, while 10-year Treasury yields held steady around 4.63 per cent, after surging on Thursday on renewed concern about higher interest rates. Earlier, Asian shares fell, tracking Wall Street’s lower close.

Advertisement 6

Article content

In Canada, the S&P/TSX composite index closed up 57.20 points at 19,587.41.

Bloomberg

What to watch today

The United States is observing Veteran’s Day today, so bond markets will be closed. Stock markets are open.

The Bank of Canada’s senior loan officer survey for the third quarter will be released at 10:30 a.m. ET.

In the U.S., the University of Michigan Consumer Sentiment Index will land at 10 a.m.

Sleep Country Canada Holdings Inc. will release its third quarter earnings and hold a conference call at 8 a.m. SNC-Lavalin Group Inc., which recently changed its name to AtkinsRealis, will also release earnings.

Related Stories

-

None

-

Investors still don’t believe in the new normal

-

Higher-income earners will soon contribute more to CPP

Need a refresher on yesterday’s top headlines? Get caught up here.

Additional reporting by The Canadian Press, Associated Press and Bloomberg

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Article content

[ad_2]

Source link

Comments

Postmedia is committed to maintaining a lively but civil forum for discussion and encourage all readers to share their views on our articles. Comments may take up to an hour for moderation before appearing on the site. We ask you to keep your comments relevant and respectful. We have enabled email notifications—you will now receive an email if you receive a reply to your comment, there is an update to a comment thread you follow or if a user you follow comments. Visit our Community Guidelines for more information and details on how to adjust your email settings.