[ad_1]

The latest business news as it happens

Article content

Today’s headlines

Advertisement 2

Article content

Article content

Top story

Alberta oil production hits record in ramp up to Trans Mountain completion

Alberta oil production hit an all-time record in November, as oilsands companies ramped up output to prepare for the imminent completion of the Trans Mountain pipeline expansion.

The Alberta Energy Regulator says crude oil production in the province rose by 8.8 per cent in November to a new historic high of 4.2 million barrels per day.

Alberta averaged 3.8 million barrels per day of oil production in the first eleven months of 2023, up 1.6 per cent from 2022 and five per cent higher than the same period in 2021.

Eight Capital analyst Phil Skolnick noted the November production figures put Canada ahead of China’s 2022 production levels and just behind Iraq, making Canada the fourth-largest oil producer globally.

The Trans Mountain pipeline expansion, which is more than 98 per cent complete, will give Canada’s oil industry an additional 590,000 barrels per day of export capacity.

Skolnick said without the addition of the Trans Mountain project, Canadian oil production volume would likely exceed this country’s current total pipeline capacity in the second half of this year.

Advertisement 3

Article content

The Canadian Press

12:55 p.m.

Barrick produced 4.05 million ounces of gold in 2023, preliminary figures show

Barrick Gold Corp. says it produced 4.05 million ounces of gold in 2023 based on its preliminary figures.

The miner says copper production for the year totalled 420 million pounds, compared with its guidance for between 420 million and 470 million pounds.

The results were down from the 4.14 million ounces of gold and 440 million pounds of copper Barrick produced in 2022.

Based on preliminary figures for the fourth quarter, Barrick says it produced 1.05 million ounces of gold and 113 million pounds of copper in the final three months of 2023.

Preliminary sales figures for the fourth quarter totalled 1.04 million ounces of gold and 117 million pounds of copper. Barrick says the average market price for gold in the quarter was US$1,971 per ounce and the average market price for copper was US$3.70 per pound.

Shares in the company were down C$1.56 at C$22.07 in early afternoon trading on the Toronto Stock Exchange.

The Canadian Press

Noon

Midday markets: TSX and Wall Street in the red

Article content

Advertisement 4

Article content

Canada’s main stock index was down in late-morning trading, weighed down by losses in base metal and energy stocks, with all the major U.S. stock markets in the red, as well.

The S&P/TSX composite index was down 0.51 per cent at 20,954.91.

In New York, the Dow Jones industrial average was down 0.55 per cent. The S&P 500 index was down 0.35 per cent, while the Nasdaq composite was fell 0.29 per cent.

U.S. bond yields rose as stocks wavered on speculation Wall Street’s bets on aggressive United States Federal Reserve rate cuts have gone too far.

“I sense that the first quarter of this year will be marked by the realization that it’s too early for the central banks to cut the interest rates,” said Ipek Ozkardeskaya, a senior analyst at Swissquote. “In the US, the resilient growth, healthy jobs market and sustained fiscal spending into the presidential election suggest no urge for a Fed cut in March.”

Data out today indicated that Canadian inflation for December accelerated as did the Bank of Canada’s favoured CPI measures, possibly complicating the bank’s decision on when to make the first cut to interest rates, economists say.

Advertisement 5

Article content

The Canadian dollar traded for 74.16 cents US compared with 74.43 cents US on Monday.

The February crude oil contract was down 0.08 per cent at US$72.74 per barrel and the February natural gas contract was down 35 cents at US$2.96 per mmBTU.

The Canadian Press, Bloomberg

11:38 a.m.

Houthis hit second merchant ship in Red Sea as Shell abandons key trade route

A second commercial ship was struck by a missile in the Red Sea in the space of 24 hours and Shell PLC halted oil tanker transits through the waterway as Houthi militants retaliated against U.S. and U.K. airstrikes in Yemen.

The Greek-owned bulk carrier Zografia was struck about 122 kilometres northwest of Al-Saleef in Yemen, according to Ambrey Analytics. On Monday, another commodity carrier, the U.S.-owned Gibraltar Eagle, was struck in the Gulf of Aden.

Since Friday, the United States navy has advised vessels to stay away from the southern Red Sea, effectively closing off the Suez Canal for those who follow the guidance. The move prompted a fresh round of trade disruption as everything from containers to oil and gas carriers embark on a detour thousands of kilometres around the coast of Africa. It’s threatening to snarl and delay supply chains and prompt a new bout of inflation that could hurt the global economy.

Advertisement 6

Article content

Companies that own and operate hundreds of ships have heeded the advice to stay away. The latest is London-headquartered oil major Shell PLC, which suspended shipments amid fears of a further escalation in the conflict, according to the Wall Street Journal. Japanese shipping giant Mitsui OSK Lines Ltd., with a fleet of about 800 vessels, also halted transits, a spokesperson said Tuesday.

A spokesman for Shell declined to comment on the Journal’s story.

Bloomberg

10:34 a.m.

Rogers overtakes Bell in annual report on telecom complaints as wireless issues rise

Rogers Communications Inc. is now Canada’s most complained about telecommunications provider, overtaking Bell Canada in an annual report measuring consumer gripes within the industry.

The study by the independent Commission for Complaints for Telecom-television Services detailed the numerous issues it was notified about between Aug. 1, 2022 and July 31, 2023.

It says complaints about Rogers increased by 43.6 per cent from the previous year, compared with a 14 per cent increase in complaints for all service providers, as the company accounted for 19.8 per cent of all complaints.

Advertisement 7

Article content

Bell, with 16.1 per cent of all complaints received, and Telus Corp., with 12.3 per cent, were the next highest on the list, with the latter seeing a 43.2 per cent jump in issues reported to the commission compared with the previous year.

For Rogers, wireless issues made up 45 per cent of all issues and were up 35 per cent year-over-year, as the company’s customers also complained more this year about experiencing a complete loss of service, incorrect charges, not receiving a refund or credit, and the quality of service.

Telus saw a 48 per cent increase in wireless issues, which now account for 57 per cent of its customers’ complaints, while disclosure complaints were Bell’s most-raised issue this year, followed by issues related to incorrect charges on monthly plans.

The Canadian Press

10 a.m.

Markets open: Stocks fall, bond yields rise on concerns Fed bets are overdone

Stocks fell and bond yields rose, with traders wading through bank earnings and awaiting clues on United States Federal Reserve policy amid speculation bets on aggressive rate cuts are overdone.

The S&P 500 lost traction, following last week’s advance. Goldman Sachs Group Inc. topped earnings estimates as its equities-trading unit posted a jump in revenue, while Morgan Stanley’s traders fell short again, dragging down profit at the firm. Treasury 10-year yields topped four per cent, while the U.S. dollar hit a one-month high.

Advertisement 8

Article content

In Canada, the S&P/TSX composite fell 0.71 per cent in early trading.

Bloomberg

8:30 a.m.

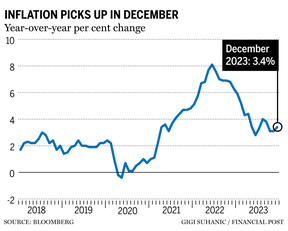

Inflation ticks up again in December to 3.4%

Canada’s annual rate of inflation rose 3.4 per cent in December, Statistics Canada said Tuesday.

Airfares, vehicles and rent all contributed to the rise in inflation.

Food prices increased 4.7 per cent, matching the pace of increase in November.

Economists were widely expecting the rise due to a sharper decline in gasoline prices in December 2022 compared to last month.

In November, the inflation rate was 3.1 per cent.

Statistics Canada said the annual average inflation rate for 2023 was 3.9 per cent, down from a 40-year high of 6.8 per cent in 2022. Price growth in 2023 slowed in six out of eight components of the consumer price index compared to the previous year.

Financial Post, The Canadian Press

Read the full story here.

8 a.m.

Tim Hortons parent RBI buys U.S. Burger King franchise for $1 billion

Restaurant Brands International Inc. says it has signed a deal to buy Carrols Restaurant Group, the largest Burger King franchisee in the United States, in a deal worth US$1 billion.

Advertisement 9

Article content

Under the agreement, Restaurant Brands, which own the Burger King brand as well as Tim Hortons, Popeyes Louisiana Kitchen and Firehouse Subs, will pay US$9.55 per share in cash.

Carrols has 1,022 Burger King restaurants in 23 states as well as 60 Popeyes restaurants in six states.

RBI said the deal is part of a plan at Burger King plan to accelerate sales growth and drive franchisee profitability.

Burger King expects to invest about US$500 million to remodel about 600 of the acquired restaurants to bring them in line with its latest design.

The company ultimately plans to refranchise the vast majority of the portfolio to new or existing smaller franchise operators.

The Canadian Press

7:30 a.m.

First Quantum pausing dividend, selling mines after Panama copper mine closure

First Quantum Minerals Ltd. will cut spending, pause its dividend and put smaller mines up for sale in a sweeping effort to free up cash after it was ordered to shutter its US$10-billion copper operation in Panama.

The Canadian miner on Jan. 16 said it’s considering a range of capital-market options to maintain its financial position and is working with banks to “address and extend” its bank loan facilities. It’s also considering selling stakes in larger mining assets after receiving expressions of interest from potential investors.

Advertisement 10

Article content

First Quantum is reeling from the fallout of Panama President Laurentino Cortizo’s abrupt orders to shutter its biggest asset late last year, following a ruling from the Supreme Court that invalidated the mine’s operating contract. The closing of Cobre Panama, which accounted for 78 per cent of First Quantum’s operating profit in the first nine months of 2023, has wiped out more than half of the miner’s market value and cast the company’s finances into uncertainty as billions of dollars of its debt mature in the coming years.

First Quantum plans to cut capital spending by US$400 million this year — to a range of US$1.2 billion to US$1.4 billion — in part from slowed spending on Cobre Panama, as well as moves to combat cost growth at its Zambian mines.

Without Cobre Panama operating, the company also said it expects copper output to fall by nearly half from last year. The company produced 708,000 metric tons of copper in 2023 and expects to produce 370,000 tons to 420,000 tons in 2024.

First Quantum had previously announced plans to pause mining operations at its Australian nickel mine. Bloomberg also reported last week the company has started a process to sell a copper mine in Spain.

Advertisement 11

Article content

Jacob Lorinc, Bloomberg

Read the full story here.

7:15 a.m.

Stock markets before the opening bell

Global stocks retreated and the dollar rose to a one-month high as central bank officials pushed back against bets on aggressive interest rate cuts.

U.S. futures slid, while the Stoxx Europe 600 index headed for a five-week low. The MSCI Asia Pacific Index lost 1.5 per cent, the most in three months. Two-year Treasury yields rose six basis points to 4.2 per cent. An index of the dollar climbed 0.6 per cent.

Bloomberg

What to watch today

Prime Minister Justin Trudeau will make a speech at the Chamber of Commerce of Metropolitan Montreal, followed by a moderated exchange with Michel Leblanc, CEO of the Chamber.

Inflation numbers for December will be released this morning. Economists expect the consumer price index reading to have ticked up again. Also on tap are Canadian housing starts for December, and the U.S. Empire State manufacturing survey.

Morgan Stanley and Goldman Sachs Group Inc. report earnings today.

Recommended from Editorial

-

Bad guys go free while compliant taxpayers burdened

-

Home sales jump in December, while prices eke out gain for year

Need a refresher on yesterday’s top headlines? Get caught up here.

Additional reporting by The Canadian Press, Associated Press and Bloomberg

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Article content

[ad_2]

Source link