[ad_1]

The latest business news as it happens

Article content

Today’s headlines

Advertisement 2

Article content

Article content

Top story

Hertz to sell 20,000 EVs in shift back to gas-powered cars

Hertz Global Holdings Inc. plans to sell a third of its United States electric vehicle fleet and reinvest in gas-powered cars due to weak demand for the battery-powered options.

The sales of 20,000 EVs began last month and will continue over the course of 2024, the rental giant said Thursday in a regulatory filing. Hertz expects to record a non-cash charge in its fourth-quarter results of US$245 million related to incremental net depreciation expense.

“The company expects to reinvest a portion of the proceeds from the sale of EVs into the purchase of internal combustion engine vehicles to meet customer demand,” Hertz said. “The company expects this action to better balance supply against expected demand of EVs.”

In October, Hertz chief executive Stephen Scherr said the company would scale back on EVs, which had made up 11 per cent of its total fleet. Teslas represented 80 per cent of that. He said EVs come with higher repair costs compared to the rest of its cars, which has hurt its bottom line. “EV’s will be slower than our prior expectations,” he said during the company’s third-quarter earnings call.

Article content

Advertisement 3

Article content

Hertz shares fell 4.6 per cent before regular trading in New York.

Richard Clough, Bloomberg

Read the full story here.

8:30 a.m.

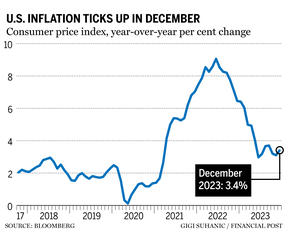

U.S. inflation comes in higher than expected in December

Higher rents and food prices boosted overall United States inflation in December, a sign that the U.S. Federal Reserve’s drive to slow inflation to its two per cent target may be a bumpy one.

Thursday’s report from the Labor Department showed that overall prices rose 0.3 per cent from November and 3.4 per cent from 12 months earlier. Those gains exceeded the previous 0.1 per cent monthly rise and the 3.1 per cent annual inflation in November.

Excluding volatile food and energy costs, so-called core prices rose just 0.3 per cent month over month, unchanged from November’s increase. Core prices were up 3.9 per cent from a year earlier, down a tick from November’s four per cent year-over year gain. Economists pay particular attention to core prices because, by excluding costs that typically jump around from month to month, they are seen as a better guide to the likely path of inflation.

Overall inflation has cooled more or less steadily since hitting a four-decade high of 9.1 per cent in mid-2022. Still, the persistence of still-elevated inflation helps explain why, despite steady economic growth, low unemployment and healthy hiring, polls show many Americans are dissatisfied with the economy — a likely key issue in the 2024 elections.

Advertisement 4

Article content

The Federal Reserve, which began aggressively raising interest rates in March 2022 to try to slow the pace of price increases, wants to reduce year-over-year inflation to its two per cent target level.

The Associated Press

7:30 a.m.

Aritizia sales rise unexpectedly on new styles, higher markdowns

Aritzia Inc. reported an unexpected increase in sales for the third quarter as new inventory and higher markdowns drew in customers.

The Vancouver-based retailer’s revenue came in at $653.5 million, beating the average analyst estimate of $621.9 million. Sales rose 4.6 per cent from a year earlier, while analysts expected a decline.

Adjusted earnings came in at 47 cents per share compared with the average estimate of 41 cents.

“Although the consumer environment remains mixed, we generated sales growth across all of our geographies and channels, as clients responded well to our new styles and outerwear offering,” chief executive Jennifer Wong said in a statement after market close Jan. 10.

Management also said it expects to introduce new styles for the spring, which could further draw in customers and boost sales. The retailer also expects its inventory issues to improve by then.

Advertisement 5

Article content

Aritzia shares lost almost half their value over 2023 after the hype surrounding the company at the time failed to translate into financial success. Much of the hope for growth rests on its long-term plan to expand in the United States.

For the current quarter, the company sees sales of $670 million to $690 million, compared with the estimate of $677.6 million. Gilbert said seasonal contribution from the brand’s famous Super Puff jacket gives it a “strong franchise.”

Lara Sanli, Bloomberg

More: Aritzia looking to new U.S. stores to boost business as it reports drop in net income

Stock markets before the opening bell

United States equity futures and European stocks ticked higher as investors prepared for inflation data that will help clarify the path for U.S. Federal Reserve policy.

Contracts for the S&P 500 pointed to small gains after the gauge wiped out all losses from the start of the year and closed just short of an all-time high set two years ago. Cryptocurrency stocks extended an advance in premarket trading after regulators approved exchange-traded funds that invest directly in bitcoin.

Advertisement 6

Article content

The U.S. inflation report is top of mind for traders Thursday. More evidence of cooling price pressures will support optimism around expectations for Fed interest rate cuts, but a hot reading could spur volatility. Economists tracked by Bloomberg expect year-over-year core inflation to fall to 3.8 per cent in the December data from four per cent in the prior month.

In Canada, the S&P/TSX composite index closed up up 18.44 points at 20,989.42 on Wednesday.

Bloomberg

What to watch today

The Economic Club of Canada hosts their annual Economic Outlook Breakfast with chief economists from Toronto-Dominion Bank, Bank of Nova Scotia, Bank of Montreal, Canadian Imperial Bank of Commerce and Royal Bank of Canada.

The United States consumer price index for December will be released this morning.

Recommended from Editorial

-

More softening ahead for jobs, but wage hikes to have staying power

-

Trade could add to Q4 GDP and help avoid technical recession

Need a refresher on yesterday’s top headlines? Get caught up here.

Additional reporting by The Canadian Press, Associated Press and Bloomberg

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Article content

[ad_2]

Source link