[ad_1]

Wirestock

After the market closes on May 10th, the management team at The Walt Disney Company (NYSE:DIS) is expected to announce financial results covering the second quarter of the company’s 2023 fiscal year. Late last year, in November to be specific, Bob Iger returned to the company as CEO in order to get the company back on track from a profitability perspective. This will represent the first full quarter in which he has been back at the firm. As such, it’s highly likely that investors and analysts alike will be putting a lot of weight into what is ultimately reported by the company during this time.

Whether you follow The Walt Disney Company out of interest, or are an investor in the firm like I am, there are some very important items that we should be on the lookout for. These are items that, for the most part, will go a long way toward determining the trajectory of the company over the next few months.

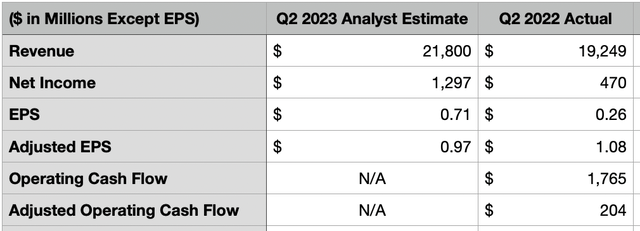

A look at headline results

As is the case with any company out there, the first thing that would be on Disney investors’ minds will be the headline news. At the very top, we have revenue. According to analysts, sales for the company should come in at around $21.80 billion. If this does come to fruition, it would represent an increase of 13.3% over the $19.25 billion the company generated one year earlier. I will get into some of the specific growth areas of the company shortly. But more likely than not, any sort of upside like this will come from the streaming operations of the firm, as well as other parts of the business that are still recovering from the COVID-19 pandemic.

Author – SEC EDGAR Data

On the bottom line, analysts think that the business would generate earnings per share of $0.71. This would represent a significant improvement over the $0.26 per share the business reported during the second quarter of its 2022 fiscal year. In absolute dollar terms, this would translate to net profits of about $1.30 billion. That would be significantly higher than the $470 million in net income the company reported for the second quarter last year. Adjusted earnings, meanwhile, should be around $0.97 per share if analysts are correct.

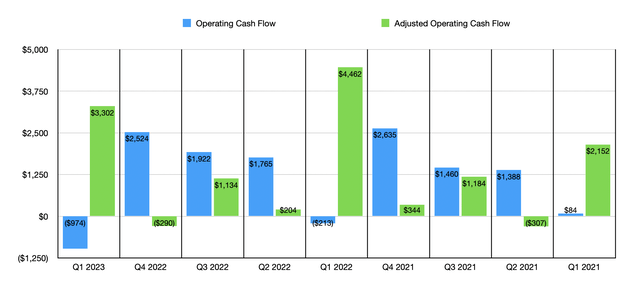

There has not been any Disney guidance when it comes to other profitability metrics. But investors should definitely be paying attention to at least the operating cash flow and adjusted operating cash flow of the firm. In the second quarter of 2022, operating cash flow was $1.77 billion. If we adjust this for changes in working capital, we would get a reading of only $204 million.

Streaming is king… probably

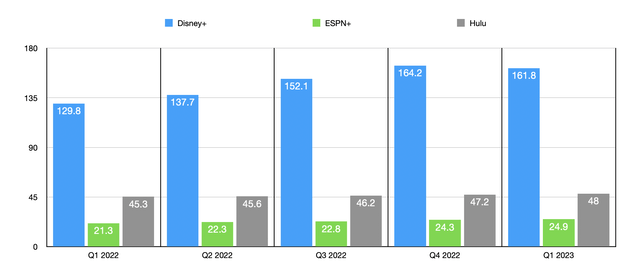

One of the most amazing growth stories in the history of Disney has been its streaming business. Starting from virtually scratch a few years ago, it has grown into the dominant streaming ecosystem on the planet. Just consider growth over the past few quarters. Disney+, the largest of the three streaming services that the company owns, expanded from 129.8 million global subscribers in the first quarter of the 2022 fiscal year to 161.8 million subscribers by the end of the first quarter of this year.

This is not to say that there is a guarantee of growth. In fact, in the fourth quarter of last year, the number of subscribers that the company had was even higher at 164.2 million. Despite this decline, overall annualized revenue associated with streaming will almost certainly go up. I say this because, as I wrote in a prior article about the company, the decline and subscribers came from the low-revenue Hotstar category of customers. During the most recent quarter, these customers generated only $0.74 per month for the company in the form of revenue. Actual core users during this time rose from 102.9 million to 104.3 million. It should be mentioned that, while I do expect growth in at least the core Disney+ subscription numbers, I recognize that the days of rapid expansion for the service are gone. Even the company acknowledged this during their first quarter earnings release. But they did say that, in key international markets, the service is still new and has upside potential.

Author – SEC EDGAR Data

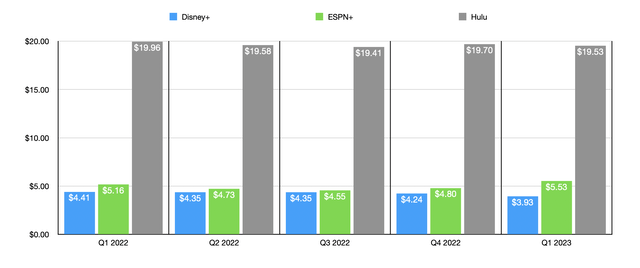

Pricing will also be a rather interesting topic. Late last year, Disney increased pricing on its Disney+ subscription to $10.99 per month. That’s an increase of $3 compared to what it was previously. But they did also provide customers with a lower tier option at the original $7.99 per month that was supported by advertisements. In the company’s first quarter earnings release for the 2023 fiscal year, CEO Bob Iger stated that advertising could be a game changer for the platform.

It is unclear if there will be any form of advertising at all on the ad-free version. The company could find ways to sneak in advertising in a way that wouldn’t be a violation of the terms of that subscription. But obviously, advertising revenue could be significant for the customers who come in at the lower tier. We do know that, in the first quarter of the year, ARPU for the platform came out at $3.93 per month. That continued a multi-quarter decline, as international customers come in at a substantially lower price point than those in the more developed markets.

Author – SEC EDGAR Data

Investors should also be paying attention to the other streaming services that Disney offers. These are ESPN+ and Hulu. As you can see in the data provided, both of these continue to grow, although their growth is far lower than what Disney+ has seen over the years. Unlike Disney+, however, their pricing has been largely stable. In fact, in recent quarters, ESPN+ has experienced a general uptrend and how much revenue it generates per month per user. Although I don’t think there is a high probability, investors should be on the lookout for any discussion regarding a potential sale of Hulu. There have been rumors to this effect, but nothing concrete enough to indicate that it will come to pass.

Pay attention to cash flows and costs

Earlier in this article, I provided a couple of data points regarding cash flow data. At the end of the day, the amount of cash a company generates is the most important thing when it comes to understanding what kind of potential it offers investors. As you can see in the chart below, the first quarter of this year saw a rather significant operating cash outflow. But if we adjust for changes in working capital, the company saw a net inflow of $3.30 billion. This was actually the highest the company generated, following the $4.46 billion reported one year earlier. But still, it’s not great to see a year-over-year decline on this front.

Author – SEC EDGAR Data

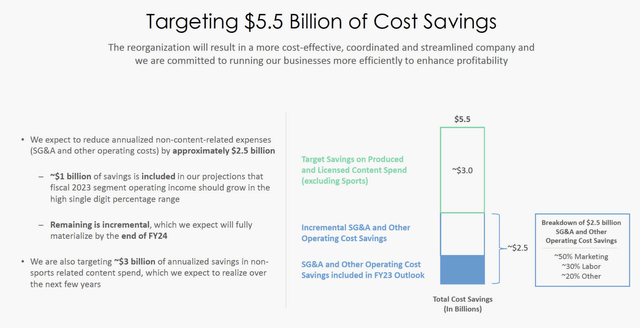

We don’t really know what to expect when it comes to cash flow. But we do know that management is also focused on significant cost-cutting initiatives. Their goal is to reduce overall expenses by about $5.5 billion. $3 billion of this will come from product and licensing content spend. Another $2.5 billion will come from operational costs. Of this $2.5 billion, 50% will fall under marketing while 30% will fall under labor. Already, the company has cut around 4,000 employees from its roster. Their ultimate goal was to grow this number to roughly 7,000. Another 20% of this $2.5 billion cost reduction will come from other miscellaneous operational sources. Management did say that about $1 billion of these cost-cutting initiatives can be expected to show up in the company’s 2023 forecast for segment operating income to grow at the high-single-digit percentage range. If any of this does come to fruition, it certainly will show up in cash flow.

Disney

Look at other problem areas

For the most part, Disney has already recovered from the COVID-19 pandemic. But there were some parts of the company that lagged in this regard. One of these involved the company’s theatrical distribution business. There is reason to be hopeful when it comes to this part of the company for the quarter. Although the company has a number of successful titles under its belt, one of the big ones recently has been Avatar 2. Released in the middle of December of last year, the movie went on to achieve $2.32 billion in the box office. This was not enough for it to beat out the original. But it was a rather significant haul.

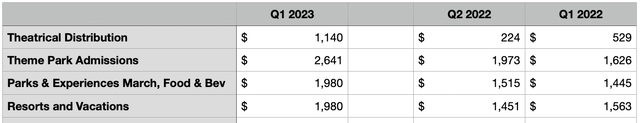

In the first quarter of this year, there was some evidence that the theatrical distribution side of the company was posting nice improvements. Revenue of $1.14 billion dwarfed the $529 million reported one year earlier. And that was with capturing only about 15 days’ worth of revenue associated with Avatar 2.

Author – SEC EDGAR Data

Outside of the theatrical distribution picture, investors should also be looking at the core theme park operations of the business. This consists of its theme parks, parks and experiences, and resorts and vacation activities. Total revenue across these units was $6.60 billion in the first quarter of 2023. By comparison, one year earlier, it came in at $4.63 billion. In its domestic markets, the company benefited from attendance rates that were 11% higher than they were one year earlier and saw occupancy rates at its hotels grow from 73% to 88%. Internationally, attendance was up 13%, with hotel occupancy climbing from 52% to 67%. Domestically, the company saw per capita guest spending grow 8% year over year, while in domestic markets it was up 21%. Similar improvements for the second quarter might not be unrealistic.

Takeaway

Based on all the data provided, I think that The Walt Disney Company investors are likely to be relatively pleased with what management reports. It’s unclear whether the company will meet, miss, or exceed, analysts’ expectations. But I do believe that, as a truly high-quality company that is built for long-term value accretion, The Walt Disney Company is a great place to allocate capital. Given these factors, I have no problem keeping it the “strong buy” I have had it rated that for some time.

[ad_2]

Source link