[ad_1]

To print this article, all you need is to be registered or login on Mondaq.com.

Background

Portugal is a popular destination for foreign investors, thanks

to its buoyant economy, favourable tax climate, and strategic

location in Europe.

If you are considering incorporating a company in Portugal,

there are a few things you should take into consideration. Please

see our sister Article which details the three Portuguese company

structures, for tax purposes, and the benefits that each offers: Three Types of Portuguese Company Advantages and

Criteria.

In this article, we will discuss the steps involved in

incorporating a Portuguese company, including:

- Choosing the right type of company structure

- Registering the company with the Portuguese Commercial

Register - Obtaining a Tax Identification Number (NIF)

- Opening a bank account

- Obtaining a business license

Choosing the Right Type of Company Structure

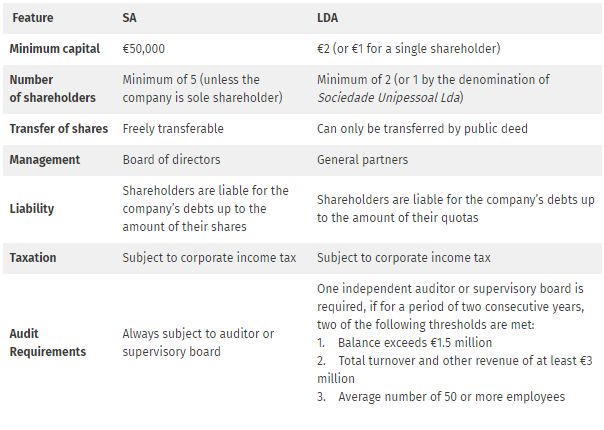

There are two main types of company that can be incorporated in

Portugal: limited liability companies (Sociedades por

Quotas ‘LDAs’) and joint stock companies

(Sociedades Anónimas, ‘SAs’).

LDAs are the more common type of company in Portugal. They are

relatively easy to set up and have a lower minimum share capital

requirement than SAs.

SAs are more complex to set up and have a higher minimum share

capital requirement.

However, they offer a number of advantages, such as limited

liability for shareholders and the ability to raise more

capital.

The table below summarises the key differences between SA and

LDA companies in Portugal:

There are, a number of additional things to consider when

choosing between an SA or an LDA:

- Future growth plans:if you plan to grow your business and raise

capital from investors, an SA may be a better option. This is

because SAs are more widely recognized and accepted by

investors. - Management structure:If you want to have more control over the

management of your business, an LDA may be a better option. This is

because LDAs are more flexible in terms of management

structure.

If you are still unsure about which type of company is right for

you, it is a good idea to consult with a lawyer or accountant who

can help you assess your specific needs and circumstances such as

Dixcart Portugal Lda.

The type of company that is right for you will depend on your

individual circumstances and needs. If you are unsure which type of

company to choose, you should consult with a professional adviser.

At Dixcart Portugal, we have senior qualified accountants who will

be able to assist.

Registering the Company with the Portuguese Commercial

Register

Once you have chosen the type of company you want to

incorporate, the company needs to be registered with the Portuguese

Commercial Register (Registo Comercial). the proposed company name

and the names and addresses of the shareholders and directors will

need to be provided.

Obtaining a Tax Identification Number (NIF)

Once your company has been registered with the Portuguese

Commercial Register, a Tax Identification Number (NIF) from the

Portuguese tax authorities needs to be obtained for the company -

this is referred to as the NIF (Número de

Identificação Fiscal – Tax identification

number).

Opening a Bank Account

Once you have obtained a NIF, a bank account needs to be opened

for your company. A Portuguese bank and/or an international bank

may be chosen to open a corporate bank account. In some cases, this

may be performed remotely. It is suggested a Portuguese bank

account is opened in order to make payments to local authorities

and be able to receive refunds (if any are due) from the local tax

authorities.

Obtaining a Business License

Once the bank account is open, a business license from the local

council is required. The company’s; articles of association,

company’s certificate of incorporation, company’s NIF, and

bank account details, need to be submitted.

Choose to Incorporate the Right Type of Company Structure for

you

Incorporating a Portuguese company can be a complex process, but

it is essential if you want to do business in Portugal.

By engaging with professionals you can ensure that your company

is incorporated correctly and that you comply with all of the

applicable laws and regulations.

The content of this article is intended to provide a general

guide to the subject matter. Specialist advice should be sought

about your specific circumstances.

POPULAR ARTICLES ON: Corporate/Commercial Law from Portugal

[ad_2]

Source link