[ad_1]

Released: 2023-08-24

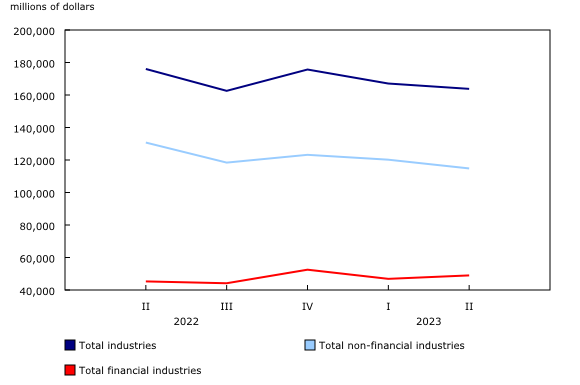

Canadian corporations’ net income before taxes, seasonally adjusted

$163.8 billion

Second quarter 2023

During the second quarter, the Bank of Canada increased its overnight rate by 25 basis points to 4.75%. In the second quarter, the main economic headlines were the inflation rate (+2.8%) falling back to Canada’s target range at the end of the quarter; oil production curtailment caused by wildfires; and a strong consumer demand for air travel.

Canadian corporations reported a 2.0% decrease (-$3.3 billion) to $163.8 billion in net income before taxes (NIBT) in the second quarter, impacting the non-financial sector (-4.5%). The decline in NIBT was partly offset by gains in the financial sector (+4.5%).

Consult the Quarterly Survey of Financial Statistics: Visualization Tool for a comprehensive overview of the quarterly changes in the financial performance of enterprises.

Chart 1

Corporate net income before taxes (seasonally adjusted)

Wildfires impact oil production and drive the decline in net income before taxes for the non-financial sector

In the non-financial sector, NIBT decreased $5.4 billion (-4.5%) from the first quarter of 2023 to $114.8 billion in the second quarter. Overall, NIBT was down in 13 of 39 non-financial industries, stemming from lower sales and declining prices.

The oil and gas extraction industry was the largest contributor to the decline in NIBT, down $3.9 billion (-38.9%) in the second quarter. This drop was largely driven by lower production and sales due to hazardous wildfires across Western Canada.

The NIBT for petroleum and coal product manufacturing was down $1.2 billion (-25.2%) in the second quarter, mainly attributable to a decline in exports of energy products and a general economic slowdown that resulted in a reduction in the price of petroleum products.

NIBT for the mining and quarrying industry was down $1.1 billion (-30.9%) in the second quarter, as operating revenues were negatively impacted by lower prices for copper and iron ores, driven by weakening global demand.

NIBT for the telecommunications industry fell $560 million (-24.0%) in the second quarter, mainly due to an increase in depreciation and amortization expenses.

The overall decline in NIBT for the non-financial sector was partly offset by an increase in NIBT for the transportation, postal and couriers services, and transportation support activities industry, up by $661 million (+10.4%) in the second quarter. A strong demand for air transportation paired with lower fuel costs drove the gains in this industry during the quarter.

Net income before taxes for the financial sector increases

In the financial sector, NIBT increased $2.1 billion (+4.5%) from the first quarter to $49.0 billion in the second quarter. It was up in 8 of 13 financial industries.

NIBT for the life, health and medical insurance carriers increased by $1.9 billion on lower expenses arising from actuarial liabilities.

NIBT for the property and casualty insurance industry recorded a decline of $531 million on higher expenses. The claims ratio increased 2.4% in the second quarter for the industry’s personal property line of business, reflecting the impact of wildfires in Atlantic Canada, as well as ice storms and floods in Ontario and Quebec.

Note to readers

Changes to the Quarterly Survey of Financial Statements

As of the first quarter of 2023, the Quarterly Survey of Financial Statements (QSFS) figures are now based on the North American Industry Classification System 2022 classification structure. Given that the new classification structure has marginal impact on the QSFS estimates, the structure of the QSFS data tables did not need to be updated to account for this change. This change should not alter the direct data comparison between the fourth quarter of 2022 and subsequent quarters.

Starting in the first quarter of 2023, the Canadian insurance companies have implemented the new International Financial Reporting Standards 17 standard on insurance contracts which had an impact on how they have reported their data each quarter. The QSFS questionnaires were adjusted to reflect those changes, which also impacted the information published each quarter in the QSFS tables. The structure of the data table (33-10-0227) was updated to introduce new variables, while some other variables had to be deleted to account for those changes. Given the difference in the concepts measured, data users should be careful by doing direct data comparison between the fourth quarter of 2022 and subsequent quarters in the insurance industries.

The QSFS has been the subject of many changes since the first quarter of 2020. For a summary of those changes, see the note to readers in the QSFS release for the third quarter of 2022.

Business performance and ownership statistics portal

The Business performance and ownership statistics portal, accessible from the Subjects module of the Statistics Canada website, provides users with a single point of access to a wide variety of information on business performance and ownership in Canada.

Next release

Financial statistics for enterprises for the third quarter of 2023 will be released on November 23.

Products

Aggregate balance sheet and income statement data for Canadian corporations are now available.

Data from the Quarterly Survey of Financial Statements are also available.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

[ad_2]

Source link