[ad_1]

jikgoe/iStock Editorial via Getty Images Swire Pacific logo (Swire Pacific)

Investment thesis

Since we prefer to Sleep Well At Night, we generally prefer to invest in SWAN companies that have low levels of debt. Most companies that do go belly-up do so because they were over-leveraged.

Many have this misconception that companies based in China are over-levered. This prejudice probably stems from the media as they in an effort to “sell the news” need to shock people with horror stories such as China Evergrande Group (OTC:EGRNF).

If you dig deeper into many of the companies in China, including Hong Kong, yes Hong Kong is part of China, you will find companies with either no debt, such as China Mobile (CHL), or with low debt.

One such company with low debt is Swire Pacific Limited (OTCPK:SWRAY)(OTCPK:SWRAF) (OTCPK:SWRBY) in Hong Kong with a comfortable leverage of just 19.5%.

For those that do not know about this company, let us introduce you to them.

Introduction

Swire Pacific Limited is now a conglomerate but it started out as a small textile trading firm in Liverpool, U.K. in 1816 founded by John Swire.

The operation in China commenced in 1866.

The business is divided into 3 main parts, namely property investment and development through Swire Properties (OTCPK:SWPFF; OTCPK:SWPLY), which is separately listed in Hong Kong. It is the largest in terms of assets and profits for Swire Pacific.

Swire Properties (Swire Properties)

Next is aviation, where Swire Pacific has a controlling share in Cathay Pacific (OTCPK:CPCAF; OTCPK:CPCAY) and Swire Pacific’s subsidiary Hong Kong Aircraft Engineering Company Limited, just known as HAECO, which is one of the world’s leading independent aircraft engineering and maintenance groups.

One reason Swire Pacific has not done well over the last couple of years is the fact that Cathay Pacific was bleeding money during the pandemic.

Cathey Pacific (Cathey Pacific)

Fortunately, things are starting to look brighter with hopes of returning to profitability. In 2019, pre-Covid19 Cathay Pacific earned HKD1.69 billion, and the year before it was HKD2.35 billion.

Number three on the list is the beverage and food division.

We have all heard of Warren Buffett’s fascination with the Coca-Cola Company (KO) and its drinks. Back in 2017 he even agreed to have his face on Cherry Coke cans when it was introduced in China.

Warren Buffett on Cherry Coke cans in China (Coca-Cola Company)

Buffett might like Swire Pacific too as they are the anchor bottler of Coca-Cola and its related products in Hong Kong, Taiwan, and most of China, as well as Vietnam and Cambodia which was added in 2022. Their franchise markets cover a population of 882 million people.

They are also bottlers for Coca-Cola in 13 states in the U.S.

In addition to these 3 main businesses, they have interests in smaller companies from bakeries to the distribution of automobiles, and in investments in hospitals. These are not what presently brings to the bacon, but some of them could one day deliver a meaningful contribution to Swire Pacific.

Swire Pacific has two classes of shares. These are A-class and B-class shares. To explain the difference between the two share classes, you should read an article from 2019 by Christoph Liu.

As Chris explains;

The B shares are entitled to the same rights as the A-shares, accounting for a fifth of the capital per share. So in absolute terms, five B-shares are entitled to the same amount of dividend payments as one A-share. However, as B-shares trade at an above 20 percent discount compared to the more liquid class A shares, the dividend yield is effectively higher”

This difference in yield still exists.

Their total market capitalization is HKD79.26 billion, which is about USD10.16 billion.

Let us look at their latest financial results for 2022 which were released on the 9th of March 2023

2022 FY Financial Results

Swire Pacific’s statutory profit for FY 2022 was HKD4.20 billion, which was up from HKD3.36 billion the year before. However, when we look at their recurring underlying profit, it was down from HKD4.88 billion in 2021 to HKD3.80 billion in 2022.

Here is how the different divisions performed in terms of the recurring underlying profit for the year.

Recurring underlying profit by division (Swire Pacific FY 2022 presentation)

We always want to look at the cash flow-generating capabilities of a company.

Here things are more enticing. In 2022, they generated cash from operations of HKD12.04 billion. This was, however, 22% lower than the HKD15.45 billion it generated in 2021.

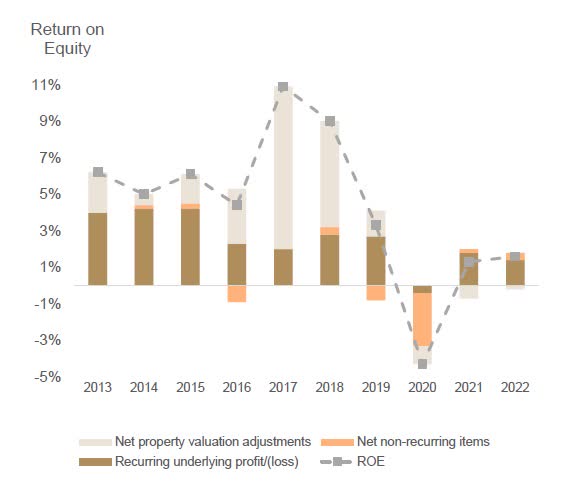

Those that follow us here in SA will know that we like to use ROE or ROCE to assess how good the business is and how well they allocate capital. A good example of a company with a high ROE is Legal & General in the U.K. which has an ROE of 20.7%.

Back to Swire Pacific and their ROE. It has been rather poor the last couple of years with a low single-digit return.

Swire Pacific’s ROE since 2013 (Swire Pacific FY 2022 Results Presentation)

However, this was due to the horrible years when Cathay Pacific was bleeding money every day. During the conference with analysts on the 9th of March, the management of Swire Pacific was quite optimistic that this trend has turned. We should see a high single-digit return from here.

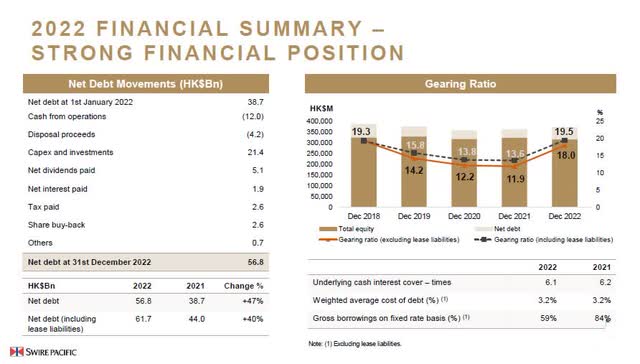

The whole thesis here is built around the soundness of the financial position of a company. We do like SWAN companies. For those that are not familiar with that, it means that you can Sleep Well At Night.

Swire Pacific’s financial position (Swire Pacific FY 2022 Financial Results presentation)

The gearing ratio that now stands at 19.5% is higher than it was during the pandemic, as they have taken on debt to make more new investments.

One example of this is their goal to invest another HKD100 billion in Swire Properties in properties in Hong Kong, China, and Southeast Asia over a 10-year period.

The weighted average cost of debt was only 3.2%, but we should expect this to rise as the interest rate rise in USD and HKD have gone up. It is exactly this rise in the interest rate that makes it so important to have a low gearing ratio.

Returning capital to shareholders

Historically, Swire Pacific has not been particularly generous in returning capital to shareholders. This seems to be changing as they have increased dividends by 15% this year and also done a fair amount of share buybacks.

The dividend for the A-shares is HKD3.00 per share and the B-share is HKD0.60 per share.

Swire Pacific’s dividend history (Aastocks, Hong Kong)

We can see that the payout ratio for 2022 was as high as 100% while it only was about 50% with the same level of dividend back in 2019.

In terms of their share buyback program of up to HKD4 billion which was announced in the middle of 2022, they have bought back shares so far worth about HKD2.6 billion.

Risk to the thesis

One risk is that they potentially will be unable to improve the ROE which has been too low. We know that the losses at Cathay Pacific in 2022 were HKD 6.55 billion. They are turning it around but we are generally not keen on investing in airlines as we have seen too many trainwrecks from that industry.

The tension between the U.S. and China is not going to go away. Further deterioration could lead to punitive actions that could harm Swire Pacific’s business.

Conclusion

Swire Pacific is a well-managed and profitable company. We like it.

Our primary concern is the long-term profitability of aviation. We would also like to see a plan for how they expect the various smaller entities which so far have not generated much profit will become contributors to the group’s profit. If they are not, it would probably be better for Swire to sell them and focus on the parts that deliver.

The share price has gone up by 31.8% in one year. Therefore, we question if the “good news” of recovery in aviation has already been priced in.

SWRAY share price up nearly 32% in one year (SA)

It does seem to be the case.

We initiate coverage of Swire Pacific stock with our first stance of a Hold.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

[ad_2]

Source link