[ad_1]

Recap for November 30

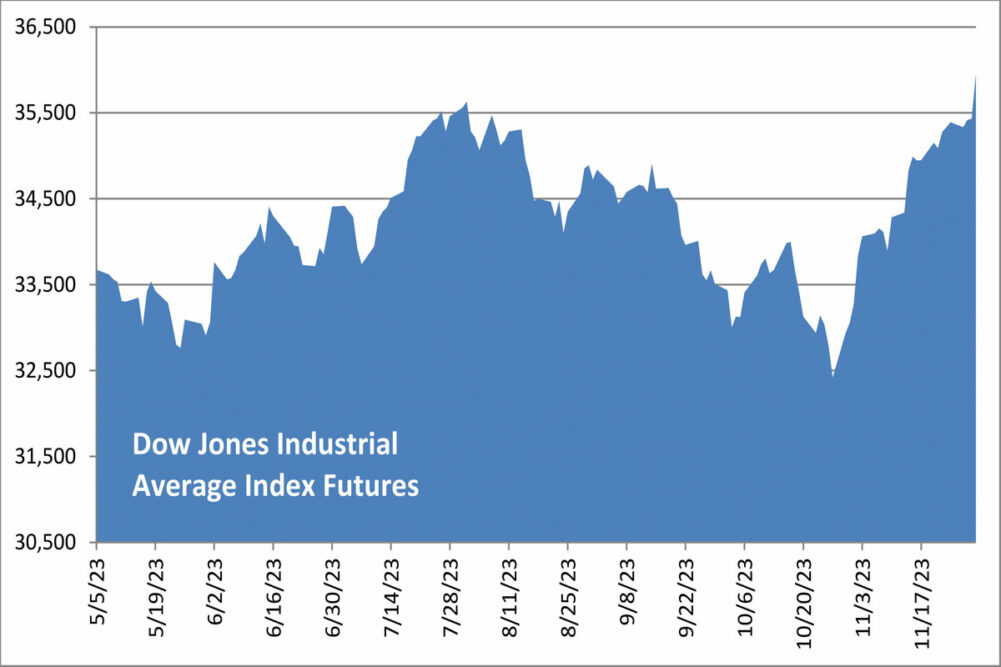

- US equity markets were mixed Thursday, the tech-centric Nasdaq posting a decline. But the Dow Industrials index soared on the last day of November after a Commerce Department report showed Americans slowed spending and that inflation continued to pull back in October, increasing investors’ hopes the US central bank would hold the line on raising interest rates. All three major indexes posted gains of at least 8% in November, ending three-month losing streaks. The Dow Jones Industrial Average soared 520.47 points, or 1.47%, to close at 35,950.89. The Standard & Poor’s 500 added 17.22 points, or 0.38%, to close at 4,567.80. The Nasdaq Composite lost 32.27 points, or 0.23%, to close at 14,226.22.

- Wheat futures continued higher Thursday after the US Department of Agriculture indicated 2023-24 US wheat export sales in the week ended Nov. 23 at 622,800 tonnes, a six-week high that topped a range of trade expectations for 200,000 to 500,000 tonnes. Wheat and corn futures also were supported by short covering after slumps to multi-year lows. Soybean futures were rangebound and closed lower despite reports of private sales of US supplies to China. December corn futures added 12¢ to close at $4.61¾ per bu. Chicago December wheat added 14¼¢ to close at $5.70¼ per bu. Kansas City December wheat added 3¼¢ to close at $6.43¼ per bu. Minneapolis December wheat added 5¾¢ to close at $7.02½ per bu. January soybeans fell 4¼¢ to close at $13.42¾ per bu; September 2024 and beyond were narrowly higher. December soybean meal was down $2.10 to close at $442.20 per ton. December soybean oil dropped 0.39¢ to close at 52.29¢ a lb.

- US crude oil prices turned lower Thursday. The January West Texas Intermediate light, sweet crude future was down $1.90 to close at $75.96 per barrel.

- The US dollar index continued higher Thursday.

- US gold futures declined Thursday. The December contract fell $9 to close at $2,038.10 per oz.

Recap for November 29

- Wheat futures pushed higher for a second straight day Wednesday, rising more than 2% on short covering ahead of the rollover into December. End-of-month positioning boosted corn futures mostly higher. Soybean futures noted few changes as the trade continued to monitor weather conditions in Brazil. December corn futures slipped 1¾¢ to close at $4.49¾ per bu, but later months were mostly higher. Chicago December wheat advanced 12¼¢ to close at $5.56 per bu. Kansas City December wheat jumped 27¢ to close at $6.40 per bu. Minneapolis December wheat added 2¼¢ to close at $6.96¾ per bu. January soybeans ticked up ½¢ to close at $13.47 per bu; later months were narrowly mixed. December soybean meal was down $6 to close at $444.30 per ton; later months were mixed. December soybean oil dropped 0.66¢ to close at 52.68¢ a lb.

- US equity markets ended mixed by Wednesday’s closing bell. Investors contemplated offsetting economic factors, pitting recent rhetoric the Federal Reserve may cut interest rates sooner than expected against data indicating the US economy was growing at a faster rate than previously reported. The Dow Jones Industrial Average added 13.44 points, or 0.04%, to close at 35,430.42. The Standard & Poor’s 500 shed 4.31 points, or 0.09, to close at 4,550.58. The Nasdaq Composite lost 23.27 points, or 0.16%, to close at 14,258.49.

- US crude oil prices were higher again on Wednesday. The January West Texas Intermediate light, sweet crude future added $1.45 to close at $77.86 per barrel.

- The US dollar index edged higher Wednesday.

- US gold futures advanced Wednesday. The December contract rose $7.10 to close at $2,047.10 per oz.

Recap for November 28

- Super-hot South American weather likely to take a toll on crops helped US soybean futures rise more than 1% Tuesday. Wheat futures were up more than 2%, a technical bounce off contract lows set a day earlier, with support from a decline in EU year-over-year wheat exports and good demand for US supplies. Corn futures were mixed, under pressure nearby from a bumper US crop with the harvest 96% complete. December corn futures lost 4¢ to close at $4.51½ per bu; September 2024 and beyond were higher. Chicago December wheat added 9½¢ to close at $5.43¾ per bu. Kansas City December wheat advanced 23¢ to close at $6.13 per bu. Minneapolis December wheat added 10¢ to close at $6.94½ per bu. January soybeans added 16¾¢ to close at $13.46½ per bu. December soybean meal fell $8.40 to close at $450.30 per ton; October 2024 and beyond were 10¢ higher. December soybean oil rose 1.43¢ to close at 53.34¢ a lb.

- Rising shares of technology and consumer-focused companies pushed US equity markets higher Tuesday. Helping the cause were benchmark treasury yields creeping lower in the wake of Federal Reserve governor Christopher Waller’s comments indicating the Fed, encouraged by signs of improvement, might leave rates alone into 2024. The Dow Jones Industrial Average added 83.51 points, or 0.24% to close at 35,416.98. The Standard & Poor’s 500 added 4.46 points, or 0.1% to close at 4,554.89. The Nasdaq Composite added 40.73 points, or 0.29%, to close at 14,281.76.

- US crude oil prices reversed course for a higher close on Tuesday. The January West Texas Intermediate light, sweet crude future added $1.55 to close at $76.41 per barrel.

- The US dollar index closed lower again Tuesday.

- US gold futures advanced, the December contract rising $27.60 to close at $2,040 per oz.

Recap for November 27

- Slow demand and technical selling, the latter in liquidation of positions ahead of Thursday’s first notice day for December deliveries, sent grain and soybean futures lower to open the post-holiday week. Soybeans settled into a two-week low, with added pressure from much needed rain in top-producing Brazil. Wheat futures and March and May corn futures fell to contract lows. December corn futures lost 7¾¢ to close at $4.55½ per bu. Chicago December wheat fell 14½¢ to close at $5.34¼ per bu. Kansas City December wheat declined 12¢ to close at $5.90 per bu. Minneapolis December wheat fell 12¼¢ to close at $6.84½ per bu. January soybeans eased 1¢ to close at $13.29¾ per bu; later months were mixed in a narrow range. December soybean meal added $1.30 to close at $458.70 per ton. December soybean oil ascended 0.38¢ to close at 51.91¢ a lb.

- US equity markets declined in subdued post-holiday trading, but the three major indexes remained on track for their best monthly performances in more than a year after four consecutive weeks of gains. The Dow Jones Industrial Average fell 56.68 points, or 0.16% to close at 35,333.47. The Standard & Poor’s 500 lost 8.91 points, or 0.2% to close at 4,550.43. The Nasdaq Composite fell 9.83 points, or 0.07%, to close at 14,241.02.

- US crude oil prices declined again on Monday. The January West Texas Intermediate light, sweet crude future was down 68¢ at $74.86 per barrel.

- The US dollar index closed lower again on Monday.

- US gold futures advanced on Monday; the December contract rose $9.40 to close at $2,012.40 per oz.

Recap for November 24

- Chicago soy complex futures dropped Friday, with soybeans and soybean oil prices down sharply, as beneficial rain fell in top soybean producer and exporter Brazil with more rain forecast for the days ahead. The rain in Brazil also pressured corn futures. Pressure on wheat futures mainly came from ongoing weak export demand for US supplies amid low-priced Russian wheat. December corn futures lost 5½¢ to close at $4.63¼ per bu. Chicago December wheat fell 7¢ to close at $5.48¾ per bu. Kansas City December wheat declined 12½¢ to close at $6.02 per bu. Minneapolis December wheat fell 14¢ to close at $6.96¾ per bu. January soybeans tumbled 25¾¢ to close at $13.30¾ per bu. December soybean meal lost $0.70 to close at $457.40 per ton. December soybean oil plunged 2.07¢ to close at 51.53¢ a lb.

- US equity markets were mixed Friday with the DJIA posting a solid gain, the S&F500 edging higher and the Nasdaq Composite easing. Support continued to come from ideas the Federal Reserve is done raising interest rates, which would be bullish for equities. The Dow Jones Industrial Average added 117.12 points, or 0.33%, to close at 35,390.15. The Standard & Poor’s 500 gained 2.72 points, or 0.06, to close at 4,559.34. The Nasdaq Composite fell 15 points, or 0.11%, to close at 14,250.85.

- US crude oil prices declined Friday as members of the Organization of the Petroleum Exporting Countries continued to debate production quotas ahead of a delayed meeting. The January West Texas Intermediate light, sweet crude future was down $1.92 at $75.18 per barrel.

- The US dollar index closed lower Friday.

- US gold futures advanced Friday; the December contract rose $10.90 to close at $2,003.70 per oz.

Ingredient Markets

| Fresh ideas. Served daily. Subscribe to Food Business News’ free newsletters to stay up to date about the latest food and beverage news. |

Subscribe |

[ad_2]

Source link