[ad_1]

- S&P Global Ratings affirmed South Africa’s credit ratings and maintained a stable outlook – despite government’s deteriorating debt position.

- While private sector power generation will boost growth from next year, Transnet’s woes will depress the economy, it says.

- The agency believes the ANC will lose its majority in next year’s elections, but expects “broad policy continuity” even if that happens.

- For more financial news, go to the News24 Business front page.

Despite a deterioration in South Africa’s government debt burden, S&P Global Ratings affirmed the country’s credit ratings and maintained a stable outlook.

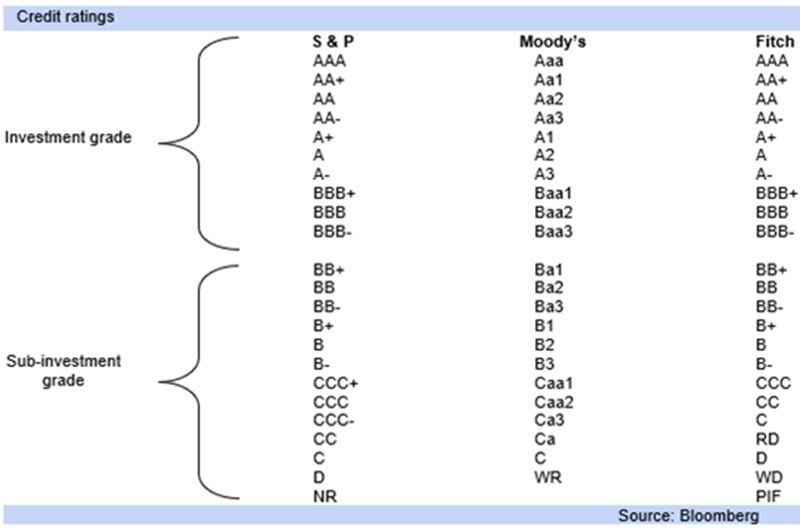

On Friday night, S&P announced that it is keeping its “BB-/B” rating on South Africa’s foreign currency debt and a “BB/B” on local currency debt unchanged.

A large public sector wage hike, disappointing tax revenue and rocketing borrowing costs have hit government finances this year. S&P now expects government debt to increase to 83% of GDP by 2026 – from its forecast of 79% earlier.

Its debt forecast is higher than the government’s, which stabilises at 77% of GDP in 2025.

S&P expects that private sector electricity generation will likely ease South Africa’s power shortages from 2025. While real GDP growth is expected to slow to 0.8% this year, it will be followed by a pickup to 1.6% on average over 2024 to 2026 as more power comes onstream.

But bottlenecks at ports and problems with railways will hit growth as exporters, especially mining firms, can’t get their goods out of the country. Rail transport volumes have dropped by more than 30% since 2018 due to Transnet’s problems.

S&P highlighted South Africa’s continued strengths: a flexible exchange rate, an actively traded currency, deep capital markets and a credible central bank. It credits the Reserve Bank’s “proactive” rate hikes for cooling inflation, which S&P expects to remain in the central bank’s 3% to 6% target range.

The perilous financial positions of state-owned enterprises remain a concern, with Transnet’s total debt now equal to almost 2% of GDP.

“It is unclear how and when the government will support Transnet to help it meet its funding needs. Discussions are ongoing, and we think it is likely to involve a mixture of guarantees and equity injections.”

But although government’s finances are strained, deep domestic capital markets and increasing concessional financing (cheaper loans) from international institutions like the World Bank, African Development Bank and New Development Bank (the so-called Brics bank) could help, says S&P.

Banks’ exposure to government debt has risen to 15% of total assets from less than 10% in 2015. But this level remains lower than that of peers such as Brazil, Mexico, and Turkiye.

“We think there is still room for banks to continue to absorb additional government debt,” S&P said. Foreign-currency-denominated debt also remains below 10% of the government’s total debt, which limits the impact of a volatile rand.

S&P also notes that while greylisting has slightly raised costs for smaller financial institutions, it is unlikely to significantly affect South Africa’s creditworthiness.

The agency believes the ANC will lose its majority in next year’s elections, but expects “broad policy continuity” even if that happens.

“We could raise [SA’s credit] ratings if there is an improving track record of effective reforms, resulting in a structural strengthening of economic growth alongside reductions in public debt and contingent liabilities,” it noted. But if reforms stall, growth worsens and government’s finances deteriorate, this could lead to a downgrade.

In a statement following the S&P announcement, Treasury said:

Over the next three years, government will focus on raising GDP growth by improving the provision of electricity and logistics, enhancing the delivery of infrastructure and restructuring the state to be efficient and fit-for-purpose. Fiscal policy continues to support this approach by stabilising debt and debt-service costs. Additionally, fiscal consolidation will be implemented through spending reductions, efficiency measures across government and moderate tax revenue measures.

S&P’s rating of SA’s debt is in line with the credit agency Fitch, which rates South Africa as BB-.

In July, Fitch reaffirmed its rating, saying that South Africa is constrained by low growth and a “modest” path of fiscal consolidation.

Moody’s rates South Africa at Ba2, which is equivalent to the BB rating Fitch and S&P use, says Investec’s chief economist Annabel Bishop. Both Fitch and S&P scored South Africa lower, at BB-.

The risks have risen for SA’s ratings on the deterioration of the fiscal projections at 2023’s medium-term budget, says Bishop.

“This will likely be reflected in the [credit rating] outlooks and so February’s Budget is key, particularly the revenue versus the expenditure estimates.”

[ad_2]

Source link