[ad_1]

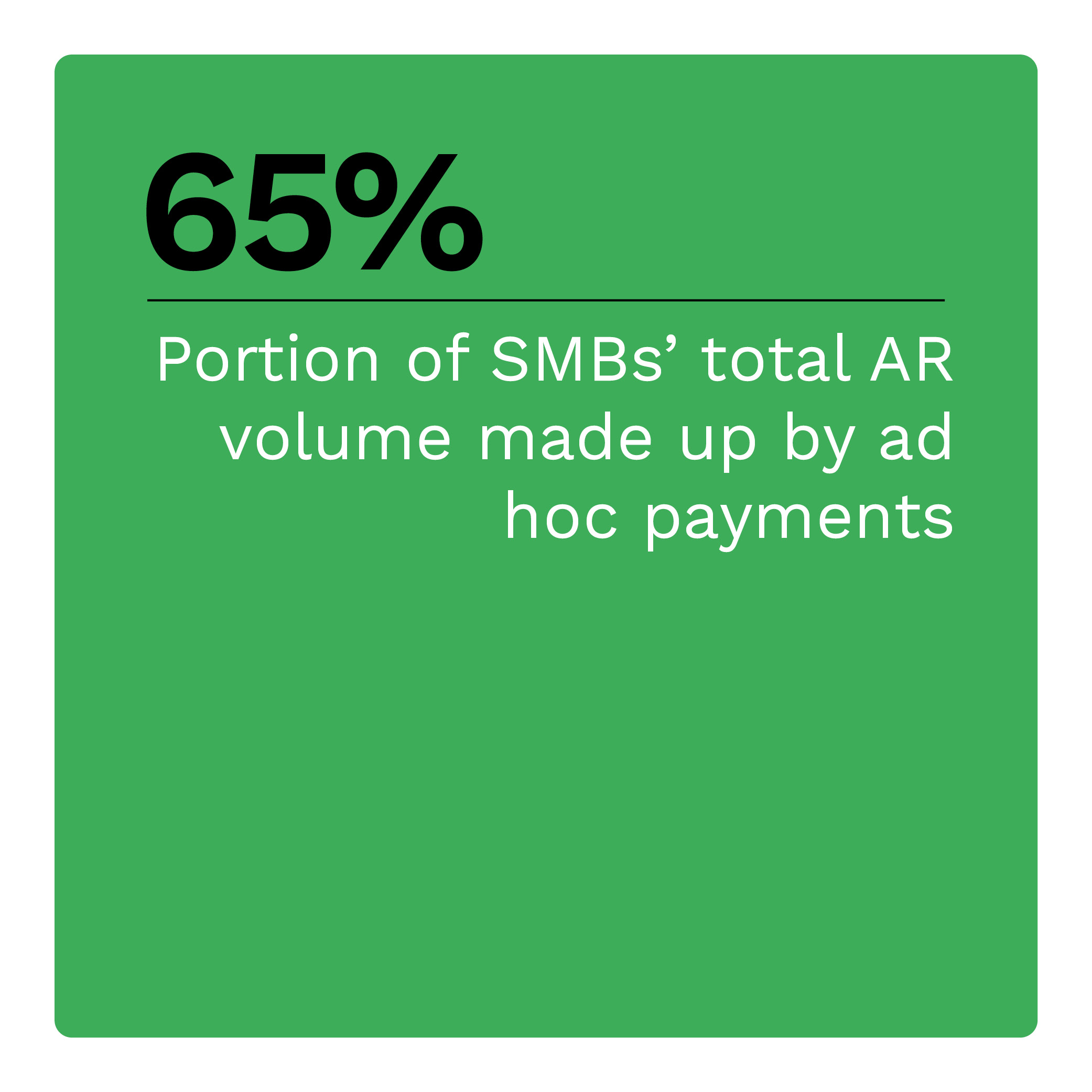

Non-recurring or ad hoc payments play a significant role in the monthly revenues of small to midsized businesses (SMBs). In fact, these payments make up 65% of SMBs’ total accounts receivable (AR) volume and are a vital revenue stream. Despite the importance of these payments, many SMBs still use slow, manual procedures when processing these payments.

Many SMBs see instant payments as one way to get timely access to the funds needed to run their businesses. SMBs of all sizes embrace instant payment solutions to improve cash flow management and gain a competitive advantage. In fact, one-third of SMBs are willing to pay fees for instant payments. Two-thirds would maintain client relationships with senders that offer free instant payments.

These are some of the findings explored in “How Instant Ad Hoc Payments Drive SMB Success,” a PYMNTS Intelligence and Ingo Money collaboration. This report is based on a survey conducted between Sept. 8 and Sept 26 of 394 SMB receivers generating less than $25 million in annual revenue across the United States. The report examines SMBs’ reliance on ad hoc payments, the challenges faced when processing AR and how instant payment methods can help SMBs manage cash flows and set them up for success.

Other findings from the report include:

Small businesses still rely on manual procedures, causing delays in availability of funds.

Since ad hoc payments are so important to their revenue streams and cash flow, SMBs benefit by receiving them as soon as possible. Yet, 32% of SMBs still primarily use manual procedures when processing ad hoc payments, which can cause friction and delays. It may not be surprising that 24% of SMB receivers report late payments as the biggest challenge faced in the last year when processing ad hoc payments.

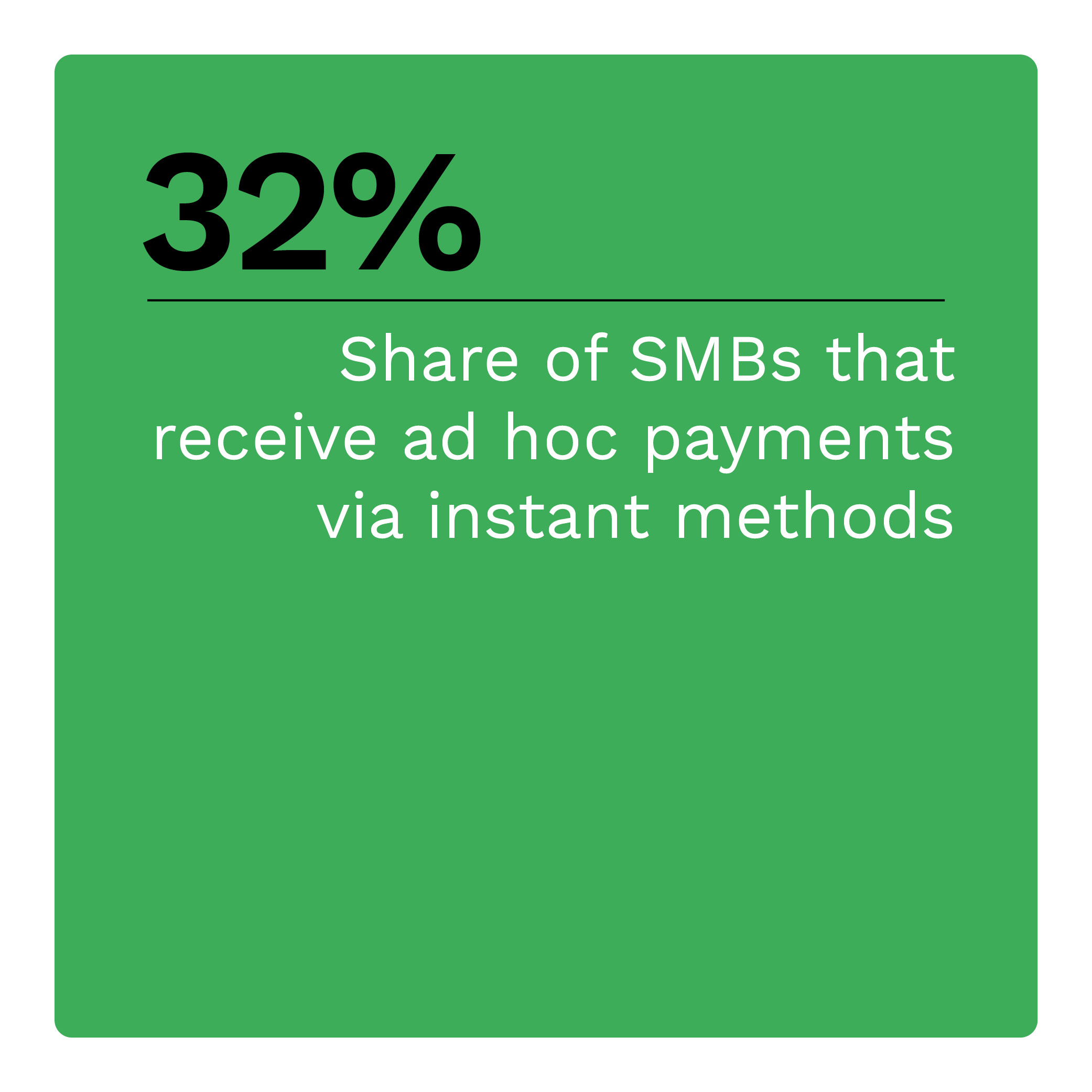

Many SMBs receive ad hoc payments via instant rails, and for several reasons.

Among SMB receivers, a significant share opts for instant ad hoc payments to improve cash flow management. In fact, 32% of all SMBs surveyed use some form of instant payment. SMB receivers cite cash flow management and an improved competitive advantage as their top reasons for choosing instant payments.

Among SMB receivers, a significant share opts for instant ad hoc payments to improve cash flow management. In fact, 32% of all SMBs surveyed use some form of instant payment. SMB receivers cite cash flow management and an improved competitive advantage as their top reasons for choosing instant payments.

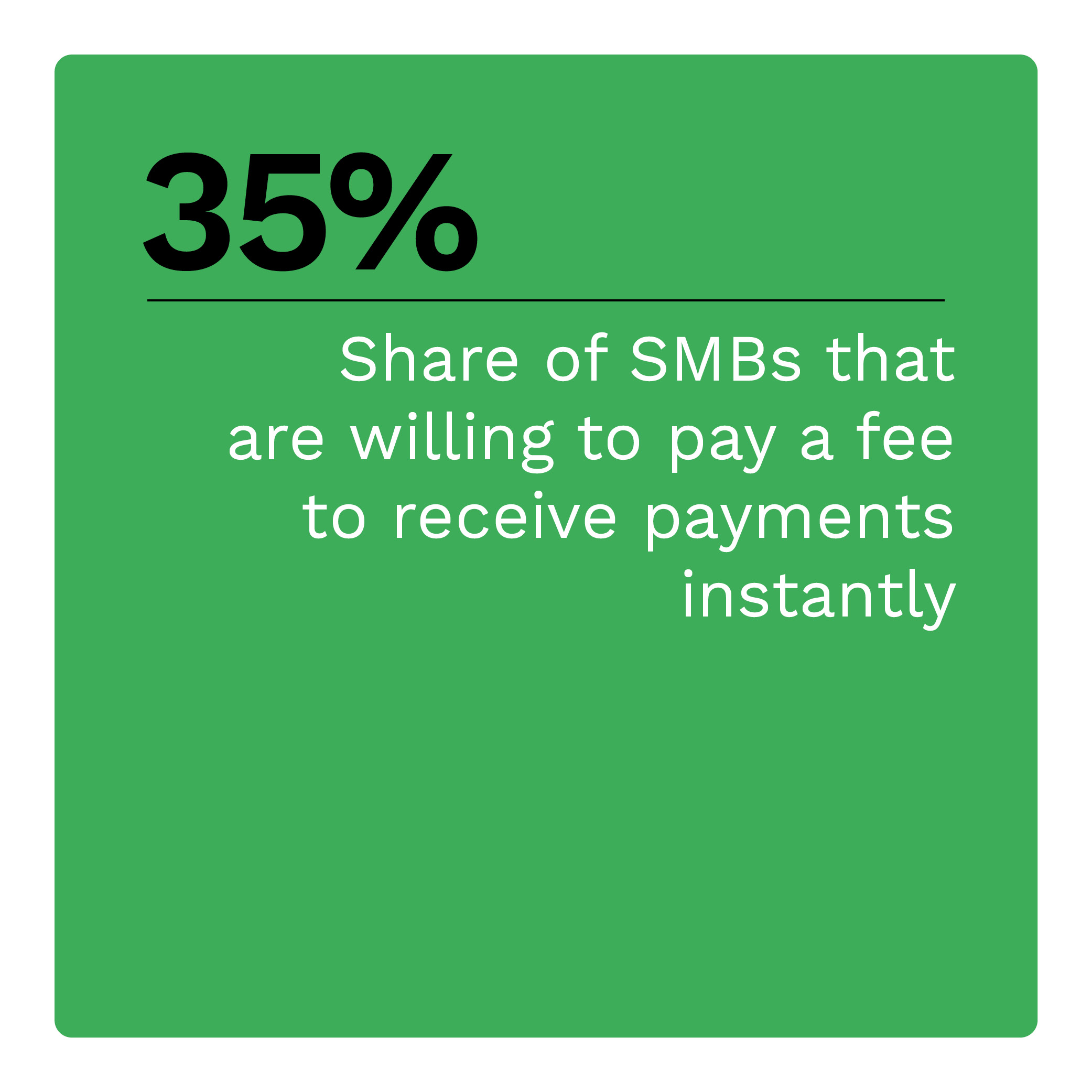

SMBs are willing to pay a fee for receive ad hoc payments instantly.

Since instant methods can help improve cash flows, a significant share of SMBs indicate a willingness to pay fees to receive ad hoc payments instantly. Overall, 7.4% of SMBs already pay fees, and an additional 35% are very or extremely willing to pay a fee. Larger SMBs are more willing than smaller SMBs to pay fees to receive ad hoc payments instantly.

Larger SMBs receive more of their ad hoc payments through instant methods. Smaller SMBs must consider instant payments to manage cash flows to stay agile and competitive. Download the report to learn why SMBs prefer receiving instant digital ad hoc payments.

[ad_2]

Source link