[ad_1]

Foreign invested enterprises account for about a quarter of China’s industrial output, a fifth of its tax revenue, and about 40 percent of its total imports and exports – making stabilizing foreign investment and optimizing the distribution of foreign capital a top priority for the government and policymakers.

Which sectors encourage foreign investment?

The newly released 2022 FI Encouraged Catalogue (Exposure Draft) contains a total of 1,435 items, increased by 16 percent from 1,235 items in the previous version. The lengthening of the catalogue signifies that more investment fields will favor foreign investors.

According to the official interpretation, the revision of the 2022 FI Encouraged Catalogue (Exposure Draft) is intended to continuously lure foreign investment in three main areas:

- Manufacturing sectors

- Production-oriented service industries

- Reginal advanced industries in China’s central, western, and northeastern regions

Nationwide, the catalogue has added or expanded items on manufacturing of components and parts and equipment. In the service industries, foreign companies are encouraged to invest in production-oriented services, with items, such as professional design, technical services, and development, newly added to the national catalogue.

Opportunities also exist in industries linked to green, healthcare, elder care, sports, and vocational education sectors besides rural revitalization.

Sector incentives for doing business in China

Incentives are offered to foreign businesses engaged in doing business in listed industries published in the encouraged catalogue, who can enjoy the following benefits:

- Tariff exemptions on imported equipment – for encouraged foreign-invested projects, the import of self-use equipment within the total amount of investment can be exempted from customs duties, excepted for those listed in the Catalogue of Major Technical Equipment and Products Not Exempt from Import Duty and Catalogue of Imported Commodities Not Exempt from Import Duty for Foreign Investment.

- Access to preferential land prices and looser regulation of land use – land can be preferentially supplied for encouraged foreign-funded projects with intensive land use. The land transfer reserve price can be determined at 70 percent of the national minimum price for the transfer of industrial land.

- Lowered corporate income tax (CIT) – for FIEs in encouraged industries in the western regions and Hainan province that meet the requirements, the CIT rate can be reduced to 15 percent.

Which industries cannot be foreign owned or solely foreign owned?

Foreign players must note that there are specific lists that determine the sector-based investment access of foreign-invested enterprises (FIEs). These are:

- Negative lists directed at foreign investors; and

- General negative lists, which are applicable to all enterprises, including domestic enterprises.

Thus, there are at least four “negative lists” that foreign businesses must keep track of.

The negative lists specifically applicable to foreign investors include:

The negative lists applicable to all foreign and domestic players include:

- The Negative List for Market Access (2022 edition) (Full list in Chinese available here); and

- The Catalogue for Guiding Industry Restructuring (2019 edition) (Full list in Chinese available here).

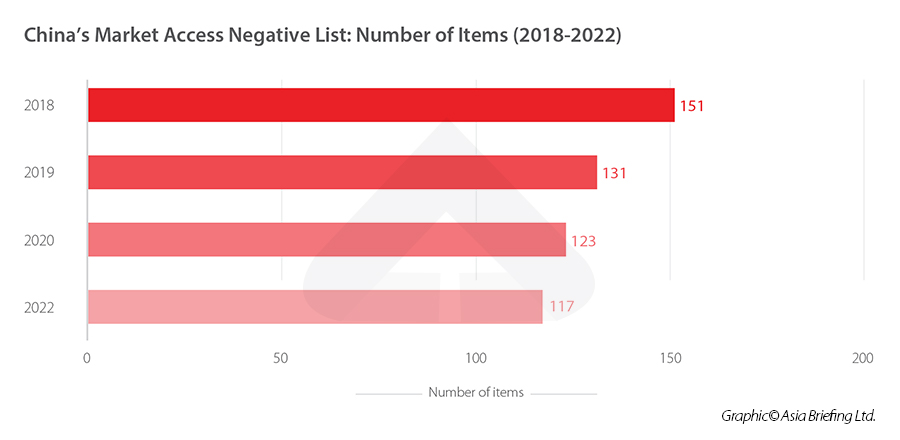

Currently, there are 33 sectors that restricted to or prohibited from foreign investment nationally, while the number is 27 in the FTZs. Meanwhile, there are 117 sectors restricted to or prohibited from private investment of both domestic and foreign investors, as mentioned in the Negative List for Market Access (2022 edition).

We suggest that foreign investors looking to enter the Chinese market cross check these lists to ensure they are eligible to access certain sectors and any further licensing or certification requirements:

1) Check the negative lists directed at foreign investors to see whether the investment is permitted at all in a sector or through what ownership structure is the investment allowed.

2) Check the Negative List for Market Access to see if any further licensing or certification requirements are required.

3) Refer to the Catalogue for Guiding Industry Restructuring (2019 edition) to see if their specific technology, equipment, and products are blocked in the country.

China’s Negative List for Market Access determines which industries are prohibited or restricted to private investment by companies in China. Any industry not included on the list is presumed to be open to investment without requiring additional administrative approvals.

The current list covers 117 industries.

The Negative List for Market Access applies to both foreign and domestic investors alike. It is not to be confused with the Special Administrative Measures (Negative List) for Foreign Investment Access and the Special Administrative Measures (Negative List) for Foreign Investment Access in Pilot Free Trade Zones, which are separate negative lists that apply exclusively to foreign investors.

For sectors removed from the negative list, all market entities can access these industries equally, and do not require special approval to enter. However, they still must comply with relevant regulations, which vary by industry.

How does the Negative List for Market Access work?

The 2022 Negative List for Market Access includes two categories: prohibited and restricted markets.

For the prohibited list, market players are forbidden from engaging in these industries, fields, and businesses in any way – whether it be in the form of investments, partnerships, or takeovers.

Market players wishing to enter “restricted” categories must do so by filing an application for access to the relevant administrative organs as per the laws and regulations.

Foreign investors need to consult both the negative list for foreign investment (FI negative list) and the market access negative list to know whether they can invest in their industry, field, or business of choice.

Sector insights guides

[ad_2]

Source link