[ad_1]

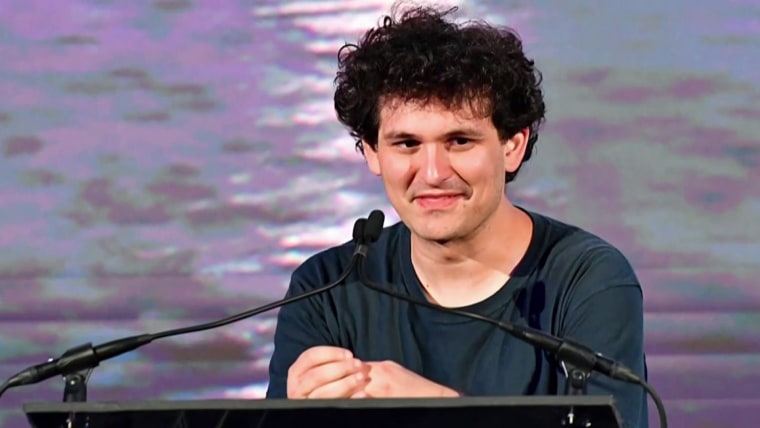

Sam Bankman-Fried pleaded not guilty in New York federal court Tuesday to eight charges related to the collapse of his former crypto exchange FTX and hedge fund Alameda Research.

The onetime crypto billionaire was indicted on charges of conspiracy to commit wire fraud and securities fraud, individual charges of securities fraud and wire fraud, money laundering, and conspiracy to avoid campaign finance regulations.

Bankman-Fried arrived outside the courthouse in a black SUV, and was swarmed with cameras from the moment his car arrived. The scrum grew so thick that Bankman-Fried’s mother was unable to exit the vehicle, falling onto the wet pavement as cameras scrambled to catch a glimpse of her son.

The former billionaire was hauled by security through the throng and into the courthouse in a matter of moments, with photographers scrambling out of their way as Bankman-Fried was carried by his lapels through the mob.

Bankman-Fried returned to the U.S. on Dec. 21 and was released on a $250 million recognizance bond, secured by his family home, on Dec. 22.

Earlier in the day, attorneys for Bankman-Fried filed a motion to seal the names of two individuals who had guaranteed Bankman-Fried’s good behavior with a bond. Judge Lewis Kaplan approved the motion in court today.

The motion argued that the visibility of the case and the defendant had already posed a risk to Bankman-Fried’s parents, and that the guarantors should not be subject to the same scrutiny.

Federal prosecutors also announced the launch of a new task force to recover victim assets as part of an ongoing investigation into Bankman-Fried and the collapse of FTX.

“The Southern District of New York is working around the clock to respond to the implosion of FTX,” U.S. Attorney Damian Williams said in a statement Tuesday.

The U.S. Attorney’s Office for the Southern District of New York had argued that Bankman-Fried suborned $8 billion worth of customer assets into extravagant real estate purchases and vanity projects, including stadium naming rights and millions in political donations.

Federal prosecutors built the indictment against Bankman-Fried with unusual speed, packaging together the criminal charges against the 30-year-old in a matter of weeks. The federal charges came alongside complaints from the Commodity Futures Trading Commission and the Securities and Exchange Commission.

All were assembled with the cooperation of two of Bankman-Fried’s closest allies, Caroline Ellison, the former CEO of his hedge fund Alameda Research, and Gary Wang, who co-founded FTX with Bankman-Fried.

Ellison, 28, and Wang, 29, pleaded guilty on Dec. 21. Their plea deals with prosecutors came after rampant speculation that Ellison, Bankman-Fried’s onetime romantic partner, was cooperating with federal probes.

But it was another former FTX executive, Ryan Salame, who apparently first alerted regulators to alleged wrongdoing inside FTX. Salame, a former co-CEO at FTX, flagged “possible mishandling of clients’ assets” to Bahamian regulators two days before the crypto exchange filed for bankruptcy protection, according to a filing from the Securities Commission of the Bahamas.

Bankman-Fried was accused by federal law enforcement and financial regulators of perpetrating what the SEC called one of the largest and most “brazen” frauds in recent memory. His stunning fall from grace was precipitated by reporting that raised questions on the nature of his hedge fund’s balance sheet.

In the weeks since FTX’s Nov. 11 Delaware bankruptcy filing, the typically staid bankruptcy process was punctuated by alarming incidents of corporate malfeasance, including a disturbing lack of record keeping which replacement CEO John J. Ray called a “complete failure of corporate control.”

Bankman-Fried was indicted in New York federal court on Dec. 9, and was arrested by Bahamas law enforcement at the request of U.S. prosecutors on Dec. 12. The weeks that followed his indictment were marred by vacillation from Bankman-Fried’s Bahamian legal team on whether their client would consent to extradition or not.

[ad_2]

Source link