[ad_1]

The Taskforce for Nature-related Financial Disclosures’ final beta recommendations are shaping material risks for investors. WSP shares their recommendations on how to prepare for nature-based reporting.

In this chapter of Environment Analyst’s Corporate Guide: Accelerating your ESG transition, WSP’s Jenny Merriman, technical director – nature advisory, and Sidney Chen, project consultant, TCFD & TNFD, offer guidance on how to prepare for TNDF and nature-based reporting.

Introduction

In March 2023 the Taskforce on Nature-related Financial Disclosures (TNFD) released its final beta recommendations, and in September 2023 we should see the TNFD’s final disclosure recommendations. This will position nature-based disclosures firmly as a material risk to investors and prompt action in ESG disclosures. What actions can organisations take now to get ahead of the curve on TNFD? And how will the recommendations change the reporting landscape?

The threat from biodiversity loss and the destruction of the world’s ecosystems is as significant to humanity as climate change.

Over half of global GDP — $44 trillion — is moderately or highly dependent on nature and its services, and the remainder is indirectly dependent on it, according to the World Economic Forum. This, together with the vital contribution that biodiversity plays in mitigating climate change, underlines the global imperative to urgently halt the loss of, and restore, degraded ecosystems.

The UN’s international biodiversity conference COP15 was a milestone in global aspiration towards nature. Chief amongst its outcomes were agreements to protect at least 30% of the planet for nature and the introduction of mandatory nature-related disclosures for large companies and financial institutions by 2030. The TNFD, a cross-sector initiative launched in 2021, will be instrumental in meeting those targets.

With careful planning, TNFD disclosure can be readily incorporated into existing reporting commitments

The taskforce has developed a market-led risk management and disclosure framework for organisations to report and act on evolving nature-related risks and opportunities. It will help inform market participants ultimately to support a “shift in global financial flows away from nature-negative outcomes and toward nature-positive outcomes”.

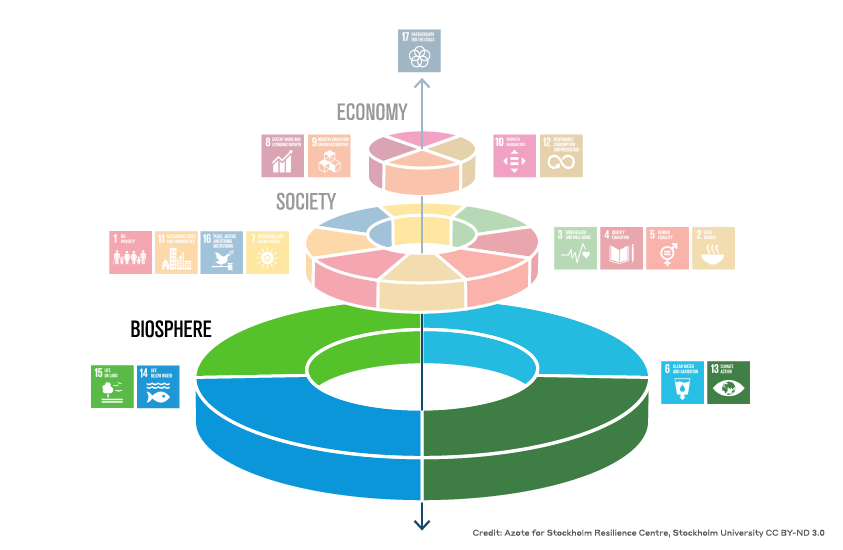

Sustainability priorities link to biosphere (credit: Azote for Stockholm Resilience Centre, Stockholm University CC BY-ND 3.0)

Core to the framework’s development have been efforts, in collaboration with international standards setting bodies, to streamline it with wider sustainability disclosure activities, notably its climate counterpart, the Taskforce for Climate-related Financial Disclosures (TCFD). TNFD also aims to align with CDP, the Global Reporting Initiative (GRI), International Sustainability Standards Board (ISSB), the EU’s Corporate Sustainability Reporting Directive (CSRD); Sustainability Accounting Standards Board (SASB) and European Financial Reporting Advisory Group (EFRAG). This ensures that reporting under nature will form an extension, rather than a new undertaking, to the data gathering exercises to which many organisations are already committed.

With careful planning, TNFD disclosure can be readily incorporated into existing reporting commitments to inform better financial decision-making and secure business continuity in step with nature.

What is the TNFD’s mission?

TNFD has been devised in conjunction with business, for business, as a global framework to understand the link with nature and its impact on a company’s financial performance. The framework assists any organisation — corporates and financial institutions of all sizes — to identify and assess nature-related issues through the lens of four key concepts:

- Dependencies: such as the ecosystem services that organisations depend on e.g. pollinators or clean water;

- Impacts: such as a change to nature resulting from an organisation’s activities, e.g. carbon emissions;

- Risks: such as physical, transitional and systemic risks as a result of our collective impact on nature and efforts to address it; and

- Opportunities: to avoid or reduce impact on nature or contribute to its restoration, and drive positive outcomes for nature, their organisation and society.

Disclosure recommendations are structured around the same four reporting pillars seen in TCFD: governance, strategy, risk & impact management, and metrics and targets. These are split into 15 core disclosures (11 of which carried over from TCFD) that organisations should include in their financial filings to provide decision-useful information.

Data availability poses a key challenge, but participants should prioritise disclosures material to their geography and activities

Who should take action?

Biodiversity loss is not only a concern for sectors that are inherently reliant on nature and ecosystem services, e.g. food production. All industries will have some materiality to address, and every organisation must look at its whole value chain, i.e. not just direct operations but also upstream and downstream.

The graphic demonstrates how our entire society and global economy are balanced on four sustainability priorities, all linked to the biosphere.

Some organisations are inherently at greater risk of causing or experiencing disruption from nature loss than others due to their activity or location. Identified priorities include:

- Priority sectors: food and beverage; renewable resource and alternative energy; infrastructure; extractives and mineral processing; health care; resource transformation; consumer goods; and transportation.

- Priority biomes (with guidance to date): tropical forests; rivers & streams; marine shelf; and intensive land use systems (with additional biomes to follow).

Why take action now?

Disruption to the functioning of earth systems poses a threat to all economic enterprises. This includes shorter term financial risk, but equally longer term risks linked not just to their own dependencies on nature but more broadly to society as a whole.

TNFD categorises nature-related risks as: physical (e.g. linked environmental conditions including climate change); transition (e.g. policy & legal, market or reputation); and systemic (e.g. ecosystem collapse or contagion).

Momentum for action is growing at numerous levels:

- Legislative and regulatory drivers: biodiversity is rising rapidly up the regulatory agenda worldwide e.g. the EU’s anti-deforestation law (2022) covering supply chains; the UK Environment Act (2021) with mandated biodiversity net gain; and Australia’s Biodiversity Conservation Act (2016) covering biodiversity offsets.

- Financing drivers: investors are demanding increased transparency around the impact of their investments on nature; access to funding and insurance is increasingly being tied to biodiversity risk. 140 financial institutions have signed Finance for Biodiversity Pledge which aims to protect and restore biodiversity through their finance activities and investments.

- Market drivers: the business community is responding e.g. Business for Nature’s Make it Mandatory campaign for legally-binding biodiversity disclosures for large businesses and financial institutions.

- Corporate ESG commitments: forward-thinking companies are already adopting their own biodiversityrelated commitments e.g. Cargill, Teck and WSP.

Currently, TNFD has been launched as a voluntary mechanism. However, it is likely that nature-related risks and impact disclosures will progressively be included in mandatory sustainability reporting, as we are seeing with climate-related disclosures — starting with the largest listed companies in advanced economies. Firms will find themselves under increasing pressure to act, making it prudent to put in place the necessary systems now.

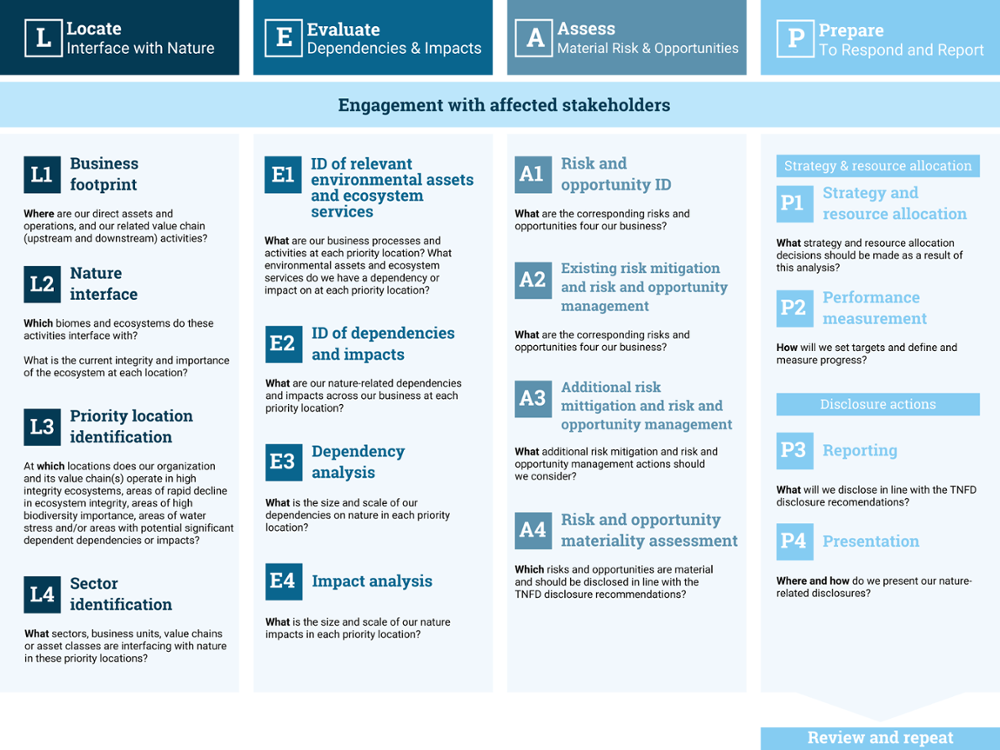

TNFD Version v0.4 beta release (source: TNFD and WSP)

Key elements to explore

For many organisations, incorporating nature-related issues into their disclosures will represent a new initiative. Key elements of the framework to consider include:

(i) LEAP approach

In the absence of a single metric, such as greenhouse gas (ghg) emissions, assessing an organisation’s interface with nature is unquestionably more complex than its equivalent carbon footprint.

TNFD has compiled a sector-agnostic approach, called LEAP, to help organisations with their nature-related disclosures. It is an optional structure that analyses the risks and opportunities across portfolios and value chains, geographically and over time. Nature-related issues are highly localised, and the LEAP approach outlines the most material risks and opportunities through a four-stage process:

(ii) TNFD and TCFD

Given the interrelationship between climate and biodiversity, the TNFD framework has been developed to align closely with that of TCFD. This creates disclosure synergies: driving content consistency; minimising duplication; focusing stakeholder engagement; and maximising the opportunities for integrated climate-nature disclosures.

Ultimately this will help organisations to start embedding combined climate-nature considerations early in their climate action and net zero planning and response, highlighting possible trade-offs that tackle climate and biodiversity crises simultaneously.

(iii) Value chain impacts

The concept of ‘Scope’ emissions deployed by TCFD, to help companies understand their impact across the whole value chain, has been modified under TNFD.

In a nature context, TNFD refers to direct operational dependencies/impacts (equivalent to Scope 1 ghg emissions), upstream (supply), downstream (distribution and sale) and financed dependencies/impacts. This approach helps participants examine hidden dependencies and impacts beyond their immediate operations.

TNFD acknowledges that, at such an early stage of adoption, data availability poses a key challenge for an organisation’s full value chain beyond its direct assets and operations. Nevertheless, the need for immediate action implies that participants should from the outset prioritise their disclosures in the specific activities and/or geographic areas where information is material, including their upstream and downstream locations.

(iv) Stakeholder engagement

The importance of stakeholder engagement has been a prominent and strengthening theme throughout the framework’s evolution. Described as a critical, cross-cutting element of the LEAP approach and part of the recommended disclosure requirement under the risk & impact management pillar, identifying and liaising with affected stakeholders will ensure that issues of social justice and equity are adequately and appropriately reflected as we transition to a nature positive and net zero economy.

Of note is the focus on stakeholders whose human and environmental rights could be affected, e.g. access to a clean, healthy & sustainable environment. Similarly underscored is the need to engage with Indigenous peoples and local communities, whose stewardship role, rights and traditional

knowledge of nature are recognised.

(v) Tools

TNFD views data and analytics as fundamental to helping participants to assess their impacts, dependencies, risks and opportunities. The decision-usefulness of data will depend on a range of characteristics including relevance, temporality, geographic coverage, comparability and traceability amongst others. Also crucial will be the accessibility of existing tools to non-technical users.

TNFD has provided a data discussion paper which includes a non-comprehensive (and unendorsed) list of available tools, together with two theoretical case studies which highlight the LEAP process, and potential gaps and challenges that participants might face. TNFD envisages the development of new tools, services and capabilities which will improve data quality.

(vi) Target setting

TNFD aims to help participants to build informed and actionable strategies, incorporating relevant and measurable nature-related targets, which will safeguard business continuity and value in the long term. However, unlike the climate context where ghgs are the key indicator, there is currently no singular, overarching global goal around which we can organise ourselves to take action for nature.

In terms of nature, where the drivers of nature loss are multiple, varied and interlinked, the framework proposes ten core global indicators relevant to most business models, sectors and biomes e.g. land use change, water consumption, resource use and pollutant release. Furthermore, and again in contrast with climate change where action can happen anywhere, the highly location-specific nature of biodiversity loss — both in the drivers and consequences — means that it is crucial to consider where to act to attain critical outcomes.

TNFD has collaborated with Science Based Targets Network (SBTN) on guidance for corporates setting science-based targets for nature to help steer strategy and future planning and actions.

Conclusion & key takeaways — preparing for TNFD

- Familiarise yourself with the final draft version of TNFD (ahead of the final recommendations in September 2023).

- Explore your organisation’s readiness in terms of experience, capacity, cost considerations to identify gaps in capabilities and resource availability. WSP has designed a proprietary gap analysis tool to help companies assess their alignment with TNFD’s recommended disclosure requirements and identify any gaps in capabilities and resource availability.

- Ensure a management or board member has been appointed and charged with preparing the organisation for nature-related disclosures.

- Leverage TCFD disclosures to identify crossovers; avoid duplication of efforts and highlight climate-nature tradeoffs in target setting.

- Familiarise yourself with the available tools that will help with the data elements.

- Consider running a TNFD pilot, including the LEAP process for a specific component of your business/value chain.

- Consider setting corporate biodiversity and wider naturerelated targets using best practice e.g. SBTNs.

This chapter of Environment Analyst’s Corporate Guide: Accelerating your ESG transition was kindly authored by Jenny Merriman, technical director – nature advisory, WSP & Sidney Chen, project consultant, TCFD & TNFD, WSP (www.wsp.com)

© Environment Analyst. You may circulate web links to our articles, but you may not copy our articles in whole or in part without permission

CORRECTIONS: We strive for accuracy, but with deadline pressure, mistakes can happen. If you spot something, we want to know, please email us at: news@environment-analyst.com

We also welcome YOUR NEWS: Send announcements to news@environment-analyst.com

[ad_2]

Source link