[ad_1]

Traders taking bets on the platform predict a 90% chance the SEC will approve spot Bitcoin ETFs by mid-January, while the minority is hedging against the converse outcome.

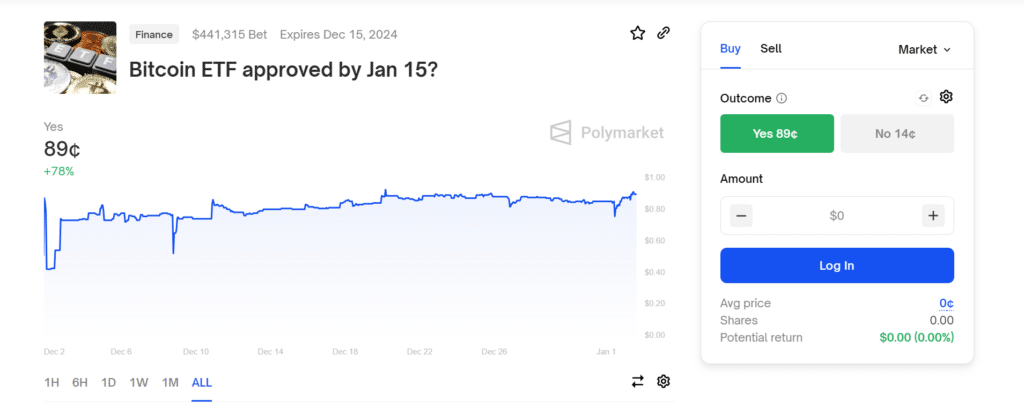

Shares of a “Bitcoin ETF approved by Jan 15” contract on Polymarket, a decentralized prediction venue, traded for 90 cents as speculation for a forthcoming decision from the U.S. Securities and Exchange Commission (SEC) dominated market sentiment.

At press time, the contract had attracted $441,315 worth of “YES” bets, with just 10% of traders choosing “NO”. These investors also admitted their opposing choice was a means to hedge their bets and turn a profit should the SEC delay beyond Jan. 15.

I don’t doubt the inevitability of a Bitcoin ETF, I doubt the SEC’s ability to work fast enough to say yes by Jan. 15.

Polymarket trader

Reuters reported that the SEC could announce approvals as early as Jan. 3 for the 14 issuers to list their products in the coming weeks. However, Fox journalist Eleanor Terrett said this is highly unlikely due to ongoing reviews of updated S-1 filings from firms like Hashdex and VanEck.

Although no one knows when the SEC will decide on spot Bitcoin ETFs, experts and crypto proponents fancy the chances of a Jan. 10 outcome. This date coincides with the deadline for a joint submitted by ARK 21Shares.

Cathie Wood, Ark Invest CEO, also foresees a decision by this date. Wood believes an approval would endorse Bitcoin (BTC) and cryptocurrencies through Wall Street, a sentiment shared by MicroStrategy founder and BTC maxi Michael Saylor.

[ad_2]

Source link