[ad_1]

Large-cap stocks have lagged behind small- and mid- cap stocks in these past three years. Nifty 50 – TRI delivered about 16% while Nifty Midcap 150 – TRI and Nifty Smallcap 250 – TRI gave 31% and 36% returns, respectively, in the last 3-year period. But fund managers are cautious. Nilesh Shah, MD, Kotak AMC, in his recent interview with Moneycontrol, said that large caps are at around the historical average valuation, mid-caps are at a little expensive and small-caps are at about 20 percent premium. “Be marginally overweight large caps, be equal weight mid-caps and marginally underweight small caps,” he added. While the earnings growth in small and mid-caps will outpace large caps, Shah says that the certainty of large-cap earnings growth is far higher.

Large-cap stocks have lagged behind small- and mid- cap stocks in these past three years. Nifty 50 – TRI delivered about 16% while Nifty Midcap 150 – TRI and Nifty Smallcap 250 – TRI gave 31% and 36% returns, respectively, in the last 3-year period. But fund managers are cautious. Nilesh Shah, MD, Kotak AMC, in his recent interview with Moneycontrol, said that large caps are at around the historical average valuation, mid-caps are at a little expensive and small-caps are at about 20 percent premium. “Be marginally overweight large caps, be equal weight mid-caps and marginally underweight small caps,” he added. While the earnings growth in small and mid-caps will outpace large caps, Shah says that the certainty of large-cap earnings growth is far higher.

Here are the top large-cap stocks that the actively managed mutual fund schemes have constantly added in their portfolio over last six months. The number of schemes that hold those stocks keeps on increasing month-on-month over the last six months.

Only actively managed equity schemes and hybrid schemes (except arbitrage funds) are considered for compilation. Data as of October 31, 2023. Source: ACEMF.

Zomato

Zomato

No. of active MF schemes newly added the stock in the last 6-months: 96

Total no. of active MF schemes holding the stock as of October 2023: 170

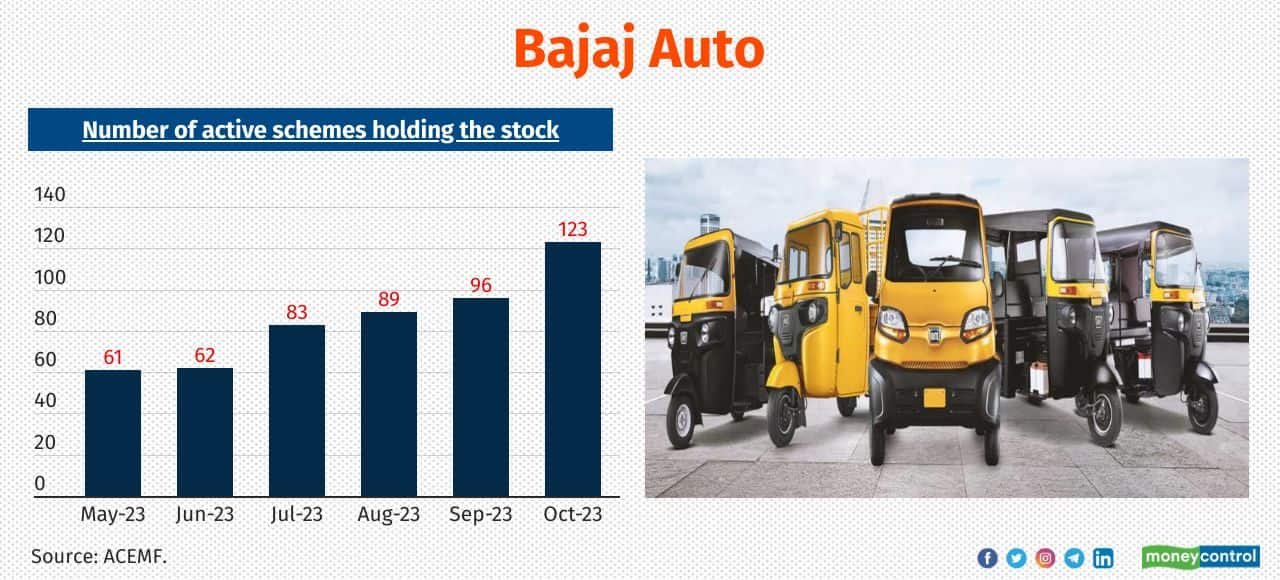

Bajaj Auto

Bajaj Auto

No. of active MF schemes newly added the stock in the last 6-months: 62

Total no. of active MF schemes holding the stock as of October 2023: 123

Also see: Opportunity in market correction: New midcap stocks that MFs added in October

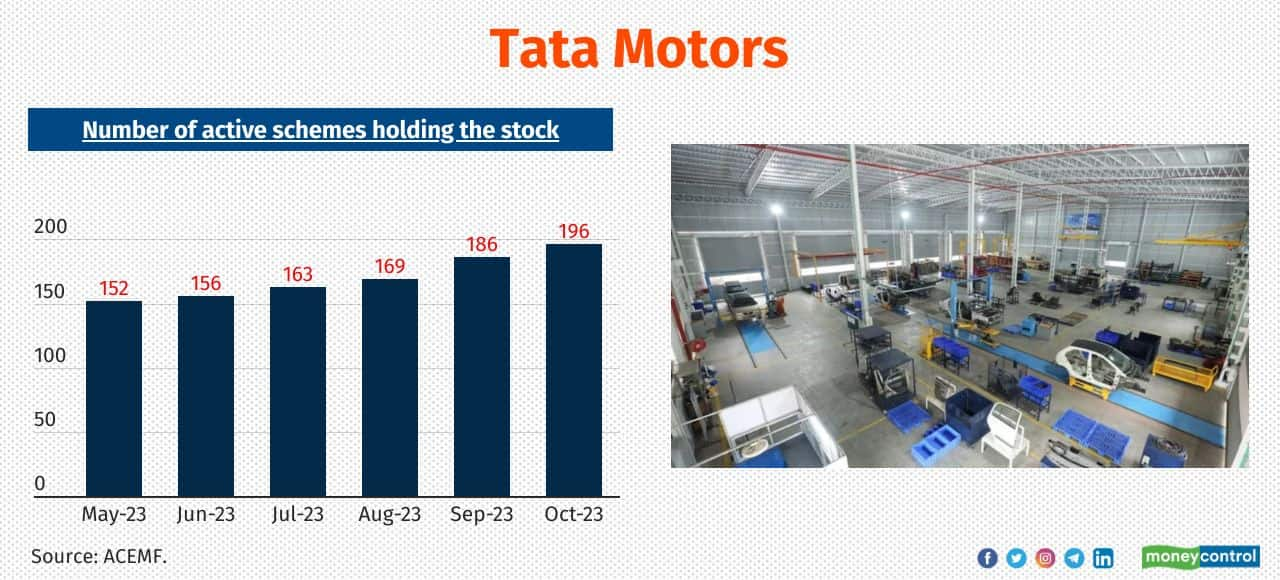

Tata Motors

Tata Motors

No. of active MF schemes newly added the stock in the last 6-months: 44

Total no. of active MF schemes holding the stock as of October 2023: 196

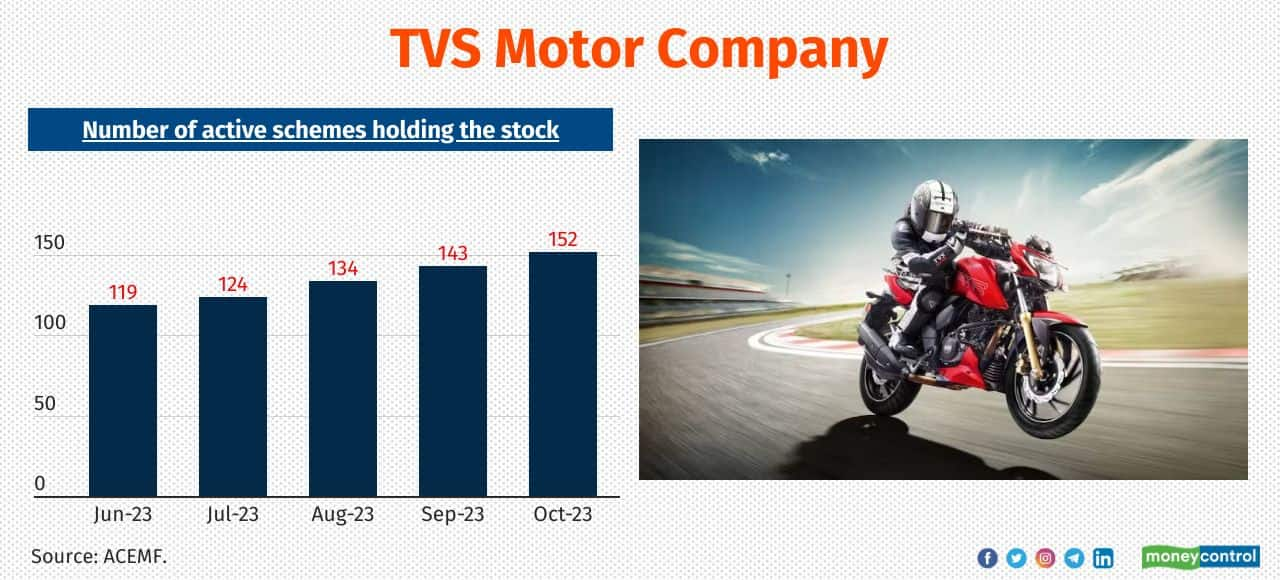

TVS Motor Company

TVS Motor Company

No. of active MF schemes newly added the stock in the last 6-months: 33

Total no. of active MF schemes holding the stock as of October 2023: 152

Hero MotoCorp

Hero MotoCorp

No. of active MF schemes newly added the stock in the last 6-months: 31

Total no. of active MF schemes holding the stock as of October 2023: 115

Also see: Active fund managers booked profit from these multibaggers. Check your portfolio

Cholamandalam Investment and Finance Company

Cholamandalam Investment and Finance Company

No. of active MF schemes newly added the stock in the last 6-months: 30

Total no. of active MF schemes holding the stock as of October 2023: 171

Bharat Electronics

Bharat Electronics

No. of active MF schemes newly added the stock in the last 6-months: 29

Total no. of active MF schemes holding the stock as of October 2023: 195

Sun Pharmaceutical Industries

Sun Pharmaceutical Industries

No. of active MF schemes newly added the stock in the last 6-months: 28

Total no. of active MF schemes holding the stock as of October 2023: 273

Also see: Wealth creators: PMSes that delivered up to 37% annual returns in 10 years

Samvardhana Motherson International

Samvardhana Motherson International

No. of active MF schemes newly added the stock in the last 6-months: 27

Total no. of active MF schemes holding the stock as of October 2023: 117

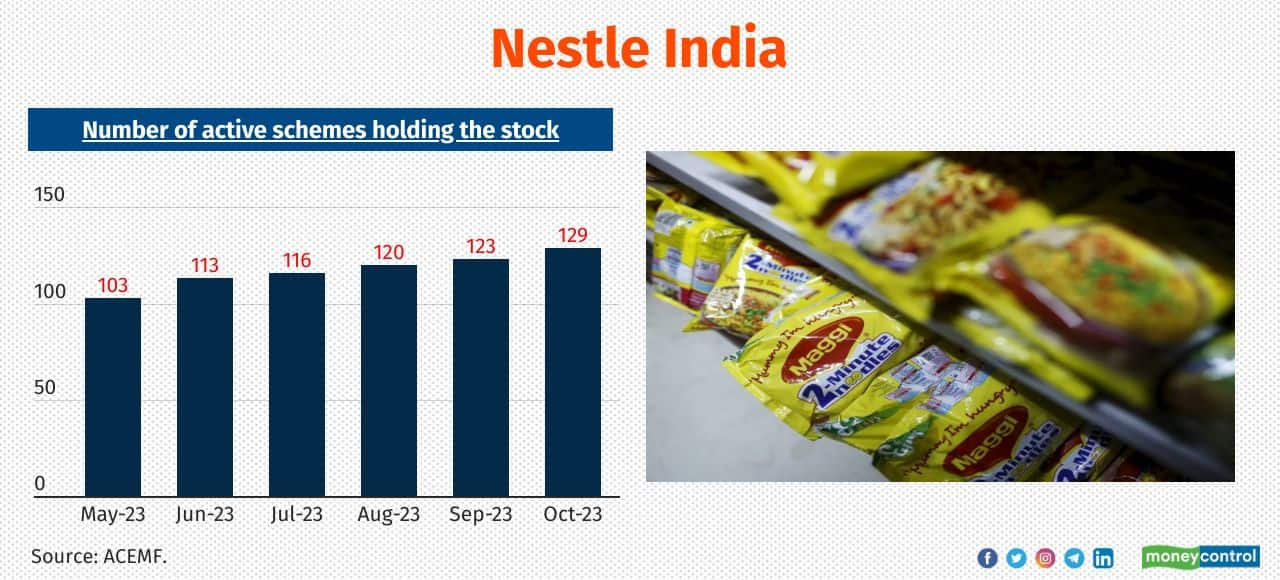

Nestle India

Nestle India

No. of active MF schemes newly added the stock in the last 6-months: 26

Total no. of active MF schemes holding the stock as of October 2023: 129

Jindal Steel & Power

Jindal Steel & Power

No. of active MF schemes newly added the stock in the last 6-months: 24

Total no. of active MF schemes holding the stock as of October 2023: 99

Also see: Long-term smallcap companies that equity savings funds put their money on

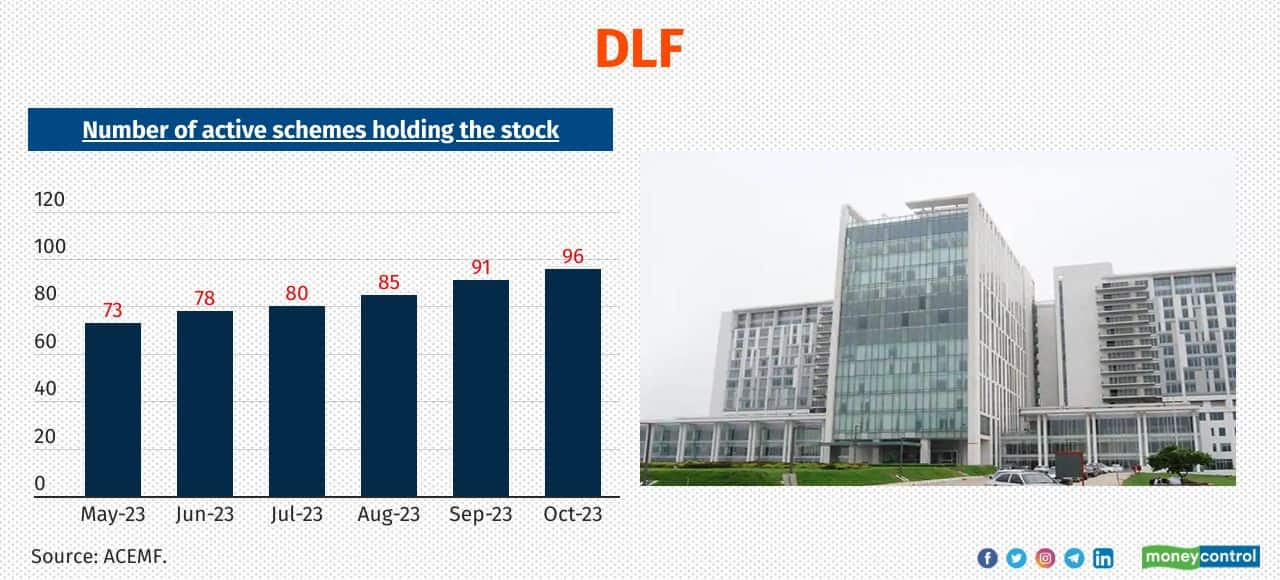

DLF

DLF

No. of active MF schemes newly added the stock in the last 6-months: 23

Total no. of active MF schemes holding the stock as of October 2023: 96

Avenue Supermarts

Avenue Supermarts

No. of active MF schemes newly added the stock in the last 6-months: 20

Total no. of active MF schemes holding the stock as of October 2023: 118

Also see: Thematic ETFs: Low on liquidity but worth a look

IndusInd Bank

IndusInd Bank

No. of active MF schemes newly added the stock in the last 6-months: 19

Total no. of active MF schemes holding the stock as of October 2023: 193

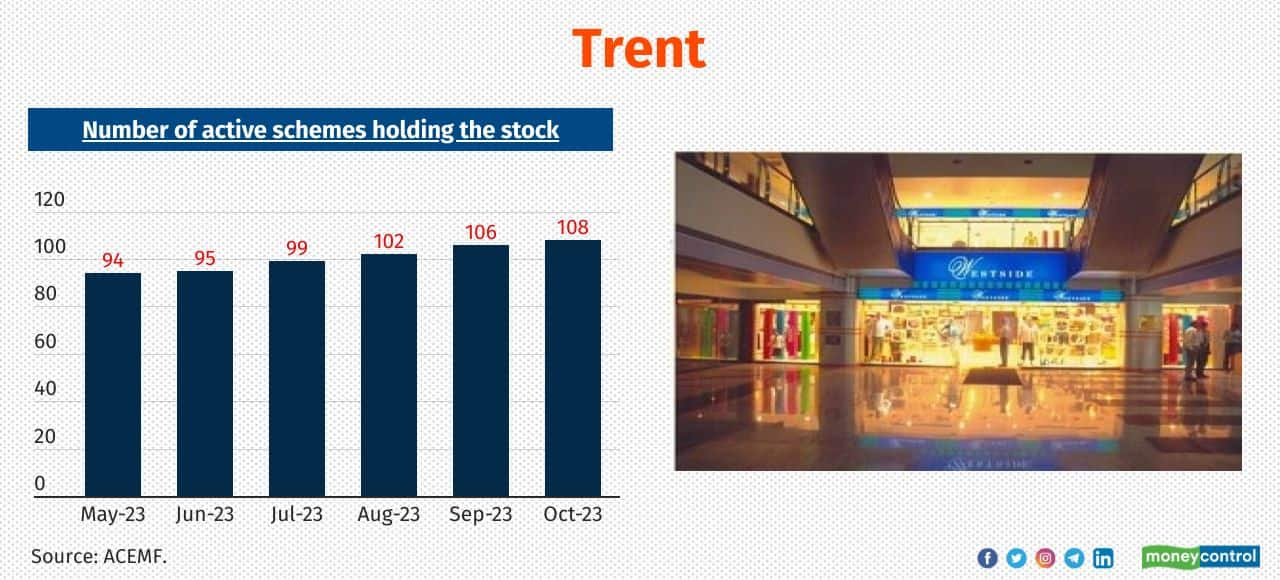

Trent

Trent

No. of active MF schemes newly added the stock in the last 6-months: 14

Total no. of active MF schemes holding the stock as of October 2023: 108

Also see: Macro proof your SIPs with this MC30 midcap fund by Edelweiss MF

[ad_2]

Source link