[ad_1]

kate_sept2004/E+ via Getty Images

Investment thesis

Our current investment thesis is:

- Paychex has a highly attractive business model, with a wide range of services and a software-driven approach to HR solutions. The company targets companies of all sizes and has achieved consistently strong growth.

- Paychex’s margins are impressive, with resilience implying its competitive position remains strong despite high competition. The key risk to the business would be a decline in its superior position, contributing to erosion of its impressive EBITDA-M of 44%. With reinvestment and a strong track record, we believe this risk is manageable.

- With a focus on product development and the potential for M&A and international expansion, we see growth continuing in the years to come.

- Paychex appears reasonably priced but we rate the stock a buy based on its current trajectory.

Company description

Paychex (NASDAQ:PAYX), headquartered in Rochester, New York, is a leading provider of human resources (HR), payroll, and benefits outsourcing solutions for small and medium-sized businesses. The company offers a range of services to help businesses manage HR tasks more efficiently.

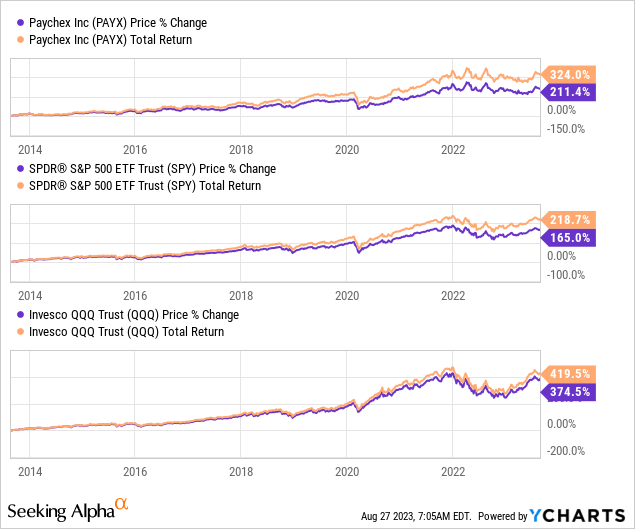

Share price

Paychex’s share price has performed exceptionally well during the last decade, returning over 300% inclusive of dividends, comparable to the technology sector and exceeding the S&P. This has been driven by financial strength and continued commercial development.

Financial analysis

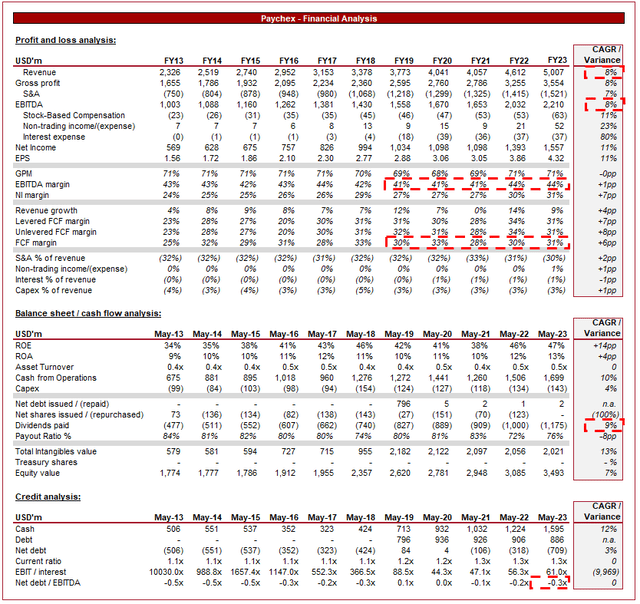

Paychex financials (Capital IQ)

Presented above are Paychex’s financial results.

Revenue & Commercial Factors

Paychex’s revenue has grown at a CAGR of 8% during the last decade, an impressive achievement given the maturity of the industry. This growth has been relatively consistent YoY, illustrating its ability to capture new customers dependably.

Business Model

Paychex offers a comprehensive suite of services that cover payroll processing, human resource management, benefits administration, time and attendance tracking, and other related functions.

Unlike many of its peers, and the traditional industry model, Paychex provides cloud-based software solutions that streamline HR and payroll processes. The technology allows clients to manage employee data, payrolls, taxes, and benefits efficiently without the restrictions associated with traditional methods. Further, its systems can be integrated with existing related solutions, such as those provided by Workday (WDAY), SAP (SAP), and Salesforce (CRM).

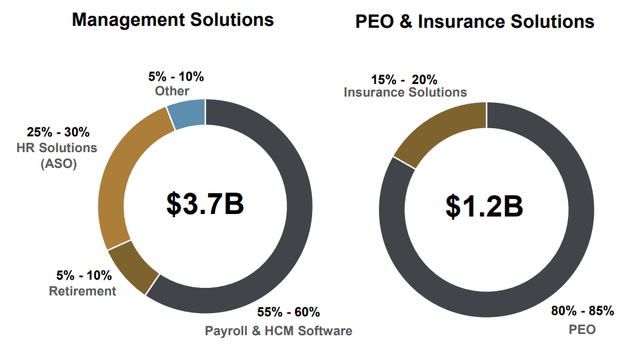

Paychex’s revenue profile is heavily diversified, with a number of segments targeted within the wider employer services spectrum. The provision of multiple related products is highly beneficial as it deepens Paychex’s integration within its clients’ organizations, reducing the risks of churn.

Revenue composition (Paychex)

The company primarily serves small and mid-sized businesses, which often lack the resources to handle complex HR and payroll tasks in-house. Many of these businesses will lack the necessary knowledge required and so will seek providers with a broad range of services that can scale with their operations. Paychex specifically offers solutions that cater to businesses at different stages of growth. This scalability makes their services accessible to startups as well as established firms. Paychex is perfectly positioned to satisfy this and has good visibility due to its numerous award wins.

Awards (Paychex)

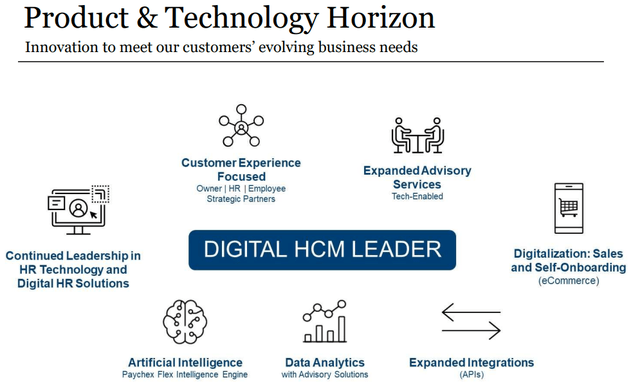

Paychex is heavily investing in product development, particularly within its software capabilities to expand its subscription-earning potential. Paychex has an impressive track record of development thus far and has succeeded in expanding its value proposition by cross-selling to its clients. We are confident that over time, additional solutions will be created.

Product development (Paychex)

Paychex primarily operates within the US. Additionally, it operates in Denmark and Germany. This gives the business significant scope for international expansion, particularly across the anglosphere.

Payroll Industry

Paychex competes with other HR and payroll outsourcing providers like ADP (Automatic Data Processing), Intuit (INTU), Gusto, and TriNet (TNET). These competitors offer similar services targeting small and medium-sized businesses.

Many businesses are increasingly choosing to outsource HR and payroll functions to specialized companies like Paychex, to reduce administrative burdens and focus on their core operations. We suspect this will only increase over time, as operational complexities deepen. Fortune Business Insight estimates the industry TAM to be $28.9bn, with a growth CAGR of 9.2% into 2030.

With growing complex data requirements and legislation (such as GDPR), the importance of utilizing HR expertise, even at a smaller scale, is high. Paychex is well-positioned to assist clients in navigating complex regulatory requirements related to taxes, employment laws, and benefits, reducing the risk of compliance-related issues.

Automation, cloud-based services, and data analytics are transforming HR and payroll processes, as corporates continue to discover the operational benefits of utilizing these technologies. This will only continue as businesses grow, with employees increasingly scattered globally.

Competitive Positioning

We consider the following to be key competitive advantages of the business:

- Scalability. The company’s scalable solutions appeal to businesses of various sizes, making it a suitable option for startups, growing companies, and established enterprises.

- Efficiency and Accuracy. Paychex’s technology-driven approach streamlines processes, reduces errors, and enhances efficiency in payroll and HR operations.

- Customer Relationships. Paychex has established long-term relationships with clients, contributing to recurring revenue streams and positive marketing benefits.

- Industry Reputation. In conjunction with the above, Paychex’s reputation as a reliable and experienced HR and payroll service provider helps attract new customers seeking trusted solutions.

- Technological Advancements. Ongoing investment in technology and software ensures that Paychex remains competitive and aligned with industry trends.

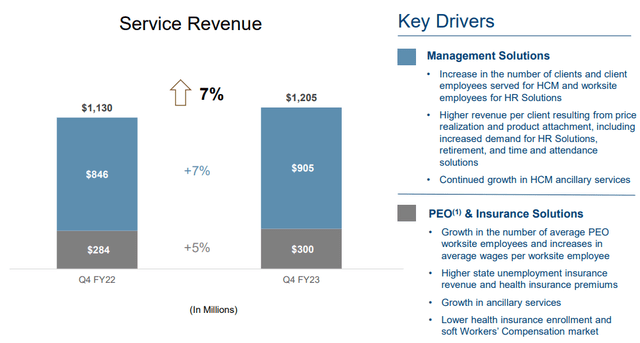

Q4

Q4 (Paychex)

Paychex achieved Service Revenue growth of 7% in the last quarter, driven by new client wins, upselling/cross-selling, and price realization. This is an illustration of the resilience of Paychex’s business model, allowing it to continue growth despite economic conditions.

Margins

Paychex’s margins are impressive, with an EBITDA-M of 44%. This has been extremely consistent during the last decade, illustrating the strength of the business model but equally a lack of operating cost leverage.

It is clear that despite its attractive position, the industry remains highly competitive. For this reason, significant investment must be retained in S&A to maintain its current trajectory.

Balance sheet & Cash Flows

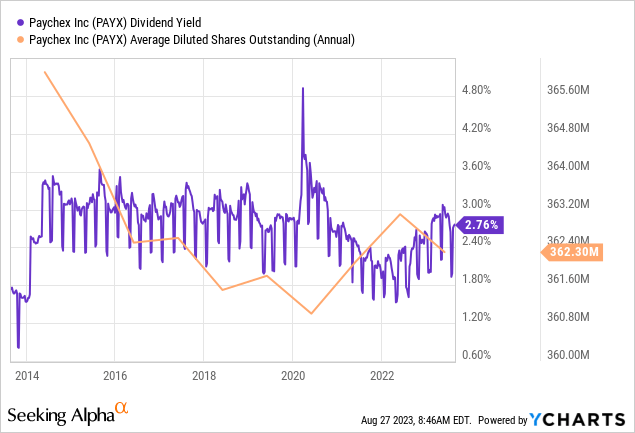

Similarly to other Technology/Services businesses, Paychex’s profitability almost wholly converts to FCF, allowing the business to keep debt limited and distribute heavily to shareholders. The company has minimal Capex requirements and has steadily conducted M&A to supplement its current suite of products.

Beyond this, the chosen method of allocation is dividends, with an impressive 9% average growth rate. Based on the consistency of earnings and the growth rate of EBITDA relative to dividends, this trajectory looks broadly maintainable.

Outlook

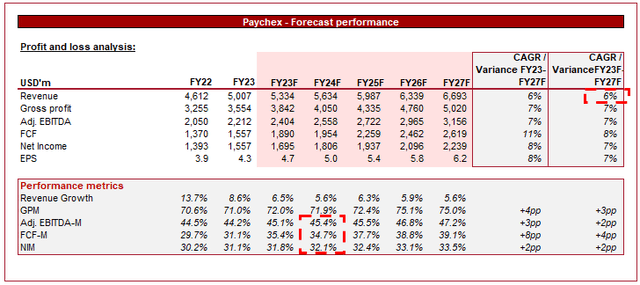

Outlook (Capital IQ)

Presented above is Wall Street’s consensus view on the coming 5 years.

Analysts are forecasting a continuation of Paychex’s current growth rate, with a CAGR of 6% into FY28. Further, margins are expected to slightly improve, directly converting to FCF uplift.

Both assumptions look reasonable in our view. Paychex continues to maintain its market-leading commercial position while continued technological development to increase software revenue will allow for gradual margin appreciation.

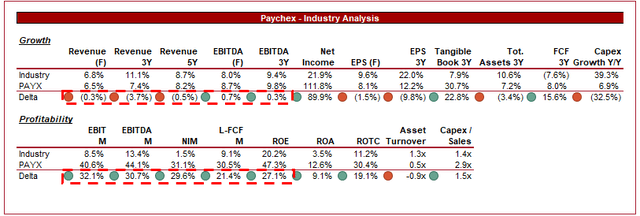

Industry analysis

Human Resource and Employment Services Stocks (Seeking Alpha)

Presented above is a comparison of Paychex’s growth and profitability to the average of its industry, as defined by Seeking Alpha (28 companies – note 7 outlier businesses removed).

Paychex performs exceptionally well relative to peers. Its growth rate is slightly below the industry average, however, this is primarily due to the company’s scale. At this level, absolute gains in a mature industry are difficult to achieve.

Margins are the company’s key area of strength, and it significantly outperforms the industry average. It should be noted that this peer group contains a number of “traditional” services businesses, such as recruiters, many of whom operate on slim margins.

This said, for exposure to an industry that will continually grow healthily, there is likely no better option than Paychex.

Valuation

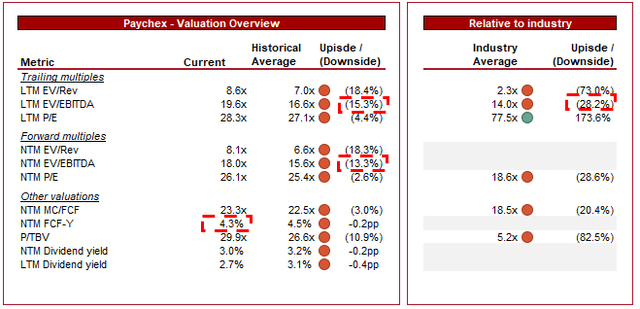

Valuation (Capital IQ)

Paychex is currently trading at 20x LTM EBITDA and 18x NTM EBITDA. This is a premium to its historical average.

A premium to its historical average is likely warranted, reflecting the company’s increased scale, greater competitive position, and business model development. Further, a premium to its peer group is equally justified given the superior financial performance and future-proof business model.

This said, the company’s NTM FCF yield has slightly exceeded its historical average, suggesting the business is likely fairly valued (in line with Wall St. analysts). This is supported by the size of the premium to its historical average, as we do not see significant upside at this price.

Final thoughts

Paychex is a fantastic business. The company has an attractive business model within an industry that will consistently grow, owing to its importance in the corporate world. Continued technological development and international expansion will support revenue growth, as well as upselling/cross-selling.

The business does appear reasonably priced but we rate the stock a buy due to its positive long-term trajectory.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

[ad_2]

Source link