[ad_1]

[Editor’s note: The board of the Missouri State Employees’ Retirement System, which oversees the state employee pension plan, this month voted down a proposal by Treasurer Vivek Malek to sell off any investments in Chinese stocks and other securities, according to reporting from The Missouri Independent.]

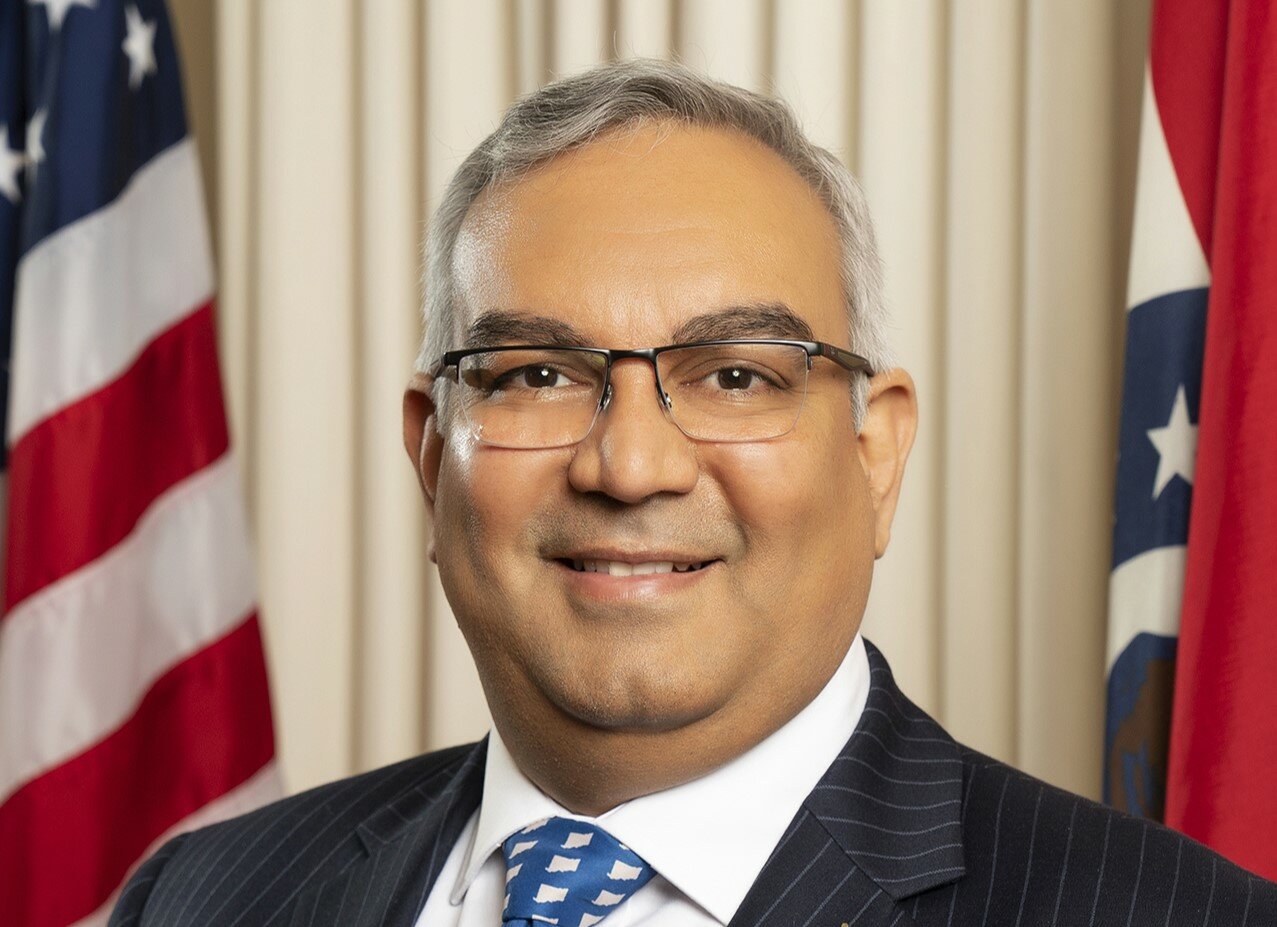

I am deeply disappointed by the Missouri State Employees’ Retirement System board’s recent rejection of my motion to get our state employees’ pension investments out of China. Not only is the communist nation an active adversary of America – China is just a bad investment.

As the state treasurer of Missouri and a MOSERS board member, it is my duty to ensure that the state’s investments provide taxpayers with the best rate of return possible. It is risky to have $200 million of our Missouri state retirees’ pension funds tied up in communist China, because China’s overt aggressive actions and alliances could create dangerous economic fallout.

With deflation, its shrinking workforce and a slow recovery from the pandemic, China is the wrong investment at the wrong time.

Communist China also allies itself with Russia and other bad actors on the international stage. I note that MOSERS acted last year to disinvest in Russia after its invasion of Ukraine. Senior U.S. military officials have argued China is preparing to invade Taiwan, which could escalate conflict and make investment in China even more risky and unstable. It is timely and appropriate to recognize this threat to investment stability and move to lessen the risk.

But, as The Missouri Independent reported, when I made my motion for MOSERS to disinvest in China, another board member, Senate Democratic Leader John Rizzo of Independence, argued that MOSERS “should wait for guidance from the General Assembly on investments in China.” Despite the MOSERS board being independent trustees with full authority to act, Sen. Rizzo said: “If this decision is going to be made, it should be done by the legislature.”

I do not believe the board should wait to act, because of China’s ongoing aggressive moves posing multiple risks to investment stability. Nor do I believe the board should defer to the 2024 legislature on identifying risks and threats from China that anyone may see for themselves today. But if lawmakers feel they must weigh in, when pre-filing of 2024 legislation opens on Dec. 1, I urge those representatives and senators who recognize reality to submit legislation calling on MOSERS to get our state workers’ pension funds out of China.

Research by MOSERS’ investment adviser, Verus, indicates multiple risks of investments in China, including that investments in emerging markets without the inclusion of China have outperformed emerging markets including China during the last several years.

In an editorial about the MOSERS board’s failure, The Joplin Globe noted that not only are there economic aspects of the risk of investing in China – “We would add to the list its human rights abuses, its spying on the U.S., its threatening posture toward other Pacific nations. The list is long.”

The Globe editorial continued: “Vivek Malek raises a great question. The state treasurer wants to know why Missouri’s state employee pension plan is investing in China. Malek is on point here. Such investment needs to reevaluated and stopped.”

It is my hope that the MOSERS board will reconsider its position and do the right thing to safeguard the value of our hard-working state retirees’ pensions, by voting to get those pension investments out of communist China.

Missouri Treasurer Vivek Malek can be reached through Treasurer.mo.gov.

[ad_2]

Source link