[ad_1]

Introduction

In the wake of growing anecdotal and empirical evidence, the centuries-old debate over how to regulate noncompete clauses has hastened towards a contentious resolution: ban them.

These post-employment restrictions, known simply as “noncompetes,” prohibit departing workers from starting or joining a competing firm for a period of time and often in a circumscribed geographic area. Historically, most U.S. states have enforced noncompetes on a case-by-case basis, seeking to balance the harms to workers and society that stem from direct restraints on competition with the firm’s need to protect its legitimate business interests.

The status quo, however, is on the verge of significant change. In 2023, the Federal Trade Commission proposed to ban noncompetes nationwide; for the first time in over a century, a state (Minnesota) has passed a ban on noncompetes, while another state’s proposed ban awaits the governor’s signature (New York); and the general counsel for the National Labor Relations Board declared that noncompetes violate the National Labor Relations Act. This recent policy action follows the many state policies passed since 2015 which have banned noncompetes for physicians, tech workers, and workers earning below specified thresholds.

Why did this historic debate over noncompetes move so abruptly towards banning them? Alongside increased media scrutiny and hard-to-stomach anecdotes of noncompetes unnecessarily derailing the lives of workers, new empirical evidence on the prevalence and harms of noncompetes and their enforceability has tilted the scales.

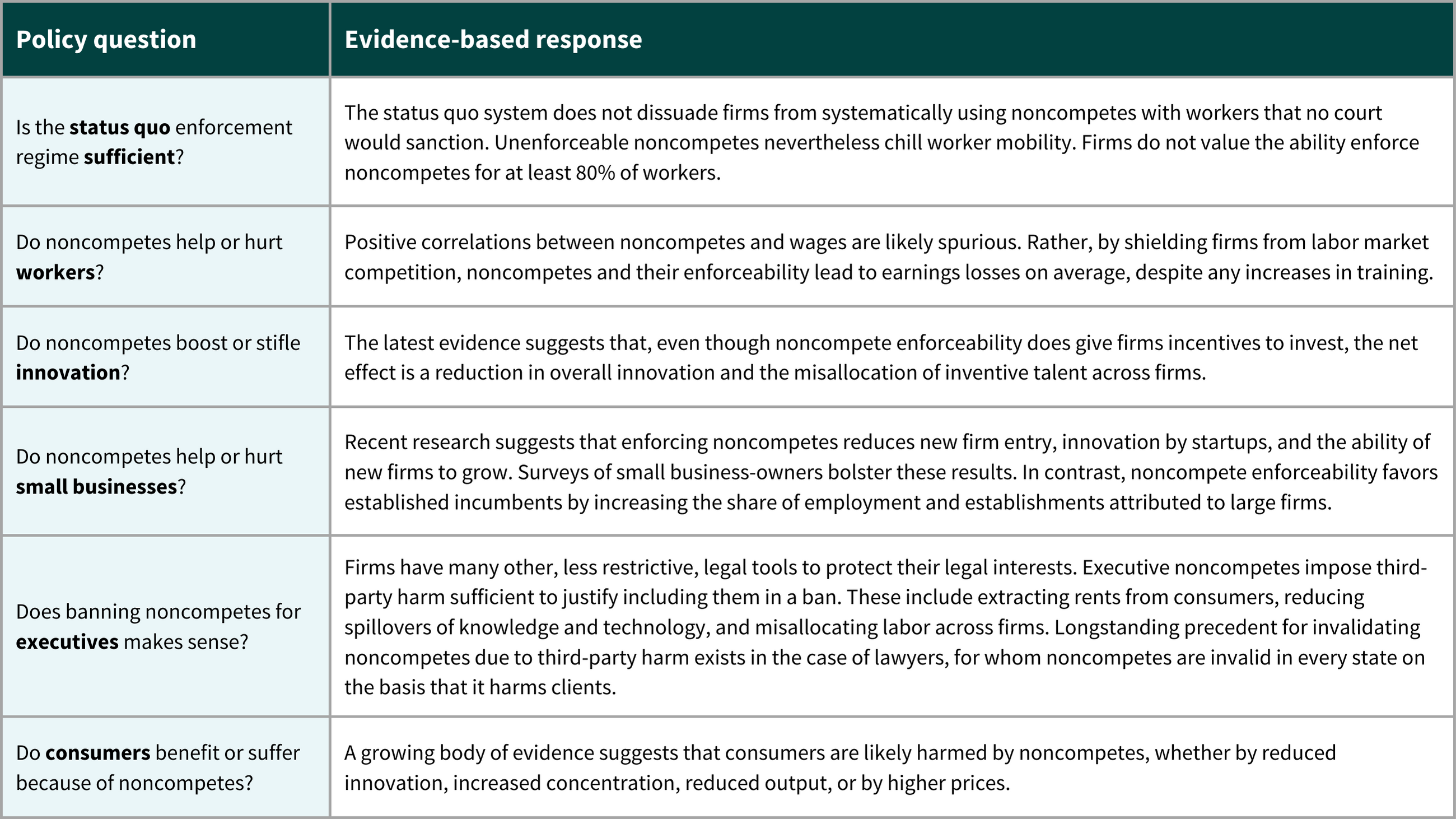

Table 1: Summary of empirical responses to common noncompetes policy questions

This new evidence has not gone unchallenged, however. In particular, the proposed FTC rule to ban noncompetes has given interested parties the opportunity to present their best justifications for why noncompetes are needed and to critique the evidentiary basis for the FTC’s proposed rule.

In this brief, I will review the core questions that commentators themselves submitted to the FTC in response to the proposed rule, and which presently challenge policymakers across the US. I’ll do so using the language and objections of commentators themselves. I will then review what the recent empirical literature on noncompetes has to say regarding each question. I focus on the following questions:

- Is the status quo enforcement regime sufficient?

- Do noncompetes help or hurt workers?

- Do noncompetes boost or stifle innovation?

- Do noncompetes help or hurt small businesses?

- Does banning noncompetes for executives makes sense?

- Do consumers benefit or suffer because of noncompetes?

By taking a question-based approach and relying on the latest empirical evidence for answers, my hope is that this guide can be useful to policymakers and readers alike, as they face these questions among their constituents.

1. Is the status quo enforcement regime sufficient?

Historically, states have determined the regulatory policy towards noncompete clauses. Except for California, Oklahoma, and North Dakota (and, as of July 2023, Minnesota), every state has opted for a regulatory approach that enforces reasonable noncompetes. While the scope of what is reasonable differs from state to state, courts have generally found a noncompete reasonable when it does not unduly harm the worker or society, and when it is no broader than necessary to protect a firm’s legitimate interests.

Several commentators have emphasized the idea that this status quo, case-by-case reasonableness approach taken by most U.S. states already addresses potential anti-competitive concerns over noncompetes. For example, Weibust and Gerson (2023) argue that because noncompetes are required to be narrowly tailored to be enforceable and because they must protect a legitimate business interests (e.g., trade secrets), the use of noncompetes among low-wage workers or workers without any business justification are outliers.[1] Former FTC Commissioner Christine Wilson similarly questioned a change to the status quo in her dissent to the FTC’s proposed noncompete ban,[2] writing (p.3), “I am dubious that three unelected technocrats have somehow hit upon the right way to think about non-competes, and that all the preceding legal minds to examine this issue have gotten it wrong” (emphasis added).

A growing body of empirical evidence suggests that we should be skeptical that status quo state enforcement policies sufficiently address the potential harms of noncompetes, or that noncompetes are associated with the many benefits that advocates suggest. In particular, the evidence suggests that (a) firms are often unscrupulous in their use of noncompetes, (b) that unenforceable noncompetes are common, that (c) noncompetes deter employees from taking jobs at competitors even when they are unenforceable, and that (d) firms do not value the ability to enforce noncompetes for most workers.

Harlan Blake, in his 1960 review of noncompetes,[3] emphasized the potential proliferation of unenforceable noncompetes and their chilling effect on behavior when he wrote (p.682-683):

“For every covenant that finds its way to court, there are thousands which exercise an in terrorem effect on employees who respect their contractual obligations and on competitors who fear legal complications if they employ a covenantor, or who are anxious to maintain gentlemanly relations with their competitors. Thus, the mobility of untold numbers of employees is restricted by the intimidation of restrictions whose severity no court would sanction.” (emphasis added)

Unfortunately, stories of noncompetes that no court would sanction are common, like the temporarily employed Amazon packer making $13,[4] or the volunteer at a non-profit that focuses on exercise among young girls.[5] And there are also stories of firms who are unwilling to hire a junior worker, even when they know the noncompete is likely unenforceable.[6]

Surveys of workers and firms suggest that these stories are not anomalies. Colvin and Shierholz (2017)[7] found in a national survey of 634 private-sector firms in 2017 that 31.8 percent of them reported using noncompetes with all of their employees, while 49.4 percent said they used them for some employees. Balasubramanian et al. (2023),[8] in an independent survey in 2017 of approximately 1,500 U.S. firms, similarly found that 29.5 percent of firms used noncompetes with all their employees, while 66.5 percent used them with at least some employees.[9] Lastly, in a 2022 survey of 446 private U.S. companies who are included of the Society of Human Resources database (SHRM),[10] the U.S. Government Accountability Office found that 55 percent of firms use noncompetes with some workers. Furthermore, the survey reveals that among employers who use noncompetes and have hourly workers, again 55 percent cover all of their hourly workers with noncompetes.[11] These statistics reveal that, contrary to what pro-noncompete advocates argue,[12] for many firms the choice to use a noncompete is not tailored to individual job duties, the types of information a worker might have access to, or compensation; rather they are fixed firm policies that cover every worker. The indiscriminate adoption of noncompetes is most likely how we find examples of unpaid interns[13] and janitors with noncompetes.[14] It is likely why, based on a 2014 nationally representative survey, the typical worker with a noncompete is paid by the hour, making at the median approximately $14 per hour.[15]

While courts are unlikely to sanction many of these noncompetes, it is perhaps more concerning that firms are similarly likely to use noncompetes for all workers regardless of whether they are enforceable. Colvin and Shierholz (2019) find, for example, that 29.3 percent of firms based in California, where noncompetes have been unenforceable since 1872, still use them for all workers. In fact, even though some studies of high-skilled jobs find noncompetes are more prevalent in states that would enforce them versus states that would not,[16] nearly every nationally representative study of noncompete use finds that noncompetes are found in approximately similar levels in states that will and will not enforce them, including studies of firms,[17] employees,[18] and in government-collected data.[19]

There are many potential reasons that firms use unenforceable noncompetes. A favorable view is that firms use unenforceable noncompetes just in case the policy might change. Alternatively, the firm might seek to invoke another state’s law within the contract to circumvent a state’s laws.[20] A more unfavorable view is that firms are deploying unenforceable noncompetes in the hopes that workers and competitors abide by them. Catherine Fisk expressed this view in her 2001 article,[21] writing (p. 782-3):

“In California, covenants not to compete have been unenforceable against employees since 1872. Employers have nevertheless sought to restrict their employees from working for competitors … presumably counting on the in terrorem value of the contract when the employee does not know that the contract is unenforceable.”

Subsequent research has bolstered the idea that noncompetes exhibit an in terrorem effect on workers. Using nationally representative data, Starr, Prescott, and Bishara (2020)[22] find, for example, that noncompetes are associated with reduced employee mobility, and are associated with redirections in worker search and recruitment behavior from competitors to noncompetitors, even when unenforceable. Perhaps most directly, they find that workers cite noncompetes as a factor in turning down a job offer from a competitor at similar rates in states that do versus do not enforce them.

In a follow-up study, Prescott and Starr (2022) show that workers tend to believe their noncompetes are enforceable, even when they are not, and that their beliefs about the law—rather than the actual law—matter to their actions.[23] They also find evidence that, rather than passively using unenforceable noncompetes, firms actively try to keep workers misinformed when their noncompetes are unenforceable. Specifically, they find that firms in states that do not enforce noncompetes are twice as likely to remind workers about the terms of their noncompete after they get a job offer from a competitor. Thus the information asymmetries around the actual enforceability of a noncompete advantage employers and disadvantage workers. Finally, this study uses an information experiment to inform workers of the law. Doing so spurs workers with unenforceable noncompetes to be more open to opportunities with competitors, but even among those who know their noncompete is unenforceable, noncompetes still play a factor in their choice to leave because they fear a potential lawsuit or feel moral or reputational concerns from violating the contract.

While these studies emphasize the effects of noncompetes that are unenforceable given the state’s pre-existing non-enforcement policy, their findings also apply to noncompetes in states where they are potentially enforceable. That is, even when noncompetes are potentially enforceable but a court deems them unenforceable, firms can and do continue using them. For example, in the FTC’s case against Prudential Security—in which Prudential required security guards to sign a 100-mile noncompete with a $100,000 damages clause if the individual violated the noncompete—a 2019 Michigan court found the noncompete unreasonable and unenforceable. After the ruling, however, Prudential kept using the same noncompete among the security guards.[24] A similar case involving logistics company Total Quality Logistics (TQL) reveals the same pattern. An attorney in a recent case noted that TQL has been using the exact same noncompete courts have previously held to be overbroad.[25]

Taken together, this body of research bolsters the longstanding criticisms of Blake (1960) and Fisk (2001) of the status quo enforcement regime in the United States. This is not to say that the courts and state statutes or policies have no effect—they do and can, as I will discuss later. But the current status quo does little to encourage firms to be judicious in their use of noncompetes; rather, because of the indiscriminate adoption of noncompetes, many if not most noncompetes are likely unenforceable, and unenforceable noncompetes still chill worker mobility.

Given the chilling effect of unenforceable noncompetes, it is natural to wonder to what extent firms value the ability to enforce their noncompetes in court. Indeed, in the event that a worker does violate the noncompete and seeks to join a competitor, it is court enforceability of the noncompete that actually prevents the worker from joining a competitor, and thus precludes the potential disclosure of confidential information. For this reason alone, many proponents of noncompetes think they should be enforceable—to give firms incentives to develop and share confidential information in the first place.[26] Nevertheless, a recent study casts doubt on the idea that firms really value the ability to enforce noncompetes for most workers, especially in light of alternative tools they already have to protect those same interests.

Hiraiwa, Lipsitz and Starr (2023) examine whether firms are willing to pay to have the option to enforce a worker’s noncompete,[27] potentially to protect a trade secret or some other valuable information. The study examines a Washington state policy enacted in 2020 that retroactively banned noncompetes for workers earning under $100k per year, a threshold that is tied to inflation and covers approximately 80 percent of workers in Washington. The basic idea in the study is that, before 2020, a worker making $99k could potentially have their noncompete enforced, subject to a typical reasonableness test. In 2020 and after, however, the likelihood of enforcement for a worker making $99k was zero—unless the firm gave the worker a small raise to get to the earnings threshold, which they could do with an end-of-year bonus. So, if the firm valued the ability to potentially enforce the noncompetes of workers earning just below the threshold, they could give those workers a small raise to get them to or just above the threshold. The resulting empirical prediction is that we should observe more workers earning just above the threshold after 2020 relative to before 2020. However, Hiraiwa et al. (2023), using data covering the near universe of workers in Washington, find no evidence that firms are giving workers raises to get to or just above the threshold, including in industries where arguments about the efficiency of noncompetes are the strongest, such as professional and technical services, information, or manufacturing. A survey of Washington-based attorneys reveals that the most common reasons for not giving just-below-threshold workers small raises was that firms didn’t generally have to go to court to enforce them, and that firms had other tools to protect their interests.

The broad conclusion of Hiraiwa et al. (2023) is that, for workers at the 80th percentile of the earnings distribution, noncompetes are either inefficient or the actual enforceability of the noncompete does not increase productivity. They are able to draw this conclusion because, if the enforceability of noncompetes created value for the company, they should be willing to pay for it—yet companies do not appear to pay for it for workers at the 80th percentile. It may be that firms are willing to pay for the ability to enforce noncompetes at some higher threshold, but a similar study with a higher earnings threshold would be required to test this possibility.

To summarize: The status quo noncompete enforcement system in the United States does not dissuade firms from systematically using noncompetes with workers that no court would sanction. Many, if not most, noncompetes operate outside the legal system, deterring workers from joining firms in their chosen industry. And even when a given noncompete is determined to be unenforceable, firms can and do continue using them. Moreover, firms themselves have revealed that they are not willing to pay for the ability to enforce noncompetes in court for most workers.

2. Do noncompetes help or hurt workers?

Whether workers are better or worse off under noncompetes is a key point of debate. Those who believe that labor markets are competitive presume that workers would never agree to restrictions on their post-employment freedoms unless they were made better off under the noncompete—perhaps because they received additional training, access to valuable information, or higher wages.[28] Others anticipate that most workers would likely just sign noncompetes when asked, and then be foreclosed from taking better jobs in the future such that in the aggregate they would be worse off as they are unable to take advantage of industry-competition for their labor and unable to start a competitor.

Many commentators highlight some of the seemingly conflicting evidence in the literature regarding this question. To briefly summarize this evidence, note that every nationally representative study of workers finds that workers with noncompetes earn higher wages than workers without noncompetes.[29] And yet, at the same time, studies of changes in state noncompete policies find that when states enforce noncompetes more vigorously, wages fall.[30] Given the competing evidence, it is thus not surprising that commentators suggest that the scientific evidence has been “muddled” and the policymakers have been accused of “cherry-picking” the evidence.[31]

The confusion of the commentators is understandable but misplaced. In this section I’ll review this evidence and try to clear up the confusion.

It is true that if you compare workers with noncompetes to workers without noncompetes, workers with noncompetes will have higher earnings, including if workers were notified about the noncompete before they accept the job offer.[32] This does not mean that noncompetes, or even “early notice” noncompetes, cause workers to have higher earnings. This interpretation would be confusing correlation for causation. There are many reasons why workers with noncompetes may earn more than workers without noncompetes that have nothing to do with the noncompete. For example, noncompetes are more common for more educated workers, and more educated workers tend to have higher earnings. So it’s not surprising that noncompetes are associated with higher earnings, but this may just have to do with the types of workers that agree to noncompetes or the types of firms that deploy them. For example, perhaps better employers pay more, are more transparent with their workers, and are more likely to use noncompetes. This might explain why early notice noncompetes are associated with higher earnings, but it has little to do with the noncompete and instead with employer quality.

Another example illustrates the point: People who go to the hospital are sicker than those who do not go to the hospital. This does not mean that hospitals make people sick. To know whether hospitals make people sicker you would want to take people who chose to go the hospital and see what would have happened to them if they had not gone to the hospital. Similarly, to determine whether noncompetes cause wages to rise or not, we need to figure out what would have happened to the wages of those who have noncompetes if they did not have noncompetes.[33] That can be a difficult task because the use of noncompetes is not random.

The interpretative problem here is not with the studies: each of them acknowledges that these relationships are correlations and that we should interpret them accordingly. Rather, the problem is with the commentators who have not faithfully reported on the interpretations on the findings of the studies. The issue is particularly important because the commentators themselves ignore the subsequent evidence in the papers that suggest that a positive noncompete wage relationship is unlikely. For example, both Rothstein and Starr (2022)[34] and Starr et al. (2021)[35] find evidence that workers are unlikely to either negotiate over noncompetes or for other benefits in exchange for signing. Moreover, if we thought that enforcing noncompetes is likely to lead to better outcomes for workers, we would expect noncompetes to be associated with relatively higher wages where they are enforceable versus where they are not. But this is the opposite of the results in Rothstein and Starr (2022) and Starr et al. (2021). For example, Rothstein and Starr (2022) find that the noncompete-wage differential in states that might enforce noncompetes is 6 percent lower than in states that will not enforce them. The conclusion of both of these studies is that something outside the noncompete is likely causing the positive noncompete-wage differential, and that the negative earnings differentials where noncompetes are more enforceable suggests that noncompetes are potentially, but not definitively, more likely to be associated with earnings losses.

A recent study by Balasubramanian et al. (2023)[36] sheds some important light on this tension. The authors show that firms tend to bundle restrictive covenants together, such that firms generally tend to use either no restrictions, only a nondisclosure agreement, or (at least) four restrictive covenants together (e.g., a noncompete, client/coworker nonsolicitation, and nondisclosure agreement). As in prior research, Balasubramanian et al. (2023) find that workers with noncompetes earn more than workers without noncompetes. But the authors decompose those two buckets further into those with all four restrictions versus those with none and those with only a non-disclosure agreement. The findings reveal that workers with all restrictions earn more than those with no restrictions but earn 3-7 percent less than those with only a non-disclosure agreement. The reason for the positive overall estimate on noncompetes versus no noncompete is that those with no restrictions cover a larger share of the workforce. The question then is which of these comparisons is more reliable? The authors posit and find evidence suggesting that a comparison of workers with all four restrictions to workers with only an NDA is a more reliable comparison because it nets out selection into the use of any restrictions. They further find that firms that use all four of these restrictions with all their workers are less likely to be concerned about turnover and are less likely to give raises relative to firms that use only NDAs with all of their workers. This suggests a natural reason why average wages would be lower under noncompetes and the other restrictions: workers with all restrictions stay longer and don’t receive wage increases.[37]

Overall, Balasubramanian et al. (2023) makes two very important contributions. First, the study clarifies that prior results of nationally representative samples finding positive wage relationships with noncompetes are likely driven by selection and should not be interpreted causally. Rather, a negative average wage effect is more likely. Second, it highlights that it is difficult to discern from any observational studies what the effect of a noncompete is, separate from the other simultaneously adopted restrictions. It’s possible and likely reasonable that the noncompete is driving the earnings losses because it is the broadest restriction and the restriction that most directly interferes with labor market competition. It’s also possible that it’s the combination of the restrictions together that drive the earnings losses.[38]

So, what have researchers done to try to say something more definitive about the causal effects of noncompetes on wages? In addition to examining how the noncompete-wage relationship changes where noncompetes are more versus less enforceable (as discussed above), they have turned to natural experiments related to state noncompete policies. In light of the potential use of unenforceable noncompetes (as noted above), these research designs do not ask how actual noncompetes affect workers or firms; rather they ask how wages within the state change when states ban, limit, or more vigorously enforce noncompetes.

Studying state policies implies that researchers are limited to policy variation that exists. Accordingly, there is no equivalent to a country-wide ban on noncompetes akin to the one the FTC has proposed; however, there are many such bans that have operated at a smaller scale, several changes to the enforceability of noncompetes, and of course long-standing differences across states and occupations (e.g., noncompetes have been prohibited among lawyers since the 1960s, a fact that is exploited in Starr et al. (2018)).[39] In 2008, for example, Oregon banned noncompete agreements for low-wage workers, while in 2015, Hawaii banned noncompetes (alongside agreements not to solicit coworkers) for high-tech workers. Researchers examining these bans, as well as those studying a multitude of smaller changes to state noncompete laws, come to the same conclusion: banning noncompetes increases wages by 3-4 percent, both for low-wage workers and high-tech workers, and increases their mobility 11-17 percent.[40]

Commentators suggest several other criticisms of this research. For example they suggest that firms will forego training without noncompetes and that workers’ wages will suffer in the long run as a result.[41] While evidence is mixed on whether noncompetes are associated with more training, the evidence also suggests that workers do not benefit on net from that training.[42] A third study also suggests that one reason we see more training in states where noncompetes are enforceable is because noncompetes prevent firms from hiring experienced workers in their industry, thus causing them to hire outsiders or newcomers and train them up. See Starr, Evan, Martin Ganco, and Benjamin A. Campbell. “Strategic human capital management in the context of cross‐industry and within‐industry mobility frictions.” Strategic Management Journal 39, no. 8 (2018): 2226-2254. For example, Balasubramanian et al. (2022) study the long-run effects of simply starting a job in a state that enforces versus does not enforce noncompetes. If training benefits these workers, then they should at some point experience greater earnings—but this study finds negative earnings effects, including lower within-individual earnings growth, that lasts over at least 8 years.

Finally, it is important to reiterate that these estimates likely underestimate the extent to which banning noncompetes will increase wages. This is because firms still use even unenforceable noncompetes, and—as discussed above—unenforceable noncompetes still chill worker mobility.[43]

To summarize: Commentators suggesting that noncompetes cause higher wages are largely misinterpreting cross-worker correlations. Rather, recent economic evidence suggests that the positive correlations between noncompetes and wages is likely spurious and that noncompetes (potentially alongside non-solicits and NDAs) likely reduce earnings by increasing retention and shielding firms from labor market competition. These findings align with studies of state policy shocks which cover state-level bans on noncompetes for low-wage workers, high-tech workers, and a variety of other changes to state noncompete laws. There is some mixed evidence that noncompetes are associated with more training, but the evidence also suggests that whatever additional training workers receive does not lead to greater worker earnings, but rather cumulative, long-term wage losses.

3. Do noncompetes boost or stifle innovation?

Many commentators highlight why noncompetes are potentially valuable for firms: they give firms incentives to develop and share valuable information with workers that may make those workers more productive, without fear that the workers will take such information to a competitor.[44] This is a classic argument, and it’s the same reason policymakers have developed various intellectual property protections including patents, trade secret law, copyrights, and other contractual protections like non-disclosure and non-solicitation agreements. Policymakers want to provide incentives for firms or individuals to develop highly valuable innovations.

But, despite the appeal of this logic and some significant critiques and mixed results of early research on the relationship between noncompetes and innovation,[45] the best evidence consistently points in the opposite direction. The story that has emerged from this evidence is that, despite the fact that noncompete enforceability modestly spurs firm investment, the overall effect of noncompete enforceability is to reduce innovation. The mechanisms underlying this reduction appear to come from several channels: reduced mobility, entrepreneurship, information flows across firms,[46] employee effort, and a misallocation of inventive talent.

The best evidence on innovation comes from several recent studies. The first is a study by Johnson, Lipsitz, and Pei (2023), which uses the variation in the enforceability of noncompetes stemming from dozens of policy changes between the 1990s and mid-2010s to assess directly how noncompete enforceability influences innovation.[47] Their findings suggest that an average-sized increase in NCA enforceability reduces patenting by 16-19 percent over the ensuing 10 years, including reductions in “break-through” inventions. Moreover, they find that this decrease does not simply reflect a strategic substitution towards trade secrecy or that it simply shifts innovation activity to other states. The authors replicate a variety of other results to bolster their findings—that enforcing noncompetes reduces the churn of technical workers as well as the rate of new business formation, while increasing investment in “intangible” investments by 8.1 percent (but with no effect on capital investment).[48] One way to interpret these results is that innovation is the result of many inputs—including firm investment, individual capital, individual effort, team capital, etc.—such that, while firm investment rises, the overall effect of noncompete enforceability is a reduction in innovation.

Other recent studies using similar variation in the enforceability of noncompetes document similar findings. For example, Reinmuth and Rockall (2023) find that an average increase in the enforceability of noncompetes reduces patenting by 11.8 percent.[49] In He (2021), the author finds that patents filed after an increase in noncompete enforceability are less valuable, suggesting that innovators are less motivated after an increase in enforceability. And Mueller (2022) finds that inventors are 67 percent more likely to change industries following an increase to the enforceability of noncompetes, and that noncompete-induced industry-movers are 30 percent less productive based on innovative output.[50] In contrast, inventors who cross industries voluntarily (e.g., not induced by the noncompete) are 16 percent more productive. Mueller (2022) concludes that innovation losses result from the misallocation of inventive labor.

Finally, given the multitude of mechanisms by which noncompetes influence innovation, it is helpful to consider a model which tries to quantify each such mechanism, which Baslandze (2022) does.[51] She uses data on patents and firm dynamics to study the relationship between noncompetes, innovation, firm growth, and welfare. She builds and estimates a general equilibrium endogenous growth model in which she allows for noncompetes to be a direct entry restriction, to increase incentives for firms to innovate, to reduce information flows, and to reduce competition by affecting the composition of firms. Her paper quantitatively evaluates all of these channels and concludes that it is both “growth- and welfare-enhancing to abolish non-compete enforcement.”

To summarize: Even though noncompete enforceability does give firms incentives to invest, the net effect is a reduction in innovation and the misallocation of inventive talent.

4. Do noncompetes help or hurt small businesses?

Many commentators are concerned about how a ban on noncompetes will affect small businesses.[52] The main concern is that small businesses developing valuable information can be especially susceptible to a key employee leaving with that information, potentially “devastating” the business.[53]

This concern is understandable, but the empirical evidence suggests instead that noncompetes hurt small businesses and favor large incumbents. Not only do firms have other tools to protect their interests like non-solicitation and non-disclosure agreements, but several studies find that when states are more likely to enforce noncompetes, new firms are less likely to form,[54] and that new firms struggle to hire and grow. For example, Johnson, Lipsitz, and Pei (2023) show that enforcing noncompetes not only reduces new firm entry but also reduces the job creation rate. They further show that increases in noncompete enforceability reduce innovation among startups. Kang and Fleming (2020), examining the 1996 Florida statute that many regard as the most vigorous noncompete enforceability policy in the United States,[55] find that the Florida law disproportionately benefited large firms vs. small firms by increasing the share of establishment entry and employment coming from large firms.

A recent survey of 312 small business owners bolsters the core ideas that noncompetes both hinder the entry and growth of small businesses:[56] Forty-four percent of small business owners report that they have been subject to a noncompete that prevented them from starting or expanding their own businesses, while 35 percent report that they have been prevented from hiring an employee because of a noncompete. Only 14 percent of small business owners oppose or strongly oppose the FTC’s proposed rule, while 59 percent of small business owners approve. While this sample may not be representative of all small business owners, it provides specific evidence that underlies the core mechanisms identified in the empirical literature.

To summarize: Rather than hurt small businesses, the evidence suggests that noncompetes favor incumbents and make it more difficult for new firms to start, grow, and innovate.

5. Does banning noncompetes for executives makes sense?

Many commentators express concern about whether noncompetes are reasonable for executives[57] The concerns are understandable. Executives (and other knowledge workers) know confidential information that might bestow a significant advantage to a competitor, should they be allowed to join one and should they share what they know.

However, there are several reasons why a ban on noncompetes even for executives can makes sense, and indeed some recent theoretical and empirical work comes to this conclusion. Those justifications derive not from assumptions about disparities in bargaining power or concerns about the harms that noncompetes cause to executives, but rather that executive noncompetes can cause significant harm to third-parties, and that alternative, less restrictive protection tools may sufficiently protect firm interests in the absence of noncompetes. I review that evidence in this section.

The first reason noncompetes might not be necessary for executives is that noncompetes are just one of many protection tools available, including non-disclosure agreements, non-solicitation agreements, trade secret law, and others. Noncompetes offer somewhat more protection than these mechanisms because they operate by precluding a move in the first place, as opposed to acting as a tool to recoup damages once a secret has been misappropriated or a client has been solicited. Without noncompetes, commentators are concerned that trade secrets might be leaked, and that costly trade secret litigation could rise.[58] While it is also possible that trade secret litigation might actually fall when noncompetes are banned (e.g., if the inability to enforce a noncompete reduces willingness to file a trade secret claim), it is nevertheless worth emphasizing three things. First, there are new tools to protect trade secrets directly that do not rely on noncompetes at all; these include the possibility of directly insuring trade secrets or partnering with companies willing to finance trade secret litigation.[59] Second, there will not be a one-to-one change in noncompete to trade-secret cases if noncompetes are banned. Workers who abide by their other restrictive covenants won’t face legal disputes. These are workers who would not give any other firm an unfair advantage but are nevertheless prohibited from competing under the status quo. Third, among those workers who might bring some information over, a firm would likely only bring a case if the information shared was valuable to the competitor in the sense that it resulted in competitive harm to the initial firm. As a result, it’s unlikely that trade secret or NDA litigation would rise all that much (if at all), if noncompetes are banned, especially if workers adhere to their less-restrictive agreements.

Nevertheless, firms have figured out how to protect themselves without the ability to enforce executive noncompetes. Sanga (2018) shows how California firms have worked around the lack of enforceability of executive noncompetes by tying the post-employment payout period to the prohibition period in the noncompete.[60]

Aside from the fact that firms have other tools to protect their valuable information or goodwill, the most common reason for considering executives in a ban on noncompetes is not because the executives will be worse off,[61] but rather that other parties will be harmed, including other firms, workers, or consumers.

For example, one natural reason to include executives in a noncompete ban is based on the preceding discussion of Baslandze (2022), which finds such a ban is optimal based on theory and empirical work related to innovation and entrepreneurship.

In addition, a recent paper by Liyan Shi (2023) studies the executive labor market and suggests that the optimal policy—for executives—is close to a ban.[62] It is natural to wonder how this might be possible when two sophisticated parties can negotiate and come to terms that are mutually beneficial, and when noncompetes do encourage firm investment. The answer is that, like in Mueller (2022), noncompetes can misallocate labor from their most productive use. The main idea in Shi (2023) is that because all parties are not at the table when negotiating a noncompete, the terms of the noncompete maximize the bilateral surplus between the executive and the focal firm, which results in excessive terms that are designed to extract rents from third parties who were not at the table. In the case of Shi (2023), the other parties are the other employers who might value the executive more than the initial employer. This results in socially costly labor misallocation, where executives are displaced from their most productive uses. Shi (2023) builds and calibrates a model of the executive labor market, using data from real executive contracts. She incorporates estimates from how firm investment relates to noncompete policies as well as how executive separations are affected. She finds “the optimal policy to be quantitatively close to a ban.”

Lipsitz and Tremblay (2021) emphasize a similar point: Consumers are also not at the table when executives bargain over these agreements. They document that noncompete enforceability increases product market concentration and posit that perhaps executives agree to noncompetes to limit competition and extract rents for themselves—as opposed to consumers receiving those rents in the form of lower prices. That is, executives can be seen as potential competitors who might increase competition down the road if they were to start a new firm, which might reduce future prices for consumers. However, if executives (and others such workers who might start a new firm) understand that increased future competition will reduce rents available in the industry, then they might rationally bargain over the noncompete to extract rents for themselves as opposed to starting a new firm in the future and delivering those rents to consumers in the form of lower prices.

Another form of third-party harm might occur when firms use noncompetes in parallel with high frequency. This idea is not specific to executives but arises with executives because they are most likely to have noncompetes. What do industry dynamics look like if most workers in the industry have a noncompete? Who can firms hire? Who will start a new firm? In such an industry, the whole market might be less dynamic. Indeed, those are the findings of Starr, Frake, and Agarwal (2019),[63] who find that, where enforceable noncompetes are used en masse, the whole market is slower moving and lower earning, including for workers not bound by noncompetes.

Finally, it is worth noting that banning noncompetes based on third-party harm actually has a long-standing tradition in the United States. The only occupation in the whole United States for which noncompetes are prohibited is the practice of law.[64] Rule 5.6 of the American Bar Association reads:[65]

A lawyer shall not participate in offering or making:

(a) a partnership, shareholders, operating, employment, or other similar type of agreement that restricts the right of a lawyer to practice after termination of the relationship, except an agreement concerning benefits upon retirement;

Moreover, the ABA’s comment on Model Rule 5.6 emphasizes the logic behind the rule is that noncompetes can hurt clients. The ABA writes (emphasis added) “An agreement restricting the right of lawyers to practice after leaving a firm not only limits their professional autonomy but also limits the freedom of clients to choose a lawyer.”[66] The same argument is often made for restrictions on physician noncompetes (that their noncompete-related departure would hurt patients).[67]

Thus, even though lawyers carry with them valuable clients, and are highly sophisticated and savvy, noncompetes are prohibited out of concern for how they can affect a third party.

To summarize: There are several reasons why even executives or high-skilled, knowledge workers might be included by a noncompete ban, even when these agents are fully rational and sophisticated and when noncompetes spur investment. These include technological spillovers, labor misallocation, rent extraction from consumers, externalities from parallel action, and other tools the firm already has to protect their interests.

6. Do consumers benefit or suffer from noncompetes?

Several commentators have argued that if noncompetes are banned then prices will rise for consumers; some rely on the assumption that if wages rise then firms will pass on the wage increases to consumers.[68] Others suggest that banning noncompetes will lead to an increase in employee misconduct, pointing to a study by Gurun et al. (2021) in which a firm entering into the “Protocol for Broker Recruiting”—which “allowed an adviser to take client lists and contact information to their new employer without fear of legal action”[69]—is found to be associated with an increase in misconduct and fees.[70]

In this section, I revisit these arguments and the evidence. In general, harms to consumers can either come from higher prices, lower quality, or reduced output. As discussed above, the research on innovation and entrepreneurship already suggests that consumers are harmed by less innovation and lower quality innovation from the enforcement of noncompetes. And the research on business dynamism suggests that enforcing noncompete agreements increases concentration,[71] in part by reducing new firm formation[72] and in part by increasing M&A activity,[73] both of which can lead to higher prices and reduced output (as we move from a more competitive market to a more oligopolistic market). Indeed, the main study on prices by Hausman and Lavetti (2021) suggests that enforcing noncompetes in the healthcare context leads to higher prices through this concentration channel.[74]

In addition, concerns that wage increases that result from allowing workers to move across firms would translate into price increases are likely misplaced. As a general rule, competition in both product and labor markets is good for consumers. By making labor and product markets more competitive and innovative, banning noncompete agreements will likely result in lower prices and greater quality and output. In a static model, the resolution of the wage-price connection is that competitive labor markets push out employment relative to monopsonistic markets, which increase supply in product markets, and thus reduce prices.[75]

Finally, as it relates to the study by Gurun et al. (2021) on the Broker Protocol, there are several important points to make. First, this study is not about noncompetes; the Broker Protocol relaxed noncompetes, nonsolicitation, and nondisclosure agreements for participating firms.[76] Second, and perhaps more importantly, commentators and the FTC failed to recognize a similar study which also examines the “broker protocol” in a broader sample, but comes to the exact opposite findings of Gurun et al. (2021).[77] This study by Clifford and Gerken (2021) finds that brokers treat clients better after their firm enters the Protocol, with the incidence of client disputes falling 20.3 percent. Clifford and Gerken also find evidence that advisors invest in acquiring costly licenses to sell new products to their customers. They see this as evidence of the advisors becoming more client-oriented, and it may also explain why fees rise in the Gurun et al. (2021) study.[78]

To summarize: The bulk of evidence suggests that consumers are likely harmed by noncompetes, whether by reduced innovation, reduced output, or by higher prices. And given the FTC’s omission of the work by Clifford and Gerken (2021), as well as some of the limitations of the work by Gurun et al. (2021), it is not unreasonable to think that consumers actually benefited from the ability of their advisors to leave for other firms in the Broker Protocol and to solicit clients to leave with them (though whether the Broker Protocol tells us anything about noncompetes separate from nondisclosure and nonsolicitation agreements is an open question).

Conclusion

The last few years have witnessed a whirlwind of policy and research activity related to the use and effects of noncompetes on U.S. labor markets. Although there are some important questions remaining,[79] by and large this research has addressed some of the fundamental questions underlying the policy debate around noncompetes. These include:

- We should be skeptical that the status quo enforcement approach—a case-by-case reasonableness inquiry—is sufficient for deterring firms from indiscriminately using noncompetes.

- Noncompetes and their enforceability most likely reduce wages for most workers, despite any increases in worker training.

- The enforceability of noncompetes reduces aggregate innovation, even if it creates private incentives for firms to invest on the margin.

- The enforceability of noncompetes hurts small businesses relative to larger incumbents.

- The potential for third party-harm and alternative protection tools suggest that bans on noncompetes could reasonably include executives.

- Consumers are likely hurt from the enforceability of noncompetes via more market concentration, lower quality product offerings, and higher prices.

[ad_2]

Source link