[ad_1]

Overview of performance 2022/23

This overview section provides an insight into our work during 2022/23 and highlights areas of progress for this year. We have described these using our five strategic themes.

Chair’s statement, Dr Ros Rivaz

This was another year of good progress for the Nuclear Decommissioning Authority (NDA). The Board’s highest priority is to progress our purpose: reducing the nuclear legacy and associated potential hazards. Nuclear safety, conventional safety and the health and wellbeing of our employees and contractors is paramount as we progress that mission.

Regarding reduction in nuclear legacy, further progress has been achieved this year, specifically with the completion of a number of strategic outcomes at Sellafield following the end of reprocessing as well as further waste management progress across the group, including at Dounreay where the first containers were sealed into the site’s low level waste vaults. I am pleased to report that safety performance has improved this year, but there is still more to do and focus must continue, taking further steps to systematically improve, including in response to regulators.

Strategic areas that have made significant progress include the arrangements for transfer of the Advanced Gas-cooled Reactor sites following completion of defueling and important steps forward with the development of Geological Disposal Facility options, including further dialogue with potential host communities.

Financial

Rising interest rates and inflation have had a considerable impact on the NDA as on others, including high and volatile energy costs and challenges within our supply chain. This has emphasised the need for constant attention and innovative thinking to reduce the impact on costs and progress of the mission. Any delay in delivering projects results in further deterioration of assets, and while the prioritisation of work for achieving the mission is constantly reviewed, there is awareness of the risk of sub-optimal decisions on deferral in the longer term. The Board is very aware of the financial pressure on the UK Government but welcomes its appreciation of the importance of our work.

Stakeholders

During the year, I continued to meet with ministers and officials from the UK Government and devolved administrations, representing the NDA and Board. The relationship with regulators is critical and we have worked closely with the Office of Nuclear Regulation, the Environment Agency, Scottish Environmental Protection Agency and Natural Resources Wales. Regular Chair meetings with these and other bodies in the nuclear sector ensure effective and appropriate connections to progress the NDA’s mission, for example with the resourcing challenge as new nuclear developments progress in the UK and beyond. Local stakeholders are extremely important in areas of existing work, future work – such as the Advanced Gas cooled Reactor transitions – and with future potential communities, for example exploring options for a Geological Disposal Facility. Our customers, both in UK and internationally, are critical to our mission.

People

The NDA group’s people are highly skilled and capable and can benefit the wider sector as well as the NDA itself. UK Government policy regarding new nuclear, and its importance in energy security and the carbon net zero commitment, shows resources to be in demand. We are pleased to have supported the UK Government’s creation of Great British Nuclear, providing resources, most notably the secondment of Gwen Parry-Jones OBE from Magnox to take the post of Interim Chief Executive Officer as of 1 May 2023. Capability and capacity of people is one of the key risks in achieving the NDA’s mission. There are considerable challenges in recruiting and retaining staff in a very tight labour market, with nuclear and other high-level skills at a premium. The NDA is working hard to ensure its remuneration and wider offer to employees and potential employees is attractive and competitive.

Environmental, social and governance

This agenda has progressed substantially in the year and the success of the first annual sustainability conference for leaders and subject matter experts was pivotal. External speakers shared best practice and inspired us on our impressive journey regarding sustainability.

Meanwhile governance has enhanced further, aided by the annual Board effectiveness review, which was conducted internally this year. Opportunity areas identified were to focus on fewer and more strategic matters and to continue to build the effective use of Board sub-committees, having implemented Matters Reserved for the Board and clear Terms of Reference for Board sub-committees the previous year.

The opportunity to continue to improve the culture across the NDA group is fully recognised and significant steps have been taken again during the year. A best-in-class ‘Speak up’ policy has been developed across the NDA and its subsidiary companies, with the group approach facilitating standard ways of working that were not possible when the parent body organisations were in place.

The Board

Chris Train OBE joined us in January 2022 as an independent Non-Executive Director and leads the Projects and Programmes Board sub-committee, with Rob Holden having left at the end of his term. Volker Beckers also departed following the conclusion of his term in October 2022, and we welcomed Kathryn Cearns OBE to the Board, heading the Audit, Risk and Assurance sub-committee from 1 August 2022. Both Volker and Rob’s commitment and expertise have made a lasting contribution to the performance of the NDA and we thank them most sincerely. I am pleased to say that the Board’s new composition means it remains strong and fit for the challenges we face.

At the end of March we announced that Chief Financial Officer (CFO) Mel Zuydam would be departing to take up a new position in the private sector. We thank Mel for his contribution and, after a rigorous recruitment process, were delighted to appoint Kate Bowyer as CFO and Board member, taking up her role in May 2023.

My term as Chair came to an end in August 2023. I am delighted with what we have achieved during the journey and my thanks go to my Board colleagues, including the Chief Executive, and to the executive teams and wider colleagues at the NDA and subsidiary companies. This important mission will continue to develop and progress for more than a hundred years, with innovation allowing continuous challenge to both the cost and duration of the mission. I am pleased that Chris Train is taking the reins as NDA Chair on an interim basis whilst the recruitment process is underway for a permanent Chair.

The year ahead – a strong culture to achieve our mission

The Board is committed in its support and scrutiny of the important work being done at the NDA to reduce the UK’s high hazards associated with the nuclear legacy. It recognises that the journey in relation to internal culture is critical to achieve the outcomes that must be achieved, and this subject will stay front and centre of the Board’s attention. It is resolute in its focus to continue to develop and strengthen the NDA to achieve this critical national task.

Dr Ros Rivaz

NDA Chair

31 August 2023

(Term of office ended: 31 August 2023)

Interim Chair’s statement, Chris Train OBE

I am delighted to have been appointed Interim Chair of the NDA as of 1 September 2023. The NDA delivers a vital role on behalf of the nation and my commitment is to continue to work with the Board and wider leadership team to ensure that our values are upheld to support the safe and efficient delivery of the mission, create great places to work and enable the NDA to be trusted to do more.

As a member of the Board I have already had the opportunity to visit many sites and offices, as well as meet some of our key stakeholders. I am looking forward to the opportunity to visit more locations and meet more people to ensure that the Board is offering the right support and challenge to the organisation.

On behalf of the Board, I would like to thank Dr Ros Rivaz for her dedication and leadership as Chair and to offer our ongoing thanks to the workforce and other stakeholders for their efforts to deliver our vitally important work.

Chris Train OBE

Interim NDA Chair

12 September 2023

Group Chief Executive Officer’s statement, David Peattie

At the NDA we want to deliver our mission safely, securely and sustainably, create great places to work and be trusted to do more on behalf of the nation. I’m clear we’ve made significant progress towards these ambitions in the last year.

We’ve operated for our first full year with all parts of the group as NDA subsidiaries, leading to greater collaboration and engagement. Phase one of creating a simpler NDA group structure was completed in April 2023 when Dounreay became a division of Magnox Ltd, further reducing complexity with fewer Boards and more streamlined governance arrangements. Staff and stakeholders across Magnox and Dounreay have been developing options for a new name and identity for Magnox Ltd, with more details due later this year. It will be an important step, recognising the company already represents much more than the original Magnox reactors and is preparing for other future missions.

With structural changes complete, the NDA group is now focused on getting full benefit for taxpayers and our people. We’re in a strong position to do this, despite operating in an increasingly complex environment. As the Ukraine war goes on and we see continued inflationary challenges, we are very aware that our programme must be affordable. Like elsewhere, we’ve seen rises in energy bills and other costs but we’re working hard to develop solutions that achieve value for taxpayers and ensure delivery of our mission.

Delivering the mission

Our work is organised into 47 strategic outcomes and, with a mission that lasts well into the next century, it’s not every year that you get to say one is permanently complete. So I’m particularly proud to celebrate not one, but four additional outcomes being closed out in this report as a result of reprocessing ending at Sellafield after almost six decades. This allows the team to focus fully on decommissioning and we’ve seen national news interest in the progress made to start waste retrievals from some of the site’s most complex facilities.

Many of our plants and ageing assets are complex and challenging, meaning innovation is hugely important to our future success. Dounreay has been working with partners to develop a robot that can access areas once thought impossible and it’s been recognised by Time magazine as one of its top 200 innovations of 2022. It’s a true demonstration of the international impact and significance of the pioneering work being delivered by our teams.

Innovation isn’t just about what’s possible in the future, the results are visible every day at our sites. This year Magnox’s Berkeley site finalised development of a new disposal package and perfected waste retrieval techniques so that the first concrete box of intermediate level waste could be safely transferred into a purpose-built store ready for final disposal.

Thinking differently is also a theme of the first Nuclear Waste Services (NWS) Strategy. I was delighted to help launch it and mark the company’s first birthday earlier this year. The team is passionate about making waste permanently safe, sooner and it’s encouraging to see continued progress with their most significant project – finding a suitable site and willing community to host a Geological Disposal Facility (GDF). Geophysical investigations have been undertaken, as well as acquiring existing geological information, supporting assessments to better understand what hosting a GDF would mean for potential host communities.

Of course, delivering the mission is about more than decommissioning sites and managing waste. It’s also about doing it safely, securely and sustainably, as well as considering the legacies we leave. The health and wellbeing of our people, communities and the environment remains our highest priority. There is always more to do and, despite reporting strong safety results, we remain focused on further improvements.

We’ve also continued investing in community projects, from the Cumbria Community Forest to the Morlais Tidal Energy Project and Sutherland Spaceport, delivering on our Energy Act obligation to support economic growth, diversification and future employment near our sites.

Creating great places to work

There’s a marked increase in competition for talent in our sector and wider industry, so we’re prioritising efforts to make sure we have the right skills to deliver our mission. This means developing and retaining colleagues, redoubling efforts with our award-winning Leadership Academy, and attracting new people to join us.

A new NDA group graduate programme launched in 2022, taking advantage of our group model to collaborate and reach new audiences. Together with Energus and the sector-wide Nuclear Graduates programme, 6,000 people applied for roles and more than 60 graduates will join us soon.

Creating great places to work is critical for attraction and retention. It’s been a focus throughout my time with the NDA and we’re seeing results including Nuclear Transport Solutions launching a career returners scheme and lifting a top diversity trophy at the Northern Power Women Awards. Many parts of the group have also received Disability Confident status, with plans to reach even higher levels of the award. There’s more to do, but we’re committed to ensuring people are respected and included, so they can perform at their best.

Trusted to do more

The next phase of our journey is about getting full benefit from the new, simpler way that we’re structured and using it as a platform for growth, ready for future missions as we are trusted to do more.

It’s an exciting time for us as preparations remain on track for Hunterston B to be the first advanced gas-cooled reactor to transfer to Magnox from EDF Energy for decommissioning when defueling completes, and we’re working closely with the Ministry of Defence as the feasibility of Magnox decommissioning its Vulcan site is assessed.

More broadly, we’re supporting the UK Government’s Energy Security Strategy as its expert advisor for new nuclear waste management and decommissioning. New nuclear has a role to play in this strategy and we have land and expertise available that can support future developments. I welcome the creation of Great British Nuclear to co-ordinate efforts and we’re already working closely with the new team.

Accounting Officer scrutiny

At the NDA we take our accountability for the money we spend very seriously. Our end of financial year NDA Accounting Officer review process identified a management override of financial controls in determining the outcome of an employee incentive plan at Sellafield resulting in an overpayment to staff. With the support of the Sellafield Board, we are taking steps to recover the overpayment and enhancements to Reward Governance will be implemented with lessons learned shared across the NDA Group.

Thank you

I was particularly proud to see the results of our stakeholder survey this year, noting an increase in positive perceptions and an endorsement of NDA staff’s professionalism and integrity. Thank you to those who responded and to all our stakeholders for the time they take to engage with us.

My ongoing thanks also go to my dedicated colleagues throughout the group, as well as our Board and the Governments of the UK and devolved administrations. I’d like to thank Ros Rivaz who recently completed her term as NDA Chair and welcome Chris Train who has taken on the role of interim Chair while a permanent successor is recruited. Our work is one of the most important environmental programmes in the world, protecting people and the planet. I remain confident that we have the right team and strategy to deliver our commitments on behalf of the nation.

David Peattie CEng HonFNucl

Accounting Officer and Group Chief Executive Officer

12 September 2023

Financial review, Kate Bowyer, Group Chief Financial Officer

This year has seen success in securing additional revenue to support our mission and active portfolio management across the estate to mitigate the risk from high energy costs and inflation.

I am delighted to have joined the NDA on 2 May 2023 and am looking forward to building on my predecessor’s improvements to our systems and processes in support of our critical mission. 2022/23 was one of financial challenges and emerging risks, with the effects of inflation being felt in budgetary management across the NDA group. In particular the unprecedented increases in energy costs resulting from the conflict in Ukraine required constant management and forward planning.

Despite these challenges, financial risks and opportunities were managed effectively on a portfolio basis, ensuring that the Group remained within the overall funding settlement agreed with UK Government through the Supplementary Estimate process. With the support of the Group Leadership Team and working closely with UK Government, we were able to take risk-based prioritised investment decisions and maximise commercial revenues.

Commercial revenues increased by 48% to £1,059 million (2021/22: £714 million) with higher levels of fuel deliveries from the UK’s operational nuclear power stations and the successful conclusion of a package of contracts for the management of wastes from overseas utilities. The high levels of inflation impacted expenditure budgets but also delivered a beneficial impact in the accounting for our long-term contract income.

Net expenditure for the year was £2,700 million (2021/22: £2,758 million), compared to the original voted net expenditure limit of £2,833 million (2021/22: £2,791 million). Capital investment was £2,193 million (2021/22: £2,024 million) and our resource expenditure was £1,566 million (2021/22: £1,448 million).

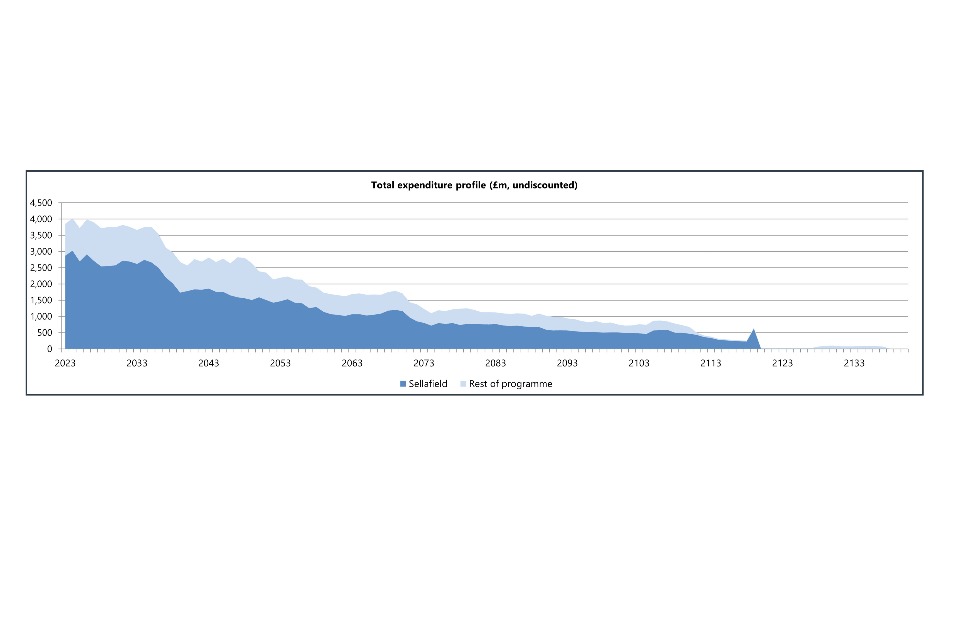

The Statement of Financial Position of the NDA group is dominated by the nuclear provision, the discounted best estimate of the future costs of the decommissioning mission, of £124.4 billion (31 March 2022: £237.0 billion).

It is important to note the inherent uncertainty around this estimate and therefore that it represents a single point in a credible range of potential outcomes. The basis is discussed on pages 133 to 135, showing that the principal movement in the year has been the change in the discount rate, along with some cost estimate changes. Detailed disclosures are given in note 24 to the accounts.

Building on the current spending settlement from UK Government, we continue to develop our longer term financial plans and mission progress reporting in anticipation of future spending reviews.

Following the finalisation of the last two parent body organisation contracts last year the structure of the NDA Group has continued to develop, with Magnox Limited and Dounreay Site Restoration Limited joining on 1 April 2023. This provides a single legal entity which will grow in future years to deliver the decommissioning of the advanced gas-cooled reactor sites when they transition into the group.

We continue to deliver improvements to our systems and processes through a series of workstreams focused on people, reporting, controls and risk.

Reporting used by the Group Leadership Team, NDA Board and UK Government has been enhanced in the year. The approach to Counter Fraud, Bribery and Corruption has been improved through the creation of a group wide forum and the launch of compulsory training within the NDA. We are now into our third year of intake to our Finance, Audit and Risk graduate scheme and we have welcomed our first cohort of finance apprentices. This will help to ensure that we have the right skills and resources in place to support the group in its important work.

Kate Bowyer

Group Chief Financial Officer

Performance against financial targets

Performance against financial targets infographic

Figures in the above graphic are prepared on the basis of Government financial reporting (HM Consolidated Budgeting Guidance) which differs in part from the basis used to prepare the financial statements:

Accounting adjustments totalling £793 million are added to the actual expenditure figure of £3,759 million. These relate to non-cash items including amortisation, revalorisation and treatment of leases and the elimination of internal trading transactions shown above to produce the Authority programme expenditure total of £4,551 million (see note 6 to the financial statements).

Accounting adjustments of £85 million are made to the actual income figure of £1,059 million to produce the Authority income total of £974 million shown in note 9 to the financial statements. These relate to the elimination of internal trading transactions, and a timing difference on the recognition of revenue in long term contracts.

Funding infographic

The NDA and our mission

We’re responsible for keeping the UK’s former nuclear sites and facilities, once at the heart of supporting national defence and generating nuclear power for electricity, safe and secure, as we decommission them and overcome the challenges of managing nuclear waste. It’s one of the most important environmental programmes in the world, protecting people and the planet.

Our 17,000 strong, skilled group workforce works hard on behalf of the UK, using innovation and technology to overcome the challenges of identifying and removing nuclear waste from ageing facilities, so we can store safely and permanently dispose of it. The work is complex and challenging. Dealing with all the waste, dismantling hundreds of buildings and facilities, and building a Geological Disposal Facility (GDF), to dispose of the most radioactive nuclear waste, will take decades. However, by investing today in the challenges left over from the UK’s proud nuclear history, we can remove the burden for future generations and continue to deliver social and environmental benefits through our jobs, knowledge, skills, technology and social investment.

Our team is working with partners in research and industry to drive innovation, using cutting-edge technology to reduce hazards and risks, so that over time the sites can be used again for worthwhile purposes.

Our history

The UK is a pioneer of nuclear technologies, which have been part of our lives since the 1950s. Our sites and facilities have been at the heart of delivering nuclear benefits for the UK, including national defence programmes and supplying safe, low-carbon power to UK homes, businesses, schools and hospitals, for decades.

Unlike modern day equivalents however, our old nuclear plants and facilities weren’t designed for managing the nuclear waste they created, or for decommissioning. There are limited historical records on what, or how much, nuclear waste was left on some of the sites during their working lives.

Generating nuclear power today will not leave future generations with the challenges we’re trying to overcome. Nuclear waste produced today is carefully managed, and following in the footsteps of other countries, a Geological Disposal Facility (GDF) will provide us with a safe way of disposing of higher active waste, permanently in England and Wales. Scotland has a distinct policy for higher activity radioactive waste which sets out a near site, near surface approach.

How we work

How we go about our work is very important to us and we must deliver results safely, responsibly, and sustainably. Our commitment to creating environmental and social benefits builds on our long history of providing value for the UK and we want to ensure that our actions and decisions continue to have a lasting, positive impact.

-

The NDA is an executive non-departmental public body, created through the Energy Act 2004, sponsored and funded by the Department for Energy Security and Net Zero (formerly the Department for Business, Energy and Industrial Strategy). We have just over 380 permanent staff and are accountable to UK Government and Scottish Government ministers for delivery of our mission through our subsidiary companies.

-

Sellafield is responsible for decommissioning the UK’s most complex and challenging nuclear site. 75 years ago, the Sellafield site helped to create the UK’s nuclear deterrent and later became the home of the UK’s first commercial nuclear power station, Calder Hall. The site houses around 85 per cent of all the UK’s nuclear waste, on an area of less than two square miles. The Sellafield workforce is taking waste out of buildings as old as the site itself, looking after fuel so that nuclear power stations can continue to operate, and repackaging the country’s stockpile of nuclear materials.

-

Magnox is responsible for the safe and secure closure of former Magnox nuclear power stations and research facilities, removing all the fuel from the stations, taking down the buildings and managing the waste. Magnox will also manage the decommissioning of seven advanced gas cooled reactor stations, as they stop generating nuclear power and progressively move over to the NDA group over the next ten years. In April 2023 Dounreay became a division of Magnox, responsible for safely and securely cleaning-up and demolishing Britain’s former centre of fast reactor research and development. Because many of its facilities were once the home for experimental research, Dounreay’s work requires innovation as well as great care.

-

Nuclear Waste Services is the UK’s leading nuclear waste management organisation, focused on managing the UK’s nuclear waste, safely and securely, for generations to come. This includes delivering a Geological Disposal Facility (GDF).

-

Nuclear Transport Solutions is our leading global provider of safe, secure and reliable nuclear transport solutions. It uses its specialist transport and logistics expertise to support our nuclear decommissioning mission and help customers and partners around the world solve their own complex challenges.

Other NDA group companies include NDA Archives Ltd, NDA Properties Ltd, Rutherford Indemnity Ltd and Energus. An organisational structure for the NDA group is shown on page 22 and reflects the group structure during the year.

Trusted to do more

As we look forward, our work will be expanding. We have been asked to use our specialist expertise and skills, to decommission newer reactors as they reach the end of their power-generating lives. Arrangements have been agreed by the UK Government, Scottish Government and EDF Energy for the NDA group to decommission Britain’s seven advanced gas-cooled reactor (AGR) stations.

The AGRs will reach the end of their operational lives over the next 10 years and, after defueling, with the fuel being transferred to Sellafield for interim storage, will transfer to Magnox for decommissioning.

UK site map

The NDA group

Our group is made up of the Nuclear Decommissioning Authority (NDA) and four key component parts: Sellafield, Magnox with Dounreay, Nuclear Waste Services and Nuclear Transport Solutions.

-

The NDA is an executive non-departmental public body, created through the Energy Act 2004, sponsored and funded by the Department for Energy Security and Net Zero (formerly the Department for Business, Energy and Industrial Strategy). We have just over 380 permanent staff and are accountable to UK Government and Scottish Government ministers for delivery of our mission through our subsidiary companies.

-

Sellafield is responsible for decommissioning the UK’s most complex and challenging nuclear site. 75 years ago, the Sellafield site helped to create the UK’s nuclear deterrent and later became the home of the UK’s first commercial nuclear power station, Calder Hall. The site houses around 85 per cent of all the UK’s nuclear waste, on an area of less than two square miles. The Sellafield workforce is taking waste out of buildings as old as the site itself, looking after fuel so that nuclear power stations can continue to operate, and repackaging the country’s stockpile of nuclear materials.

-

Magnox is responsible for the safe and secure closure of former Magnox nuclear power stations and research facilities, removing all the fuel from the stations, taking down the buildings and managing the waste. Magnox will also manage the decommissioning of seven advanced gas cooled reactor stations, as they stop generating nuclear power and progressively move over to the NDA group over the next ten years. In April 2023 Dounreay became a division of Magnox, responsible for safely and securely cleaning-up and demolishing Britain’s former centre of fast reactor research and development. Because many of its facilities were once the home for experimental research, Dounreay’s work requires innovation as well as great care.

-

Nuclear Waste Services is the UK’s leading nuclear waste management organisation, focused on managing the UK’s nuclear waste, safely and securely, for generations to come. This includes delivering a Geological Disposal Facility (GDF).

-

Nuclear Transport Solutions is our leading global provider of safe, secure and reliable nuclear transport solutions. It uses its specialist transport and logistics expertise to support our nuclear decommissioning mission and help customers and partners around the world solve their own complex challenges.

Other NDA group companies include NDA Archives Ltd, NDA Properties Ltd, Rutherford Indemnity Ltd and Energus. An organisational structure for the NDA group is shown on page 22 and reflects the group structure during the year.

The NDA organisational structure

NDA organisational structure

Sustainability in the NDA

How we go about our work is very important to us and we must deliver results safely, responsibly, and sustainably. Our commitment to creating environmental and social benefits builds on our long history of providing value for the UK and we want to ensure that our actions and decisions continue to have a lasting, positive impact.

This year work has progressed to implement the NDA’s Sustainability Strategy and roadmap, embedding the approaches into different parts of the organisation and wider group.

Sustainability as a critical enabler

Sustainability is one of the NDA’s critical enablers, added for the first time as part of our 2021-2026 Strategy published 2021, with the objective to ensure that mission outcomes and the journey to deliver them are sustainable.

Sustainability is often associated with an organisation’s environmental activities. The NDA group supports Government aspirations to be carbon net zero by 2050, or 2045 in Scotland. However, sustainability for us entails a much broader commitment to the way our work is delivered, aligned with the United Nations Sustainable Development Goals.

Extensive engagement has been undertaken to understand the impact of our work and the factors that influence it. This has resulted in the identification of four sustainability legacies – decommissioning, environment, socio-economics and culture.

Progress towards sustainable outcomes

Step changes continue to be made that will bring longer-term benefits in the future. For example, the process for preparing a business case now requires sustainability considerations to be included. This ensures that sustainability is at the heart of the NDA’s future decision making.

It is however recognised that there is much more to do. Last year a sustainability report was added to the Annual Report and Accounts for the first time. This year its position has moved forward in the document, but the content has been streamlined. This is a deliberate decision, intended to recognise that progress is not just being made under the banner of sustainability, but across all parts of the organisation, aligned to a common goal.

Progress towards the sustainable outcomes outlined in this report can be seen throughout all subsequent reports and case studies in this document.

Janet Ashdown

Chair, Sustainability and Governance Committee

Our definition of sustainability

To create value through nuclear decommissioning – at pace, affordably, with participation and creatively.

At pace – Keep safety and security paramount, optimise progress in decommissioning

Affordably – Consider the long-term value for money alongside short-term financing, optimising investment decisions

With participation – Seek and support the opinions, plans and aspirations of our workforce, communities and stakeholders

Creatively – Decommission our nuclear sites, enhancing the environment and achieving net carbon zero.

Our approach

We want to be recognised as a leader in transforming nuclear legacies into opportunities for local, regional, national and international sustainable development.

The NDA Sustainability Strategy was published in March 2022. It followed significant engagement with key stakeholders from around the NDA group, as well as regulators, Government and community stakeholders. This followed a structured process, known as a materiality assessment, identifying areas which both represent the organisation’s most significant impact on the economy, environment, and people, and equally the most significant impacts of those areas on the business.

The result was the identification of four overarching themes, known in the NDA as our legacies, setting out how the NDA could achieve the desired vision, with a roadmap of activities to get there.

More information can be found on our website

The NDA group Sustainability Strategy 2022 – GOV.UK (www.gov.uk)

Sustainability legacies

Our sustainability roadmap identifies four legacies:

Decommissioning

* Deliver our mission safely, securely, protecting people and the environment

* Be outcomes based, high performing and innovative

* Balance pace and priority of activities to provide lifetime value for money and achieve intergenerational equity

* Be guided by sustainability criteria embedded in delivery and outcomes

Environmental

* Protect, remediate, and enhance the environment

* Be recognised by our stakeholders for our environmental performance

* Achieve net zero

Socio-economic

* Empower people and communities to create sustainable local and regional economies

* Think internationally and act locally on nuclear skills, developing the capabilities of the UK skills base to facilitate decommissioning and the wider nuclear sector

* Be a positive contributor to the national and international trade agenda

Cultural

* Engage openly, transparently, and authentically

* Work together to establish respectful and inclusive working environments so our people can perform at their best

* Create an impact conscious and future focused mindset

* Be trusted to deliver in a safe, responsible, and timely manner

Each legacy area is led by a senior representative of the NDA. The cultural legacy is collectively owned by a Sustainability Next Generation group. This is made up of young people from different professional backgrounds with representatives from each of the operating companies.

Governance and incentivisation

A governance structure that reaches all levels of the NDA group is fundamental to achieving the vision.

In collaboration with the Group Leadership Team and the Sustainability Steering Group, there is clear leadership with decision making capability in the NDA, helping to expedite progress. Across the NDA group there is the Sustainability Working Group with representatives from each operating company, and the Sustainability Next Generation group which leads the cultural legacy workstream. In addition, complementary sustainability steering and working groups drive progress within each operating company.

Several incentives are given to sustainability across the NDA group. One of these is the Long-Term Incentive Plan, setting incentivised targets until 2025, as well as incentives associated with being a beacon project.

United Nations Sustainable Development Goals

The United Nations Sustainable Development Goals are a blueprint for peace and prosperity, now and into the future. Many are directly related to the environment and work we do, including responsible consumption and life on land, as well people focused impacts such as gender equality and sustainable cities and communities.

The case studies highlight how our work contributes towards these goals.

UN sustainability goals

A small number of topics are chosen each year to be NDA group beacon projects, with senior sponsorship, aiming to deliver consistent change and progress in all parts of the group. Sustainability has been a beacon project for two years in a row.

Sustainability networks across the group are actively engaged in embedding sustainability into our ways of working. There are numerous examples where the foundations are being put in place to enable an effective, joined-up consideration of sustainability in decision making. Embedding sustainability in business cases is one such example where it is becoming part of our decision making. New business case templates include such requirements with a subsequent guidance note which sets out more detail. The note incorporates the four NDA sustainability legacies; decommissioning, environmental, socio- economic and cultural, and aligns with the requirements from other external guidance, notably the HM Treasury Green Book and Procurement Policy Notes, [see fig]

Sustainability in supply chain and procurement

Specific activities include:

-

Procurement Policy Notes (PPN)

a. 06/20 Social Value incorporated into all NDA group in-scope procurements, across the following themes:

Fighting climate change

Tackling economic inequality

Equal opportunity

Wellbeing

Covid recovery

b. 06/21 Carbon reduction plans incorporated into all NDA group in-scope procurements -

NDA group-wide Atamis procurement and supply chain platform captures PPN06/20 and PPN 06/21 adherence

-

Procurement specific sustainability guidance incorporated into NDA commercial toolkit

-

Delivery of procurement elements of NDA Social Value Beacon Project relating to PPN 06/20

-

Creation and roll-out of carbon questionnaires for incumbent suppliers and development for future invitations to tender

Business case sustainability considerations and alignment

| NDA sustainability legacy | NDA value framework | HMT green book | Procurement Policy Notes (PPN) |

| Socio-economic | Socio-economic impacts | Productivity and employment, Place based impacts | PPN 06/20 Social Value – covid 19 recovery – tackling economic recovery, PPN 05/21 National Procurement Policy – new business/jobs/skills |

| Environment | Environment | Greenhouse gases, Natural capital, Climate change resilience, Place based impacts | PPN 06/21 Carbon Plans – bidders for procurements >£5m must have a carbon plan, PPN 05/21 National Procurement Policy – climate change and waste, PPN 06/20 Social Value – fighting climate change |

| Cultural | Public Sector Equality Duty (PSID) | PPN 06/20 Social Value – equal opportunity – well being | |

| Decommissioning | Enabling the mission, Risk and hazard reduction | Place based impacts | PPN 05/21 National Procurement Policy – improving supplier diversity, innovation and resilience |

Our strategic approach and themes

Our strategic themes

We use five strategic themes to describe all the activities needed to deliver the NDA’s mission.

The first four strategic themes, Spent Fuels, Nuclear Materials, Integrated Waste Management and Site Decommissioning and Remediation, relate directly to our clean-up and decommissioning work and are known as driving themes.

The fifth theme describes the important activities needed to support the delivery of our mission and is known as Critical Enablers. The diagram below demonstrates how they interact.

Currently, the most urgent tasks are dealing with our sites’ highest-hazard materials, spent fuel, nuclear materials and highly-radioactive wastes. Once the inventory has been removed and either securely stored or disposed of, the redundant nuclear facilities can be dismantled and demolished.

Integration of our strategies

Integration of our strategies diagram

Our driving themes and strategic outcomes

Across our four driving themes, we break our mission down into 47 strategic outcomes. These outcomes represent the significant pieces of work that must be achieved to deliver our mission.

In March 2021 we published our new Strategy. As a consequence, we have revised some of the detail around a number of outcomes to ensure they continue to align with our strategic approach.

Increasingly, we’re building a more accurate picture of the work that has been completed across our 47 outcomes and that which is still left to do.

The percentage figures in the charts opposite show the proportion of work that has so far been completed towards the achievement of each outcome. Overall, good progress continues to be made across our mission as we safely manage our nuclear inventory and reduce the risks associated with it.

Last year saw more spent fuel of all types placed in interim storage pending final disposal. Four more strategic outcomes have been achieved in relation to the end of reprocessing, whilst work continues with the building of new modern treatment and storage facilities to manage nuclear material and waste, ultimately working towards the final disposal of nuclear inventory and the release of land for other economic uses. The full mission progress report will be available on our website later this year.

Case studies for 2022/23

Click on the links below to read our case studies

Case studies: Spent Fuels strategic theme – GOV.UK (www.gov.uk))

Case studies: Nuclear Materials strategic theme – GOV.UK (www.gov.uk)

Case studies: Integrated Waste Management strategic theme – GOV.UK (www.gov.uk)

Case studies: Site Decommissioning and Remediation strategic theme – GOV.UK (www.gov.uk)

Case studies: Critical enablers – GOV.UK (www.gov.uk)

Accountability report

The accountability report sets out how we meet our key accountability requirements to Government. The report is divided into three sections:

The corporate governance report which:

Remuneration and people report which:

-

Discloses the remuneration of our Board members

-

Highlights employee matters and details staff numbers, costs and pension arrangements

Parliamentary accountability and audit report which includes:

-

The Parliamentary accountability disclosures, reporting on losses and special payments and remote contingent liabilities of interest to Parliament

-

The Audit report prepared by the National Audit Office setting out the Audit opinion on the annual accounts

Directors’ report

We are an executive non-departmental public body, established by the Energy Act 2004 to secure the decommissioning of the UK’s civil nuclear legacy. Since then, our remit has been extended to include the long-term management of all the UK’s radioactive waste by finding appropriate storage and disposal solutions.

Accounts direction

These accounts have been prepared in a form directed by the Secretary of State with the approval of HM Treasury and in accordance with section 26 of the Energy Act 2004.

As permitted by the guidance for preparing Government annual report and accounts in the UK, some of the matters required to be included in the Directors’ Report are disclosed elsewhere in the annual report and accounts, identifiable from the cross references provided.

The Department for Energy Security and Net Zero (DESNZ) is the sponsoring department for the NDA. Further detail on the role of DESNZ and UK Government Investments in relation to the NDA can be found in the Governance Statement.

NDA Board

The Board is comprised of executive members and non-executive members (including the Chair) with the latter forming a majority. The non-executive members must comprise a Chair, appointed by the Secretary of State, and a number of other persons appointed by the Secretary of State after consultation with the Chair. The executive members must comprise a Chief Executive, appointed by the non-executive members. Whether there are to be any executive members in addition to the Chief Executive is a matter for the non-executive members. In May 2023 the Board resolved that the Group Chief Financial Officer should be an executive member of the Board. All matters presented to the Board are decided by a majority of votes of those Board members present. There is no distinction in the voting rights of the executive and non-executive members. Details of the current Board members are set out in the Governance Statement.

Changes to the NDA Board during the year

Volker Beckers served as a non-executive Board member during the year and stepped down on 31 October 2022 (his last term having been extended by three months from 31 July 2022). Kathryn Cearns was appointed as a non-executive Board member on 1 August 2022. Mel Zuydam resigned as the Group Chief Financial Officer on 31 March 2023. Kate Bowyer joined us as Group Chief Financial Officer on 1 May 2023.

Outside of the 2022/23 financial year, Ros Rivaz stepped down as Chair on 31 August 2023 and Chris Train was appointed as Interim Chair from 1 September 2023.

Directors’ interests

Members of the Board must declare any personal or business interests which may, or may be perceived to, influence their individual decisions and judgments in performing their role as Board members. We maintain a register of such interests.

During the year, the Chair, Ros Rivaz, highlighted a potential conflict of interest in respect of an IT services agreement extension proposal for Sellafield due to her directorship at a different provider (Computacenter). The Board considered the matter and resolved that Ros Rivaz did not need to recuse herself from the discussion at that meeting and on other occasions of similar discussion during the year.

The other members have no personal or business interests which present material conflicts with their role as a member of the Board.

A full register of members’ interests and the associated procedure for Board members to manage their interests is available at: www.gov.uk/government/ publications/nda-register-of-directors-interests

Auditor of the NDA

We are audited by the Comptroller and Auditor General (C&AG) in accordance with the Energy Act 2004. The audit is carried out on the C&AG’s behalf by the National Audit Office (NAO). The services provided by the C&AG relate to statutory audit work for the NDA. No fees were paid to the C&AG for services other than statutory audit work.

Pensions

NDA employees are eligible to participate in the Civil Service Pension Arrangements. A small number of employees who transferred to the NDA from INS in 2019 continue to accrue benefits in the UKAEA Combined Pension Scheme.

Group employees participate in various defined benefit pension schemes detailed in note 26 to the accounts.

Group employees also participate in various schemes which are accounted for on a defined contribution basis, with details given in note 26 to the accounts.

Prompt payments

It is UK Government policy to pay 90% of undisputed invoices within five days, with the remainder paid within 30 days.

| 2022/23 | 2021/22 | 2010/21 | |

| Invoices paid within 5 days | 62% | 66.1% | 62.2% |

| Invoices paid within 30 days | 93% | 93.4% | 90.5% |

The average number of payment days from invoice date for a valid invoice is 10 days, a slight increase from 9 days in 2021/22. Performance compared with Government policy has been impacted by the implementation of a new enterprise resource planning system in the first half of the year (April 2022 to September 2022: 55% of invoices paid in 5 days and 92% in 30 days; October 2022 to March 2023: 67% invoices paid in 5 days and 94% paid in 30 days) which has introduced electronic approval workflows and has improved our linkage between purchase orders and supplier invoices. This provides a platform for improving our prompt payment performance.

Personal data

There were six internal data breaches recorded during 2022/23, five of which were investigated and classed as minor, non-reportable incidents. One incident was initially reported to the Information Commissioner’s Office; however, it was ultimately confirmed that no personal data had been compromised and therefore no further action was required.

In all cases appropriate mitigating measures were taken subsequently in order to reduce the chance of re-occurrence.

Other disclosures

Details on how the Board has engaged with our stakeholders and discharged its section 172 duties can be found in the section 172 statement.

Our assessment of the effectiveness of NDA controls is detailed on page 94 including the actions we are taking to learn from two events identified during the year.

Disclosures on equal opportunities, learning and development and how we engage with all staff are in the Remuneration and People Reports.

Our environmental performance is detailed in the Health, Safety, Security, Environment and Wellbeing report.

Details of investment in socio-economic developments, research and development and funding, counterparty and foreign exchange risk are all included in the financial statements.

Events after the reporting period

IAS 10 requires the NDA to disclose the date on which the accounts are authorised for issue. The Accounting Officer authorised these Financial Statements on 12 September 2023. The Report of the Comptroller and Auditor General was issued on X September 2023.

On 1 April 2023 Dounreay Site Restoration Ltd combined with Magnox Ltd.

Going concern

A full explanation of the adoption of a going concern basis of accounting appears in note 2.1 of the financial statements.

Chris Train

Interim NDA Chair

12 September 2023

Section 172 statement

Under our obligations as an executive non-departmental public body, we adopt a best practice approach in terms of our corporate governance oversight and reporting. The Board therefore voluntarily adheres to the requirements outlined in Section 172 of the Companies Act 2006 in respect of its decision making, and reports on stakeholder considerations accordingly.

Given the nature of its work, we have a large number and wide range of stakeholders. The Board considers stakeholder engagement an essential element of its responsibilities as well as a key enabler to mission delivery. It allows us to understand issues better by obtaining stakeholders’ points of view, supporting informed decision-making by the Board and creating confidence in the operation of the organisation.

We divide our stakeholders into the following broad categories:

- Government, Regulators and external authorities. This includes decision-makers with a direct or indirect impact on our ability to make decisions and allocate resources

- Employees, workforce and their representatives

- Supply chain and commercial partners

- Customers, both in the UK and internationally, contributing to the revenue generating activities of the group

- Other influencers and opinion formers including: MPs, MSPs, Welsh assembly members, County Councils, Borough Councils, civil society, Non- Governmental Organisations, local communities (including site stakeholder groups), international organisations etc.

The fair treatment of stakeholders is always a key consideration in decisions taken by the Board, although the Board acknowledge that in some situations, stakeholders’ interests will be conflicted and they may have to prioritise as appropriate.

All Board members are involved in a wide range of events, such as staff meetings, engagement with Government, parliamentary meetings and site stakeholder meetings. Stakeholder engagement by the Board and executives is supported by specialists in the communications team who have a comprehensive understanding of our stakeholder network. Engagements during the year are supplemented by roadshows and an annual stakeholder summit.

Stakeholder engagement takes place through regular and structured contact, augmented by informal relationships. For example, formal decision-making in the NDA is supported by regular meetings with Government and regulators. There are a number of technical forums (Nuclear Decommissioning Policy and Strategy Group and Theme Overview Groups for example) which take input from subject matter experts, regulators, Government and other parties.

Local stakeholder engagement is built around our sites and their site stakeholder groups, multiple other standing forums and 11,000 people regularly engaged through our database. The results of our most recent stakeholder survey, conducted by Opinion Research Services during the summer of 2022, showed an increase in positive perception, and an endorsement of our staff’s professionalism and integrity. The research also highlighted areas where respondents feel we could be doing better including the challenge for us to reach a wider, more diverse set of stakeholders and inviting more communication from us around the technical challenges faced in dealing with high-hazard materials.

The full report is available at: Survey reflects increasingly positive stakeholder’s view of NDA – GOV.UK (www.gov.uk)

In respect of employee engagement, there are well-established formal bargaining and consultation mechanisms in place to engage with trade union representatives. Board members also engage individually with employees, hearing from them first-hand during the Board’s site visits, at employee breakfast sessions, employee conferences and at Joint Consultation Group sessions which bring together management and employee representatives.

The Board has welcomed the attendance of each of the operating company Board Chairs in rotation. Senior executives from the operating companies also frequently present items at NDA Board and committee meetings.

The NDA Group Chief Communications and Stakeholder Relations Officer attends Board meetings and provides a link to stakeholders and a specialist view of different perspectives and concerns.

In addition to stakeholder considerations, the Board also evaluates each decision against our mission and risk appetite, providing constructive challenge where required. We set out the issues and factors we take account of in our decision making in our Value Framework. This provides a structured mechanism to consider:

- Health and safety

- Security

- Environment

- Risk/hazard reduction

- Socio-economic impacts

- Finance

- Enabling the nuclear decommissioning mission

Strategic decisions coming to the NDA Board build in these considerations systematically and they are also reflected and assured in subsequent business case approvals. The Board evaluates each decision against our mission and risk appetite, providing constructive challenge as well as support.

The NDA Board considers that it has acted in good faith in a way most likely to promote the achievement of its decommissioning mission for the benefit of the country and having regard (amongst other matters) to factors (a) to (f) S172 Companies Act 2006, in the decisions it has taken during the year ending 31 March 2023. Examples of some of these decisions are listed below.

Chris Train

Interim NDA Chair

12 September 2023

Joining of Magnox and Dounreay

In March 2023 the Board approved the final proposal to join Magnox Limited and Dounreay Site Restoration Limited as one entity.

Relevant stakeholders

- Employees, workforce and their representatives

- Supply chain and commercial partners

- Other influencers and opinion formers, in particular: local communities and site stakeholder groups

- Scottish Government and Regulators

The Board’s decision-making process

- Since the decision taken in 2020/21 to commence with the joining, the Board has carefully monitored all activities relating to its delivery

- The primary focus of the Board has been on the fair treatment of colleagues impacted across the group alongside community partners in the Dounreay area

- At its meeting in November 2022, the Board received updates on the TUPE status and revised pension arrangements of those Dounreay colleagues transferring to Magnox Limited

- During the year, the Board received reports from the employee forums established to support the process. This allowed colleagues a platform to express their views on the process as well as a medium by which they were kept informed of key developments

- The Board scrutinised the arrangements made for asset and service transfer within the joining, ensuring the fair treatment of key partners and suppliers

‘One NDA’ Group Operating Framework (GOF)

Following the successful completion of phase one of reshaping the NDA group, the Board’s focus has turned to subsequent decisions associated with the implementation of the new GOF.

Relevant stakeholders

- Employees, workforce and their representatives

- Regulators and other external bodies

The Board’s decision-making process

- During the year, the Board turned its attention to supporting the successful implementation of the new GOF which focuses primarily on people, behaviours, and ways of working

- The Board has received and scrutinised regular reports from the GOF Working Group which have provided updates on developments and concerns and interests of key stakeholders impacted by the recent changes. Further to feedback received, the Board examined the governance structure of the NDA and endorsed changes to the Group Leadership Team and Executive Leadership Team to support the more efficient deployment of senior staff

- The Board also led the way in establishing cross-working peer groups with colleagues in the operating companies. The following have met within the year and an All-Boards event took place in July 2023:

- Board Chairs’ Forum

- Committee Chairs’ Forums

Early performance award payment

In 2022/23, the Board approved an early partial performance related payment to eligible employees under the terms of the Short-Term Incentive Plan.

Relevant stakeholders

- Employees, workforce and their representatives

- Regulators and external governors (including the Nuclear Liabilities Fund)

The Board’s decision-making process

- In consideration of the financial climate, the cost-of-living increase and associated challenges, the Board reviewed and approved an early partial payment of the 2022/23 Short-Term Incentive Plan (STIP) award to eligible colleagues in December 2022. Pending final performance against the NDA Group Key Targets, the award would have normally been paid after the close of the 2022/23 financial year

- The Board scruitinised reports from colleagues, stakeholder groups and from our engagement with its recognised trade unions and other colleague representatives, taking their input on the best way forward

- In approving the proposal, the Board scrutinised the payments, ensuring they sat within guaranteed STIP performance outturns as defined against our Group Key Targets forecast for the year

Statement of Accounting Officer’s Responsibilities

Under Section 26 of the Energy Act 2004, the Secretary of State (with approval of HM Treasury) has directed the NDA to prepare for each financial year a statement of accounts in the form and on the basis set out in the Accounts Direction.

The accounts are prepared on an accruals basis and must give a true and fair view of the state of affairs of the NDA and of our income and expenditure, Statement of Financial Position and cash flows for the financial year.

In preparing the accounts, the Accounting Officer is required to comply with the requirements of the Government Financial Reporting Manual and in particular to:

- Observe the Accounts Direction issued by the Secretary of State with the approval of HM Treasury, including the relevant accounting and disclosure requirements, and apply suitable accounting policies on a consistent basis

- Make judgements and estimates on a reasonable basis

- State whether applicable accounting standards as set out in the Government Financial Reporting Manual have been followed, and disclose and explain any material departures in the accounts

- Prepare the accounts on a going concern basis

- Confirm that the Annual Report and Accounts as a whole is fair, balanced and understandable and take personal responsibility for the Annual Report and Accounts and the judgements required for determining that it is fair, balanced and understandable.

The Accounting Officer for the Department for Energy Security and Net Zero (formerly Department for Business, Energy and Industrial Strategy) has appointed the Group Chief Executive Officer as Accounting Officer of the NDA.

The responsibilities of an Accounting Officer, including responsibility for the propriety and regularity of the public finances for which the Accounting Officer is answerable, for keeping proper records and for safeguarding the NDA’s assets, are set out in Managing Public Money published by the HM Treasury.

As the Accounting Officer, I have taken all the steps that I ought to have taken to make myself aware of any relevant audit information and to establish that the NDA’s auditors are aware of that information.

So far as I am aware, there is no relevant audit information of which the auditors are unaware.

As the Accounting Officer, I confirm that to the best of my knowledge and belief, this annual report and accounts as a whole is a fair, balanced and understandable reflection of the NDA’s performance this year.

David Peattie CEng HonFNucl

Accounting Officer and Group Chief Executive Officer

12 September 2023

Governance statement

The NDA is sponsored by the Department for Energy Security and Net Zero (DESNZ). UK Government Investments (UKGI) provides strategic oversight of our corporate governance and corporate performance, working closely with and reporting directly to UK Government senior officials and providing advice to ministers. The formal arrangements between us and our sponsoring department are set out in a framework document, supported by a memorandum of understanding between DESNZ and UKGI. The Scottish Government also has an important governance role to ensure its expectations are met.

The following Governance Statement provides an insight into the corporate governance framework for the NDA and our group entities during 2022/23. The framework is used to measure our performance and effectiveness in the delivery of strategic and operational objectives.

The NDA’s Governance Framework

The NDA is a body corporate governed through the Energy Act 2004; the Government’s NDA framework document; and Cabinet Office guidelines for non-departmental public bodies (NDPBs). We also draw on best practice as set out in the UK Corporate Governance Code where appropriate, reporting exceptions to UKGI. This is within the context that our value is not primarily financially metric driven and that its remuneration policy is in line with public sector guidance.

Our governance is under constant review and, as part of the new operating model, a Group Operating Framework (GOF) was published in July 2022. Developed with input from all parts of the NDA group, the GOF is a suite of co-created documents that set out how the group is organised, governed and works together.

The Energy Act 2004 requires us to prepare a strategy for carrying out our functions and to prepare an annual business plan in respect of each financial year. The strategy and annual business plan must be approved by the Secretary of State and, to the extent appropriate, by the Scottish Ministers.

Certain scopes of work require approval from DESNZ. Where work falls outside our delegated authority, we must seek approval before commencing the work and demonstrate that it is affordable, aligned to our mission and provides value for money.

The Board

The NDA Board is responsible for all aspects of our activities and performance. It sets the strategic framework and direction for operations; is responsible for ensuring high standards of corporate governance at all times; sets the risk appetite; agrees plans against which our performance is measured; and ensures the maintenance of an appropriate control framework that provides assurances on risk assessment and the application of appropriate controls.

As at the date of this report, the NDA Board is comprised of six non-executive Board members, including the Chair, a Senior Non-Executive Member and two executive members: the Group Chief Executive Officer (CEO) and the Group Chief Financial Officer (CFO). The Group General Counsel and Company Secretary attends all Board meetings.

The names and biographies of the Board members who served during the period 1 April 2022 to 31 March 2023, their respective terms of office and memberships of the committees of the Board, can be found in the next section.

The Chair of the Board is accountable to the Secretary of State for our activities and performance in implementing our strategy and annual business plan, for formulating the Board’s strategy for discharging our statutory functions and duties and for providing effective leadership and direction of the Board.

The Chair is supported by the Senior Non-Executive Member. The Senior Non-Executive Member leads the annual performance review of the Chair.

The Group CEO is responsible for the leadership and operational management of the NDA. As CEO they are accountable to the Board and as Accounting Officer to Parliament for: NDA activities, public funds employed, ensuring targets are met and for implementing the strategy and plans approved by the Board and DESNZ.

Board committees

The Board is advised by, and delegates some of its responsibilities to, six committees:

- Audit and Risk Assurance Committee (A&RAC)

- Nominations Committee (NOMCO)

- Remuneration Committee (REMCO)

- Programmes and Projects Committee (P&PC)

- Health, Safety, Security and Environment Committee (HSSE)

- Sustainability and Governance Committee (S&G)

Each committee is chaired by a non-executive Board member. Membership of the committees is made up of a combination of executive and non-executive Board members as appropriate. The majority of members on the committees are always non-executive members.

The Group General Counsel and Company Secretary attends most committee meetings. Other Board members, members of the Executive Leadership Team (ELT), external advisors, representatives from the operating companies and other key stakeholders attend meetings at the invitation of the respective committee chairs.

Each committee reports directly to the Board by way of a Committee Chair’s report and committee minutes are made available to all Board members as appropriate. Urgent matters are escalated by the Committee Chair to the Board as appropriate.

The membership, meeting attendance records, purpose, responsibilities and key activities within the year of each committee can be found on the committee pages.

Executive Leadership Team

The Board delegates execution of strategy and day-to-day operational management of the NDA to the CEO and their ELT. The ELT comprises the: Group Chief Financial Officer; Group Chief Operations and Performance Improvements Officer; Group Chief People Officer; Group Chief Commercial and Business Development Officer; Group Chief Communications and Stakeholder Relations Officer; Group Chief of Staff and Security Officer; Group General Counsel and Company Secretary; and Group Chief Nuclear Strategy Officer.

Board members

Dr Ros Rivaz

Non-Executive Chair

(Term of office ended: 31 August 2023)

Board skills and experience:

Ros is an experienced Board Member, having held non-Executive positions since 2013. She has wide ranging leadership experience, predominantly in highly regulated and high hazard environments in the UK and internationally. She started her career at Exxon-Mobil, before progressing to senior roles in international companies including Tate & Lyle, ICI and Diageo. Her executive career culminated as Smith & Nephew’s Global Chief Operating Officer. There, Ros led work on the group’s global transformation for supply chain, manufacturing, engineering and procurement. She was also responsible for regulatory matters including health, safety, environmental performance, IT and cyber-security.

External appointments:

Ros is Senior Independent Director, Remuneration Committee Chair and the Designated Director for Employee Engagement for Computacenter plc. She is Senior Independent Non-Executive Director for Victrex plc as well as Lead Independent Director for Aperam S.A. She is also on the board of the community interest company Eton Community CIC.

Chris Train OBE

Interim Non-Executive Chair

(Term of office ends: 31 January 2025)

Board skills and experience:

Chris has over 38 years’ experience in the Energy, Utilities, Regulation and Infrastructure sectors. He has held chief executive, senior project management, operations and business development roles at Cadent, National Grid, Transco and Lattice. He has also sat on various European and international committees covering subjects such as regulation, commercial and infrastructure development.

External appointments:

Chris is the Non-Executive Chair of South East Water Limited and Clean Power Hydrogen (CPH2). Chris is also a member of the Department for Energy Security and Net Zero (DESNZ) Hydrogen Delivery Council.

David Peattie

Executive Board Member – Group Chief Executive Officer and Accounting Officer

Board skills and experience:

David is a Chartered Engineer and began his career at BP. During his 33 years with the company, his roles included Head of BP Group Investor Relations, Commercial Director of BP Chemicals, Deputy Head of Global Exploration and Production, Head of BP Group Planning, and finally as Head of BP Russia where he was responsible for BP’s interests in the TNK-BP joint venture as well as its businesses in the Russian Arctic and Sakhalin. He was also BP’s lead director on the board of TNK-BP and Chair of its Health, Safety and Environment Committee. David was also Chief Executive of Fairfield Energy, a late-life North Sea oil and gas producer.

External appointments:

David is Chair of Pacific Nuclear Transport Limited, the international nuclear shipping company, partly owned by the NDA. He established and personally funds a bursary at the University of Dundee. The fund provides financial support to undergraduate students in the Engineering Department of the University. In 2022, David was appointed as an Honorary Fellow of the Nuclear Institute.

Kate Bowyer

Executive Board Member – Group Chief Financial Officer

Board skills and experience:

Kate Bowyer joined the NDA as Group Chief Financial Officer (CFO) in May 2023 and plays a key role on our Group Leadership Team and on our Board. Kate brings a wealth of financial and leadership expertise to the role, joining from Muse Places, part of the Morgan Sindall group. In her role as Managing Director, Kate led the delivery of regeneration projects with private and public sector partners, bringing sustainable and transformational change to towns and cities across the UK. Prior to this, Kate was Chief Financial Officer of The Crown Estate, a £14 billion land and property owner and manager.

External appointments:

None

Janet Ashdown

Senior Non-Executive Board Member

(Term of office ends: 31 July 2024)

Board skills and experience:

Janet worked for BP plc for over 30 years, holding a number of local and global positions in fuel supply, manufacturing, oil trading and retail marketing. She was a senior leader in BP, running its UK retail and commercial fuel business in her last role. Until the end of 2012, Janet was Chief Executive Officer of Harvest Energy Ltd.

External appointments:

Janet is a Non-Executive Director and Chair of the Remuneration Committee at Victrex plc, a Non-Executive Director and Chair of the Corporate Sustainability and Remuneration Committees at RHI – Magnesita NV and is a Non-Executive Director at Stolt Nielsen.

Evelyn Dickey

Non-Executive Board Member

(Term of office ends: 31 July 2024)

Board skills and experience:

Evelyn has extensive human resources experience, leading design and delivery of major change programmes, business restructuring, employee relations, resourcing, executive remuneration, organisational capability and performance management initiatives. Evelyn has worked in HR consultancy and as HR Director (HR Operations) for Boots the Chemist, before joining Severn Trent’s HR function in November 2006, retiring as Director of HR in 2017.

External appointments:

Evelyn is a member of the independent panel for Menopause Friendly Accreditation.

Kathryn Cearns OBE

Non-Executive Board Member

(Term of office ends: 31 July 2025)

Board skills and experience:

A chartered accountant with extensive senior level experience in both the public and private sectors, Kathryn was Chair of the Financial Reporting Advisory Board to HM Treasury from 2010 to 2016 and was Chair of the Institute of Chartered Accountants in England and Wales (ICAEW) Financial Reporting Committee for 10 years up to the end of 2017. Her past roles include project director at the UK Accounting Standards Board and for many years she was a consultant accountant for an international law firm. Kathryn is a past Chair of the Office of Tax Simplification, past Non-executive member of Companies House and the UK Supreme Court, and a former member of the External Audit Committee of the IMF. She was also until recently a Trustee of Mencap.

External appointments:

Kathryn is Vice-Chair of The Property Ombudsman. She is a Senior Independent Director and Chair of the Audit and Risk Committee of National Highways and Chair of the Press Recognition Panel. Kathryn is also a Non-Executive Member of the UK Endorsement Board and is a Member of the Group Audit, Risk and Assurance Committee of the Department for Transport. She serves as a Member of the Audit and Risk Committee of the British Medical Association and is a Non-Executive Director of Emperor Design Services.

Professor Francis Livens

Non-Executive Board Member

(Term of office ends: 30 Nov 2026)

Board skills and experience:

Francis has performed numerous important advisory roles in the UK and internationally as a recognised expert in radiochemistry, in particular plutonium and nuclear materials. Francis was a Director of the Dalton Nuclear Institute from 2016 to September 2023, responsible for the coordination of nuclear research and education across The University of Manchester, where he is now a Professor of Radiochemistry. Francis is a Fellow of the Royal Society for Chemistry and Member of the Institute of Strategic Studies.

External appointments:

Francis is Chair of the Nuclear Innovation and Research Advisory Board as well as a member of the Office for Nuclear Regulation Independent Advisory Panel.

Alex Reeves

Non-Executive Board Member and UKGI Representative

Board skills and experience:

Alex is a Director at UK Government Investments (UKGI). He currently leads on inward mergers and acquisitions and other corporate finance projects, as well as running UKGI’s Non- Executive Director Forum. Alex also has oversight of the UKGI shareholder teams of the National Nuclear Laboratory. Prior to joining UKGI, Alex spent over ten years in corporate advisory and investment banking roles focused on the financial services sector, most recently in the FIG mergers and acquisitions team at Jefferies in London. Alex was a Non-Executive Director of London & Continental Railways Limited from 2018 to 2021.

External appointments:

Alex is a co-opted member of the Investment Committee of the Charity for Civil Servants.

Board members who served during the year:

Volker Beckers

Non-Executive Board Member

(June 2015 to October 2022)

Board skills and experience:

After starting in the IT sector, Volker worked as a senior leader in RWE’s regulated and non-regulated divisions internationally, grid (transmission and distribution level), retail, generation (including nuclear, conventional and renewable energy) and midstream businesses. Volker was Group Chief Executive Officer of RWE Npower plc until the end of 2012 and prior to this, its Group Chief Financial Officer from 2003 to 2009.

External appointments:

Volker holds non-executive roles in the public and private sector as well as academia and charities.

Mel Zuydam

Executive Director: Group Chief Financial Officer until 31 March 2023. Mel was also a member of the Executive Leadership Team.

Board skills and experience:

Prior to joining the NDA, Mel worked across the private and public sector, including as a Listed Company Chief Financial Officer in Europe-wide engineering consulting group Sweco, and with organisations including Balfour Beatty, CH2M, and The Highways Agency. He was also Chief Financial Officer with private infrastructure investors, such as Singapore Sovereign Wealth Fund GIC and JP Morgan Infrastructure Fund. Mel is a member and fellow of the Institute of Chartered Accountants of England and Wales.

External appointments:

Mel is a trustee of Mercy Ships UK.

Executive leadership team

David Peattie

Group Chief Executive Officer and Accounting Officer

Kate Bowyer

Group Chief Financial Officer

Alan Cumming

Group Chief Operations and Performance Improvements Officer