[ad_1]

As an overview, NAV based financings involve funds borrowing from an external financing provider against the value of their investment portfolio.

In our experience, there are a number of ways the funds borrowed might be used, including:

- generating a liquidity event for investors in the fund in advance of the actual commercial disposal of underlying investments. This could take place, for example, where there is a reluctance to sell a particular investment due to the potential for further upside; or

- providing follow-on funding to a portfolio company, where (for example) investor commitments have been fully drawn.

These transactions pose a number of tax and structuring considerations, several of which we summarise below.

Using an SPV

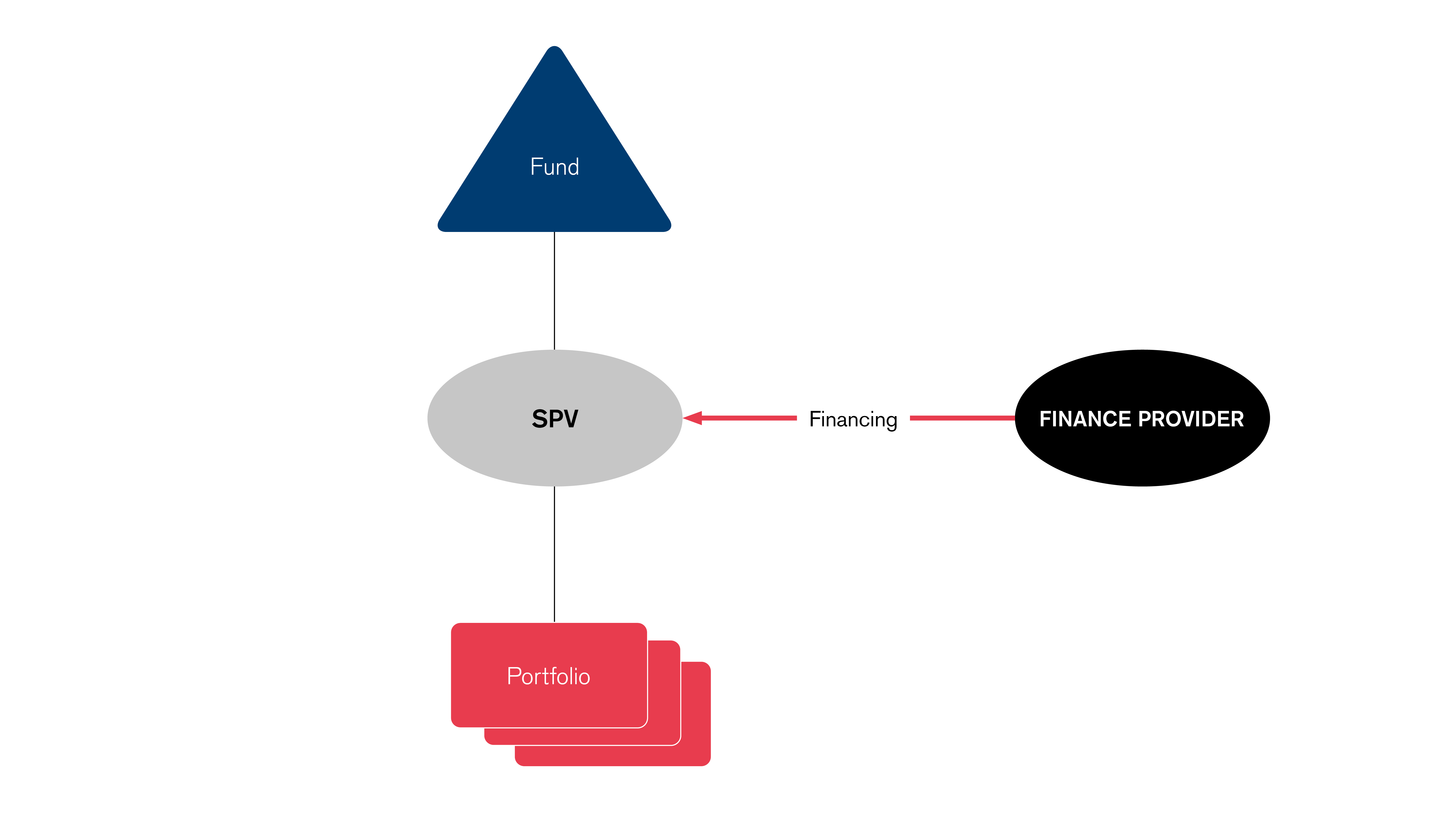

For both the lender and borrower, it is usually necessary to interpose a new vehicle (SPV) between the fund and the assets against which the financing is being provided. The SPV will be the vehicle to which the funds are advanced.

There are a few reasons for this:

- to produce a single borrower entity (this will be required where, for example, the fund’s investment assets are split between a number of parallel fund vehicles);

- to segregate assets within the financing perimeter from those outside it; and

- to simplify the legal arrangements with the finance provider.

A simplified diagram of the resulting structure is shown here:

Initial contribution of assets

Since an SPV is usually required, a NAV financing will typically require the fund to make an initial contribution of the relevant portfolio assets to the SPV.

This can give rise to several tax and non-tax considerations, including:

- from the perspective of fund investors, the tax treatment of the contribution transactions (e.g. whether any dry tax charges might be triggered);

- whether any portfolio level taxes will apply, such as transfer taxes or non-resident capital gains taxes; and

- portfolio level legal issues, such as whether any regulatory change in control consents are triggered by the contributions.

Choice of vehicle: partnership or company?

An important part of structuring a NAV financing is choosing the legal form of the SPV entity, which will typically be either a limited partnership or a corporate entity.

With a partnership SPV, there should be fewer tax implications for the SPV itself (compared to a corporate) because the partnership should not be subject to entity level taxes. However, a corporate SPV may be chosen to simplify tax reporting or to avoid investor tax issues linked to partnership borrowing (this is discussed further below).

The choice of SPV is also likely to impact the tax analysis applicable to the initial contribution of assets to the vehicle – in particular, whether these contributions will be tax neutral for fund investors.

The lender’s interest: preferred equity or debt?

There are also several tax considerations that flow from the structure of the finance provider’s interest in the SPV, and in particular whether this is structured as a simple loan or a preferred equity interest.

A loan may be simpler to implement, but there are downsides to this approach from a tax perspective. For example, a UK tax deduction will not be available in respect of interest on the loan for UK resident individuals in the fund, and there may be other investor level tax issues (including the potential for UBTI generation for US tax exempt investors).

If the finance provider instead takes a preferred equity interest in the SPV, this may be preferable for investors, as (for example) an effective UK tax deduction should be available for UK resident individuals on the finance costs. However, this approach can make executing the transaction more complex, because a finance provider will typically require greater contractual protection in respect of the activities of the SPV (given that it will be a partner in this vehicle). For example, within the SPV documentation they might require:

- protection against tax filing obligations being triggered as a result of investing in the SPV; and

- the right to receive specific information to fulfil their own tax reporting obligations.

Impact on carry holders

The potential impact of the transaction on executives holding an entitlement to carried interest in the fund should also be analysed, particularly where the NAV financing partially funds a carry distribution.

A key point that comes up in practice here is the timing of the tax charge arising in respect of the carry distribution and how this interacts with the borrowing and subsequent disposal of assets. A borrowing-funded carry distribution will usually give rise to a tax charge under the UK carried interest rules, but there is then a question as to whether (and how) double tax relief can be accessed when the relevant investments are disposed of and profits are generated that are allocable to carry holders.

In practice, we find that this issue can be successfully navigated but it is important to ensure the analysis has been properly considered.

Conclusion

NAV financings can give rise to a host of tax and structuring considerations for a fund manager. These need to be carefully worked through, given their potential effect not only on the financing transaction but also the tax treatment of investors and carry holders. The Macfarlanes Tax group has advised on a number of these transactions from the perspective of both finance providers and fund managers. If you would like to discuss any of the issues raised in this post, please do not hesitate to get in touch.

[ad_2]

Source link