[ad_1]

Jacopo M. Raule

Here at the Lab, it is already the second time we have covered Natuzzi S.p.A. (NYSE:NTZ) over the last trailing twelve months. As a reminder, the company is engaged in the design, production, and marketing of leather and fabric upholstered furniture. Natuzzi currently employs its activities in two divisions: Natuzzi brand and Private label with unbranded products sold in North America, EU, Brazil, and APAC. The company’s range of products covers almost two million combinations, including sofas and armchairs collection. In our initiation of coverage called ‘a Pass for Now‘, we emphasized a few risks that are currently happening. We called this publication All The Chickens Coming Home To Roost.

In detail, Natuzzi 2026 strategic business plan laid the foundations of the company’s recovery with the Italian Ministry of Economic financial support. This was also due to mitigating redundancies in a region with one of the highest unemployment rates. Last time, we reported how downside risks were equally important, and even if the Italian Unions were favorable to the plan, Natuzzi would likely risk not using the government’s financial support.

Recently, the Ministry for Business and Made in Italy (MIMIT) announced postponing a series of investments in Natuzzi’s business plan. Last March, the non-payment by Invitalia of the €4 million activated an immediate alert on trade unions. The MIMIT control room will meet again in June, but Q1 financial figures are worrying in the meantime.

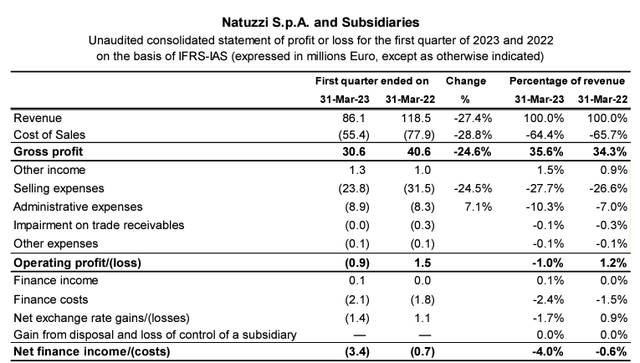

In early June, the company reported its quarterly results, and top-line sales declined to €86.1 million in the three months between January and March. The turnover is down from €118.5 million achieved in Q1 2022 and €106.2 million during pre-COVID-19.

2023 opens with a big question mark in Natuzzi’s house. The upholstered furniture multinational asked for an extension of the Extraordinary Redundancy Fund for 460 workers. And this is still pending. At a global level, the furniture sector is going down from the impressive phase that started after COVID-19 in 2021. This has created growth, but it has also led to an unprecedented excess of inventories at the various levels of the supply chain. This weaker economic scenario confirms the importance of a new strategic plan to ensure tight control over discretionary costs and a more effective capital allocation. Natuzzi should increase efficient CAPEX on factory modernization and new store openings in key markets.

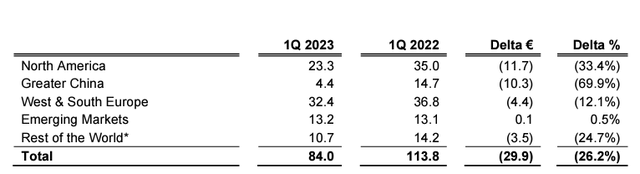

Natuzzi key market breakdown Q1 2023

Regarding the P&L analysis, Natuzzi’s financials are less rosy than anticipated. We can see a minus sign on all ratios in 2023 Q1. Rising inflation is not helping the company’s income statement, and sales are slowing down sharply in the United States and China, as also recalled by the CEO Antonio Achille’s Q&A call. In the North American area, Natuzzi is reorganizing the commercial structure with a new manager, Scott Kruger. In China, on the other hand, the goal is to support local franchise partners to improve sales performance.

Natuzzi Q1 Financials in a Snap

Conclusion and Valuation

The CEO confirmed that the context in which Natuzzi is “operating continues to be challenged.” The company had lower cash from €54.5 million to €43.8 million. In addition, Natuzzi is suffering from higher interest rates, which negatively impact the company’s P&L. On a negative note, given the US market is a crucial area, FX (€/$ evolution) will increase the exchange rate loss. On an EPS basis, Natuzzi is already in negative territory. To this are added the unknown activities from the MIMIT, and without a doubt, we can conclude that the company is in a delicate and complex situation. We know that Natuzzi is currently trading at a depressed valuation; however, we are still not confident about the next twelve-month time horizon. Last time, we concluded that the company would likely face profitability pressure. And this is what happened. Therefore, we confirm our “hold” rating on NTZ stock at €7 per share.

Mare previous analysis

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

[ad_2]

Source link