[ad_1]

Liberal Democrats: emergency mortgage protection fund needed

Sir Ed Davey, leader of the Liberal Democrats, is calling for a £3bn emergency mortgage protection fund to protect people who would otherwise be repossessed.

Speaking on Radio 4’s Today programme, Davey says the government should provide the kind of help that was available after the last financial crisis.

Davey explains:

We’ve already seen the number of people’s homes been reposessed going up massively – surging by 50% in the latest quarter, and my worry is that we’re going to see lots of other families losing their homes, and we could be in a spiral of repossessions.

The banks have got to play a bigger role. They need to step in and help people who are in trouble.

But just as there was before, there needs to be more protection for those who are really suffering and the government just aren’t doing that.

Q: But this would be regressive – people who don’t own homes shouldn’t support those who do? It would heat up demand, when the Bank of England is trying to cool it, and aren’t there better uses of public money? Plus, lax monetary policy has helped people who own assets…

Davey says the Lib Dems’ proposal is “quite targeted and time-limited” and it will get help to people who would otherwise lose their homes.

If we don’t give that sort of help to those people, you’d see a spiral down and it will hit the whole economy.

He adds that there also needs to be more support for carers, and for renters “who are getting a really poor deal”.

Davey argues that MPs should spend next Monday debating the cost of living crisis, not all day debating Boris Johnson following yesterday’s privileges committee report.

Davey says:

We should spend the day thinking about how we help people, whether it’s the Liberal Democrat idea of a mortgage protection fund, our proposals to help people with energy bills…

We need to help people. Families and pensioners, millions of them are struggling and the Conservatives are just failing because of their chaos.

Q: You’re proposing spending £3bn to help people who borrowed to buy homes, when many people can’t afford to, and younger people are looking forward to a housing crash so they can get onto the housing latter. What does that say about your priorities?

Davey says the Liberal Democrats want to reverse the tax cuts given to the banks in the last few years, and use some of that extra money to help people who would otherwise lose their homes.

This isn’t their only policy, he points out – citing the need to invest in the health service so the UK has enough GPs, and to tackle the wider cost of living crisis.

But if we don’t tackle the mortgage crisis, it’s going to see a spiral downwards.

Key events

A support package for mortgage holders would be a mistake, says Tim Pitt of consultancy Flint, a former senior adviser to former chancellors Philip Hammond and Sajid Javid.

Pitt argues it would undermine the transmission of monetary policy (the process by which higher interest rates reach the economy), would unfairly help wealthier people, distort the housing market, and be a poor use of fiscal resources.

Large scale Covid and energy support packages were the right policy response. But they have cemented the idea that the government can and should act to take away all economic pain. It can’t and shouldn’t.

Short🧵w/ 4 reasons why subsidising mortgage payments is a terrible idea: https://t.co/FrBO7wmDTe

— Tim Pitt (@TimPitt11) June 15, 2023

1/ Inflation. Mortgage payments are one of the main transmission mechanisms the Bank of England has to cool demand. Subsidising mortgage payments acts against that, making it harder to get inflation down. This is terrible economics and bad politics.

— Tim Pitt (@TimPitt11) June 15, 2023

2/ Distributional. Less wealthy non-homeowners should not be subsidising wealthier homeowners – particularly during a cost of living crisis.

— Tim Pitt (@TimPitt11) June 15, 2023

3/ Market distortion. Cheap money has fueled a house price boom, meaning home ownership is out of reach for too many. Subsidising mortgage would keep house prices artificially high, with various negative knock on consequences.

— Tim Pitt (@TimPitt11) June 15, 2023

4/ Fiscal. I couldn’t possibly do a thread without mentioning the dire state of the public finances. This would be a very bad use of very scarce fiscal firepower.

— Tim Pitt (@TimPitt11) June 15, 2023

Sharp mortgage increases are going to be very painful for millions, and politically very difficult for the Tories. But the politics and economics of intervening would be much worse / ENDS

— Tim Pitt (@TimPitt11) June 15, 2023

Deutsche Bank expects the Bank of England to hike Bank Rate for a thirteenth consecutive meeting next Thursday, by a quarter-point to 4.75%.

But the decision by the monetary policy committee probably won’t be unanimous; they predict a 7-2 vote tally, with both Silvana Tenreyro and Swati Dhingra voting to keep rates on hold.

Deutsche then expect two further rate hikes taking Bank Rate to 5.25% in September, before a pause in November.

Senior economist Sanjay Raja explains:

Inflation, we think, will continue to remain volatile and skewed to stronger prints in the near-term.

And the labour market will also likely remain hot in the very near-term as the ONS incorporates more of the forthcoming pay deals into the hard data. We do, however, see downside risks emerging from late Q3 to early Q4, allowing the MPC to push the pause button at the November meeting.

If mortgage rates do hit 6% thent homeowners will be spending 23.6% of their incomes on mortgage repayments, the most since 1991, Neal Hudson, a property market analyst at BuiltPlace, has calculated (via The Times).

He’s also made this excellent chart, showing how effective mortgage costs are close to their levels in the 1980s even though interest rates are lower:

(because mortgage are much bigger today, meaning repayments are a large bite of income).

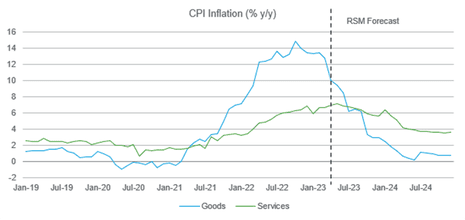

RSM predicts UK interest rates will peak at 5%

Economists at RSM, the accountancy group, have predicted this morning that UK interest rates will peak at 5%.

That’s half a percentage point higher than today, but lower than the 5.75% peak currently implied in the money markets.

RSM argue that falling fuel, energy and food prices on the international markets will pull UK inflation down to 4% by the end of this year (hitting the government’s target of halving it).

That means the case for further rate hikes becomes a bit less convincing, argues RSM economist Thomas Pugh.

He says:

‘Another two interest rate hikes seem likely, which would take interest rates to 5%. It would, therefore, seem sensible for the MPC to take a hawkish pause in much the same way that the Fed did on Wednesday. This would allow the MPC to examine the impact of its previous rate hikes, while giving it the option to hike further if needed.

‘As it happens, we think by September it will become clear that inflation is on a steep downward track and that enough slack has emerged in the labour market for the MPC to stop its tightening cycle at 5%. However, the risks are definitely weighted toward intertest rates going higher.

Financial markets are probably “over-egging” the chances that rates reach 6%, Pugh says, cautioning “but don’t rule it out”….

Homeowners are spending a bigger slice of their income on mortgage repayments than at any time since the financial crisis of 2008 as rates continue to rise towards 6%, The Times reports this morning.

They explain:

Mortgage repayments on new loans made up 20.4 per cent of borrowers’ incomes on average between January and April, according to the trade association UK Finance.

This is up from under 17 per cent in 2020 and the largest percentage since November 2008.

Aaand @resi_analyst tells me homeowners are poised to spend the greatest % of income on mortgage repayments (23.6%) since 1991 if rates hit 6%.

New data from UK Finance out today showed repayments reached a 14-year high of 20.4% between Jan and Aprilhttps://t.co/oVxdbA8Fip

— George Nixon (@George_Nixon97) June 15, 2023

Retailer Tesco says Britain has passed peak food inflation

There are “encouraging early signs” that food price inflation is starting to ease, according to the boss of Tesco.

Tesco CEO Ken Murphy told reporters this morning:

“We do believe that we’re past the peak inflation.”

That would cheer the Bank of England, as it weighs up how high interest rates must rise to fight the cost of living crisis.

Murphy also claimed the BoE has been unfair in blaming supermarkets for Britain’s stubbornly high inflation level.

Asked if he believed the Bank of England was being unfair in calling out the industry, Murphy said: “Yes I do.”

Murphy was speaking after Tesco reported a 9% rise in UK sales in the 13 weeks to 27 May.

Britain’s largest supermarket says it has “led the way” in cutting prices on everyday essential items, amid criticism of the retail sector for price rises.

No signs of “greedflation” in Tesco’s results. Like-for-like sales grew by 8.8% in the quarter. But it’s clearly absorbing some of the higher prices to maintain market share. Profitability took a hit.

— Ben Wright (@_BenWright_) June 16, 2023

Travis Perkins warns on profit as high interest rates hit housing market

UK building supplier housebuilder Travis Perkins has warned its profits will miss expectations, in a sign that difficulties are building in the UK housing market.

Travis Perkins has 1,400 branches around the UK, and says it is the country’s largest distributor of building materials, supplying cement, bricks, roof tiles, tools, plumbing, heating kit and electricals products to constructors.

But this morning, the company warns that the housing market is being hit by higher interest rates and weaker consumer confidence.

In light of ongoing challenging market conditions, full year adjusted operating profits are now expected to be around £240m, missing the £266m which the City expected.

It told shareholders:

The Group delivered a resilient performance in the first quarter but has not seen the anticipated easing of market conditions in the second quarter to date.

Volumes in both the new build housing and private domestic RMI [repair, maintenance, and improvement] markets continue to be impacted by higher interest rates and weaker consumer confidence driven by persistent, higher than anticipated consumer price inflation.

Travis Perkins warns on profit 👇

“Travis said the jump in mortgage rates and ongoing high levels of inflation meant that the construction industry was holding back in building new homes.”https://t.co/4lg24Q0MiW

— Andy Bruce (@BruceReuters) June 16, 2023

Shares in Travis Perkins have fallen over 6% in early trading, while housebuilder Barratt Development has dipped 1.5%.

In the City, the pound has hit a new one-year high above $1.28 agains the US dollar.

The rally, to the highest level since April 2022, comes as traders anticipate further increases in UK interest rates, while America’s central bank paused its rate increases on Wednesday.

Explainer: What could government do to help mortgage borrowers?

My colleague Hilary Osborne has examined what support the government could prove.

It could, for example, widen the existing support for people on benefits who are struggling to meet their monthly mortgage payments.

Tax relief on mortgage payments could potentially be brought back, which would provide financial relief to borrowers, or lenders could be urged to exercise more forbearance rather than repossessing homes.

Or (and this is rather unlikely), the government could take control of interest rates back off the Bank of England. At this stage, though, the government has been backing the BoE as it tries to tame inflation.

Here’s the full piece:

Atom Bank says more support needed, as it raises rates

Atom Bank is also lifting its mortage rates today – by between 0.25% to 0.6% on certain products.

Mark Mullen, Atom’s chief executive, says the bank raised rates because the financial markets are pricing in further increases in Bank of England base rate.

Mullen isn’t sure that UK interest rates will hit 6%, as some have forecasts, but believes we are in a higher rate environment:

I think that the current interest rate environment is likely to remain there-or-there abouts where we are today for much longer than perhaps people might wish.

Q: So do home owners and borrowers need support, as the Liberal Democrats are calling for?

Mullen says they do, adding that support can take many forms.

As well as the interest rate environment, but also, “what are banks doing to help them in their savings rates?” and are they helping customers before they miss mortgage repayments, Mullen asks.

So there’s lots that banks can do, but sure, they absolutely needs support.

Q: But when public finances are strained, is it right to give money to people who have borrowed money to buy a house?

Mullen warns that people who took out mortgages a few years are going to “get a shock” when they remortgage, and move onto a rather higher rate.

The reality is there’s pain all around in a high-inflationary environment.

Liberal Democrats: emergency mortgage protection fund needed

Sir Ed Davey, leader of the Liberal Democrats, is calling for a £3bn emergency mortgage protection fund to protect people who would otherwise be repossessed.

Speaking on Radio 4’s Today programme, Davey says the government should provide the kind of help that was available after the last financial crisis.

Davey explains:

We’ve already seen the number of people’s homes been reposessed going up massively – surging by 50% in the latest quarter, and my worry is that we’re going to see lots of other families losing their homes, and we could be in a spiral of repossessions.

The banks have got to play a bigger role. They need to step in and help people who are in trouble.

But just as there was before, there needs to be more protection for those who are really suffering and the government just aren’t doing that.

Q: But this would be regressive – people who don’t own homes shouldn’t support those who do? It would heat up demand, when the Bank of England is trying to cool it, and aren’t there better uses of public money? Plus, lax monetary policy has helped people who own assets…

Davey says the Lib Dems’ proposal is “quite targeted and time-limited” and it will get help to people who would otherwise lose their homes.

If we don’t give that sort of help to those people, you’d see a spiral down and it will hit the whole economy.

He adds that there also needs to be more support for carers, and for renters “who are getting a really poor deal”.

Davey argues that MPs should spend next Monday debating the cost of living crisis, not all day debating Boris Johnson following yesterday’s privileges committee report.

Davey says:

We should spend the day thinking about how we help people, whether it’s the Liberal Democrat idea of a mortgage protection fund, our proposals to help people with energy bills…

We need to help people. Families and pensioners, millions of them are struggling and the Conservatives are just failing because of their chaos.

Q: You’re proposing spending £3bn to help people who borrowed to buy homes, when many people can’t afford to, and younger people are looking forward to a housing crash so they can get onto the housing latter. What does that say about your priorities?

Davey says the Liberal Democrats want to reverse the tax cuts given to the banks in the last few years, and use some of that extra money to help people who would otherwise lose their homes.

This isn’t their only policy, he points out – citing the need to invest in the health service so the UK has enough GPs, and to tackle the wider cost of living crisis.

But if we don’t tackle the mortgage crisis, it’s going to see a spiral downwards.

Introduction: Mortgage rates move towards 6%

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

UK mortgage rates are heading towards 6% as the squeeze on borrowers tightens – prompting calls for the government to provide emergency help.

The average rate on a two-year fixed mortgages rose to 5.92% yesterday, up from 5.9% on Wednesday, and 5.26% at the start of last month.

Average five-year fixed rate mortgage rates hit 5.56 per cent, up from 5.54% 24 hours earlier – and 4.97% at the beginning of May.

Nationwide, the building society, is joining the rush to raise rates today – increasing its new fixed rates by up to 0.7 percentage points.

These moves come as City traders predict UK interest rates could hit 5.75% by the end of this year, up from 4.5% today. The Bank of England seems certain to raise interest rates next week.

The yield (or interest rate) on two-year government bonds – used to price fixed-term mortgages – is trading at 15-year highs this week.

UK inflation taking ‘longer than expected’ to cool down🚨🧵

Two-year gilt yields on Tuesday rose 0.26 points to 4.89%, compared with their peak of 4.64% in late Sept.

Markets expect the BoE to increase rates from 4.5% to 5.76%.$FTSE $SPX $QQQ $BTC $AMD pic.twitter.com/yLkp0kNeGJ

— Kapoor Kshitiz (@kshitizkapoor_) June 13, 2023

Although rates are below their levels before the 1990s housing crash, mortgages today are much higher – and mortgage payments make up a larger slice of people’s income.

So, the squeeze is already the worst since the early 90s, analysts say:

Not pretty.

Right now, based on rates currently available, those refixing or taking out new loans are entering the biggest mortgage squeeze since 1991.

This is not a projection. It’s happening RIGHT NOW.

NB the ’91 mortgage squeeze contributed to a mammoth housing crash/recession pic.twitter.com/mktnI8rxfa— Ed Conway (@EdConwaySky) June 14, 2023

The Liberal Democrats are calling for an emergency support fund for mortgage borrowers, which would provide temporary grants to those most at risk of losing their homes.

Liberal Democrat Treasury spokesperson Sarah Olney MP said earlier this week:

“This Conservative government has unleashed mortgage hell for millions of homeowners but isn’t lifting a finger to help.

“Rishi Sunak is totally out of touch with the concerns of people across the country worried sick about how they will afford their monthly mortgage payments.

“The Prime Minister should haul the banks into Downing Street and discuss what extra support can be given to homeowners on the brink. The very least that Conservative Ministers should do is take responsibility for the mess they’ve created instead of sitting on the sidelines.”

The inflation squeeze in the eurozone prompted the European Central Bank to lift its interest rates again yesterday.

But earlier today, the Bank of Japan maintained its ultra-easy monetary policy even though Japanese inflation is higher than expected. The BoJ signalled it would focus on supporting Japan’s fragile economic recovery, and remains confident that inflation will slow later this year.

European stock markets are set to open a little higher:

The agenda

[ad_2]

Source link