[ad_1]

Payrolls more than solid enough, challenging views of imminent rate cuts

Todays podcast

- Payrolls more than solid enough, challenging views of imminent rate cuts

- Risk appetite recovers, Apple beats, and short-covering in regional banks

- Yields higher led by the short end, but overall moves contained

- This week: AU Budget, BoE (25bp), US CPI, CH Trade & Credit, Earnings

- Coming up today: NAB Survey, ECB’s Lane, US Loan Officers Survey

“We wait. We are bored. No, don’t protest, we are bored to death, there’s no denying it”, Vladimir, Waiting for Godot, Samuel Beckett 1953

The ‘Godot recession’ strikes again with US payrolls printing much better than expected (253k vs. 185k expected; albeit with sizeable downward revisions to the prior months), the unemployment rate falling (not rising, at 3.4% vs. 3.6% expected). The rub for markets though was average hourly earnings (0.5% vs. 0.3%) which suggests hopes for immaculate disinflation are so far misplaced, and is a challenge to market views of aggressive rate hikes outside of expectations of greater financial spill overs from the regional banking crisis. Not it wasn’t only in the US with strong jobs data, Canada also reported a bumper number. For those not versed in Beckett’s 1953 play, Godot never came. As an aside, regional Fed President Bullard made a similar quip on Friday, invoking Mark Twain: “The imminent demise of the U.S. economy is greatly exaggerated ”.

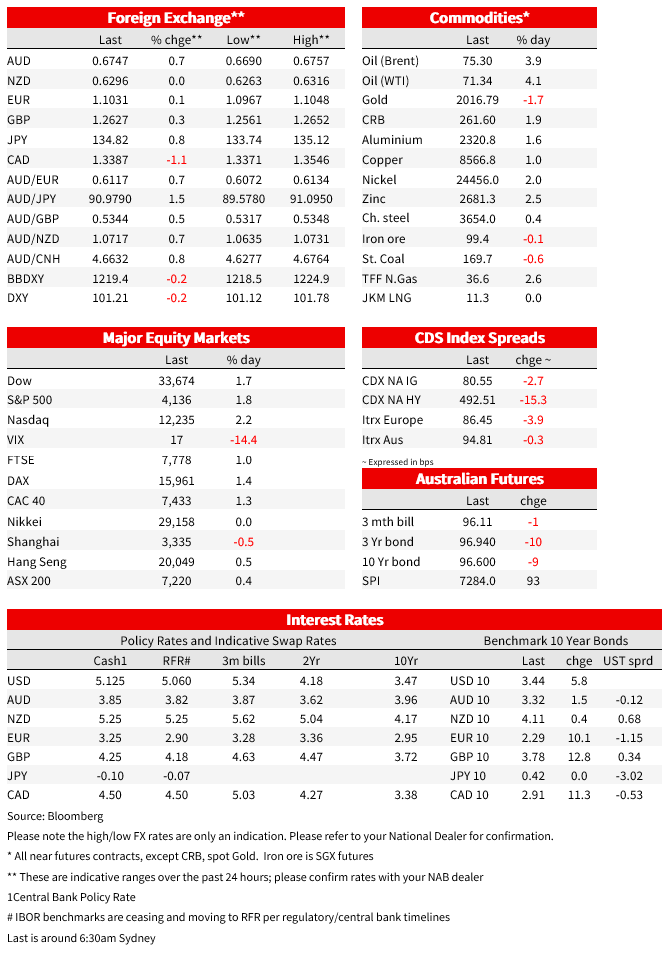

As for market moves, yields rose, though with a tightening in credit conditions in train and Fed talk appearing less hawkish the moves were contained. The US 2yr yield rose 11.9bps to 3.91% and the 10yr yield also rose 5.9bps to 3.44%. North of the border the Canadian 10yr rose 11.3bps to 2.91%. Markets pushed back out cuts for the US Fed with 74.9bps worth of cuts now priced in H2 2023, compared to 86.8bps the day prior. Big moves were seen in oil (Brent +3.9% to $75.30) and in gold (-1.7% to $2,016). Equities soared, though due to a variety of reasons. Apple (+4.7%) reported better than expected results post-close Thursday, and the KRE regional bank ETF soared 6.3% on little news and with PacWest up 81.7% short-covering ahead of an uncertain weekend the obvious driver. The overall S&P500 rose 1.8%, though closed the week -0.8%. Equity strategists continue to warn of the lack of breadth for the rally in 2023 with the five mega tech stocks fully accounting for the rise in the S&P500 given their 22% weight in the index.

As for FX, the USD (DXY) was slightly weaker at -0.2%, as it gave up its payrolls rally which initially saw it rise 0.4%. EUR was +0.1%, GBP was +0.3%, and USD/Yen+0.8% given the yield moves. The standout move was the Canadian dollar, buoyed by the outsized rates move on the back of strong Canadian jobs data and the recovery in oil prices, which saw USD/CAD -1.1%. The AUD also had a strong day, up 0.7% and starts the week at 0.6747.

First to US payrolls which came in stronger than expected, along with a hot average hourly earnings print. Headline payrolls were 253k vs. 185k previously, though the prior two months were revised down by a combined 149k (Feb payrolls now 248k, Mar payrolls now 165k). The unemployment rate fell to 3.4% where it was expected to rise to 3.6% from 3.5%. Notably average hourly earnings printed hot at 0.5% m/m vs. 0.3%. The data overall are consistent with a still tight labour market, and should push back hopes for immaculate disinflation. Under the hood, temporary-help jobs did fall for the third straight month, though it is unclear whether it is giving the same immediate recession signal given there is still 1.6 job openings for every unemployed person. The Fed will get another report before the next June FOMC. A hot labour market was also seen in Canada with headline employment 41.4k vs. 20.0 expected, unemployment stayed at 5.0% vs. 5.1% expected, and hourly wages for full time rose to 5.2% y/y vs. 4.8% expected.

Fed speak appeared to be less hawkish on net. Bullard (non-voter) who was being interviewed said he was willing to assess the economic data as it comes in, but would need to see “meaningful declines in inflation” to be convinced higher rates aren’t necessary. In Bullard’s words “the aggressive policy we pursued in the last 15 months has stemmed the rise in inflation, but it is not so clear we are on” a path to 2%” and that “this is a very tight labour market. It’s going to take a while to cool it off”. Bullard is still of the view that the economy can achieve a soft landing. Meanwhile Goolsbee (voter) remained much less hawkish, noting that “ we know that credit conditions, like the ones we’re seeing now, in the past have been correlated with recessions, credit crunches — kind of done the tightening work of monetary policy” and “we’ve got to be data-dependent.” And that with tighter conditions set to slow the economy “it has to give you some pause” about raising rates further.

On the US debt ceiling, the Administration is weighing a short-term extension to keep negotiations going. However, it is unclear what concessions would be give to get a short-term extension across the line. Rhetoric remains high and Politico reports 43 Senate Republicans backed House Republicans in saying they would not consent to passing a debt ceiling increase without “spending cuts and structural budget reform.” (see Politico: No good options if Congress fails to raise the debt limit, Yellen says ). Recall Treasury Secretary Yellen said X-date, when the US runs out of emergency measures, may come as soon as 1 June. T-bills continue to have a 60-90bp premium for those maturing in June and July, reflective of tensions within in markets.

Finally in Australia, on Friday the RBA’s May SoMP revealed the risks around the inflation forecasts are asymmetric in 2023 and heavily reliant on the resolution of supply disruptions. Core trimmed mean inflation is still only expected to get to 2.9% by mid 2025, even with a cash rate peak of around current levels before declining to around 3% by mid-2025. That leaves the RBA very vulnerable should the resolution of supply disruptions take longer than expected, or should domestic inflationary pressures pickup more on the back of higher than expected wages and/or lower than expected realised productivity growth. On the growth outlook, forecasts were revised down a little in the near-term (Dec 2023 1.2% y/y from 1.6% previously) despite higher population growth. The risk remains that the RBA will have to hike one or two times more (see NAB note: AUS: US: SoMP says more tightening may be needed, while inflation forecasts seem too reliant on the resolution of supply chains).

This week:

- Australia: Attention shifts to fiscal policy with the Federal Budget unveiled at 7:30pm on Tuesday. Along with headlines, there will also be focus on what this may mean for monetary policy. We expect a sharp improvement in budget revenues from the strong labour market and elevated commodity prices, meaning a small $0-5bn surplus is possible, before underlying structural pressures see a rewidening to a deficit of something like -$15-30bn in subsequent years Media briefing is broadly consistent with this with The Australian stating “ with booming revenue putting the budget into surplus for the first time in 15 years”. As for the heavy lifting in the fight against inflation, it is likely to continue to fall to the RBA. Elsewhere in the week, the NAB Business Survey is in focus today. Other data out includes Consumer Confidence, Q1 Retail Volumes and Building Approvals. Also worth a look are bank earnings, with Westpac on Monday and CBA providing a trading update on Tuesday.

- Offshore: A few key events this week, though US regional bank developments will dominate: (1) US Senior Loan Officers Survey takes top billing to judge how much credit conditions are tightening on the back of recent ructions, but as Fed Chair Powell noted it is unclear how large an impact it will have on activity and inflation. We may have to wait for a few months to judge the fallout. Outside of a larger financial shock it is hard to see the 75bps worth of cuts priced by the market for H2 2023; (2) The BoE meets and is expected to hike by 25bp. Focus will be on the path going forward amid signs of entrenched inflation given ongoing elevated wages growth. Markets currently price a follow up hike by August; (3) US CPI to judge the pace of inflation. We are mindful that CPI rental growth should start to ease given asking rents; and finally (4) China data on trade and credit given uncertainty around the pace of growth on after the manufacturing PMI recently printed below 50.

Coming up today:

- AU: NAB Survey & Building Approvals: The NAB Business Survey is being released a day earlier than usual given the Australian Federal Budget on Tuesday. No hints here. As for Building Approvals, we see a 5% m/m rise, broadly in line with the consensus of 3.0%.

- EZ: ECB’s Lane & Sentix Sentiment: The ECB’s Chief Economist Lane is giving a keynote speech. Also out is German Industrial Production for March.

- US: Senior Loan Offices Opinion Survey: The survey of lending practices which may give a guide to what extent credit conditions are tightening in the wake of US regional bank ructions. Fed Chair Powell who was privy to the results noted in his post-FOMC presser that “small- and medium-sized banks [are the ones] who are feeling that they need to tighten credit standards, build liquidity. What’s going to be the macroeconomic effect of that?”. As for Fed speak, Kashkari is moderating a panel on the minimum wage.

Market Prices

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets. Read our NAB Markets Research disclaimer.

[ad_2]

Source link