[ad_1]

Weak US Manufacturing survey data overnight reversed the impact of higher oil prices, leaving bond yields lower and the AUD higher. It’s all about the RBA today

Todays podcast

- Weak US manufacturing ISM trumps much higher oil prices…

- …to leave bond yields lower on the day as recession views strengthen

- 5% energy sector gains puts S&P500 (just) in the green

- USD lower, led by strong gains for commodity currencies (AUD +1.5%)

- RBA today. Market says they’ll pause, economists divided

Sunday’s news of a surprise 1.15 million bpd cut to OPEC oil production starting in May, on top of Russia’s already planned 500,000 bpd cut, had seen equites lower, bond yields higher and the oil sensitive NOK and CAD stronger during the APAC session. Overnight, a weaker than expected US Manufacturing ISM has seen the rise in bond yields more than fully reversed as recession fears take a tighter grip, even though oil prices have retained the bulk of Monday’s APAC session gains.

The USD is weaker against all G10 currencies, down the best part of 0.5% in index terms, with gains led by NOK (1.75%) and AUD (1.6% to now be looking up at 0.6800) the latter somewhat surprisingly outpacing CAD but is often the way when the USD is weakening, oil price strength notwithstanding. All about the RBA today of course, where markets continue to attach only a very small chance to a rate hike, unlike a divided economics community where the Bloomberg survey shows 19 of 30 respondents seeing a hold and 11 of the 30 for +25bps,. NAB is in the latter camp but acknowledges it’s a line ball call.

The US manufacturing sector may represent little more than 10% of the US economy, but it punches well above its weight when it comes to market attention and impact (and where scribes as old as this one were brought up to believe that where goes the manufacturing economy, so goes the rest of it). The headline index fell to 46.3 from 47.7, below the 47/5 consensus estimate (lowest since May 2009 if we exclude the early covid era plummet). Among the main sub-indices, new orders were down 2.7 points to 44.3 and inventories down 2.6 points to 47.5. Employment slumped to 46.9 from 49.1, in which respect ISM economist Tim Fiore, commenting on the report, is quoted saying “Companies are taking a much more conservative look than where they were in January in February and they’re deciding that they need to bring that headcount down.” Prices Paid fell back below 50 (49.2) partially reversing a recent blip up, suggesting goods prices are back in disinflation territory.

The Services ISM equivalent on Wednesday will, realistically, be more telling about the state of the US economy (and inflation) than last night’s release, but that hasn’t stopped markets from lifting its US recession probabilities, something to which higher oil prices were already contributing earlier Monday. This was alongside concerns about their inflationary impact and how that might further impede any instinct by monetary policy makers to cut rates if recession is indeed shortly to be upon us, in the US or elsewhere. Based on the moves in oil prices (so far) those concerns look overdone but will be much less so if oil pushes up closer to $100 in coming months .

Also of note last night was the Dallas Fed Banking Conditions survey . While not nearly as wide-ranging as the Fed’s Senior Loan Officer Opinion Survey (SLOOS) where the next quarterly report should be out in early May, the survey showed only a modest net tightening in credit standards and some limited further deterioration in loan demand. The survey data was collected Mar 21-29 (so post SVB, etc.) from 71 financial institutions based in the Dallas Fed district. Credit standards were tightened across a net 36% of respondents versus 30% six weeks ago, but which still puts conditions slightly easier than they were back in November 22 (37.5%).

Elsewhere Monday, households and business surveyed by the Bank of Canada shows a majority of firms continue to see inflation running much faster than 2% until at least 2025. The separate survey of household showed then seeing the current inflation rate at 7.1% and at 6% in a year. Following the reports, markets have somewhat pared back the BOC rate cutting expectations embedded in money market pricing.

US equity markets have finished the New York session with the S&P500 up 0.4%, almost entirely down to a 4.9% gain for the Energy sub-sector. The other nine sector are more narrowly mixed, Healthcare the only other one showing a gain of more than 1% (1.1%) and four sectors in the red (Consumer Discretionary stocks faring worse (-0.9%) consistent with somewhat heightened recession gear. The NADSAQ ended 0.3% lower, while European indices earlier finished narrowly mixed.

In Treasuries, 5-6bps gains across the curve during the Tokyo session have morphed into equivalent falls on the day post the ISM report (2s -6bps, 10s -5bps).

In FX as of NY close, both the DXY and BBDXY USD indices are 0.4% down on the day, with NOK (1.6%) and AUD (1.5%) vying for top spot. Though hard to tell directly, it does look like there was some reasonably sized USD buy-side flow into month and quarter end on Friday (and perhaps some AUD selling too) and which is no longer a factor. AUD might well need to see a rate rise from the RBA this afternoon if we are to see AUD print a 0.68 handle for the first time since 24 February. Oil is still showing a gain of just shy of $5 on the day (WTI $4.75 or 6.3%, Brent $4.95.

Coming Up

- All eyes on the RBA decision for whether they will deliver a pause, or hike. We think the data justifies another 25bp hike, but acknowledge it is a line ball decision with the March RBA Minutes noting that Members agreed to reconsider the case for a pause at the following meeting ‘.11 of 27 analysts in the Bloomberg survey pick a hike, while 16 look for a pause. The risk is the RBA pauses and retains a hiking bias, preferring to err on the side of a more protracted battle against inflation until or unless its hand is forced by the data. Governor Lowe will be speaking on Wednesday, so an opportunity to explain the decision. Today’s meeting will also discuss the findings of the Financial Stability Review, published Thursday.

- In NZ, the QSBO is likely to show higher business confidence from the record low of minus 73% recorded in Q4 but results still likely consistent with stagflation in the economy.

- Data wise, tonight we have the US JOLTS February job openings report, a release attracting much attention these days as markets search for any signs of a softening labour market (Challenger job layoffs is on Wednesday, ahead of Friday’s US payrolls report). JOLTS are expected at 10.50mn, down from 10.82mn in January and a peak of 12,03mn in March last year. US factory Goods orders (including final durable goods orders) is also out, while the Eurozone gets PPI, German trade and the ECB’s monthly survey of consumer’ inflation expectations.

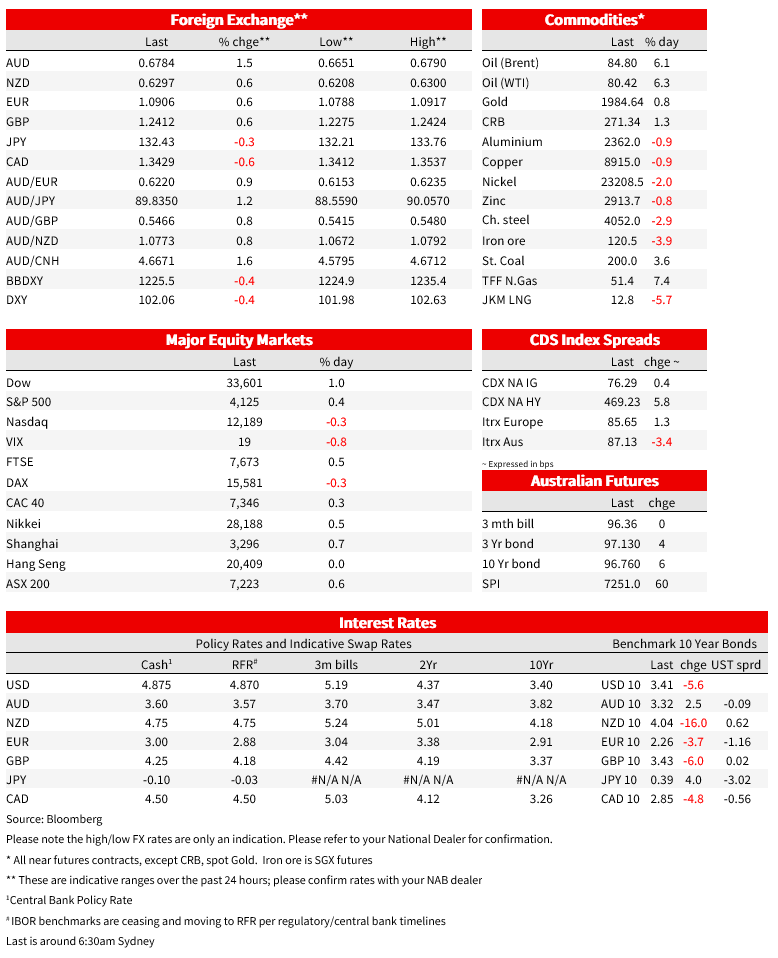

Market Prices

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets. Read our NAB Markets Research disclaimer.

[ad_2]

Source link