[ad_1]

Todays podcast

- US equities keep pushing on. S&P 500 and NASDAQ up over 1%

- ECB hikes as expected, lifts inflation forecast and delivers hawkish guidance

- European yields climb on the ECB news. Euro gains over 1%

- UST yields fall amid a string of soft US data releases. 10y UST -6bps to 3.71%

- USD broadly weaker with AUD and NOK leading the charge

- Coming up: NZ manufacturing PMI, BoJ, University of Michigan survey

Events Round-Up

NZ: REINZ house sales (y/y%), May: -0.4 vs. -15.3 prev.

NZ: GDP (q/q%), Q1: -0.1 vs. -0.1 exp.

CH: 1y med.-term lending rate, Jun: 2.65 vs. 2.65 exp.

AU: Employment change (k), May: 75.9 vs. 17.5 exp.

AU: Unemployment rate (%), May: 3.6 vs. 3.7 exp.

CH: Industrial production (y/y%), May: 3.5 vs. 3.5 exp.

CH: Retail sales (y/y%), May: 12.7 vs. 13.7 exp.

CH: Fixed assets invest. (YTD y/y), May: 4.0 vs. 4.4 exp.

EC: ECB deposit rate (%), Jun: 3.5 vs. 3.5 exp.

US: Retail sales (m/m%), May: 0.3 vs. -0.2 exp.

US: Retail sales ex auto, gas (m/m%), May: 0.4 vs. 0.2 exp.

US: Initial jobless claims, wk to Jun-10: 262 vs. 245 exp.

US: Empire manufacturing, Jun: 6.6 vs. -15.1 exp.

US: Philly Fed business outlook, Jun: -13.7 vs. -14.0 exp.

US: Industrial production (m/m%), May: -0.2 vs. 0.1 exp.

Keep pushin on, Things are going to get better

It won’t take long – Borsi Dlugosch, Inaya Day

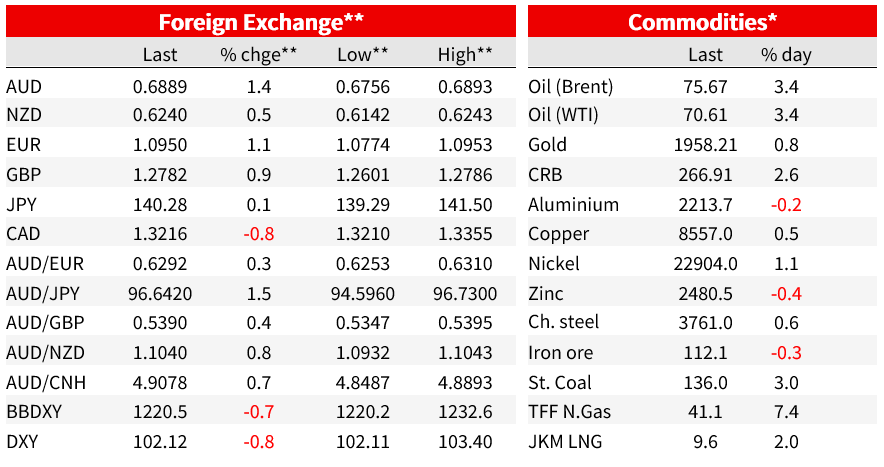

US equities have pushed on yet again, shrugging off a string of soft US data releases. The ECB hiked it deposit rate as expected, lifted its inflation forecast and delivered a hawkish guidance. Core European yields climb on the back ECB news with the euro gaining over 1%. Softer US data triggers a decline in UST yields with the USD weaker across the board. The AUD has climbed close to 69c aided by a solid employment report and expectations of an imminent China stimulus package after yesterday’s MLF rate cut.

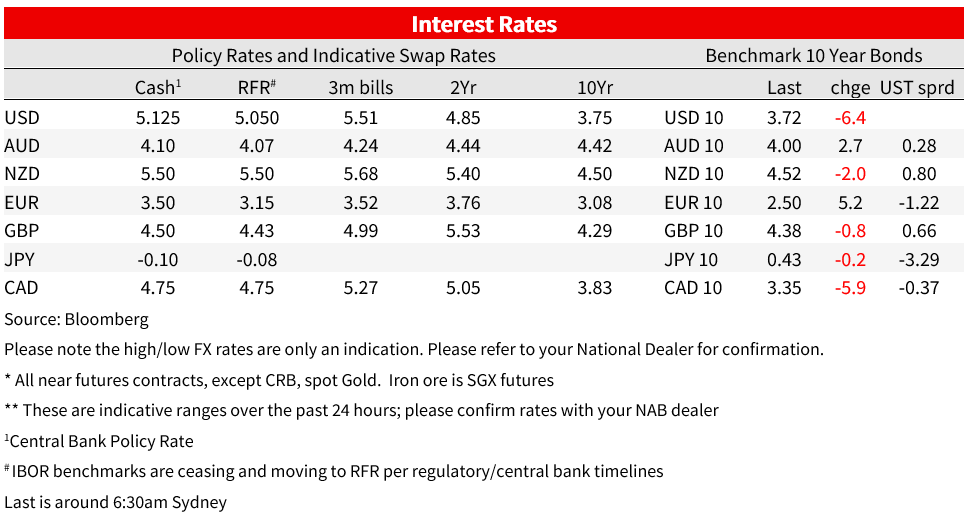

The ECB lifted its deposit rate by 25bps to 3. 5% and the Refinance rate to 4%, as expected, taking the cumulative tightening this cycle to 400bps. The new set of forecasts revealed upward revisions to core HICP inflation, 2023 is upped from a March forecast of 4.6% to 5.1%, 2024 core HICP is now seen at 3% from 2.5% in March and for 2025 underlying inflation is now seen at 2.3% from 2.2%. In contrast GDP growth forecasts were only very modestly shaved. 2023 GDP growth is lowered to meet the latest disappointing outturns, now at 0.9% down from 1% while 2024 GDP is now seen at 1.5% from prior 1.6% and 2025 unchanged at 1.6%.

Speaking at the press conference ECB president delivered a hawkish guidance noting that hat inflation in the euro zone is set to stay “too high for too long” and that the ECB isn’t done tackling it yet. Lagarde then added that “I can tell you that barring a material change to our baseline, it is very likely the case that we will continue to increase rates in July.”

Reaction to the ECB news and Lagarde’s comments lifted expectations for a rise in the deposit rate over coming months. Another 25bps hike in July is now more than fully priced (28.5bps) while a move towards 4% is almost fully priced by December (a cumulative 49.7bps of hikes by then). Core European yields also moved higher on the news with the lift in yields led by front end tenors. The 2y Bund yield climbed 11bps to 3.098% while 10y Bunds gained 5bps to 2.499%. The euro also benefitted, jumping over 1% and now trades at 1.0948.

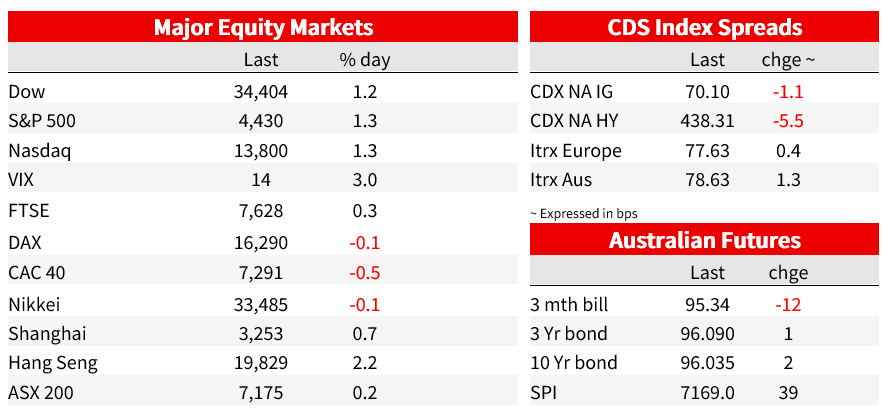

In contrast to the moves seen in Europe, a string of soft US data releases triggered a decline in UST yields with the belly of the curve leading the move lower. The 5y tenor fell 7bps to

3.914% while the 10y note now trades at 3.71%, down 6bps relative to levels this time yesterday. Of note, the move down in UST yields, effectively reversed the uptick seen post the FOMC decision yesterday. Looking at the OIS market, there is also a clear message, the market is not buying the Fed’s view that at least two more hikes might be appropriate this year, indeed looking at the curve the market only sees 20bps of hikes over coming months (so less than one hike) while expectations of rate cuts creep in before the end of the year.

Looking at the US data releases, headline retail sales and the ex-auto and gas measure rose 0.3%/0.4% m/m in May respectively, both higher than expected, but the data release included downward revisions. Pantheon Macroeconomics notes that the negative carry-over effect of the revisions into Q2 means that if sales are unchanged in June then they’ll showed an annualised contraction of 0.9% for the quarter.

Adding to the soft US economic narrative, jobless claims held constant at 262k for the week ended June 10, against expectations for a decline to 245k. In May industrial production fell 0.2% m/m vs. expectations for 0.1% outcome. The Philly Fed index fell to -13.7 from -10.4, close to the consensus, -14.0 with the Empire State manufacturing index the odd data print, jumping to +6.6 from -31.8, well above the consensus of -15.1.

Moving on to equities, the Hang Seng and China’s CSI 300 are at the top of the leader board up 2.17% and 1.57% respectively. Asian equities have been boosted by expectations of an imminent China stimulus package. Yesterday the PBoC lowered the MLF rate by 10bps to 2.65% as expected, China’s activity readings for May were broadly softer, confirming the post zero-covid economic rebound has lost momentum in Q2. Official data showed a slump in real estate, a worrying decline in business investment and record joblessness among young people. According to Bloomberg the State Council is expected to discuss a broad package of stimulus proposals for sectors including property, and overnight a commerce ministry spokesperson said measures to boost consumption – including those to promote the development of the car, home appliance and catering industries- are currently under discussion.

The ECB news weighed on European equities with the Eurostoxx 600 ending the day at -0.13%. Meanwhile in the US, the S&P 500 and NASDAQ have essentially ignored the hawkish message from the Fed, extending recent gains. The S&P 500 closed 1.22% higher, up for a sixth consecutive day, the benchmark has now broken through the 4400 mark and encouragingly we are now seen signs of the rally broadening to sectors beyond IT. As my BNZ colleague notes, a US recession might be just around the corner, but equity investors are partying like its 1999.

The move lower in UST yield on the back of softer US data releases plus hawkish guidance from the ECB weighed on the USD with the DXY and BBDXY indices, down 0.8% and 0.7% respectively. The AUD and NOK have led the charge against the USD within G10 pairs. Yesterday Australia’s May labour force report beat expectations by some margin, boosting expectation of more RBA hikes over coming months. Jobs for the month printed at +76k vs +17.5k expected and the unemployment rate fell a tenth to 3.6%. Month to month employment data continues to be very volatile, but this shows that the slowing in employment growth last month has not held. The AUD struggled to perform on the positive labour market news amid a decline in CNY and soft China data releases, but with the USD struggling overnight the AUD has led the charge, up 1.37% over the past 24 hours and now trades close to the overnight high at 0.6884.

NOK has been the other outperformer, up 1.58% and the NZD has returned to the high seen pre-FOMC, meeting some resistance just shy of 0.6240. The Kiwi now trades at 0.6233. NZ GDP contracted for the second consecutive quarter, with activity down 0.1% q/q, in line with the consensus, after the downwardly revised 0.7% fall in Q4. Historical revisions meant that annual growth of 2.2% was four-tenths below market expectations, with an even greater miss relative to the RBNZ’s above-market estimates. The soft GDP print will add to the RBNZ’s confidence that enough tightening has taken place to drive inflation lower.

Ahead of the BoJ meeting today (see more below), USD/JPY has also been in focus, yesterday the pair traded to a 7month high of ¥141.5 before broad USD weakness saw it move back down and now the currency starts the new day at ¥140.27.

Coming Up

- This morning New Zealand releases its May Manufacturing PMI and in April the survey printed a headline reading sub 50 for a second month in a row (49.1). The BoJ concludes its policy meeting at some point during our day with the market expecting a no change outcome.

- In recent weeks Governor Ueda has been at pains to stress that the current ultra-easy policy setting is still appropriate given the need to see concrete evidence that inflation can stay at around 2% over the medium term. This of course against a backdrop of an economy that is growing with core-core inflation at 4.1%yoy, a level not seen since the early 1980 and with both its manufacturing and services sectors expanding (a unique feature compared to other major economies). Japan’s equity market is booming, the yen is extremely undervalued and fiscal policy is supportive. Economic conditions are telling the BoJ that its ultra-easy policy has passed its used by date, yet given what Ueda has been saying, the consensus view is that the BoJ will stand pat today. That said if the BoJ wanted to surprise the market, today would be a good day.

- Later in the day, the BoE releases its inflation attitudes survey and tonight the US gets the June University of Michigan survey (Current Conditions 65.1 exp. vs 64.9prev. and 5-10yr Inflation 3.0% exp vs 3.1% prev.)

Market Prices

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets. Read our NAB Markets Research disclaimer.

[ad_2]

Source link