[ad_1]

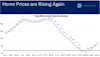

Home prices are rising again, up 4% on an annual basis in September (the most recent available data). That marks the third straight month of gains.

Be smart: Housing prices remain high because demand outpaces supply. So even with higher interest rates, buyers are still buying because they have few options.

Why it matters: Affordable housing will remain a major issue as long as supply fails to meet demand. We must build more houses and make it easier to renovate existing stock, but too often, obstacles like permitting and zoning laws get in the way.

Holiday Shoppers Lean on Discounts and ‘Buy Now, Pay Later’

November 29, 2023

The first weekend of the holiday shopping season shows consumers are spending, but they are looking for discounts and making more use of ‘Buy Now, Pay Later’ as they contend with inflation and rising credit card balances.

Why it matters: These early trends are consistent with what we have seen from consumers for months. They continue spending with a significant portion of it from borrowing.

By the numbers: “Consumers spent a record $9.8 billion shopping online on Friday, according to Adobe Analytics,” USA Today reported.

Be smart: This early data from one segment of the retail industry (online) shows a good start to the holiday shopping season. But if the delayed-payment, bargain-hunting, and card-fueled spending trends hold, they indicate weakening consumer strength. This makes it important that leaders work to strengthen the economy so Americans’ incomes keep growing.

Falling Office Building Values Could Lead to Credit Crunch

November 21, 2023

More people working from home and higher interest rates are driving down the value of commercial office buildings. Stress in the commercial real estate market could result in a credit crunch for small- and medium-sized businesses.

Why it matters: Many of the banks that loaned money to finance large office buildings are regional ones. These are the banks that small- and medium-sized businesses rely on for access to credit.

Details: Office building occupancy is about 40% below what it was before the pandemic. As rental income fell the values of building fell too.

High interest rates are also driving down buildings’ values.

- Generally, these buildings are on five-year loans. Owners are re-financing them now at higher rates.

- Some owners find re-financing to be uneconomical and are walking away from these buildings.

Be smart: Regional banks are in the same class of banks stressed during the fallout of Silicon Valley Bank’s (SBV) failure earlier this year.

- Should financial markets scrutinize which banks are overly exposed to office space risk, this could force regional banks to pull back on lending to small- and medium-sized businesses.

Read more on the future of the office and the challenges of converting commercial office space to other uses.

Retail Sales Dip, But Consumers Keep Spending

November 17, 2023

Retail sales fell 0.1% in October, coming off a strong 0.9% increase in September.

- Auto sales amounted to much of the decline, mainly due to the auto strike. If those are taken out, sales were up 0.1%.

Why it matters: Consumers continued spending and showed resilience despite their personal savings falling and credit card balances rising.

Details: Electronics and appliance stores, food and beverage stores, health and personal care stores, non-store retailers (mostly online sellers), and bars and restaurants saw gains.

- But sales were down at motor vehicles and parts dealers, furniture stores, and miscellaneous stores.

Bottom line: If leaders avoid adding uncertainty to the economy – like from a government shutdown – and push pro-growth policies that address the worker shortage and help U.S. companies sell more to international customers, the job market will remain robust, keeping incomes steady and consumers spending.

Unpacking October Inflation Numbers

November 15, 2023

The Consumer Price Index (CPI), the broadest measure of consumer prices, rose 3.2% annually in October down from 3.7% in September. On a monthly basis, inflation was flat from September to October.

Why it matters: Inflation may be down from its peak of 8.8% in June 2022, but it is still above the Federal Reserve’s 2% target rate.

By the numbers:

- Housing was up 6.7% annually.

- Energy prices fell 4.5% annually because of a 5.3% drop in gas prices. Electricity rose 2.4%.

- New car prices rose 1.9% annually, but used car prices fell 7.1%.

- Grocery prices rose 0.3% in October and are up 2.1% annually.

Be smart: Core prices, which strips out volatile elements like food and energy and is closely watched by the Fed, rose 4.0% annually and 0.2% from September to October.

Looking ahead: This report is a step in the right direction, but we are still far from the Fed’s 2% inflation target. This improvement likely means the Fed will hold off on interest rate hikes at least until early 2024.

Consumer Strength Continued in September

November 10 , 2023

Consumers increased spending by 0.7% in September. This was 0.3% higher than inflation.

Why it matters: Consumers continue spending at a strong rate, given all the headwinds they face. If they keep spending, the economy will keep humming.

By the numbers:

- Inflation-adjusted spending on goods was up 0.3% (durables 0.6% & nondurables 0.1%).

- Inflation-adjusted spending on services was up 0.4%.

Be smart: Here are two to consider when determining if this trend continues:

- September inflation-adjusted income grew by 0.3%, slower than inflation.

- Savings dropped sharply in September and have been dropping precipitously for almost two years.

This leaves only credit cards for consumers to use to keep spending above inflation, but consumers have spent up their balances sharply in recent months.

Bottom line: Good pro-growth economic policies will strengthen the economy and support American workers and families. Making it easier to build by reforming the permitting process, addressing the worker shortage, and pushing a bold trade agenda will help.

Shrinking Labor Force Spells Trouble for Business Growth

November 8, 2023

The most concerning news from the October jobs report was that the labor force shrunk by 201,000.

Why it matters: A smaller labor force makes it difficult for businesses to find the workers they need to grow and compete, especially since job openings grew from August to September (the most recent data available).

Be smart: Scaling up skills-based employment can be a successful strategy for companies to expand talent pools beyond traditional four-year degree holders and can help workers showcase their skillsets.

Learn more: The America Works Initiative helps employers develop and discover the talent needed to fill open jobs.

Tackling the Worker Shortage with Immigration Reform

November 3, 2023

Job openings grew by 56,000 from August to September. There are 3.2 million more job openings than unemployed workers.

Why it matters: The gap between openings and available workers will persist, because we have a structural shortage of workers for the foreseeable future.

Be smart: Businesses are still adding workers, and workers are still confident they can quit their current jobs and find better ones easily.

Big picture: Employers, especially small businesses, deal with the worker shortage every day. Part of the answer is modernizing our legal immigration system to better respond to businesses’ needs. Securing our borders and updating our immigration laws to allow more workers into the U.S. would help businesses grow and prosper.

Learn more:

- The Chamber’s LIBERTY Campaign is working to pass meaningful border security and immigration legislation.

A Smaller Workforce Is the New Normal

November 1, 2023

There are too few workers relative to the size of our population, causing a chronic worker shortage that will impact businesses for the foreseeable future. I discussed the implications with Rick Wade, Senior Vice President of Strategic Alliances and Outreach at the U.S. Chamber, as part of the Equality of Opportunity Initiative.

Why it matters: An older, smaller workforce is our new reality. Every business, every industry, and every region will experience a worker shortage going forward.

Big picture: The generations that followed the Baby Boomers are notably smaller. As Baby Boomers retire, the labor force shrinks.

- And: As people get older, they consume more and produce less, which is a key issue for businesses.

What can be done: The worker shortage will likely remain a problem for years to come. Policymakers can tackle this by:

- Reforming legal immigration to bring in workers with a variety of skill levels.

- Improving second chance hiring.

And: Employers can fill the labor gap by responsibly using artificial intelligence and other technologies.

Watch my full conversation with Rick Wade here:

Learn more:

- The America Works Initiative helps companies develop and discover talent to fill open jobs and grow our economy.

What Higher Interest Rates Mean for the Federal Debt

October 27, 2023

Rising interest rates have caused the 10-year U.S. Treasury rate to bump up against 5% for the first time in 15 years. This has significant implications for the federal budget.

Why it matters: Interest costs on the national debt could reach a record share of the economy within three years, making it the second-largest federal spending item, more than defense spending or Medicare.

By the numbers: The Committee for a Responsible Federal Budget lays out the details:

- Interest costs could total more than $13 trillion over the next decade and $1.9 trillion per year by 2033.

- Most long-term forecasts suggest the economy is likely to grow by 3.5% to 4% per year over the long term. This is below the interest rate on new bonds, meaning existing debt may grow faster than the economy.

Bottom line: Interest payments on our debt, along with rising costs to retirement and healthcare programs, are pushing America’s fiscal outlook into uncharted territory. Congress must prioritize efforts to reform our entitlement programs, the major driver of our debt and deficits.

Americans Keep Pulling Out Their Credit Cards

October 25, 2023

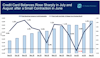

Credit card debt jumped sharply in July and August (0.8% and 1.2% respectively), after a small decline in June.

But as a share of disposable income, credit card debt is below the 20-year average, meaning it is not at levels that would be risky to the financial system.

Why it matters: Consumers are spending at a faster pace than many analysts expected. Part of this is by using credit cards, but that may not last.

Big picture: From February 2020 to April 2021, Americans paid down the balances on their cards by $128 billion.

- Since then, credit card debt has risen $313 billion and is now $1.29 trillion – an all-time high.

This increase in credit card debt comes amid inflation struggles and high interest rates. Many Americans will have to rely more on their incomes and savings to fund their spending.

Bottom line: It is a reminder that American workers and families need a strong economy. Our leaders can do this by addressing the worker shortage, reforming the permitting process to allow us to build much-needed infrastructure, and advancing a bold trade agenda that supports American jobs.

Resilient Consumers Still Spending in September

Consumers are still spending, showing remarkable resilience. Retail sales rose 0.7% in September, coming off a strong 0.8% increase in August.

- The strong jobs market and income growth that is on pace with inflation fuels spending.

- Consumers using credit cards is also up.

Details: Big drivers of the gains in September were car sales, online purchases, and sales at miscellaneous retailers. Purchases at restaurants, bars, and gas stations were robust, too.

Big picture: A strong economy will keep consumers confident and spending. To strengthen the economy businesses need pro-growth policies that address the worker shortage and advance a bold trade agenda.

Labor Force Can’t Grow Fast Enough to Fill Job Openings

October 11, 2023

The job market continued to sizzle in September with 336,000 new jobs created – the vast majority created by the private sector. Also, job gains for July and August were revised up a combined 119,000. Workers made more as well with wages rising 0.2%, up 4.2% annually.

Why it matters: While the labor force continued growing, expanding by 90,000 in September, it’s not growing fast enough to fill millions of open jobs.

Be smart: Finding more workers is critical for businesses to grow and compete. More legal immigration is part of the solution, along with helping Americans get in-demand skills and removing barriers keeping people from entering the workforce.

By the numbers: The top five industries that added jobs in September were:

- Leisure and Hospitality: 96,000

- Government: 73,000

- Education and Health: 70,000

- Wholesale and Retail Trade: 31,000

- Professional and Business Services: 21,000

Learn more:

- The America Works Initiative is helping companies solve America’s workforce challenges.

Job Openings Rise, Tight Labor Market Continues

October 6, 2023

With the release of September jobs numbers this week, let’s look back at the last few months. After falling in June and July, job openings rose in August. The labor market remains tight.

- Job openings were 9.6 million at the end of August, up 690,000 from July.

- Businesses are still adding workers, and workers are still confident they can quit their jobs and find better ones easily.

Why it matters: As of the end of August there were 3.3 million more job openings than unemployed workers, 176,000 more than in July.

Big picture: The trend of more job openings than unemployed workers is likely to remain. Policymakers can address this by:

- Reforming legal immigration and securing our borders

- Improving childcare availability for families

- Revamping educational and job training opportunities

- Removing barriers to entering the workforce

Dig deeper: The Chamber’s America Works Initiative is tackling these issues to help employers develop and discover the talent they need and advance economic opportunity.

Inflation Strains Consumer Spending Growth

October 4, 2023

Consumer spending has driven the remarkable economic growth we have seen this year. But there are signs consumers are starting to buckle under the weight of inflation.

Why it matters: Consumers continue defying economic analysts’ predictions that their spending ability was sapped.

By the numbers:

- Inflation-adjusted spending was up 0.1%, essentially flat from July.

- Inflation-adjusted spending on goods was down 0.2% with spending on bigger-ticket durable goods down 0.3%.

- Spending on services rose 0.2% after inflation.

Be smart: While consumer spending was flat, consumer savings fell sharply in August. They have used credit cards and COVID-era savings to keep up with inflation, and their savings are likely depleted.

- August could be an aberration, but with inflation remaining higher than the Federal Reserve wants, we should watch how consumers keep ahead of it.

Bottom line: Inflation may have come down from 40-year highs, but it continues to weigh on consumers. It is critical that policymakers work to ease the burden of higher prices by avoiding overregulation, addressing the workforce shortage, and reducing tariffs.

Read more from the Chamber:

- Economic Data: Comprehensive quantitative snapshots of business sectors and topics to help business and political leaders make informed decisions.

- Workforce Data:Capturing the current state of the U.S. workforce.

- Small Business Index: The MetLife & U.S. Chamber of Commerce Small Business Index is released on a quarterly basis and is compiled from 750 unique online interviews with small business owners and operators each quarter. The Index delivers a comprehensive quantitative snapshot of the small business sector as well as explores small business owners’ perspectives on the latest economic and business trends.

- Middle Market Business Index:The survey panel consists of approximately 1,500 middle market executives and is designed to accurately reflect conditions in the middle market.

About the authors

Curtis Dubay

Curtis Dubay is Chief Economist, Economic Policy Division at the U.S. Chamber of Commerce. He heads the Chamber’s research on the U.S. and global economies.

Read more

[ad_2]

Source link