[ad_1]

a_Taiga

The Netherlands narrowly avoided a recession with a positive fourth-quarter GDP growth print, led by higher exports and resilient household consumption. This bodes well for 2023, as the Dutch consumer continues to sit on excess accumulated savings and has benefited from an accelerated pace of wage increases thus far. Also helping the outlook will be additional government expenditure (mainly the energy price cap), which should offset any business cycle weakness from ‘higher for longer’ Euro-area rates. Inflation remains high at +8% YoY in February, but is well off its 2022 peak, so I don’t expect unemployment increases from here, nor do I see a material recession anytime soon. A brighter domestic outlook bodes well for the iShares MSCI Netherlands ETF (NYSEARCA:EWN) – while the top two holdings, ASML (ASML) and Prosus (OTCPK:PROSY), are tech businesses with largely international income streams, the rest of the portfolio remains highly levered to the Dutch economy.

Fund Overview – Low-Cost but Concentrated Exposure to Dutch Champions

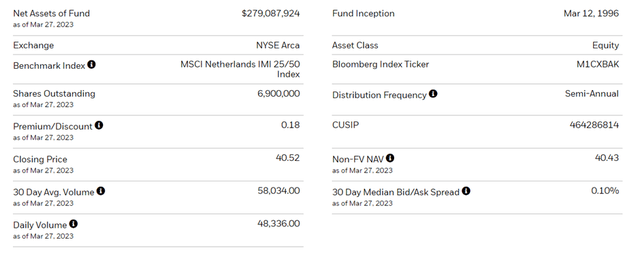

The US-listed iShares MSCI Netherlands ETF seeks to track, before fees and expenses, the performance of the MSCI Netherlands IMI 25/50 Index, which comprises large, mid, and small-cap Dutch equities (~99% of the free float-adjusted market cap). The ETF held ~$279m of net assets at the time of writing and charged a 0.5% expense ratio, making it a cost-effective option for US investors looking to access Dutch equities. A summary of key facts about the ETF is listed in the graphic below:

iShares

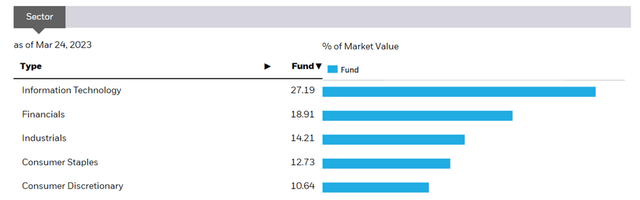

The fund is spread across 57 holdings, with the largest sector allocation going to Information Technology at 27.2%, followed by Financials at 18.9% and Industrials at 14.2%. The fund also has significant exposure to the consumer, with a combined staples and discretionary allocation of 23.4%. On a cumulative basis, the top five sectors accounted for ~87% of the total portfolio, making EWN one of the more concentrated Euro-area ETFs from a sector perspective. In line with the tech-heavy exposure, the fund’s equity beta is relatively high at 1.12, so it should outperform in a cyclical upswing (and vice versa).

iShares

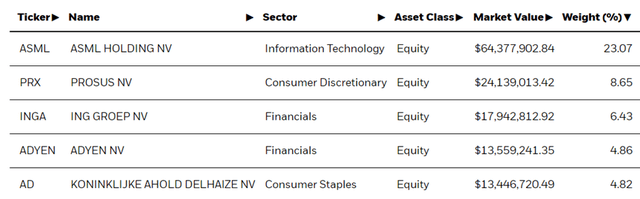

The single-stock allocation stands out for the size of the fund’s holding in semiconductor equipment manufacturer ASML at 23.1%. The second largest holding is global investment group Prosus at 8.7%, followed by Dutch financial services company ING Groep (ING) at 6.4% of the portfolio. Other key holdings include payment company Adyen (OTCPK:ADYEY) at 4.9% and food retail group Ahold Delhaize (OTCQX:ADRNY) at 4.8%. In total, the top five holdings account for ~48% of the overall portfolio, again making EWN one of the more concentrated single-country ETFs. The fund’s underlying earnings and book value multiples seem rich at first glance, but given the two largest holdings (~32% of the portfolio) have established themselves as serial compounders with high long-term earnings growth algorithms, the ~16x P/E valuation isn’t all that pricey, in my view.

iShares

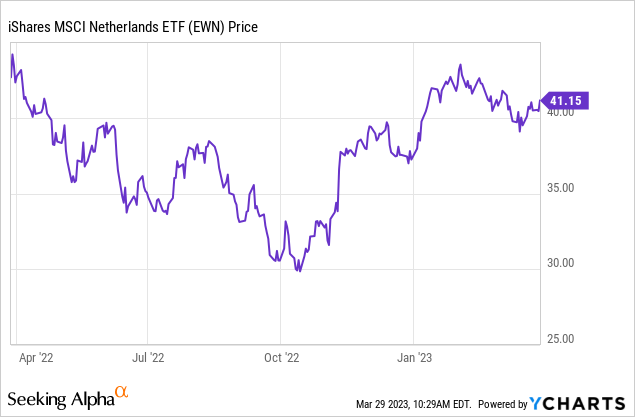

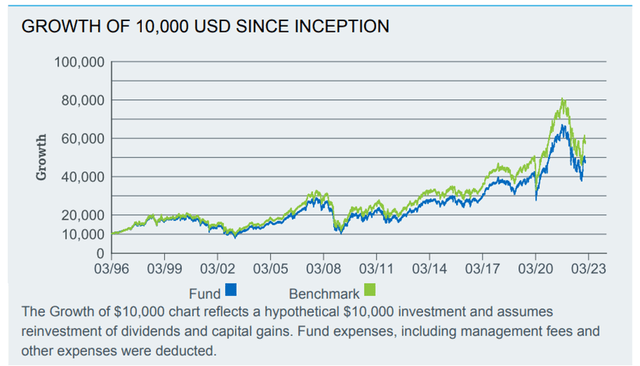

Fund Performance – Stellar Track Record of Capital Appreciation with a Nice Income Supplement

On a YTD basis, the ETF has risen by 6.5% and has compounded at an impressive 6.0% rate in market price and NAV terms since its inception in 1996. Outside of last year’s >20% drawdown, the fund has steadily compounded through the cycles, with the three, five, and ten-year returns at 4.9%, 5.2%, and 8.4%, respectively. Given the fund’s high-beta tech exposure, returns can be volatile, though. Case in point – 2018 saw EWN suffer a mid-teens percentage decline before recovering with a 31.3% return in 2019 and 24.2% in 2020.

iShares

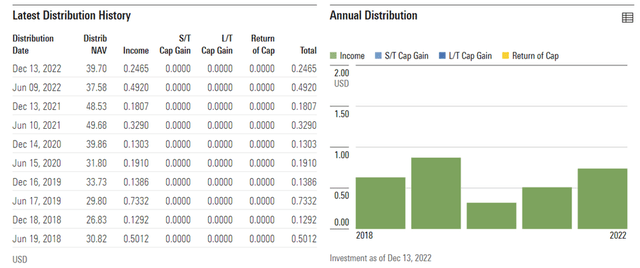

The semi-annual distribution is derived entirely from income, with the fund’s holdings in cash-generative sectors like financials underpinning much of the capital return. At a trailing twelve-month yield of 1.8% (1.6% on a 30-day basis), EWN isn’t the highest-yielding Euro area ETF, but the income portion is a nice supplement for investors who favor the steady earnings growth profile of EWN’s portfolio holdings.

Morningstar

Dutch Economy Stays Resilient Through the Turbulence

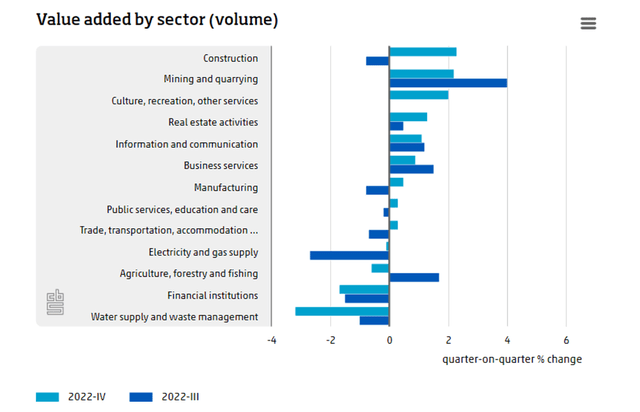

The latest GDP print was even more positive than expected, with GDP up on a QoQ and YoY basis. Digging deeper into the Q4 print, the growth in net trade appears to be the key contributor, led by a higher +3.6% growth of goods exports. Household consumption was also a strong point despite the ongoing inflationary pressures, as increased services spending offset the weakness elsewhere. Government consumption and higher gross capital formation were also positive contributors to the GDP growth delta. What stood out, though, was the value-added by sector disclosure (i.e., production net of energy, materials, and services consumption). Leading the growth in value-added were construction and business services, likely signaling a fundamental improvement in profit margins as well.

Statistics Netherlands

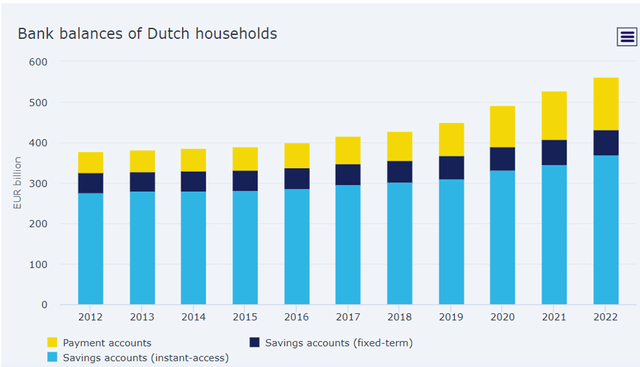

While the surprisingly resilient Q4 GDP report doesn’t necessarily mean the Netherlands will completely avoid a recession, it is likely to prompt upward revisions of consensus growth forecasts in early 2023. Whether the growth translates into near-term earnings upside will depend on the pace of core inflation, which remains an issue despite decelerating toward the end of last year. There is a case for stronger household consumption, though, with consumer confidence on the rise and 2022 data showing a further growth of accumulated savings despite the inflationary pressures. Also helping are the contractual and minimum wage increases for the year, as well as support measures like the energy price cap. So while retail sales volumes did decline in December, as confidence returns, the savings deployed by domestic consumers present an incremental tailwind to GDP growth going forward.

DNB

On the Recovery Path

Coming off a challenging 2022 for EWN, the outlook for this year looks much better, with the latest Dutch GDP growth print coming in positive. Adding to the good news is that inflation looks to have peaked and continues to decelerate from the low teens percentage highs late last year, helped by ongoing government support measures (e.g., the energy price cap). At the consumer level, a resilient labor market, accelerating wage increases, and excess savings also bode well for EWN’s >23% consumer allocation (durables and staples). The fund’s ~16x P/E might seem pricey at first glance, but given its large stakes in high-growth tech names like ASML, which typically trades at >30x earnings (rightly so, given it remains on track to double its EPS through FY25) and Prosus, another high-growth tech franchise, the rest of the portfolio is priced very reasonably.

[ad_2]

Source link