[ad_1]

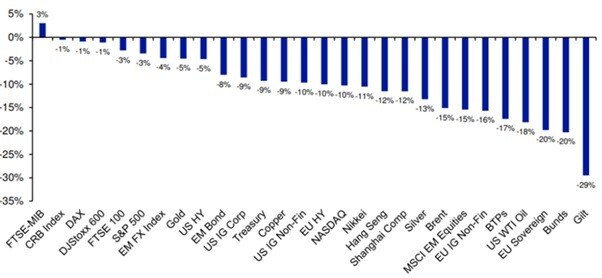

Figure 2: One-year performance of major asset classes. Sources: BLOOMBERG FINANCE LP, DEUTSCHE BANK, Marketwatch

The Russia-Ukraine conflict brought an immediate end to the era of ultra-low interest rates and triggered steep hikes in energy prices. The sharp increase in gas and oil prices also rapidly spilled over into other commodities, such as copper, aluminium, and nickel. Inflation has skyrocketed globally, with consumers grappling with the soaring costs of living right around the world.

Governments and central banks, including those in Australia, have been compelled to pivot urgently towards fiscal and monetary policies that focus on tax adjustments and interest rate hikes that combat inflation.

The bearish investor sentiment is palpable across the world’s major financial assets, with equity markets in developing nations and the US experiencing the most significant decline (see Figure 2).

In contrast and perhaps somewhat counterintuitively, the main European share markets have proven more resilient to the geopolitical turbulence in the region, despite being in much closer proximity to the conflict than other parts of the world. For instance, the German DAX has fallen by one percent and the FTSE by three percent.

Following several wild swings, oil, gas, and other commodity prices have settled down (see Figure 3). However, the issue of energy security remains a continuing concern for Europe.

Germany and Europe, more generally, have managed relatively well in the past year to reduce their dependence on Russia for their high energy needs. They have done this by diversifying energy infrastructure away from Russian oil and gas, but the significant energy shock has driven energy prices sky-high and fuelled inflationary pressures in all corners of the world.

[ad_2]

Source link