[ad_1]

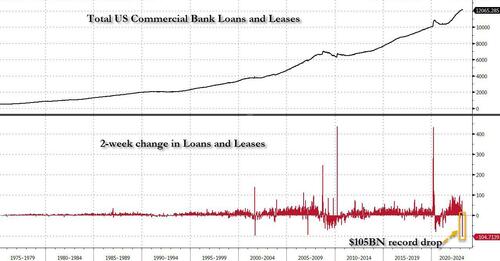

Over the weekend we reported that the credit crunch had entered the crash phase when we showed that in the last two weeks of April, a record $105 billion in commercial bank loans and leases were either sold, discharged or otherwise transferred from bank balance sheets…

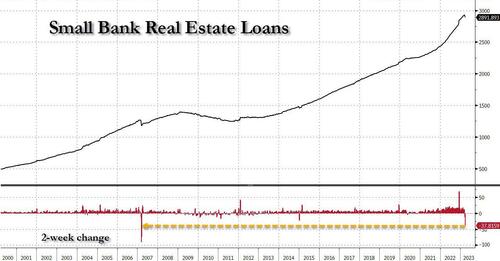

… and we followed that up by showing that the bulk of loan declines was due to Small bank real estate loans, a clear indicator that the commercial real estate collapse was starting to impact bank solvency (something we warned about one month ago).

Yet while credit was clearly collapsing at the fastest pace in years, until we get the Fed’s next SLOOS report it would be very difficult to answer the next key question: was this credit plunge the result of falling demand, or supply… or both?

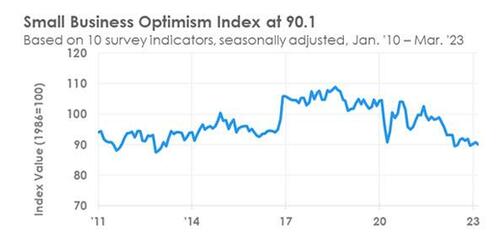

It was therefore a stroke of luck that today’s NFIB’s latest Small Business Optimism report hit (it showed a modest drop from 90.9 to 90.1, just above the consensus estimate of 90.1), providing some key insight into where exactly the credit plumbing was clogged.

The report was rather gloomy and downbeat as has been the case for much of Biden’s tenure, marking the 15th consecutive month below the 49-year average of 98 with 24% of owners reporting inflation as their single most important business problem, and a net negative 47% of small business owners expecting better business conditions over the next six months (so not really), which in turn is hammering hiring plans.

“Small business owners are cynical about future economic conditions,” said NFIB Chief Economist Bill Dunkelberg. “Hiring plans fell to their lowest level since May 2020, but strong consumer spending has kept Main Street alive and supported strong labor demand.”

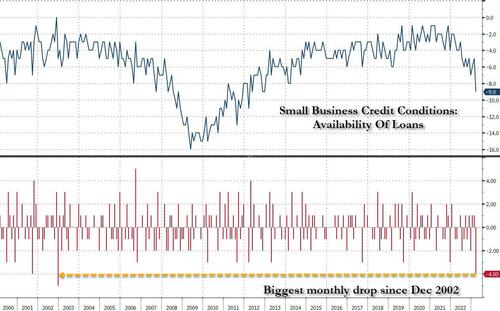

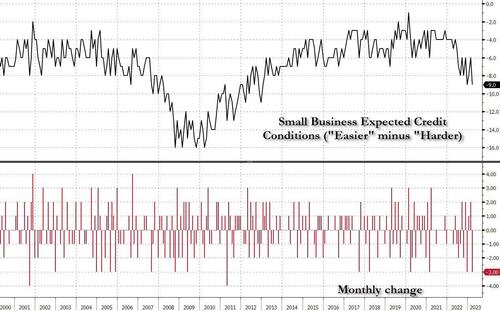

But what we found most notable in the context of the credit crunch is how difficult it was for small US businesses to obtain a loan in March after multiple bank failures led to a further tightening of credit conditions. According to the NFIB, a net 9% of owners who borrowed frequently said financing was harder to get compared to three months earlier, the most since December 2012. Worse, the 4 point monthly drop in the series was the biggest collapse in credit availability in more than 20 years.

The same share expects tougher credit conditions in the next three months, matching the highest level in a decade and confirming that the credit crisis is only just starting, at least when small businesses are asked how they perceive coming supply or the lack thereof.

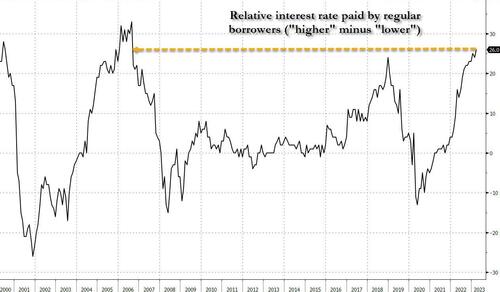

Adding insult to injury, some 26% of owners who borrow said they paid a higher interest rate in March compared to three months earlier, the biggest share since 2006.

Hilariously, even though credit is getting a bit more difficult, it ranks well below inflation and quality of labor as the single biggest problem for small businesses. So Biden and his central bank are damned if they keep fighting inflation – as credit conditions now mean a collapse in growth – and damned if they focus on rebooting credit growth instead, which in turn would lead to a fresh burst in inflation.

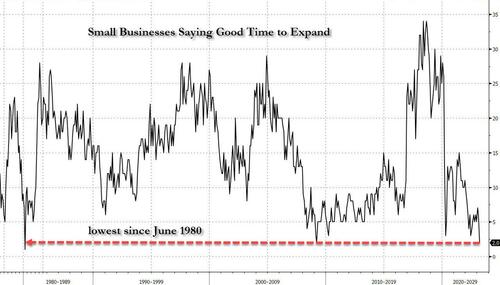

Bottom line: the politically-charged NBER may not admit it yet – after all there are presidential elections coming up in the not too distant future – but for all intents and purposes the credit crunch is here… and so is the recession, which is why just 2% of small businesses said it it was a good time to expand, the lowest in over 20 years. The last time we saw a lower print: June 1980.

Loading…

[ad_2]

Source link