[ad_1]

The direction came at a review meeting chaired by Union finance minister Nirmala Sitharaman.

Timeline: How the 2023 banking crisis unfolded

After a detailed meeting with the chiefs of the state-run banks, the finance ministry said in a statement that lenders have been asked to identify stress points, including “concentration risks and adverse exposures”.

During the meeting, Sitharaman reviewed the exposure of state-run banks and immediate external global financial stress from both the short and the long-term perspectives.

Banks should safeguard themselves from any potential financial shock, Sitharaman told lenders according to the statement.

“All the major financial parameters indicate stable and resilient public sector banks,” the statement added.

During the review meeting, an open discussion was held with the heads of the banks on the global scenario following the failure of the Silicon Valley Bank and the Signature Bank along with the UBS’s takeover of crisis-hit Credit Suisse.

“The finance minister underlined that PSBs must look at business models closely to identify stress points, including concentration risks and adverse exposures. She also exhorted PSBs to use this opportunity to frame detailed crisis management and communication strategies,” the statement said.

FM Sitharaman’s 6-point advice to state banks …

- Take focused steps to attract the deposits given the steps taken by the government to reduce the tax arbitrage in some debt instruments;

- Pivot their strengthened financial position to support credit needs of the growing economy;

- Focus on credit outreach in States where the credit offtake is lower than the national average, particularly in northeast and eastern parts of the country;

- Enhance business presence in new & emerging areas like One District One Product (ODOP), e-NAM, and drones;

- Aim to increase brick & mortar banking presence in border and coastal areas

- PSBs should promote the Mahila Samman Bachat Patra announced in the Budget 2023-24 through special drives and campaigns.

Meanwhile, the bank executives told Sitharaman that they are vigilant of developments in the global banking sector and are taking all possible steps to safeguard themselves from any potential financial shocks.

This review meeting comes amid volatility in the US banking system due to the recent collapse of Silicon Valley Bank and some other banks in contagion.

A number of Indian startups have funds parked in the failed Silicon Valley Bank and possibly others too.

However, analysts have said that Indian banks are in a relatively good position to withstand the global headwinds amid the crisis.

Earlier this week, S&P Global Ratings said that Indian lenders are capable of enduring any potential contagion effects emanating from the US banking turmoil.

“Strong funding profiles, a high savings rate, and government support are among the factors that bolster the financial institutions we rate,” the rating agency said.

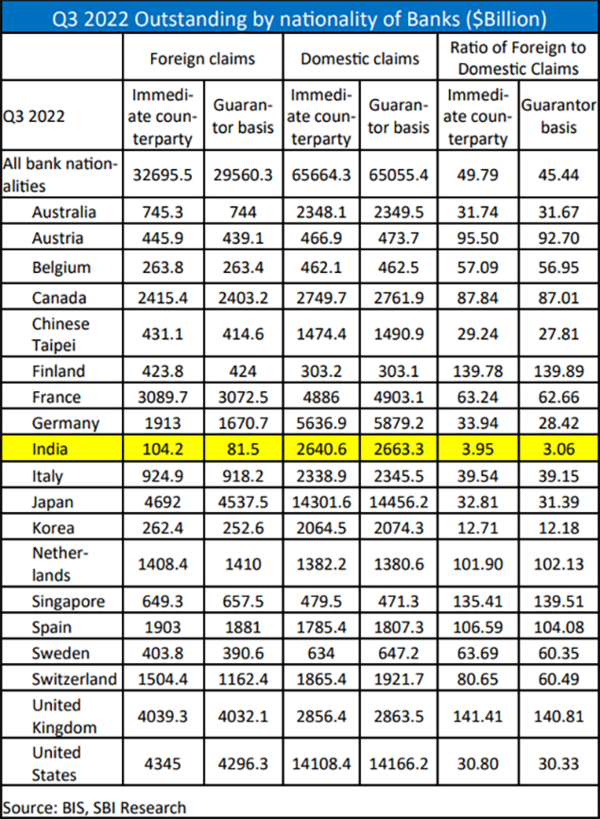

According to State Bank of India’s recent economic research report ‘Ecowrap’, Indian banks are the “epitome of resilience” in terms of global claims.

The research report said that foreign claims on India are way less than in countries like UK and US, limiting the country’s exposure to the global uncertainties.

“When compared with other major countries, India has least foreign claims, both as counterparty basis, and also as guarantor basis,” it said.

[ad_2]

Source link