[ad_1]

Last week, Canada gave the final approval to HSBC Holdings’ HSBC proposed divestiture of its unit to Royal Bank of Canada RY. The consent is conditioned on several steps to be taken by RY following the completion of the deal, which will make the company a banking behemoth in Canada.

The transaction, announced in November 2022 and valued at C$13.5 billion ($10.1 billion), had been under scrutiny for its potential impact on competition in the country. The acquisition is expected to further bolster RY’s position in a market where the top six banks control around 80% of banking assets.

In the press note released on Thursday, the Canadian finance ministry stated that the deal had been approved by the federal banking regulator and the Office of the Superintendent of Financial Institutions too. Earlier in September, the Competition Bureau gave its nod to the transaction.

Some of the notable conditions to be fulfilled by Royal Bank of Canada include creating a global banking hub in Vancouver, waiving fees associated with the transfer of mortgages from HSBC, no job cuts at the HSBC unit for the first six months following the closure, continue providing banking services at minimum 33 HSBC branch locations for four years and provide C$7 billion in financing for affordable housing construction across the country.

At present, HSBC employs roughly 4,000 people in the country and offers banking services to nearly 780,000 Canadians.

Following the completion of the deal in the first half of 2024, HSBC is expected to announce a special dividend of 21 cents per share from the proceeds. The company is anticipating a pre-tax gain of $5.7 billion, including the recycling of $0.6 billion in foreign currency translation reserve losses.

The proposed transaction is part of HSBC’s business restructuring initiative, under which it is exiting from several markets across the globe. The company has exited the United States and Greece retail banking space. It is in the process of divesting retail banking operations in France and New Zealand as well as fully exiting Russia.

Meanwhile, HSBC is pivoting its business toward the Asia region. In sync with this, in October, the company announced a deal to acquire Citigroup’s retail wealth management business in China. Also, it re-launched its private banking business in India after eight years. Further, last year, the company acquired 100% of the issued share capital of AXA Insurance in Singapore and L&T Investment Management Limited.

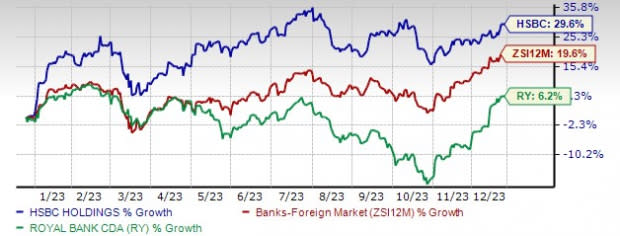

Over the past year, shares of HSBC and RY on the NYSE have rallied 29.6% and 6.2%, respectively, compared with the industry’s growth of 19.6%.

Price Performance

Image Source: Zacks Investment Research

Currently, HSBC and Royal Bank of Canada each carry a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Canadian Banks Strive to Bolster Market Share

Over the past few years, Canadian banks have been striving to strengthen their presence in America. This February, Bank of Montreal BMO completed the acquisition of Bank of the West, BNP Paribas SA’s U.S. banking unit. Following the integration, BMO now has more than 1,000 branches in 32 states across the United States.

Further, in March, The Toronto-Dominion Bank TD acquired the U.S.-based investment bank, Cowen Inc. The deal supports TD’s endeavors to expand capabilities and accelerate the growth of TD Securities. The acquisition advances TD Securities’ long-term growth strategy in the United States and adds highly complementary products and services to its existing businesses.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Bank Of Montreal (BMO) : Free Stock Analysis Report

Toronto Dominion Bank (The) (TD) : Free Stock Analysis Report

Royal Bank Of Canada (RY) : Free Stock Analysis Report

HSBC Holdings plc (HSBC) : Free Stock Analysis Report

[ad_2]

Source link