[ad_1]

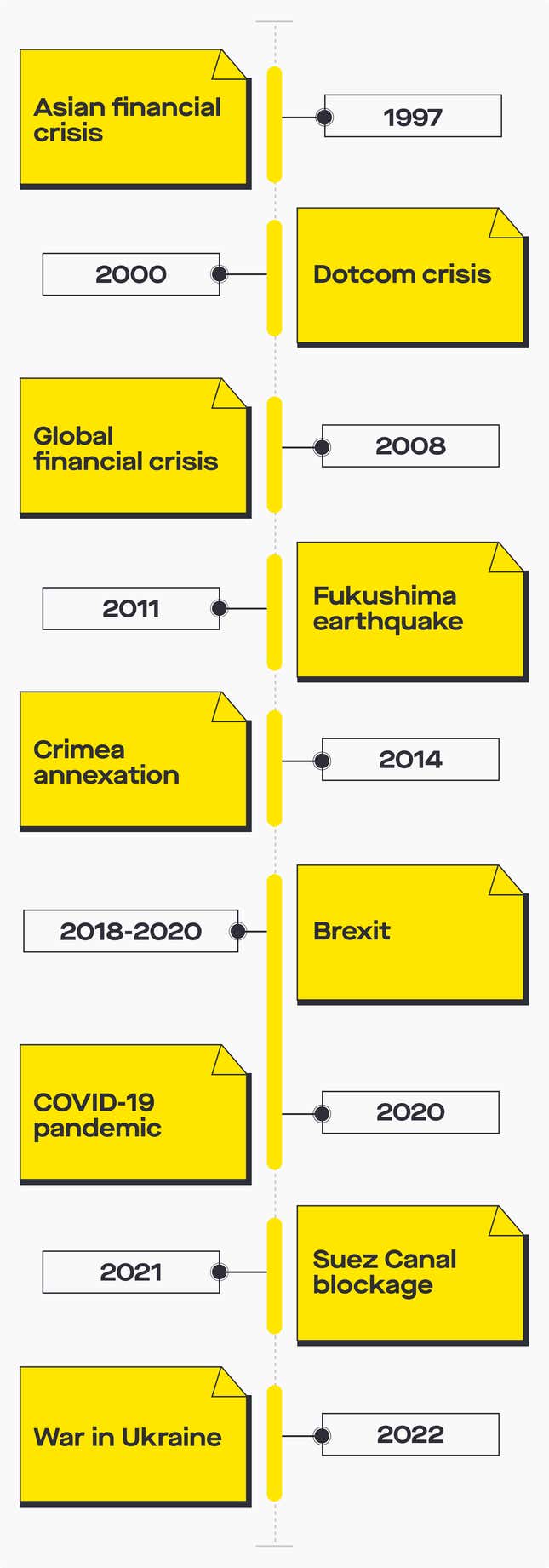

While market forces like going digital and responding to unstable supply chains have made enterprise-agility critical, rapid innovation is the surefire way to future-proof your organization because it allows for adaptability, growth, and differentiation.

While companies across every sector were already shifting to the cloud as the cornerstone of their innovation plans, these new and overlapping macroeconomic forces have made cloud migration table stakes for staying competitive in three ways.

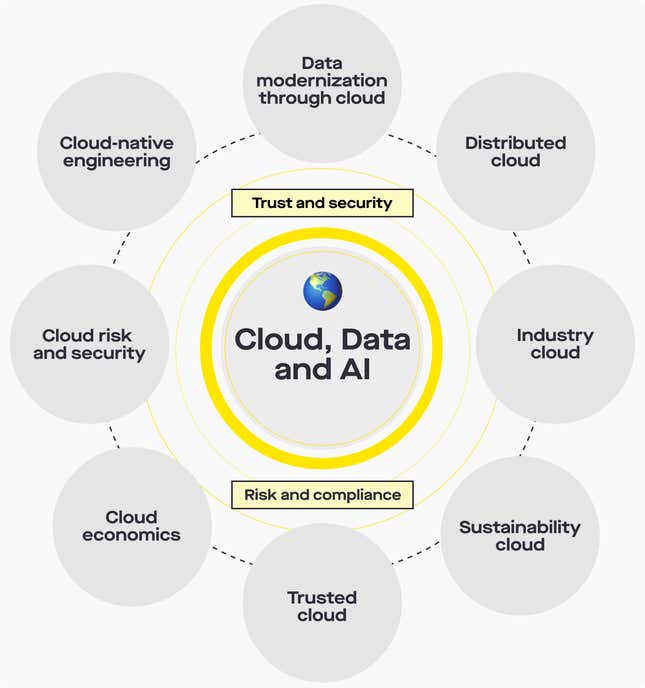

1. Modularity: Business-led, fit-for-purpose cloud and data platforms that support the development and scaling of digital use-cases

2. Agility: Composable architecture that enables business responsiveness with the flexibility of frequent releases and rapid iterations

3. Price: Consumption-based cloud models that enable predictable and precise economics

Whether your cloud needs are driven by ever-shifting compliance regulations or business innovation, there is an implementation that can be custom designed to meet your company’s needs. The very nature of cloud ecosystems, linking microservices and enabling data-centric operations, allows for a build-your-own or build-as-you-go mentality.

Below are three diverse initiatives in which the EY organization —with its keen understanding of the global marketplace and where the technology can be a lever—helped companies see the cloud opportunity, design the solution, and execute on it.

Discover how with the support of the EY organization and its broad business ecosystem, your company can better serve its customers, increase its revenue, and operate more efficiently — all with the cloud.

Case study 1 | Catering to customers through digital convenience

Wawa, a US convenience store chain, has always been proud of its culture of innovation. So, when customers and associates expressed a preference for an even more customized experience, Wawa rose to the challenge. Thinking big, they asked: How can technology enhance the more than 400 million customer interactions and over 40,000 associates without sacrificing personal connections?

“We want to continue to push the limits of what it means to be innovative while staying true to our commitment to provide Boundless Convenience™,” noted John Collier, Chief Information Officer, Wawa. “By offering more personal choices and more ordering options, we are better able to support our incredible associates to deliver even greater customer service.”

Wawa’s goal is to create a unified commerce strategy — augmenting human action with digital enhancements for greater experiences for both customers and associates. It’s important for Wawa to be available whenever and wherever its customers want. So, Wawa turned to EY organization professionals, and other key partners, to run several customer persona workshops. Using data and user research, the EY organization team documented current and potential Wawa consumer needs and buying motivations.

Under the premise that front-line associates can be the intelligence hub of the organization, Wawa is uniquely positioning technology to assist associates in working and thinking differently. The goal is to ensure operations run more smoothly and customers’ needs are more quickly addressed.

To help enable more autonomous operations, EY organization professionals helped build a cloud-based technology infrastructure. By moving back-office applications into a modern technology stack, Wawa associates are better equipped to keep pace with productivity and Wawa can gain operational efficiencies – leading to accelerated time to market of new products and services.

“Our competitive differentiation is really predicated on the empowerment of local frontline store associates,” highlighted Collier.

“We know our associates are the heart and soul of our organization and we want to use technology to complement their capabilities. Wawa is working on an augmented intelligence strategy to help serve customers better. Store associates are being equipped with the tools and dynamic capabilities needed to make real-time in-store decisions regarding customer needs.”

Driving innovative solutions meant Wawa had to embrace new ideas. One big idea came in the form of a net new business — catering — infusing the brand with its consumers in ways never imagined before.

“CIOs today need to react quickly to changing environments by utilizing data and technology differently,” says Rakesh Kumar, EY Americas Strategy and Transformation Leader. “We helped develop the back-end technology and complex services needed to support Wawa’s new interactive website and mobile application catering platform.”

The new catering business will be successfully deployed with over 950 Wawa stores expected to have catering by the end of 2022. Every customer will be able to order Wawa signature products sold in-store or online through the new catering service for events, milestones and celebrations.

Case study 2 | Driving revenue for a global sport

Cycling had a challenge. The fanbase is global, with an estimated 565 million cycling enthusiasts, and the Tour de France captures the world’s attention every July, but a longstanding and effective monetization strategy seemed beyond reach. One way to see the disparity is to compare global revenues of other professional sports.

If you were to look at the relative audiences, cycling generates just over a dollar per fan, while US football (400 million fans) yields nearly $20USD on average, and European football (3.5 billion fans) just under $5USD per footie enthusiast.

Whereas pro sports like football benefit from their physical stadiums—advertising opportunities, merchandise and concession spends, ticket sales—cycling takes place over hundreds of open-air miles and lacks a physical infrastructure to bolster fandom and dollars. But what cycling does have is reams of real-time data culled from the riders. It was a challenge tailor-made for a cloud implementation. Better yet, since there was no existing infrastructure that had to be reworked, thinking about how to operate in the cloud could be done from an entirely fresh slate.

The EY organization, in collaboration with Microsoft and a consortium of 11 global cycling teams, built a Microsoft Azure cloud platform to capture data from the sport’s riders. The platform was designed to ingest metrics to help develop compelling interactive stories for the riders’ teams, TVs around the world, and a dedicated app. This brought fans closer to the action, increased their engagement, and established a new digital platform from which cycling could grow. This was accomplished through three phases, each relying on the cloud in different ways: ingesting data, aggregating and processing data, and finally bringing it all to the fan.

Phase 1: Attach IoT-enabled devices beneath the bike’s saddle to capture compelling metrics like power, speed, GPS information (location, elevation, direction of travel), and heart rate.

“It’s been an incredibly complicated technical challenge to get that information, and then do something sensible with it, that we can drive insight from, visualize, and show to consumers in a meaningful way,” says Michael Henry, Director, Analytics practice, Ernst & Young LLP.

“We’re taking vast amounts of information across bikes that move up to 100 kmph … across thousands of miles for eight hours at a time.” Multiply this by 150 riders and data snapshots every second, and the payload becomes tremendous; the algorithms involved in crafting insights conduct approximately 1.2 billion real-time data calculations every race day.

Phase 2: Aggregate and pair the data with factors like team names and race routes to aid in developing analysis, and secure the data, as certain elements were proprietary to specific teams.

Here is where the EY organization stepped in with a data platform that allowed for high-speed streaming ingestion, storage, cognitive analytics, and artificial intelligence. With cloud computing, the platform helped enable large network access, both inbound and outbound, and can be scaled according to the request count in real time. Within the project, this provided the backbone for building the aggregation and analytics functions of the app.

Phase 3: Bring all this data to the fan. The EY organization pulled in all the data related to terrain, the riders’ exertion, and insights from leading sports scientists to develop a new metric: “the red zone.”

This enhancement facilitated through a blend of AI and human cycling experts, highlighted which riders had gone too hard and which might still have something left in the tank, pulling viewers more deeply into the race and the riders’ strain and prognosticating winners and losers. This allowed users of the app watching the race roadside, in the comfort of their own home, or gathered at the pub to get an inside look into just how quantifiably hard a cyclist was pushing themselves.

Having the ability to follow your favorite race and rider not simply visually but with up-to-the-minute data not available anywhere else produces further stickiness and appetite for races in the future. Taken together, the compelling data only available with this new platform, created the foundation for a scalable cycling economy, including monetizing races through sponsorship and advertising revenue and subscriptions to a premium version of the app.

Case study 3 | Making insurance more human

Though insurance isn’t often associated with terms like “innovation” and “consumer-friendly,” that is the connotation teams at the EY organization were able to create on behalf of UK insurer Hastings Direct.

Purchasing a policy online is one thing, but often making claims, canceling, and renewing can be sub-par digital experiences. Recognizing that anything less than a stellar customer experience could have a negative effect on their business, Hastings Direct wanted to put a stake in the ground as a digital-friendly product, and with the help of the EY organization, become the UK’s leading digital offering in the category.

Key metrics for any consumer-facing offering, both in the marketing of the product and the experience itself, are speed, ease of use, and a degree of customization. By leaning into the cloud, Hastings and the EY organization were able to significantly improve both how the insurer operated internally to service customers as well as externally on their websites and their app.

Hastings and the EY organization had a relationship dating back to 2014, and based on that history the two organizations were ready to develop a customer-first, mobile-first evolution in a three-step process:

Step 1: Complete a company-wide migration to the cloud

Step 2: Invest in data enrichment and management at all levels of the organization

Step 3: Upgrade the core platform to improve the customer journey

EY organization teams rebuilt the entire application suite in a cloud environment, allowing for the kind of fluidity and responsiveness required to both retain and build their customer base.

Internally, these changes allowed Hastings Direct’s development teams to be 40% more efficient in their work. Externally, they bolstered the user experience, for example, offering insurers’ chat functionality with the customer service department.

“Together, Hastings Direct and the EY organization continue to deliver beyond Hastings Direct’s stated expectations enabled by technology. It’s a relationship that helps us go from strength to strength with digital at the heart of our customer proposition,” says Mark Parker, Chief Operating Officer of Hastings Direct.

Alongside the technological transformation, it was important to make the experience more human by having a consumer-first mindset. Making transactions frictionless was accomplished in different ways, from creating simplified question sets to providing a greater level of self-service in choosing a policy through the app.

The net result for Hastings Direct was more efficient underwriting internally and faster online pricing externally. In January of 2022 they were the highest-rated app in the finance category, a sign of positive customer satisfaction. Looking to the future, Hastings Direct is embedding a rich use of data to develop more tailored, relevant, and adaptable products for customers.

Collectively these case studies highlight the ways in which cloud can move an enterprise forward and drive agility.

In the case of the retail chain, the powerful combination of data and cloud created a better experience for shoppers and store associates alike.

For the cycling association, a new mode of interaction was born, laying the foundation for a future relationship with a growing fan base.

And for the insurer, their cloud story allowed them to not simply remain competitive with digital upstarts but even surpass them.

This content was produced on behalf of the EY organization by Quartz Creative and not by the Quartz editorial staff. Sources are provided for informational and reference purposes only. They are not an endorsement of the EY organization or the EY organization’s products or services. This publication contains information in summary form and is therefore intended for general guidance only. It is not intended to be a substitute for detailed research or the exercise of professional judgment. Member firms of the global EY organization cannot accept responsibility for loss to any person relying on this article.

[ad_2]

Source link