[ad_1]

The Hang Seng Index fell 0.2 per cent to 16,216.33 on Monday, after sliding 1.8 per cent last week. The Tech Index slumped 1.9 per cent, while the Shanghai Composite Index erased losses to add 0.2 per cent.

The People’s Bank of China maintained its one-year policy rate on medium-term lending facilities at 2.5 per cent on Monday, dashing market hopes of a cut similar to the surprise move in August. The central bank, however, injected 216 billion yuan (US$30.2 billion) into the system via the facility.

“The market lacks the kind of catalysts that can significantly drive up stocks,” said Fang Yi, analyst at Guotai Junan Securities in Shanghai. “The consolidation pattern will probably last longer than expected.”

The city’s benchmark fell 4.7 per cent in the first two trading weeks, the worst start to a year since 2016 when the benchmark fell 10 per cent over the same period. Government reports last week showed consumer prices in mainland China fell for a third month in December. Trade data failed to inspire, with exports exceeding consensus estimates and imports trailing projections.

Distressed builder Logan Group vows to cut debt amid US$8 billion workout plan

Distressed builder Logan Group vows to cut debt amid US$8 billion workout plan

Distressed developer Logan Group jumped 5 per cent to HK$0.63 after pledging to cut its debt level by as much as US$3 billion to facilitate its debt repayment. Some creditors consented to its plan to repay US$8 billion of offshore debts and a shareholder loan with cash and new securities over a nine-year period.

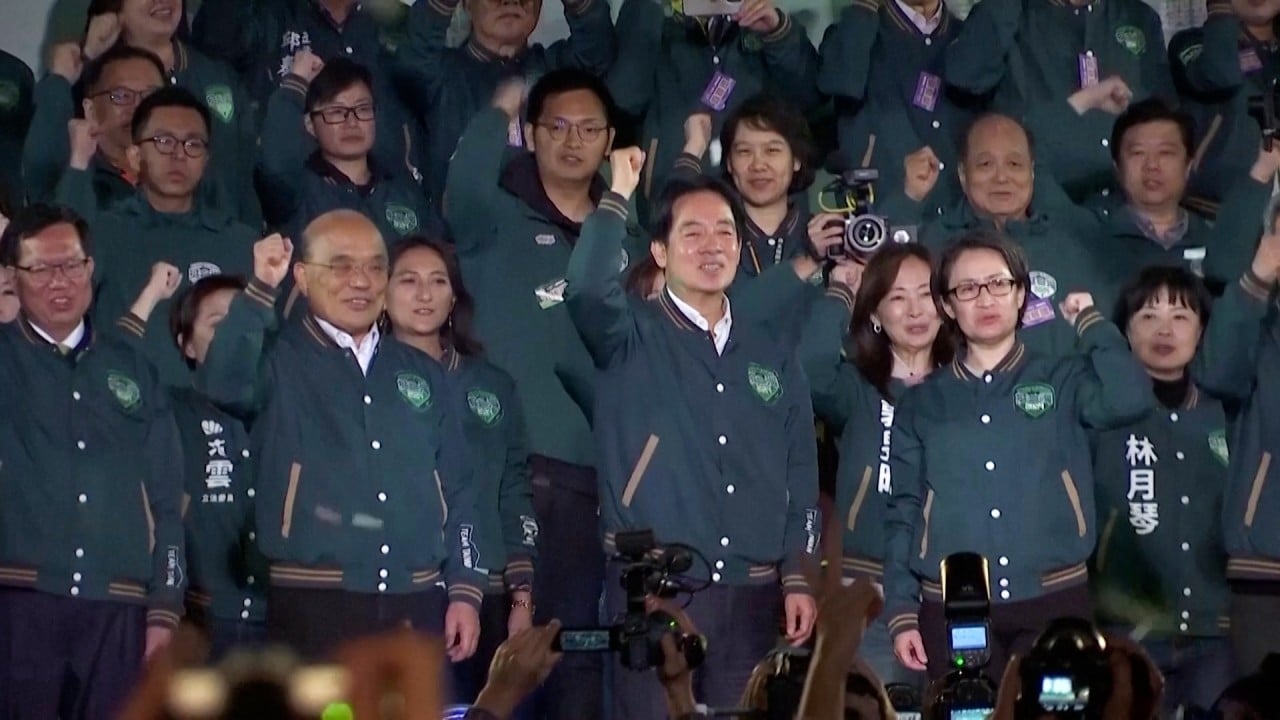

Tingyi Holding, which produces noodles, slid 1.9 per cent to HK$8.46 in Hong Kong. Foxconn Industrial Internet fell 1.1 per cent to 12.72 yuan in Shanghai. In Taipei, the benchmark Taiex index climbed 0.2 per cent, following a 2.3 per cent slide last week.

Other major Asian markets were mixed. Japan’s Nikkei 225 climbed 0.9 per cent, while South Korea’s Kospi and Australia’s S&P/ASX 200 were little changed.

[ad_2]

Source link