[ad_1]

“As the pressure of inflation recedes, the real interest rate is rising and creating an environment that is too restrictive,” said Raymond Mok, assistant vice-president of investment strategy at KGI Asia. “We expect the first 25 basis points cut to happen in the second quarter next year.”

The Fed may lower rates by more than 100 basis points, or a full percentage point, throughout the year, more than it had signalled in its latest guidance, he added.

The Fed kept its target rate unchanged at 5.25 per cent to 5.50 per cent range at its final meeting of 2023 on December 13. Fed board members and bank presidents, in their personal forecasts and assumptions, projected the median rate to fall to 4.6 per cent in 2024, suggesting three equal cuts of quarter-point each.

Fed chairman Jerome Powell last week said the US central bank would start cutting rates well before it hit its inflation goal of 2 per cent.

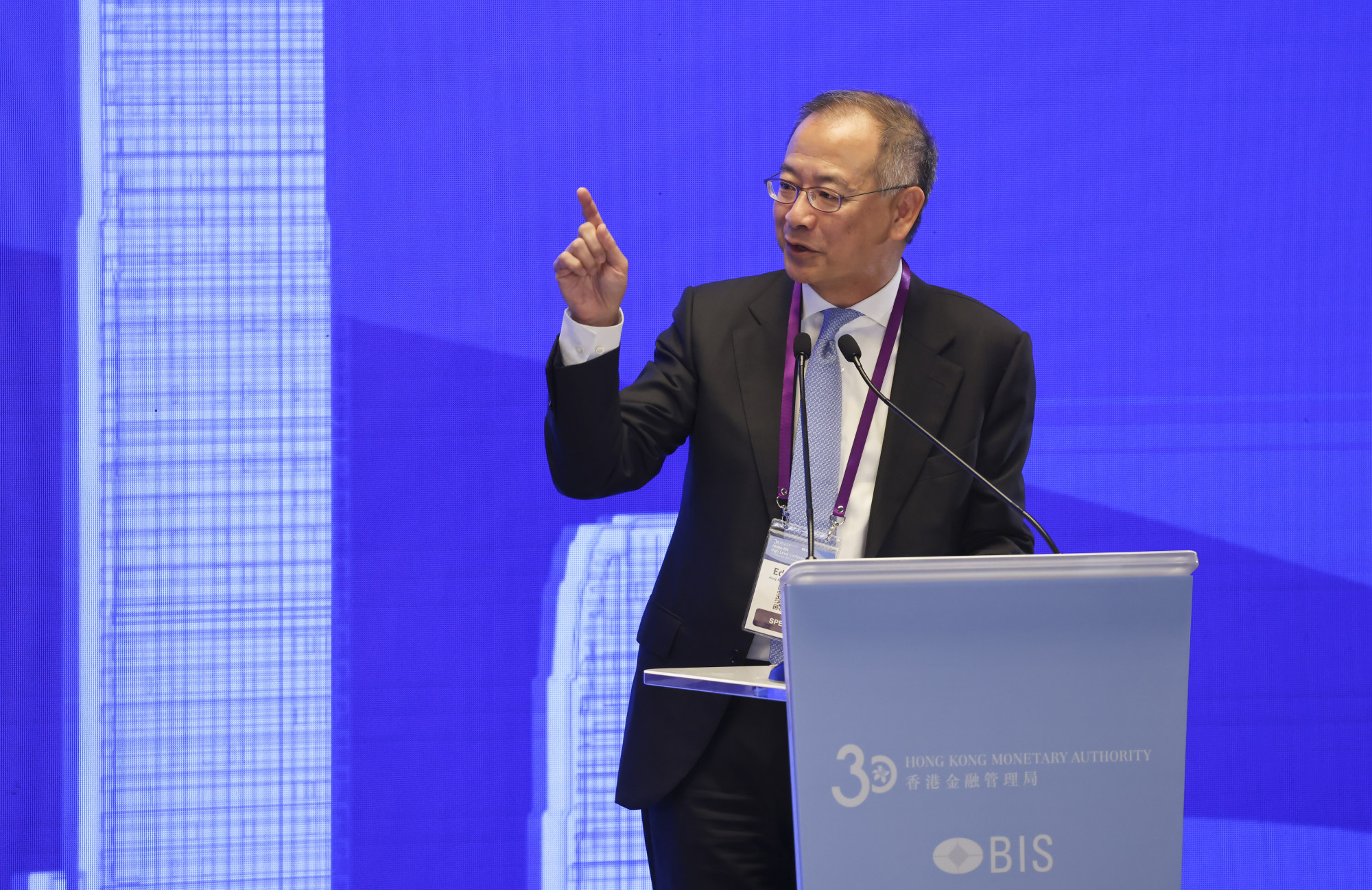

Hong Kong Monetary Authority (HKMA) CEO Eddie Yue Wai-man, however, believes the rate cut may only happen in the second half of next year.

“After the Federal Reserve released a ‘dovish’ statement last week, there are some analysts who believe the rate cut could come as early as February or March,” Yue said on a radio programme on Sunday. “I believe they are overly optimistic.”

The first US rate move will depend on a range of economic data, he added.

Yue’s view is shared by many analysts.

“Rates probably will not be lowered until the cumulative and lagging impacts of the Fed’s historic hawkishness come home to roost in the form of a mild recession, which we expect will occur in the second half of 2024,” said Saira Malik, chief investment officer at US asset management company Nuveen.

The HKMA maintained its base rate at 5.75 per cent on December 14, after the Fed left its target rate in the 5.25 per cent to 5.5 per cent range following the Federal Open Market Committee’s last meeting of the year.

It was the fourth pause since the Fed began its rate-hike cycle in March 2022, a sign the current rate rise cycle has come to an end. In total, the HKMA has increased the base rate by 525 basis points since March 2022, even as the city’s economy was mired in a recession.

Since the local currency has been pegged to the US dollar since 1983, local interest rates move in lockstep with the US.

Hong Kong commercial banks may cut their prime rate sometime next year.

Lenders have increased their prime rate five times since September 2022 by a total of 87.5 basis points. The best lending rate at HSBC, Bank of China (Hong Kong) and Hang Seng Bank is currently 5.875 per cent per year, while Standard Chartered, Bank of East Asia and others have set theirs at 6.125 per cent.

“The Hong Kong economy surely benefits from lower US rates, especially the property sector,” said David Chao, global market strategist for Asia-Pacific (ex-Japan) at Invesco. “Hong Kong markets are also likely to benefit as lower US rates increase investors’ risk appetite.”

Chao is among the four bankers polled by the Post who believes the first rate cut will happen early in the second quarter.

A suspension in the interest rate increase and a possible rate cut next year would be a relief for property owners with mortgages, said Eric Tso Tak-ming, chief vice-president of mortgage broker mReferral.

This would also benefit the mortgage market, which is showing signs of a recovery, Tso added.

“A rate cut will help attract capital flow back from US dollar assets to Asian capital markets, which will benefit Hong Kong’s stock market and help stop the yuan from devaluing further,” said Raymond Yeung, chief economist for Greater China at ANZ Banking Group.

Paul McSheaffrey, a senior banking partner at KPMG China, said banks tend to benefit in a falling interest rate environment.

“For the banking sector, any cut in interest rates, as long as it is not too drastic, is likely to be positive,” he said.

[ad_2]

Source link