[ad_1]

Amongst the ‘top short sellers’ are also two Indian companies – one registered in New Delhi, against whose promoter SEBI had passed an order for misleading investors and stock market manipulation. The other is registered in Mumbai.

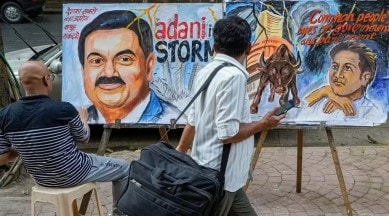

THE Enforcement Directorate has concluded, after a preliminary investigation into the Hindenburg Research report and the subsequent market crash, that a dozen companies including foreign portfolio investors and foreign institutional investors (FPIs/ FIIs) based in tax havens were the “top beneficiaries” of short selling in shares of Adani Group companies, The Indian Express has learnt.

Short sellers are investors who believe and bet share prices will fall; they borrow shares to sell and buy them back later at a lower price, thus making a profit in the transaction.

According to ED, which shared its findings with market regulator Securities and Exchange Board of India (SEBI) in July, some of these short sellers allegedly took positions just 2-3 days before the Hindenburg Research report was published on January 24, and some others were taking short positions for the first time ever.

You have exhausted your

monthly limit of free stories.

To continue reading,

simply register or sign in

Get unrestricted access to journalism that sharpens your conversations. Check out the ePaper + Premium combo plan

This premium article is free for now.

Register to read more free stories and access offers from partners.

Get unrestricted access to journalism that sharpens your conversations. Check out the ePaper + Premium combo plan

This content is exclusive for our subscribers.

Subscribe now to get unlimited access to The Indian Express exclusive and premium stories.

Domestic investors as well as FPIs/ FIIs registered with SEBI are allowed to trade in derivatives — instruments that allow investors to hedge the market risks by taking short positions. SEBI allows regulated short selling and believes that restrictions may distort efficient price discovery, provide promoters unfettered freedom to manipulate prices and on the contrary, favour manipulators.

According to sources, three of the 12 entities are India-based (one is the Indian branch of a foreign bank); four are based in Mauritius and one each in France, Hong Kong, Cayman Islands, Ireland and London. They said none of the FPIs/ FIIs have disclosed their ownership structures to Income Tax authorities.

For instance, one was incorporated in July 2020, and had no business activity till September 2021, and in a short period of six months from September 2021 to March 2022, claimed income of Rs 1,100 crore on a turnover of Rs 31,000 crore.

Another global financial services group, which operates as a bank in India, earned just Rs 122 crore, but as an FII earned “whopping income of Rs 9,700 crore” without any income tax.

The parent company of a Cayman Islands FII, one amongst the dozen ‘top beneficiaries’ had pleaded guilty of insider trading and paid a fine of $1.8 billion in the US. In fact, this FPI took a short position in Adani Group scrips on January 20, and enhanced it further on January 23. Another Mauritius-based fund took a short position on January 10 for the first time.

Amongst the ‘top short sellers’ are also two Indian companies – one registered in New Delhi, against whose promoter SEBI had passed an order for misleading investors and stock market manipulation. The other is registered in Mumbai.

Most Read

Sunny Deol responds if he’s charging Rs 50 cr as his fees after Gadar 2 success: ‘Main samajhdaar insaan hoon’

Sushmita Sen says Farah Khan apologised to her after Main Hoon Na’s final edit: ‘You are barely there in the film’

The ED had earlier presented the intelligence and analysis gathered by it on alleged insider trading to a six-member Expert Committee set up by the Supreme Court in March to investigate regulatory failure in relation to the Adani Group. In fact, in its final 173-page report, submitted to the Supreme Court on May 6, the Expert Committee had said that ED had found “potentially violative selling by specific parties” and that “this may lead to credible charges of concerted destabilisation of the Indian markets, and SEBI ought to be probing such actions under securities laws.”

In its latest submission before the Supreme Court last week, SEBI had said 22 investigation reports were final, and two were interim. While one related to violations of SEBI’s minimum public shareholding norms, the other pertains to investigation of trading patterns or short positions of certain entities in Adani Group companies. SEBI sought to find if these were unusual around the time of the release of the Hindenburg report. The time period of investigation was January 18-31. The regulator had said it was actively pursuing and waiting for information from external agencies/ entities.

The conclusion of the ED, shared earlier with the Expert Committee and now with SEBI – is that transactions and income tax data throw up the possibility of the FPIs and FIIs not being the “end beneficiaries” of the gains made from short selling, but actually acting as brokers for bigger players located overseas.

© The Indian Express (P) Ltd

First published on: 29-08-2023 at 04:15 IST

[ad_2]

Source link