[ad_1]

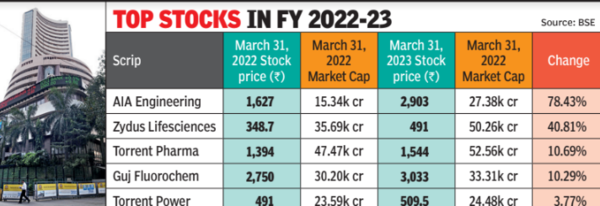

However, a number of other companies including state PSUs lost up to 67% in the financial year. Analysts say Gujarat-based companies have strong presences in their sectors and bright projections, which helped them do well in a difficult economic scenario.

Hitesh Somani, a Sebiregistered research analyst, said, “We did not see a major change in the indices in the last financial year but we saw massive volatility in the stock prices of Gujaratbased listed companies.

Various factors affected the stock markets this year such as the Russia-Ukraine war, high inflation, increasing interest rates and low demand in many sectors.” He further added, “major companies from Gujarat performed well, while many others have shown negative returns, such as Sadbhav Engineering (-67%) and GNFC (-40%).”

The sensex showed a very small rise (0.72%) and the Nifty a marginal decline (0.60%) in this financial year. AIA Engineering grew by a whopping 78% in the last financial year, while Zydus Lifesciences appreciated by 40%. “These companies have shown resilience against global negative factors and have strong financials and projections.

Other Gujaratbased companies have had mixed results, but Gujarat PSUs are down again losing more than 30% of their market cap,” Somani added. Viral Mehta, the west zone head of a stock broking firm, said, “The rupee depreciation helped exportoriented companies but weak demand from Europe and the US hurt revenues and profits of some companies. Gujarat companies have strong fundamentals and ambitious plans, so they will do better when global factors are more favourable.”

[ad_2]

Source link