[ad_1]

Introduction: “Everyone got a little bit greedy” as Wilko failed, claims Putman.

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Greed has been blamed for the failure to agree a rescue deal for Wilko, as MPs prepare to examine the collapse of the discount retailer this autumn.

Doug Putman, the billionaire Canadian business executive, says he came very close to agreeing a deal that would have saved thousands of jobs, but was thwarted by the homeware chain’s suppliers.

Putman told Radio 4’s Today Programme that he really thought he had a deal to take over Wilko, which closed its doors last month with the loss of around 12,000 jobs.

But, he explains, companies – such as Wilko’s IT suppliers – refused to budge on fees they wanted to charge for the transition.

Putman says these companies were “super inflexible” about cooperating for the “four months or so” that he would have needed their systems before transitioning to his own.

Putman, who owns HMV, says:

I thought we did have a deal. We thought we would, we would get that over the line….

But for those four months, the amount of money that the companies wanted to charge made the Wilco deal literally impossible to do. And that was something that was found out really late in the game.

He cites a landlord who hosted Wilko’s servers, in a tiny room, but wanted to charge rent on their whole million square feet facility for Putman to keep the server.

He explains:

So I would say everyone just got a little bit greedy, and unfortunately, weren’t thinking about the 10,000-plus jobs that would have been saved and were only thinking about their little piece of it.

Wilko fell into administration in August, as it struggled with debts of £625m.

Putman offered to take on up to 350 of Wilko’s 400 stores and ensure the main creditors – led by the restructuring specialist Hilco – were paid. But that offer collapsed in mid-September, and was followed by the closure of the company.

Putman says today:

PwC [Wilko’s administrators] really wanted a deal. We wanted a deal. We had a deal.

We had an agreement and I think these things came out of the woodwork for both of us, where we were both a bit stunned.

MPs on the Business and Trade Committee will dig into the colllapse of Wilko today, when they hold a hearing with the firm’s former chair, Lisa Wilkinson (who stepped down in January) and Mark Jackson, the company’s CEO.

The committee say they will examine:

-

the Wilkinson family’s justification for taking millions of pounds in dividends out of the firm, even when it was heavily indebted;

-

what attempts were made to save the business and whether crucial advice was ignored; and

-

the £50 million shortfall in the company’s pension fund.

They’ll also hear from union representatives and industry experts about what went wrong, and quiz business minister Kevin Hollinrake.

Here’s a post from the committee from last night:

The agenda

-

10am GMT: Business and Trade committee hearing on Wilko’s collapse begins

-

10.15am GMT: Treasury committee questions OBR officials on autumn statement

-

2pm GMT: US house price index for October

-

2.15pm GMT: Treasury committee questions economists on autumn statement

-

3pm GMT: US consumer confidence index for October

Key events

UBS chair blames Credit Suisse’s investment bankers for its collapse

Kalyeena Makortoff

UBS’ chairman Colm Kelleher has blamed Credit Suisse’s investment bankers for leading to the lender’s eventual demise, and admitted one of his biggest concerns in taking over the rival lender was “cultural contamination” from those “bad actors”.

Speaking at the FT Banking Summit, Kelleher said:

“I was concerned [that] my single biggest risk when we acquired Credit Suisse was whether we would have cultural contamination there. That hasn’t worked out the case, mainly because most of the bad actors left anyway.”

Those “bad actors”, he explained, were “a lot of the investment bankers at Credit Suisse.”

“Credit Suisse would not have been in the position it was, if the investment bank had been allowed to be run properly. And I’m sure there were very many good investment bankers at Credit Suisse, that’s not a general rule, but it’s a clear point of what went on.”

While many Credit Suisse bankers left voluntarily as a result of the merger, UBS has also embarked on brutal job cuts, designed to cut costs and to avoid duplicating roles across the new group.

UBS confirmed earlier this month that they had slashed more than 4,000 jobs between July and September, bringing total job losses to 13,000 so far this year.

Phillip Inman

The OBR’s chair Richard Hughes, economic adviser professor David Miles and Whitehall watcher Tom Josephs (a former senior Treasury and DWP civil servant) will be quizzed in Parliament this morning by MPs who sit on the Treasury committee.

Here are some questions they might ask, at the session which begins at 10.15am.

-

Why have you assessed the economy as much stronger than the Bank of England? The BoE’s assessment of the underlying growth rate (used to determine how fast the UK can grow without triggering inflation) is below 1% and yours is above 1%. If you had used the BoE assessment, the chancellor would have seen his £25bn windfall wiped out.

-

Why do you believe the trade deals with Australia and New Zealand and the Asian countries in the CTPP bloc will only reap 0.1% and 0.04% respectively in extra GDP, when leaving the single market costs as much as 4% of GDP.

-

Should you have said that at the end of the five year horizon the government will have a £13bn buffer when that includes the re-application of fuel duty, when we know – and you say in the report – that the government has scrapped the rise in fuel duty.

The report says:

“Our forecast again incorporates £6.2bn of extra revenue in 2028-29 from the Government’s stated policy of increasing fuel duty rates in line with RPI inflation and the reversal of the ‘temporary’ 5p cut. If, like all Chancellors since 2011, rates are instead held at the current rate then more than 43% of the headroom in 2028-29 would be removed and debt would no longer be falling in 2027-28.”

Flooring retailer Topps Tiles has warned the City that sales have dipped in recent weeks as consumers cut back.

The company says like-for-like sales at Topps Tiles are down 6.1% in the last eight weeks (the start of its financial year).

It blames the “well-documented challenges to discretionary consumer spending”, including higher interest rates and prolonged high inflation, falling house prices and lower housing transactions.

Chief executive Rob Parker explains:

“As we enter our new financial year, it is clear that there has been a weakening of discretionary consumer spending.

The business is well positioned to deal with this period, our established brands are market leading, we are competitively advantaged and we are confident that we will continue to take market share.

Topps Tiles also reported that revenues grew 6.3% in the last financial year. up to September 30th, although pre-tax profits fell 37% to £6.8m.

UK housebuyers negotiating larger discounts

After a choppy time in the housing market, homebuyers are in the strongest negotiating position for five years, according to property website Zoopla.

Zoopla reports this morning that sellers are accepting discounts of £18,000, on average, to secure a deal.

This is due to more homes coming onto the market, while higher mortgage rates are constraining how much buyers can borrow.

Richard Donnell, executive director at Zoopla, explains:

“These are the best conditions for home buyers for some years with more homes to choose from and with sellers more prepared to negotiate on price to agree a sale. There is a growing acceptance that what a home might have been worth a year ago is now largely academic given current market conditions. Sellers have plenty of room to negotiate with average house prices still £41,350 higher than the start of the pandemic.

It’s a positive sign that new sales continue to be agreed at a faster rate than a year ago and pre-pandemic. This indicates that house prices do not need to post bigger falls to get people moving but sellers need to be ready for more negotiation on price.

New sales will slow as we run up to Christmas and some sellers will take homes off the market ready to relaunch in the new year.“

Here’s the full story:

And here’s more details of Zoopla’s report, from property agent Emma Fildes at Brick Weaver:

Those who can still afford to move, shop around for a bargain, sifting throu UK Estate Agents well stocked rails to secure an avg discount of £18,000. Further price reductions in London & the South East, avg’ing £25,000 proves a draw for those keen to avoid a commute @Zoopla pic.twitter.com/PDlJJrUmi7

— Emma Fildes (@emmafildes) November 28, 2023

Despite demand remaining 13% lower than 2019 levels, in this 2023 winter sale, sales volumes have inc’d 15% on last year & 5% on 2019 levels. This is due to cash rich & deposit heavy buyers choosing to move when the price is right & there is less competition @Zoopla pic.twitter.com/rHQOV7KKOI

— Emma Fildes (@emmafildes) November 28, 2023

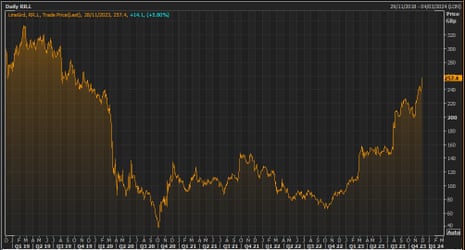

Rolls-Royce shares hit four-year high on profitability push

Shares in Rolls-Royce have hit a four-year high this morning, after the UK engineering company set out new targets for operating profit and free cash flow this morning.

Rolls-Royce said it intends to become financially stronger and more resilient than before, as it updates shareholders at its Capital Markets Day today.

It also plans to sell between £1bn and £1.5bn of assets over the next five years, including its electric plane arm.

Rolls-Royce makes and services jet engines, and is also developing a small, modular nuclear reactor.

Chief executive Tufan Erginbilgic, who took over in January, is attempting to grow Rolls-Royce’s profitability, with higher sustainable free cash flows and a strong balance sheet.

Erginbilgic says:

Rolls-Royce is at a pivotal point in its history.

After a strong start to our transformation programme, we are today laying out a clear vision for the journey we need to take and the areas where we must focus.

We are creating a high performing, competitive, resilient and growing Rolls-Royce that will have the financial strength to control and shape its own destiny. We are confident in our ability to achieve these ambitions and have a clear and granular plan to deliver on our targets.

We have made significant progress, with 2023 profit and cash forecast to be materially ahead of 2022.

Shares in Rolls-Royce are leading the FTSE 100 risers, up 6% at 258p.

Back in early October 2020 they fell below 35p, as the disruption to travel in the Covid-19 pandemic hit its revenues, before rallying as the first vaccine trial results came in.

Record profit at easyJet

In the City, budget airline easyJet has reported a record profit, but warned that conflict in the Middle East will hit trading.

EasyJet has posted a headline pre-tax profit of £455m for the year to 30 September, up from a loss of £178m a year earlier.

It benefited from the end of pandemic restrictions, flying 19% more passengers than a year before.

But, easyJet expects its winter schedule to see an impact from the Israel-Hamas war, with flights to both Israel and Jordan temporarily paused.

It adds:

Additionally there was a broader impact on near term flight searches and bookings across the industry, though this seems to be coming back with a recent improvement in trading.

EasyJet still has a positive outlook for the current year, though, which helped to send its share up 2.5% this morning.

Johan Lundgren, CEO of easyJet, said:

“We see a positive outlook for this year with airline and holidays bookings both ahead year on year and recent consumer research highlights that around three quarters of Britons plan to spend more on their holidays versus last year with travel continuing to be the top priority for household discretionary spending.

UK shop inflation falls to 17-month low, but….

Elsewhere in the retail world, inflation in UK shops has fallen to a 17-month low…. but shops are warning that the trend may not continue,

Shop price annual inflation dropped to 4.3% in November, from 5.2% in October, according to the Britsh Retail Consortium.

That’s the slowest rate of price rises since June 2022, as retailers competed to win sales ahead of the Christmas rush.

Non-Food inflation fell to 2.5%, down from 3.4%, but food decelerated to 7.8%, from 8.8%.

But Helen Dickinson, chief executive of the BRC, warned that rising costs might lead to prices accelerating again:

“Retailers are committed to delivering an affordable Christmas for their customers.

They face new headwinds in 2024 – from government-imposed increases in business rates bills to the hidden costs of complying with new regulations. Combining these with the biggest rise to the National Living Wage on record will likely stall or even reverse progress made thus far on bringing down inflation, particularly in food.

More here:

For the first time since Wilko’s collapse – their boss will be grilled by MPs today.

More than 10,000 workers lost their jobs. The least they deserve is answers. pic.twitter.com/rPOOKuGAZg

— GMB Union (@GMB_union) November 28, 2023

The agenda for today’s Wilko session

Here’s the schedule for the Business and Trade Committee hearing into the collapse of Wilko:

Panel 1 (10.00am GMT):

-

Nadine Houghton, National Officer, GMB

-

Patrick O’Brien, Global Retail Research Director, GlobalData

-

Professor Atul Shah, Professor of Accounting and Finance, City University

-

David Steinberg, Partner, Stevens & Bolton

Panel 2 (10.45am GMT):

-

Mark Jackson, former CEO of Wilko

-

Victoria Venning, Partner, EY

-

Andrew Walton, UK Head of Audit, EY

-

Lisa Wilkinson, former Chair of Wilko

Panel 3 (11.30am GMT):

-

Kevin Holinrake MP, Minister for Enterprise, Markets and Small Business, Department for Business and Trade

-

Angela Crossley, Director of Strategy Policy and Analysis, Insolvency Service

GMB: Wilko staff deserve answers

Former Wilko workers are travelling to parliament today to hear the company former chair and CEO explain why the chain collapse, and they lost their jobs, the GMB union say.

GMB National Officer Nadine Houghton, who will testify to MPs today, explains:

“This will be the first time Wilko workers have heard from bosses about what went wrong and why the company was allowed to collapse.

“They’ve never received an apology or explanation from Lisa Wilkinson, despite many staff having dedicated decades of their lives to the business.

“Wilko chiefs should know that GMB members will be there listening; they expect the answers they have been denied for so long.”

Introduction: “Everyone got a little bit greedy” as Wilko failed, claims Putman.

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Greed has been blamed for the failure to agree a rescue deal for Wilko, as MPs prepare to examine the collapse of the discount retailer this autumn.

Doug Putman, the billionaire Canadian business executive, says he came very close to agreeing a deal that would have saved thousands of jobs, but was thwarted by the homeware chain’s suppliers.

Putman told Radio 4’s Today Programme that he really thought he had a deal to take over Wilko, which closed its doors last month with the loss of around 12,000 jobs.

But, he explains, companies – such as Wilko’s IT suppliers – refused to budge on fees they wanted to charge for the transition.

Putman says these companies were “super inflexible” about cooperating for the “four months or so” that he would have needed their systems before transitioning to his own.

Putman, who owns HMV, says:

I thought we did have a deal. We thought we would, we would get that over the line….

But for those four months, the amount of money that the companies wanted to charge made the Wilco deal literally impossible to do. And that was something that was found out really late in the game.

He cites a landlord who hosted Wilko’s servers, in a tiny room, but wanted to charge rent on their whole million square feet facility for Putman to keep the server.

He explains:

So I would say everyone just got a little bit greedy, and unfortunately, weren’t thinking about the 10,000-plus jobs that would have been saved and were only thinking about their little piece of it.

Wilko fell into administration in August, as it struggled with debts of £625m.

Putman offered to take on up to 350 of Wilko’s 400 stores and ensure the main creditors – led by the restructuring specialist Hilco – were paid. But that offer collapsed in mid-September, and was followed by the closure of the company.

Putman says today:

PwC [Wilko’s administrators] really wanted a deal. We wanted a deal. We had a deal.

We had an agreement and I think these things came out of the woodwork for both of us, where we were both a bit stunned.

MPs on the Business and Trade Committee will dig into the colllapse of Wilko today, when they hold a hearing with the firm’s former chair, Lisa Wilkinson (who stepped down in January) and Mark Jackson, the company’s CEO.

The committee say they will examine:

-

the Wilkinson family’s justification for taking millions of pounds in dividends out of the firm, even when it was heavily indebted;

-

what attempts were made to save the business and whether crucial advice was ignored; and

-

the £50 million shortfall in the company’s pension fund.

They’ll also hear from union representatives and industry experts about what went wrong, and quiz business minister Kevin Hollinrake.

Here’s a post from the committee from last night:

The agenda

-

10am GMT: Business and Trade committee hearing on Wilko’s collapse begins

-

10.15am GMT: Treasury committee questions OBR officials on autumn statement

-

2pm GMT: US house price index for October

-

2.15pm GMT: Treasury committee questions economists on autumn statement

-

3pm GMT: US consumer confidence index for October

[ad_2]

Source link