[ad_1]

US stocks rose on Wednesday as fears of further turmoil in the banking sector eased, while Asian equities were buoyed by Chinese ecommerce giant Alibaba’s plans to splinter into six business units following years of pressure from domestic regulators.

Wall Street’s S&P 500 and the tech-heavy Nasdaq Composite added 1 per cent and 1.3 per cent respectively, leaving both indices on track for modest monthly gains despite the recent collapse of three midsized US lenders. The KBW Bank index rose 1.5 per cent, while shares in First Republic Bank climbed 6.1 per cent.

“Banking system stress remains high but there are some signs of stabilisation,” said analysts at Bank of America, with lenders on Tuesday borrowing roughly $5.7bn from the Federal Home Loan Banks, down from $156.4bn borrowed from the liquidity provider on March 13, when stresses in the banking sector first emerged.

Bond markets traded between gains and losses throughout the day, with the two-year US Treasury yield down 0.01 percentage points at 4.04 per cent and the yield on the 10-year Treasury down 0.01 percentage points at 3.56 per cent in New York. Yields fall when prices rise. The dollar advanced 0.3 per cent against a basket of six other currencies.

Figures out on Wednesday showed US home sales rose for the third consecutive month in February, up 0.8 per cent compared with January. Economists polled by Refinitiv had expected a monthly decline of 2.3 per cent.

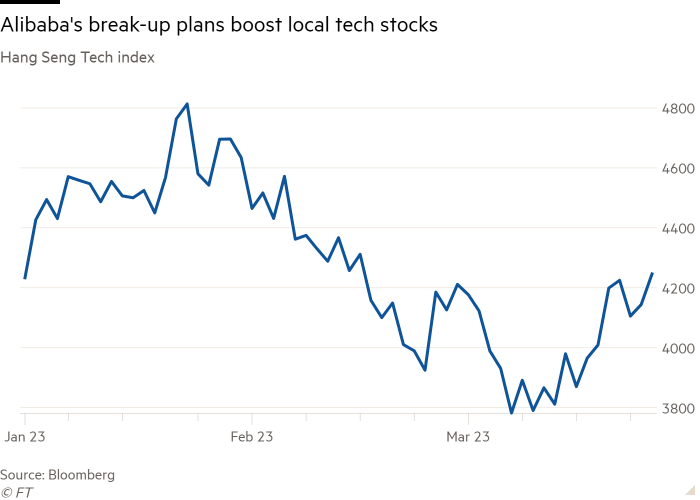

In Asia, Alibaba’s Hong Kong-listed shares rose more than 12 per cent, following similar gains on Wall Street the day before, while the Hang Seng Tech index tracking the largest technology companies listed in the city climbed 2.4 per cent to its highest level since late February. China’s CSI 300 rose 0.2 per cent.

The moves came after Alibaba announced a radical restructuring plan on Tuesday that would mean the company separating into business groups dedicated to cloud computing, ecommerce, local services, logistics, digital commerce and media. Long under pressure from domestic regulators, Alibaba’s stock has fallen almost 70 per cent from its October 2020 peak.

Europe’s region-wide Stoxx 600 index added 1.2 per cent, with shares in UBS up 3.7 per cent after the bank said it would bring back Sergio Ermotti as chief executive to steer its takeover of Credit Suisse. Europe’s Stoxx 600 Banks index gained 1.9 per cent.

London’s FTSE 100, meanwhile, rose 1 per cent, helped by real estate stocks after UK mortgage approvals edged up in February, rising to 43,500 from 39,600 in January.

Prices for Brent crude gave up earlier gains to slip 0.6 per cent to $78.38 a barrel, but up from roughly $73 a barrel two weeks ago.

[ad_2]

Source link