[ad_1]

The global economy is poised to slow this year, before rebounding next

year. Growth will remain weak by historical standards, as the fight against

inflation and Russia’s war in Ukraine weigh on activity.

Despite these headwinds, the outlook is less gloomy than in our October

forecast, and could represent a turning point, with growth bottoming out

and inflation declining.

Economic growth proved surprisingly resilient in the third quarter of last

year, with strong labor markets, robust household consumption and business

investment, and better-than-expected adaptation to the energy crisis in

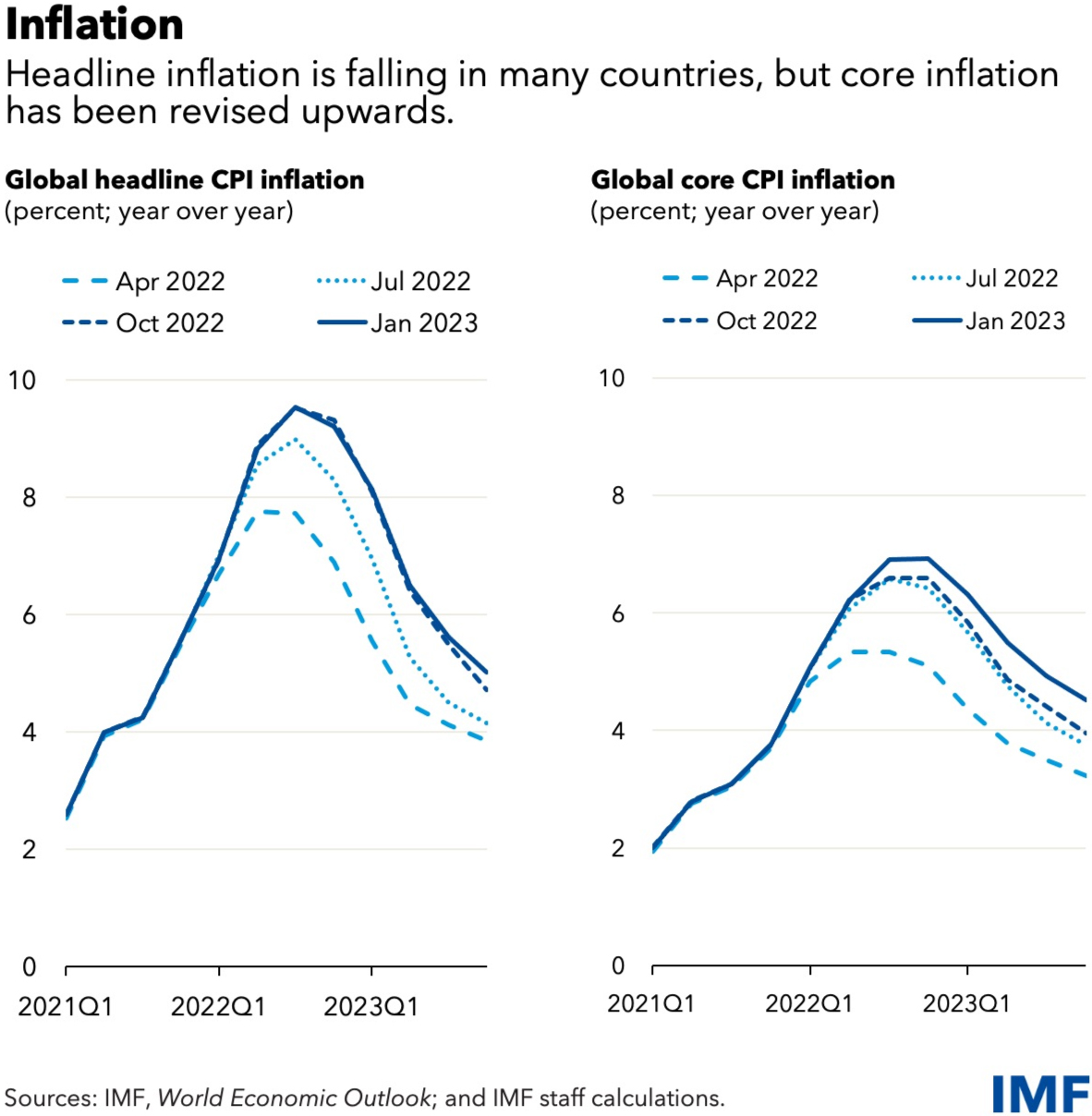

Europe. Inflation, too, showed improvement, with overall measures now

decreasing in most countries—even if core inflation, which excludes more

volatile energy and food prices, has yet to peak in many countries.

Elsewhere, China’s sudden re-opening paves the way for a rapid rebound in

activity. And global financial conditions have improved as inflation

pressures started to abate. This, and a weakening of the US dollar from its

November high, provided some modest relief to emerging and developing

countries.

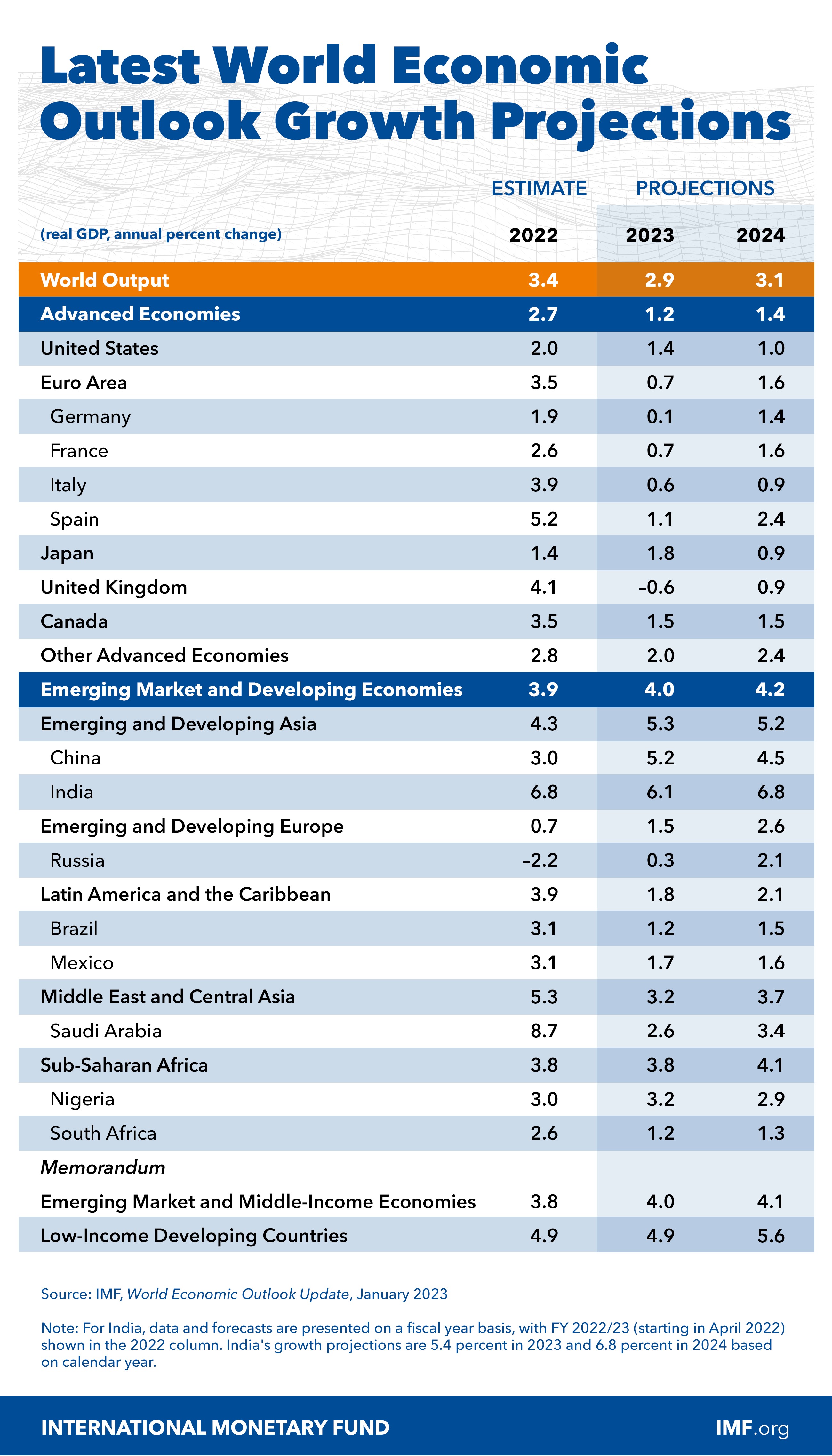

Accordingly, we have slightly increased our 2022 and 2023 growth forecasts.

Global growth will slow from 3.4 percent in 2022 to 2.9 percent in 2023

then rebound to 3.1 percent in 2024.

For advanced economies, the slowdown will be more pronounced, with a

decline from 2.7 percent last year to 1.2 percent and 1.4 percent this year

and next. Nine out of 10 advanced economies will likely decelerate.

US growth will slow to 1.4 percent in 2023 as Federal Reserve interest-rate

hikes work their way through the economy. Euro area conditions are more

challenging despite signs of resilience to the energy crisis, a mild

winter, and generous fiscal support. With the European Central Bank

tightening monetary policy, and a negative terms-of-trade shock—due to the

increase in the price of its imported energy—we expect growth to bottom out

at 0.7 percent this year.

Emerging market and developing economies have already bottomed out as a

group, with growth expected to rise modestly to 4 percent and 4.2 percent

this year and next.

The restrictions and COVID-19 outbreaks in China dampened activity last

year. With the economy now re-opened, we see growth rebounding to 5.2

percent this year as activity and mobility recover.

India remains a bright spot. Together with China, it will account for half

of global growth this year, versus just a tenth for the US and euro area

combined. Global inflation is expected to decline this year but even by

2024, projected average annual headline and core inflation will still be

above pre-pandemic levels in more than 80 percent of countries.

The risks to the outlook remain tilted to the downside, even if adverse

risks have moderated since October and some positive factors gained in

relevance.

On the downside:

- China’s recovery could stall amid greater-than-expected economic

disruptions from current or future waves of COVID-19 infections or a

sharper-than-expected slowdown in the property sector - Inflation could remain stubbornly high amid continued labor-market

tightness and growing wage pressures, requiring tighter monetary policies

and a resulting sharper slowdown in activity - An escalation of the war in Ukraine remains a major threat to global

stability that could destabilize energy or food markets and furtherfragment the global economy

- A sudden repricing in financial markets, for instance in response to

adverse inflation surprises, could tighten financial conditions, especially

in emerging market and developing economies

On the upside:

- Strong household balance sheets, together with tight labor markets and

solid wage growth could help sustain private demand, although potentially

complicating the fight against inflation - Easing supply-chain bottlenecks and labor markets cooling due to falling

vacancies could allow for a softer landing, requiring less monetary

tightening

Policy priorities

The inflation news is encouraging, but the battle is far from won. Monetary

policy has started to bite, with a slowdown in new home construction in

many countries. Yet, inflation-adjusted interest rates remain low or even

negative in the euro area and other economies, and there is significant

uncertainty about both the speed and effectiveness of monetary tightening

in many countries.

Where inflation pressures remain too elevated, central banks need to raise

real policy rates above the neutral rate and keep them there until

underlying inflation is on a decisive declining path. Easing too early

risks undoing all the gains achieved so far.

The financial environment remains fragile, especially as central banks

embark on an uncharted path toward shrinking their balance sheets. It will

be important to monitor the build-up of risks and address vulnerabilities,

especially in the housing sector or in the less-regulated non-bank

financial sector. Emerging market economies should let their currencies

adjust as much as possible in response to the tighter global monetary

conditions. Where appropriate, foreign exchange interventions or capital

flow measures can help smooth volatility that’s excessive or not related to

economic fundamentals.

Many countries responded to the

cost-of-living crisis

by supporting people and businesses with broad and untargeted policies that

helped cushion the shock. Many of these measures have proved costly and

increasingly unsustainable. Countries should instead adopt targeted

measures that conserve fiscal space, allow high energy prices to reduce

demand for energy, and avoid overly stimulating the economy.

Supply-side policies also have a role to play. They can help remove key

growth constraints, improve resilience, ease price pressures, and foster

the green transition. These would help alleviate the accumulated output

losses since the beginning of the pandemic, especially in emerging and

low-income economies.

Finally, the forces of

geoeconomic fragmentation

are growing. We must buttress multilateral cooperation, especially on

fundamental areas of common interest such as international trade, expanding

the global financial safety net, public health preparedness and the climate

transition.

This time around, the global economic outlook hasn’t worsened. That’s good

news, but not enough. The road back to a full recovery, with sustainable

growth, stable prices, and progress for all, is only starting.

[ad_2]

Source link