[ad_1]

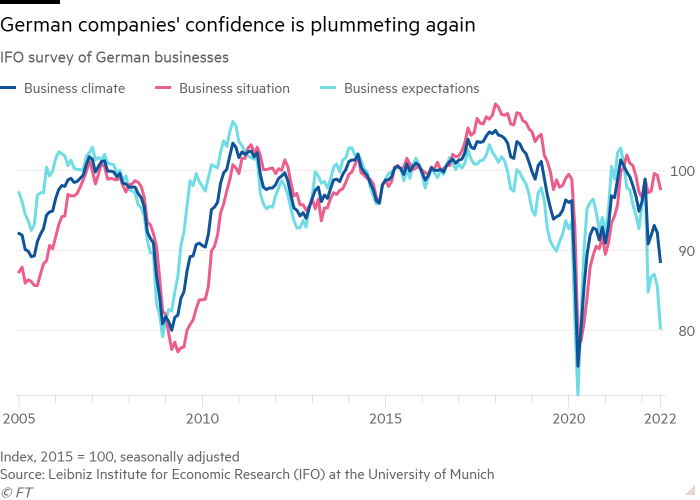

German business confidence has fallen to its lowest level for more than two years in the latest sign that Europe’s largest economy is teetering on the brink of recession.

Companies across Germany became more gloomy about both their current situation and the outlook for the next six months, according to the Ifo Institute’s closely watched index of business confidence. The think-tank’s index this month fell to 88.6, down from 92.2 in June, marking its lowest level since June 2020.

Germany has been hard hit by soaring prices and the Russian gas crisis, which threatens to halt production at some of the country’s industrial powerhouses over the winter months.

Gross domestic product figures for the second quarter are out on Friday and are expected to show German growth of only 0.1 per cent, according to economists polled by Reuters. The economy grew 0.2 per cent in the first quarter after shrinking 0.3 per cent in the final three months of 2021.

The Ifo results were worse than expected by economists polled by Reuters, who on average forecast the index would fall to 90.5. “Higher energy prices and the threat of a gas shortage are weighing on the economy,” said Ifo president Clemens Fuest, adding that the eurozone’s largest economy was “on the cusp” of a recession — defined as two straight quarters of negative growth.

The gloom among the 9,000 German businesses surveyed by the Munich-based think-tank was widespread. Fuest said confidence had “plummeted” among manufacturers, while it had “worsened substantially” among services providers, “took a nosedive” at retail traders and had “deteriorated” in construction.

“The mood turned even in tourism and hospitality, despite great recent optimism here,” he said, adding: “Not a single retail segment is optimistic about the future.”

Carsten Brzeski, head of macro research at Dutch bank ING, said he expected German GDP to contract in the second quarter, under pressure from gas shortages and soaring prices. “In the base case scenario, with continuing supply chain frictions, uncertainty and high energy and commodity prices as a result of the ongoing war in Ukraine, the German economy will be pushed into a technical recession,” said Brzeski.

Dutch front-month futures, the benchmark for European gas prices, rose 3.8 per cent to €166 on Monday — a more than seven-fold increase from a year ago.

A survey published on Monday by the DIHK association of German chambers of commerce and industry found that 16 per cent of manufacturing companies said they would respond to higher energy prices by scaling back their production or partially abandoning some areas of business.

“These are alarming numbers,” said DIHK president Peter Adrian. “They show how strongly permanently high energy prices are a burden on our location. Many companies have no choice but to close down or relocate production to other locations.”

The drop in the Ifo index mirrored the equally downbeat results from a survey of purchasing managers, conducted by S&P Global, which showed German businesses had suffered their biggest fall in activity for more than two years in July.

“The German economy is probably already in a downturn,” said Jörg Krämer, chief economist at German lender Commerzbank. “Unfortunately, how bad things end up is primarily in [Russian president Vladimir] Putin’s hands. If there were a complete halt to gas supplies, a deep recession would be inevitable.”

The German central bank warned in April that an immediate ban on Russian gas imports would knock 5 percentage points off German GDP.

Russia has already slashed exports of gas to Europe as tensions have risen between Moscow and the west over the war in Ukraine. Berlin last month triggered the second stage of its national gas emergency plan, a move that brought it a step closer to rationing supplies.

German consumer prices rose 8.2 per cent in June, driven by soaring energy and food costs, despite the dampening effect on prices of government transport and fuel subsidies.

“High inflation is already squeezing consumer demand while the threats of high interest rates and gas rationing are looming,” said Jessica Hinds, senior Europe economist at research group Capital Economics. “Germany looks set to fall into a deeper recession than most in the coming months.”

Economists are also concerned that recent dry weather has reduced the water level in Germany’s main rivers to close to the multiyear lows hit during the 2018 drought that disrupted shipping on the Rhine and hit the country’s economy.

[ad_2]

Source link