[ad_1]

France’s largest listed lenders expect their corporate and institutional banking businesses to extend their strong run after posting record profits in 2022.

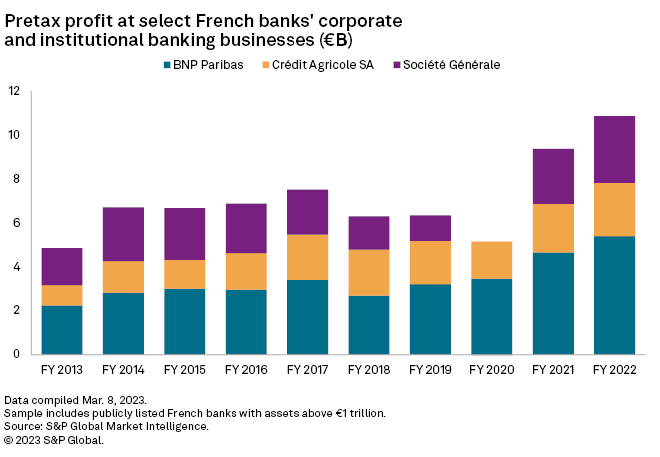

Aggregate pretax profit at the businesses that house BNP Paribas SA’s, Crédit Agricole SA‘s and Société Générale SA‘s CIBs, or i-banks, rose by almost 16% year on year to €10.86 billion in 2022, S&P Global Market Intelligence data shows. Last year’s performance followed similarly strong earnings in 2021.

BNP Paribas revised its targets for its CIB’s compound annual growth rate for 2025 to above 5%, CFO Lars Machenil said during the bank’s full-year 2022 earnings call in February.

“Consolidating on 2022’s strong performance and keeping its discipline, CIB is embarking on a growth path above [the rest of the] market,” Machenil said.

The resilience of the French lenders’ i-banks comes as other business lines, particularly domestic retail banking, suffer from the impact of rising interest rates. Local banking regulations mean that, as interest rates rise, French lenders are earning less from borrowers and paying more to depositors than many other European banks.

Revenue growth

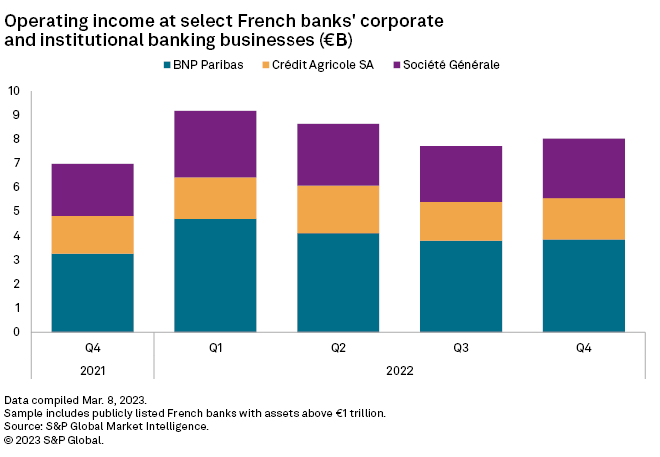

Aggregate operating income growth of more than 14% helped drive the increase in profits at the French banks’ CIBs, Market Intelligence data shows. BNP’s CIB enjoyed 15.7% year-on-year growth in operating income to €16.47 billion in 2022, the largest gain among the three banks, resulting in a 16.1% increase to €5.4 billion in pretax profit, the data shows.

SocGen’s CIB recorded the largest growth in pretax profit among the three banks at 21.6% to €3.04 billion, according to the data.

“Overall, this is a remarkable performance given the [challenging] context for capital markets,” SocGen CFO Claire Dumas said.

Increased market volatility as a result of the uncertainty caused by high inflation and rising interest rates boosted the performance of the banks’ fixed income, currencies and commodities businesses throughout 2022.

The strong 2022 performance for the bank’s CIBs came despite a decline in aggregate pretax profit in the fourth quarter. CIB pretax profit across the three banks fell 7.9% quarter on quarter to €2.56 billion in the three months to the end of December. This was driven by a more than 30% decline in BNP’s fourth-quarter pretax income to €950 million, Market Intelligence data shows. Both SocGen and Crédit Agricole SA, or CASA, recorded strong growth in the quarter.

It was a “very active quarter” for CASA’s i-bank, with a record high level of revenues in both capital market activities and financing activities, especially in international trade and transaction banking, said CASA CFO Jerôme Grivet.

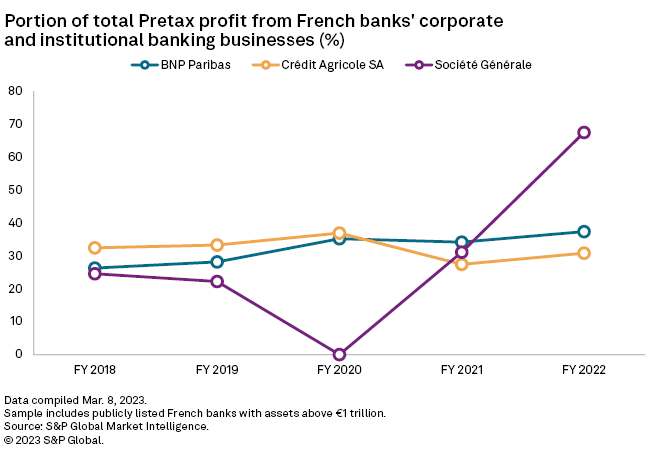

Given their strong performances, the lenders’ CIB businesses were responsible for larger shares of the banks’ pretax profits in 2022. SocGen saw the biggest increase to 67% from 31%, while CASA’s increased 4 percentage points to 31% and BNP’s increased 3 percentage points to 37%, Market Intelligence data shows.

After a record 2022, SocGen does not expect further growth in CIB revenues in 2023, deputy CEO Slawomir Krupa said. Even if operating income at SocGen’s CIB business stayed flat, or even declined slightly, in 2023, it would remain above the long-term trend.

“We expect a normalization,” said Krupa. “We remain cautious, but not pessimistic.”

[ad_2]

Source link