[ad_1]

Markets rallied sharply and witnessed broad-based buying support on June 7 ahead of the credit policy meeting outcome. Upbeat moves prevailed throughout the session. All eyes will be on the RBI’s growth outlook and inflation projection for the year and in case there is any downgrade in inflation expectations optimism is likely to persist. The Nifty closed up 127.40 points or 0.68 percent at 18,726.40. (Blue bars show volume and golden bars open interest (OI).)

Markets rallied sharply and witnessed broad-based buying support on June 7 ahead of the credit policy meeting outcome. Upbeat moves prevailed throughout the session. All eyes will be on the RBI’s growth outlook and inflation projection for the year and in case there is any downgrade in inflation expectations optimism is likely to persist. The Nifty closed up 127.40 points or 0.68 percent at 18,726.40. (Blue bars show volume and golden bars open interest (OI).)

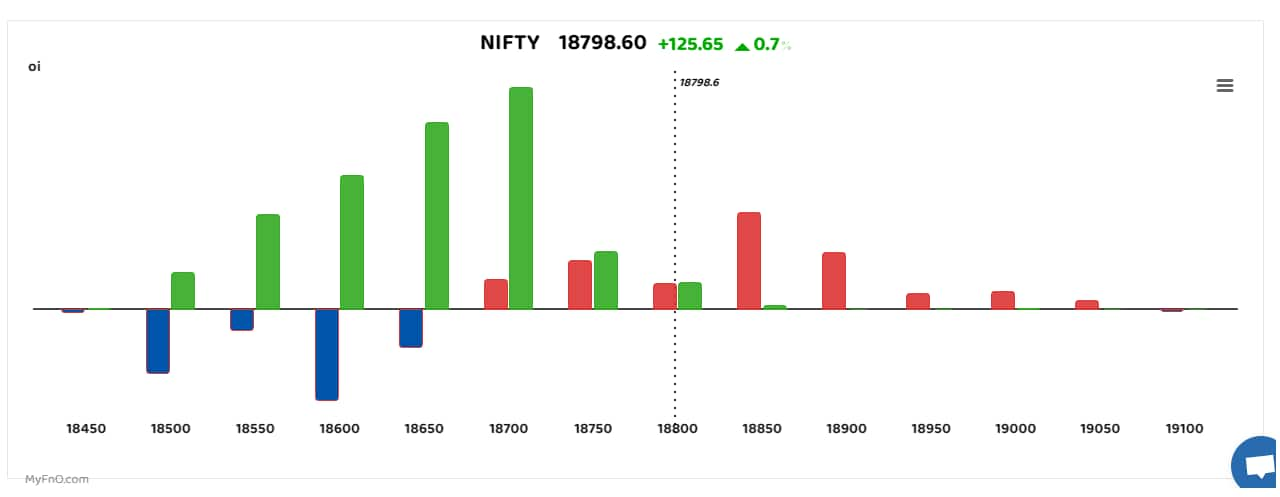

The Nifty index on June 7 saw huge put writing at the 18,600 and the 18,700 level for this week’s expiry along with put writing even at the 18,800 put leg for the June monthly expiry. The 18,800 put is an in-the-money options leg. “This is a very bullish sign and the current candle closing of today also signifies momentum on the upside. The all-time high levels on the Nifty index have a very high probability of breaking in the June series itself. The near-term bottom for the Index has now shifted to 18,400 from the earlier band of 18,000 to 18,200,” said Rahul Ghose, Founder & CEO – Hedged (Bars reflect change in OI during the day. Red bars show call option OI and green bars show put option OI.)

The Nifty index on June 7 saw huge put writing at the 18,600 and the 18,700 level for this week’s expiry along with put writing even at the 18,800 put leg for the June monthly expiry. The 18,800 put is an in-the-money options leg. “This is a very bullish sign and the current candle closing of today also signifies momentum on the upside. The all-time high levels on the Nifty index have a very high probability of breaking in the June series itself. The near-term bottom for the Index has now shifted to 18,400 from the earlier band of 18,000 to 18,200,” said Rahul Ghose, Founder & CEO – Hedged (Bars reflect change in OI during the day. Red bars show call option OI and green bars show put option OI.)

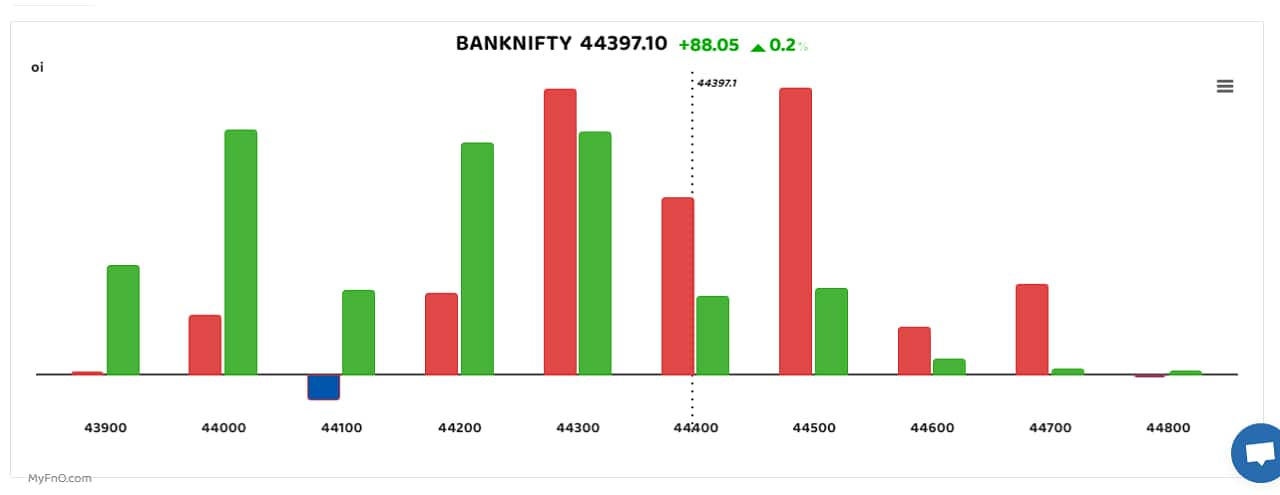

The Bank Nifty remained sideways following a positive start. “The undertone of the index is still bullish, maintaining the support of 44,000 in a spot where a decent amount of Put writing is seen and resistance is still intact at 44,500. After the central bank policy meeting, the Bank Nifty is expected to give a move on either side. Upon a decisive move of 44,500 we might see strong directional upside moves,” said Rupak De, Senior Technical Analyst at LKP Securities. (Bars reflect change in OI during the day. Red bars show call option OI and green bars show put option OI.)

The Bank Nifty remained sideways following a positive start. “The undertone of the index is still bullish, maintaining the support of 44,000 in a spot where a decent amount of Put writing is seen and resistance is still intact at 44,500. After the central bank policy meeting, the Bank Nifty is expected to give a move on either side. Upon a decisive move of 44,500 we might see strong directional upside moves,” said Rupak De, Senior Technical Analyst at LKP Securities. (Bars reflect change in OI during the day. Red bars show call option OI and green bars show put option OI.)

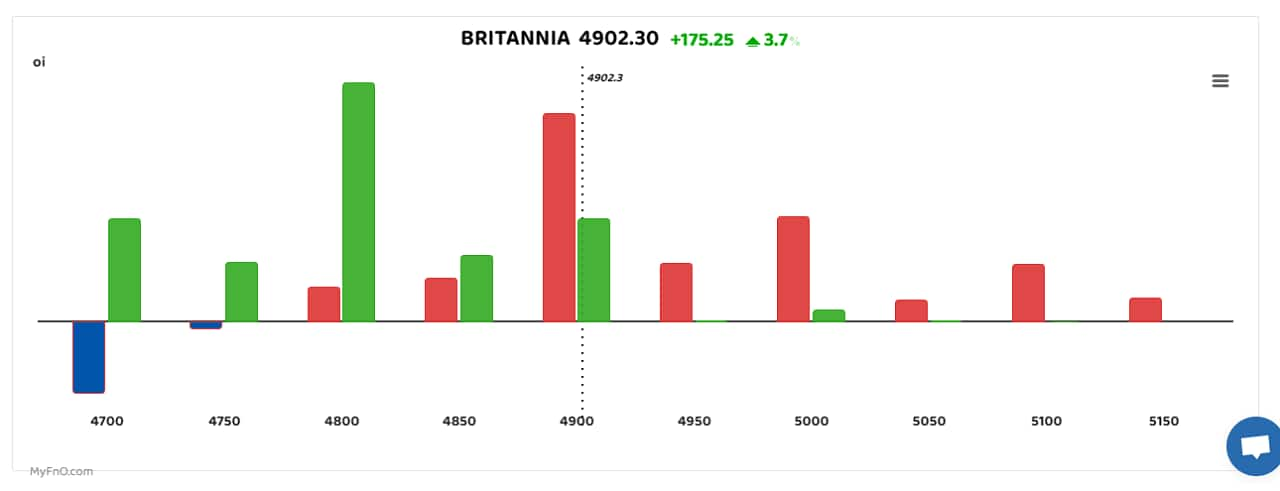

Britannia saw a long buildup with open interest rising 38 percent. A long build-up is a bullish sign that happens when open interest and volume increase with the rise in share price. Vodafone Idea, HPCL and Glenmark Pharna were others that saw heavy long buildup. (Bars reflect change in OI during the day. Red bars show call option OI and green put option OI.)

Britannia saw a long buildup with open interest rising 38 percent. A long build-up is a bullish sign that happens when open interest and volume increase with the rise in share price. Vodafone Idea, HPCL and Glenmark Pharna were others that saw heavy long buildup. (Bars reflect change in OI during the day. Red bars show call option OI and green put option OI.)

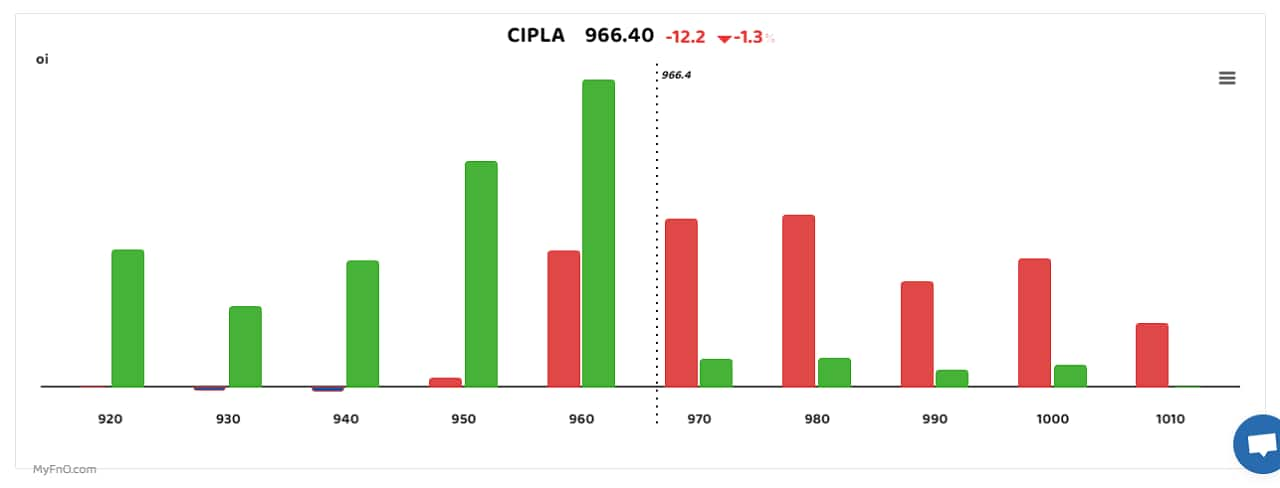

Cipla was among those that saw a short buildup with open interest jumping 7 percent. The short build-up is a bearish sign that takes place when the price of a stock falls, along with high open interest and volume. (Bars reflect change in OI during the day. Red bars show call option OI and green put option OI.)

Cipla was among those that saw a short buildup with open interest jumping 7 percent. The short build-up is a bearish sign that takes place when the price of a stock falls, along with high open interest and volume. (Bars reflect change in OI during the day. Red bars show call option OI and green put option OI.)

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

[ad_2]

Source link